Traditionally, farmers are known to be dogged loyal to and identify closely with certain “colors” when it comes to the brand of equipment they purchase. To emphasize the competitive nature of the farm machinery business, not too awfully long ago, it was common to see signs in dealerships that read, “Friends don’t let friends drive red tractors” or “green tractors,” whatever the case may be. It wasn’t at all unusual to hear farmers brag about the superiority of their preferred brand of machinery.

While some in the ag equipment business insist that this level of brand loyalty has diminished over the years, this isn’t what farmers are telling us.

Every 3 years beginning in 2011, Farm Equipment has conducted a survey of farmers across 12 states encompassing the Corn Belt (Illinois, Indiana, Iowa, Ohio, Missouri), Lake States (Michigan, Minnesota, Wisconsin) and Northern Plains (Kansas, Nebraska, North Dakota, South Dakota) regions of the U.S. to gage the level of loyalty they hold toward equipment. That survey of farmers in those same states and using the same questions were replicated in 2014 and again in June of this year.

The only difference this year is not only were all of the responses aggregated, but they were also segmented by annual revenue levels: by farmers who earned $500,000-$999,000 in annual revenue (identified in Part 2 of this report as <$1M) and those who earned $1 million or more in annual revenue (>$1M). This year, we also asked one additional question that related to the current low commodity price environment the industry has operated in the past few years.

Once again, the survey was aimed at determining how growers see themselves when it comes to their brand loyalty toward farm machinery and to determine any significant trends in brand preference. It was also designed to consider the role of dealers in how farmers feel about the tools of their trade and what it would take to get them to switch their allegiance to another brand of equipment.

EXCLUSIVELY ONLINE

For more information on Band Loyalty, download the FREE ebook “Now is the Time to Protect — and Win — Customer Loyalty to YOUR Brand”

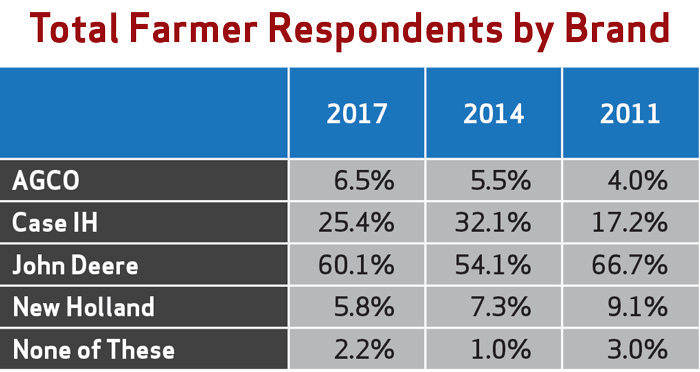

As in the past two surveys, this one, which was conducted in June 2017, included the four major brands of ag equipment typically found in a row-crop operation. These are AGCO brands, including Massey Ferguson and Challenger, Case IH, John Deere and New Holland.

In total, 276 producers completed the 7 question survey this year.

Still Loyal After All These Years

Farmers were asked to indicate “The primary brand of tractors and combines on your farm” and were only allowed to choose one of the four listed or “none of these.” Considering usable responses, 60% said their primary brand was John Deere and 25% identified Case IH as the predominant brand of equipment on their farms. Some 7% of farmers indicated New Holland was their primary brand, about 6% checked off AGCO and 2% said “none of these.”

A comparison of farm respondents by brand clearly shows that Deere dealers continued to dominate overall volume of survey responses as they did in the first two studies. This could be reflective of the estimates of North American market share in large ag equipment. According to Piper Jaffray, an investment bank headquartered in Minneapolis, Deere is estimated to have a 53% share of market in high horsepower tractors, followed by CNH Industrial (Case IH and New Holland) at 35%, AGCO with 7% and “other” with 5%. According to the investment bank, Deere holds about a 63% share in combines, CNH Industrial an estimated 30% and AGCO with 7%.

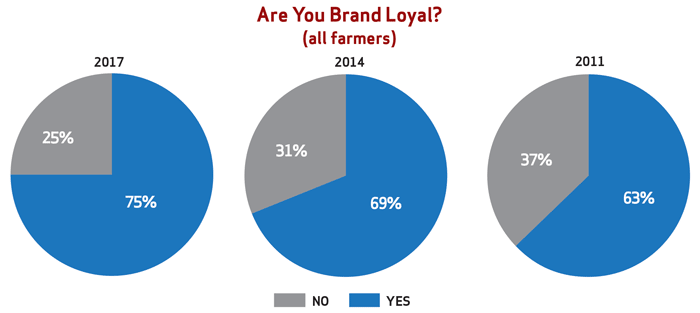

Overall, the results of the survey demonstrate that farmers believe they’re as loyal as they’ve ever been, if not more devoted to their brand of choice. Responding to the question, “Would you describe yourself as ‘brand loyal’ — purchase the same brand year-after-year — when you purchase tractors, field equipment or combines?” 75% answered “Yes.” That’s up from 69% who said “Yes” in 2014 and 63% in 2011.

The following table shows the farmers’ level of loyalty in aggregate (industry/all farmers) as well as broken down by the major brand each respondent selected as their “primary” brand.

When asked, “Would you describe yourself as ‘brand loyal’ — purchase the same brand year-after-year — when you purchase tractors, field equipment or combines?” 75% of farmers responding said “yes,” which is up 6% since the last study.

Source: Farm Equipment survey, June 2017

As shown in the table, loyalty to three of the four brands covered in the study increased since the last study in 2014, while the fourth stayed even with its score from 3 years earlier.

Compared to 2014, AGCO made the most progress in increasing its level of loyalty among farmers who said that an AGCO equipment brand was their primary brand. It improved its score by 27% in the past 3 years and by 35% compared to 2011. Nonetheless, it still lags the other major brands, as well as the industry’s overall average level of customer loyalty.

When it comes to customer loyalty, John Deere farmers have been the most consistently steadfast since the first study in 2011, ranging from 73% in 2011, 71% in 2014 and 77% in the most recent survey. The 6% gain over the past 3 years was equal to that of Case IH during the same period.

However, Case IH edged out John Deere — 80% vs. 77% — in terms of the total percentage of each company’s customers who say they are loyal to “their” brand. They also showed a very significant 45% improvement since the first study in 2011.

The same percentage of New Holland farmers who reported being loyal to New Holland equipment in 2014, 63%, reported being loyal in 2017. While the manufacturer of blue tractors didn’t gain any ground, they also didn’t lose any of their farm base over the past 3 years, and they’re up considerably (19%) since the first study in 2011.

Loyalty Past vs. Present

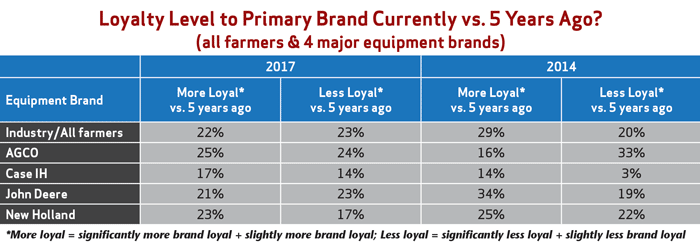

The farmers were also asked to describe their feelings about their primary brand today vs. 5 years ago. They could choose only one of 5 responses: Significantly more loyal, Slightly more loyal, About the same, Slightly less loyal or Significantly less loyal.

Overall, the manufacturers lost some ground in this area. Industry-wide, without regard to brand, 21% of farmers reported being “more” loyal and 23% reported being “less loyal.” Over half, 56% said they feel about the same as they did 5 years ago.

AGCO farmer responses in the most recent study slightly favored “more loyal” (25%) vs. “less loyal” (24%). But it was a huge improvement over the 2014 survey when only 16% said they were “more loyal” and 33% said they were “less loyal.”

The loyalty level of Case IH’s farmers improved by a net 3% in 2017, as 17% said they were overall “more loyal” and 14% reported they were “less loyal” compared to 5 years ago. In 2014, 14% of farmers claimed to be “more loyal” vs. only 3% who said they were “less loyal” than they were 5 years earlier.

In the 2017 study, fewer John Deere farmers said they were “more loyal” (21%) than reported being “less loyal” (23%). This is markedly different than the previous survey when 34% of John Deere farmers claimed they were “more loyal,” while 19% reported being “less loyal.”

New Holland fared somewhat better this time around than it did in 2014. In the 2017 study, 23% of New Holland farmers said they were “more loyal” and 17% reported being “less loyal” for a 6% net gain. This was better than the levels they saw in the previous survey when 25% said they were “more loyal” and 22% said they were “less loyal.”

Starting the Purchasing Process

How customers initiate their buying process can also be an indication of their depth of loyalty. If a farmer decides to “look around” rather than go directly to a dealership that carries the brand of equipment that they’ve preferred in the past, it may only be a case of curiosity or to keep their dealer honest. On the other hand, it could also be a sign of discontentment with either their preferred brand in the past or possibly the dealership itself.

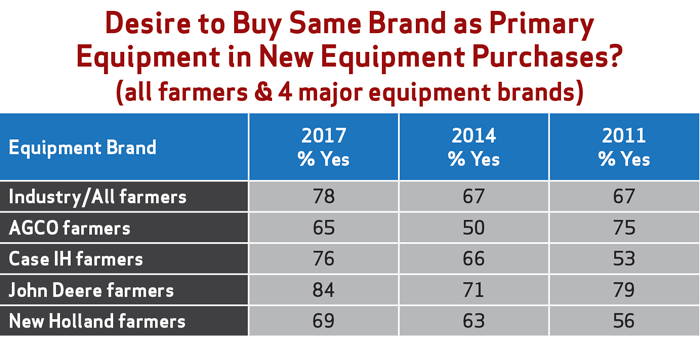

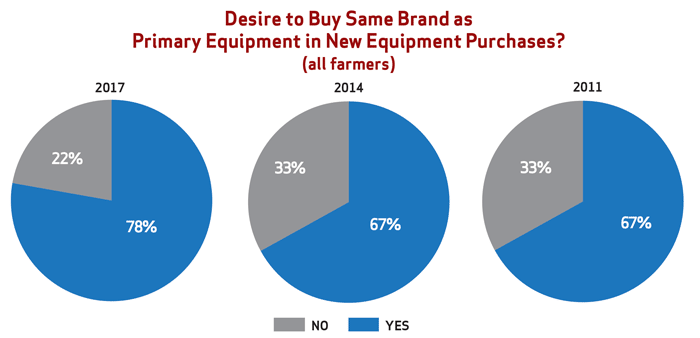

As in the past two brand loyalty surveys, farmers were also asked, “When you purchase new (not used) farm equipment, do you begin the process with the desire to purchase the same brand as your tractor/combine?”

Overall, 78% of all respondents answered “yes,” they desired to purchase the same brand of product as the tractor and combine they currently own. This is up from 67% in both the 2011 and 2014 surveys. This would seem to further reinforce the current survey’s finding that most farmers are, indeed, solidly loyal to their preferred brand of equipment.

Nearly 80% of farmers responding to the 2017 brand loyalty study said “yes” when asked, “When you purchase new (not used) farm equipment, do you begin the process with the desire to purchase the same brand as your tractor/combine?”

Source: Farm Equipment survey, June 2017

Comparing how the brands differ when it comes to their individual customers initiating the buying process, each improved their score compared to the 2014 study.

As in the past studies, more John Deere farmers, 84%, look first to John Deere products when initiating the buying process — by a large margin. This is up from 71% in 2014 and 79% in 2011.

Next are Case IH farmers as 76% of them indicate that, when they start looking to buy new equipment, first turn to Case IH products. This represents a 10% increase vs. 2014 and a 23% improvement when compared to 2011.

More than two-thirds (69%) of New Holland farmers continue to want to purchase New Holland machines when they start shopping, as they’ve indicated in the past. In 2014, 63% of New Holland farmers begin their buying decisions by looking first to New Holland equipment, and that was up from 56% in 2011.

AGCO, too, showed solid improvement in the 2017 survey vs. the 2014 results. This time around, 65% of AGCO farmers reported wanting to first look to AGCO products when they decide to purchase new. This is a 15% improvement compared to the previous study.

What Have Farmers Bought?

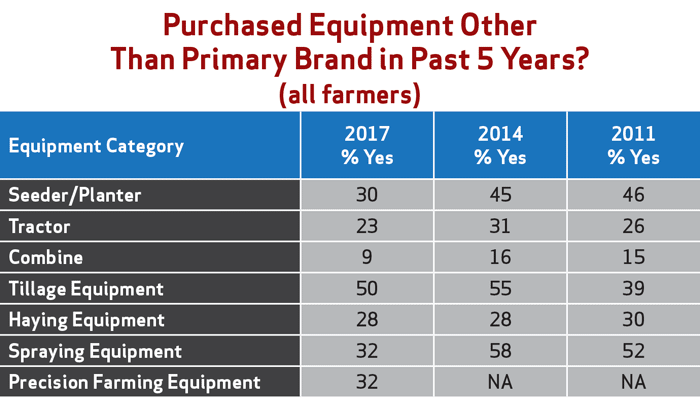

To check and see if the farmers surveyed strayed from the path of buying all of their equipment from their primary supplier of ag machinery, the following question was asked: “Have you purchased any of the following items that were NOT manufactured by your primary-brand line in the last 5 years?”

In the 2011 and 2014, they were given six broad categories of equipment and asked to indicate “yes” or “no” they did or didn’t purchase another brand of equipment in each specific category. In the 2017 study, precision farming equipment was added to the list.

Except for haying equipment, the farmers who responded to the 2017 survey indicated they purchased less equipment of other brands outside of what they considered their primary brand in each of the categories.

The category where the four “major” full line equipment manufacturers are still vulnerable to other brands is tillage. Half of the farmers responding said they had purchased tillage tools from other manufacturers. While this is down 5% from 2014, it still represents the category where shortline manufacturers have the best potential to compete with the majors.

Based on the 2014 brand loyalty survey results, specialty agricultural sprayer manufacturers also held a strong position when competing with the majors. In that study, 58% of all the farmers responding reported purchasing a sprayer that was not produced by one of the big full line equipment makers. This dropped to 32% in the 2017 study, which was the biggest drop (–26%) in all of the equipment groups.

Maybe this shouldn’t come as a big surprise as this segment of ag machinery has seen more consolidation and change than any of the others. New Holland got the ball rolling in the fall of 2014 when it acquired Miller-St. Nazianz. Then in early 2016, France’s Exel Industries acquired Equipment Technology’s line of Apache sprayers, and a private investor group acquired Bestway, a manufacturer of pull-type and mounted agricultural field sprayers. This was followed by John Deere’s agreement to acquire a major stake in Hagie Mfg., which produces high clearance sprayers.

The one equipment category where the shortline brands held their own was in haying tools, where 28% of farmers said they acquired other equipment outside their primary brand. This is the same percentage as 2014.

A new category added this year is precision farming equipment. Nearly one-third of the farmers indicated they had purchased other products not made by the manufacturer of their primary equipment.

Considering a Change in Current Ag Environment?

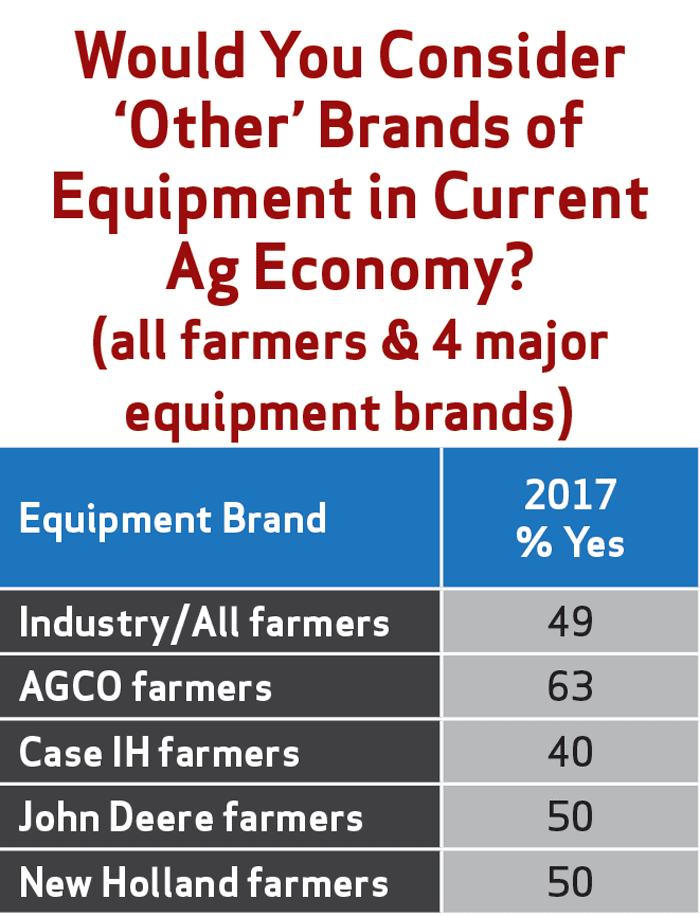

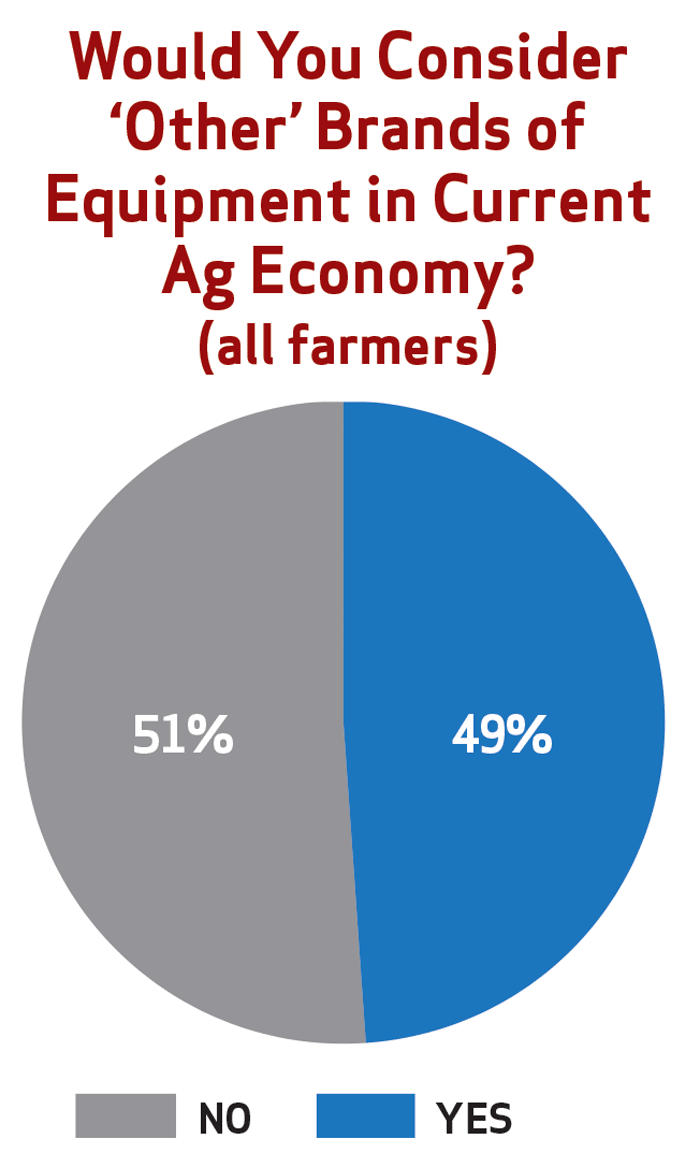

A new question was added this year to gage if the lower commodity prices impacted farmers decision to stick with “their” primary brand. Specifically, it asked: “Considering the decline in commodity prices during the past few years, has your attitude toward equipment purchases changed in that you are more willing to consider brands other than the one that you would typically prefer?”

Overall, nearly one-half, 49%, of farmers responding to the poll said “yes” they would be willing to consider another brand of equipment.

Source: Farm Equipment survey, June 2017

Source: Farm Equipment survey, June 2017 Despite low commodity prices, slightly more than one-half of farmers said they would not consider purchasing equipment that was not their preferred brand.

Despite low commodity prices, slightly more than one-half of farmers said they would not consider purchasing equipment that was not their preferred brand.Source: Farm Equipment survey, June 2017

Nearly two-thirds of AGCO farmers (63%) reported that they would be more willing to consider another brand of equipment; and 40% of Case IH farmers also said they would consider other brands in the current ag economy.

John Deere and New Holland farmers were split evenly with 50% willing to look at other brands of farm machinery in light of the ongoing slump in crop prices.

Switching Brands: What Would It Take?

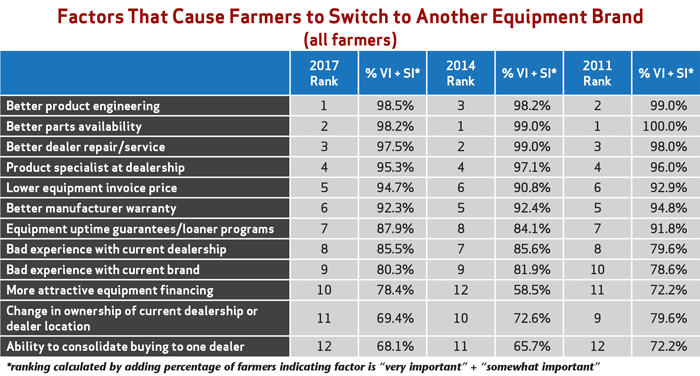

Based on the strong level of loyalty farmers hold for the “primary brand” of farm machinery, it’s clear that it would probably take one or more reasons for most farmers to make the big decision to switch equipment brands or dealerships.

As has been demonstrated in the first two studies conducted in 2011 and 2014, the dealership plays a critical role in maintaining the level of customer loyalty to any of the major brands currently enjoy. Of the five major reasons a farmer would shift his or her allegiance to another brand from the one they prefer, the dealer plays the biggest role in at least three of the most important causes, and at least a partial role in a fourth rationale to switch.

Probably the biggest change in the results of this year’s survey is that “Better product engineering” edged out “Better parts availability” as the number one motivation for a farmer to change equipment brands. In the 2014 study, better engineering ranked #3 on the list and it was #2 in 2011. In the first two surveys, better parts availability finished at the top of the list in 2014 and 2011. “Better dealer repair/service” clocked in at #3 in the most recent study. It was #2 in 2014 and #3 in 2011.

“Product specialist at dealership” has finished a consistent #4 in all three surveys. “Lower equipment invoice price” slipped into the top five in 2017. It had been ranked #6 in the previous two surveys. Dropping down to #6 was “Better manufacturer warranty,” which was ranked #5 in the 2011 and 2014 studies.

Two of the three factors that might cause a farmer to switch to another equipment brand that appear to have the least influence on farmers when making a purchase decision also involve dealers. These three have placed #10, #11 and #12, or at the bottom of the list, for all three surveys and include: “Change in ownership or location of current dealership,” “Ability to consolidate buying to one dealer” and “More attractive equipment financing.”

A Major Takeaway

While the results of Farm Equipment’s 2017 survey reinforce much of what was shown in the first two studies, probably the most important takeaway is that, no matter how well or poorly a brand is perceived, there is room for improvement.

The results also go beyond implying that brand and customer loyalty is built at the retail level. It unequivocally proves it. There’s simply no denying it, brand loyalty is built on customer loyalty and it’s essential that for an equipment brand to succeed, it needs the solid, ongoing support of its dealers.

Most Farmers Still Loyal to ‘Their’ Brand

Brand Loyalty Part 2: Does Farmer Revenue Matter?

Brand Loyalty Part 3: Farmers & Dealers Differ on the Direction of Brand Loyalty

Brand Loyalty Part 4: How the Major Ag Equipment Makers fared in the Brand Loyalty Study