Editor’s Note: P&K Equipment was named by Farm Equipment’s independent panel of judges as the 2025 “Best in Class” Dealership. The judges praised P&K for its investment in an in-house dealer-led training program, revenue levels per employee, outstanding market share in all customer segments, community involvement, succession planning and success in integrating 30 locations of 2 geographic regions of distinct historical entities.

Farm equipment is a straight-forward business. It’s not “rocket science,” or as Yogi Berra might have said, “rocket surgery.”

But for one of our industry’s most unique dealer-principals, farm equipment is an escape from the stresses of neurosurgery and a successful business enterprise that supports his passions for farming, technology and community.

P&K Equipment

Founded: 1985 (Kingfisher, Okla.)

Locations: 30 in Oklahoma, Arkansas, Iowa and Illinois

Major Line: Deere

Shortlines: Diamond Mowers, Tiger, Alamo, Landoll, Kuhn Krause, Unverferth, Stihl, A&I Products, Ag Spray Equipment, Bestway Ag, Brandt, Ogden, Pride of the Prairie, Ryan Turf, Sitrex, SteelGreen, Tru-Turf and Western Plows

Business System: Equip

Employees: 715 (250 techs)

2024 Revenue: $700 million plus

Parts Inventory Maintained: $55 million

Absorption: 75.2% (small ag and turf locations carry higher overhead/expense load in the metro areas, making higher absorption performance a challenge, says P&K)

Executives: Barry Pollard, Owner; Scott Eisenhauer, GM/CEO; Preston Pollard, CFO

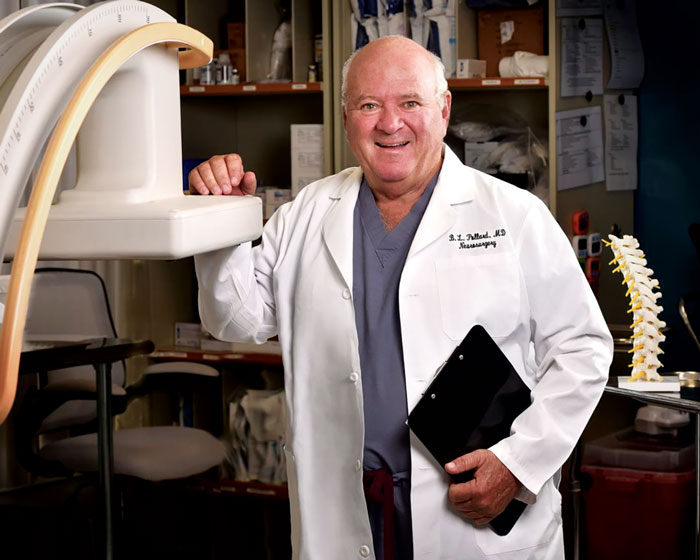

P&K Equipment’s owner and chairman is Dr. Barry Pollard, an unlikely executive leading a fast-growing, Oklahoma-based John Deere dealer group that leapfrogged the state of Missouri into Iowa.

Non-Negotiables: Trust & Delegation

In the mid-1980s, Pollard spent his free days from the operating room running a small feedlot and wheat farm in Enid, Okla. It was at that time Pollard, with a young family and passion for agriculture, was presented with an unexpected business opportunity. The local equipment dealership that he and his dad had long bought from came up for sale. And as they say, the rest is history.

Partnering with Allis Chalmers dealer Wendell Kirtley — the “K” in P&K Equipment to join the doctor’s “P” — Pollard embarked on a journey with a John Deere contract neither could have anticipated. Today, P&K has 30 locations in Oklahoma, Arkansas, Iowa and Illinois and supports a diverse ag customer base. In addition to its rural lifestyle and government customer bases, P&K is the golf and sports turf distributor for Deere in Oklahoma, and most of Arkansas. The dealership sells compact construction equipment to those same customers.

What hasn’t changed in 40 years, however, is the commitment to the customer and small-operation culture of Pollard and Kirtley.

“Dad was lucky to have a gentleman in Wendell who was reliable, faithful, confident and trustworthy,” says the doctor’s son, Preston Pollard, CFO, who joined the company in 2009. “He was experienced in the business and they communicated well and made things happen.” Kirtley, who died in 2015 at the age of 84, retired shortly after the company’s first acquisition in 1996.

“You may think you’re in accounting or in sales or whatever. But we’re all in service. It’s a simple business when you focus on that…” – Preston Pollard

Whether intentional or not, Pollard’s medical career required him to trust — and delegate. A renowned neurosurgeon, he couldn’t afford to be “hands-on” in his machinery business ventures. That delegation, trust and empowerment is foundational to P&K’s approach to the business.

Two of Kirtley’s proteges were instrumental in the firm’s growth. Drew Combs moved to and ran the Enid store in 1996, and later devoted much of his time at the Norman store, and today is sales manager for all locations. Shane Clifton was another long-tenured staffer who manages the original — and recently remodeled — store in Kingfisher.

“Barry would tell you that having good people is the key to success. It boils down to capable, dedicated and trustworthy people,” says Scott Eisenhauer, general manager.

Today, Preston and Eisenhauer are the duo driving the business, and the 74-year-old “good doctor” can look after his practice and his farm operation, which includes 10,000 acres as well as a registered herd of high-quality Angus genetics and board work with the American Angus Assn. His herd includes 30 elite donor cows, 400 performance cows and heifers, and 400-500 spring and fall calves every year.

Growth Mode Begins

Like his boss, Eisenhauer had no intention of getting into the equipment business. He planned for a real estate career, but stopped by a John Deere booth during a career fair at Oklahoma State Univ. “We ran Deere at home and I liked the brand, so I stopped and talked to them.”

That encounter led to a career as a John Deere marketing rep in 1999. He traveled the region with a territory manager, and then moved into that role himself and gained aftermarket duties. He came to P&K in 2006 at Pollard’s prompting, and now manages day-to-day plans alongside Preston.

While the initial years saw P&K operating solely in Kingfisher, opportunities would come. The Enid store was added in 1996 and then came 2 additional Oklahoma locations in Norman and Purcell in 2000. This was all at a time when multi-store operations were still a rarity, especially at the smaller end of the spectrum.

Eisenhauer recalls Deere’s lighting-quick consolidating initiatives as he walked into his new gig. Farm Equipment’s late editor Bill Fogarty shared a Deere memo on its 2002 Dealer of Tomorrow plan that stated, “How do we get to the point that makes sense and will lead to high performance? We believe the answer in many locations is through continued dealer consolidation. This new dealer structure may consist of 3-5 stores in contiguous trade areas and sales over $50 million.”

Dr. Barry Pollard, a renowned neurosurgeon and rancher, arrived at a trust-and-delegate philosophy early on that is foundational in the business today. Oklahoma State Univ.

Deere’s “Dealer of Tomorrow” initiative was so impactful its threshold levels were deemed out of date before the ink was dry.

In 2005, when Farm Equipment launched its Dealership of the Year program, Jamestown Implement was the top performing dealer in the “large-multi-store category,” which at the time was $40 million in revenue. For perspective on the industry changes today see the Farm Equipment 100™ listing on p. 14. The recognition program’s rooftops and revenue threshold increased numerous times, as the industry makeup was altogether different in a few short years.

Eisenhauer recalls when the target was $100 million, and then in short order, $150 million. In the early years, those levels were thought to be staggering, he says.

“At the time, a $30-million store was considered big,” Eisenhauer says.

Preston recalls, “There was a 10-year period from where there was just one store, and 10 years later there were 10. And after 10 more years, there were 30.”

Eisenhauer adds that while Pollard was known to be aggressive and growth-oriented, no one expected the rate of growth, or the prospect of moving into a new and non-contiguous territory like Iowa.

“No, there was ‘zero chance’ that Dad saw a business this big or stretching this far,” says Preston. “But as the opportunities came along, we evolved.”

- 2010: Expanded to 10 locations.

- 2012: Made a significant leap by acquiring 6 stores in Iowa, marking its first venture outside Oklahoma.

- 2017: Entered the Arkansas market with the acquisition of Countryside Farm & Lawn Equipment in Springdale.

- 2018: Further solidified its presence by acquiring Grissoms, a neighboring John Deere dealer with 5 locations throughout Oklahoma, and Spider Webb Farm Implement (Poteau, Okla., and Fort Smith, Ark.).

- 2021: Expanded into Chickasha and Duncan, Okla., through the acquisition of Standridge Equipment.

Leapfrogging into Iowa

While other John Deere dealer groups like RDO, Stotz Equipment and Brandt were tallying up acquisitions, P&K demonstrated that the smaller-size operations could participate too with its “up north” expansion.

The 2012 expansion into Iowa was a pivotal moment for the company whose fortunes up until that point were tied mostly to wheat and cattle producers. With the new AOR, P&K would step further into the big corn and soybeans markets of the Midwest.

Adding 6 distantly located stores presented a variety of challenges. Preston took the helm, relocating to Iowa to oversee the integration. (Incidentally, he has no trouble remembering company milestones. He was born in 1984 just a year before P&K was founded, and P&K Midwest was formed on his birthday in 2012. The 2017 acquisition was on the day of his daughter’s birth. “I sent the payment from the delivery room,” he recalls.)

“You show up in a place where you’ve got 6 stores, no name recognition and a culture that hadn’t yet gelled,” Preston explains. “It was different than anything we’d done before.”

Building trust was paramount, Preston emphasizes. “We wanted to be present,” he says, “and to show that we knew what we were doing. People need to see that you’re committed; that you care.”

Learn More

Most everything was different about the Iowa stores — customer personalities, the pace of commerce and farming, the communities, expectations with Deere factories in its backyard, opinions about ethanol (north) vs. oil and gas (south). “A large corn and soybean producer thinks differently and has different needs and expectations of what ‘good service’ looks like than a hay producer in Eastern Oklahoma,” Eisenhauer adds.

While many things were different, the pair say success still comes down to the same things: customer care, used equipment management, adherence to best-practice metrics and efficiency in parts and service.

“It took more than 5 years,” Eisenhauer admits. “But we’ve got great people up there now. Many of them are still with us — some just now retiring.”

P&K’s Flat Organization

Regardless of what’s different about the geographies, the foundation to similar goals begins with building trust. “You can’t lead with titles or org charts,” Eisenhauer says. “You’ve got to show up, understand their world and earn the business.”

Preston and Eisenhauer maintain that both structure and flexibility are essential. The company operates with an unusually flat organizational structure, granting autonomy to store managers for store-level decision-making.

When asked of he and Preston’s role, Eisenhauer explained an important word choice. “We don’t use the word ‘corporate.’ We ‘work with’ everyone at every location.”

“Used equipment is where the story starts for a lot of customers. If you get that part right, you’ve already earned their trust — and that’s everything…” – Scott Eisenhauer

P&K’s org chart can fit on an index card. From Pollard to Eisenhauer and Preston, it flattens out to the stores “mighty quick.”

The key to making that movement work is visibility — and simplicity. “We don’t have layers of management that slow things down,” says Eisenhauer, noting that company-wide roles exist for sales, aftermarket, finance and marketing.

This decentralized model allows each store to adapt to its community’s unique needs while benefiting from the collective strength and resources of the larger organization. “Every store might be set up a little differently based on the people there; we’re not taking a cookie cutter approach. We utilize everyone’s skill sets,” says Eisenhauer.

“We might have a strong store manager who also sells or we might have a strong aftermarket manager at this store. It’s about utilizing what everybody’s best at.”

Overseeing Two Divisions

With the Iowa operations so well established, the pair isn’t needed onsite like it once was. “Back then, we were up there every 2-3 weeks,” says Eisenhauer. “Today, it’s probably 5-6 times a year, depending on what’s going on. It’s not that we can’t get up there if we need to be.”

The “train-and-trust” process is working well and Preston and Eisenhauer’s connection to the store are more often about strategic planning and mentorship. But both say they embrace and enjoy the ability to be out in the locations consistently, without any expectation that they must be chained to their desk.

A Small-Store Culture

“We have all the resources of a 30-store organization,” says Eisenhauer. “But at the end of the day, we need those customers at their local store to feel like that’s the only store we’ve got. To them, that’s the ‘only store’ that matters.”

The benefits of the large-store resources may not be visible to the local customer, but they know that P&K knows how to get answers or expertise from another store. The answer to a technology problem in Edmond, Okla., might be solved by talking to the store in Sumner, Iowa, and vice-versa, says Preston.

The strength that comes from empowering employees to make decisions, take care of customers as they see fit, be involved in their communities, and trust to be the face of P&K is something both execs feel sets their company apart.

“We want them to be the face of the store,” Eisenhauer says. “We have all the resources of a 30-store organization, but we don’t want anyone to feel like they’re just a cog.”

In March, the Kingfisher (Okla.) Chamber of Commerce held a ribbon-cutting ceremony for P&K’s expansion at the store that “started it all” 40 years ago. All About Kingfisher

How it Works. Eisenhauer explains that the structure makes the team prone-to-action. “Everybody can see what’s in the inventory at all 30 locations. If we need to, we’ll move a unit from Keystone, Iowa, to Blackwell, Okla., to make a retail sale.”

Wins will come with simple hustle. He explains how the Springdale, Ark., store had a buyer and called up to Welton, Iowa, about a unit sitting on the ground there. Within minutes, the store and buyer had more pictures and info to make a decision.

And not only that, but they share expertise and knowledge.

“We had to change of course, as we grew and spread out,” says Preston. “We started as a one-store organization. If you went back and looked at the values those individuals had, that’s still what Scott and I are trying to accomplish — but now with 30 locations. We have more and different people and different geography, but a lot of those values and expectations are the same that they were in 1985.”

Building Equity With Customers

Preston emphasizes the importance of customer relationships, and routinely cites “consistently building equity” with customers. That is, something that takes years to build that can be gone in a moment.

Preston says the phrase was used a lot in his time in Iowa, and at the time when equipment and parts were hard to find. “There were challenges beyond any one person’s control and different solutions had to be figured out or we had to ask for patience.”

Eisenhauer agrees, adding that success is only going to come through a passion. “If you aren’t passionate about the ag business and taking care of and supporting customers, you’re not going to be happy nor successful at it. We work long hours and you’re going to be called out late at times. And we work hard. There’s a lot of reward in the satisfaction of knowing that you’re helping our farmer producers, but if you’re just looking for a job, you’re probably not going to be successful.”

Preston adds that “there’s no quick path to prosperity in the farm equipment business. You can work with the best manufacturers and can have great employees, but that equity can be used up quickly with difficulties with a repair or a machine that didn’t work as intended. We always need to be building equity with customers.”

Still Driving Forward … On Their Terms

P&K has continued to make things happen in recent years as well, including:

- New location in Welton/Delmar, Iowa (consolidating 2 sites into a new facility)

- New service department and remodeled parts and showroom at Kingfisher, Okla.

- Acquired 2 turf facilities in the Quad Cities area (Davenport, Iowa, and Silvis, Ill.)

- The addition of new technology products and personnel for better customer support

- Creation of new General Manager of Personal Knowledge Management (PKM) for the organization

It is becoming more rare to have full family ownership with the ever-increasing large multi-store dealers today. Yet it can be a differentiator in commitment, communication and approach.

For example, private-equity or multiple ownership would bring different oversight, accounting structures and financial requirements. A family business that exists for one and one thing only — the farm equipment business — can choose its own path.

This pours over into P&K’s “people values” and flexibility, for example, realizing that those doing late-night combine service can be free the following day to attend kids’ late-afternoon baseball games. But it’s as much a practical approach as altruistic.

“I haven’t found any company yet that says it has an overabundance of people, especially but not limited to technicians,” Eisenhauer says. “Retention and recruiting are still difficult in our business.”

As P&K stands at 30 locations, the question of future expansion naturally arises. Preston offers a measured perspective: “There’s no master plan for 40. But if an opportunity fits, we’re ready.”

Rather, their focus remains on maintaining a healthy, long-term business, not growth for growth’s sake. There’s plenty of areas still to be refined, including improving inventory turns, attracting and retaining top talent — especially technicians — and continually enhancing the customer experience.

As far as more stores, Eisenhauer notes that low hanging fruit has already largely been picked in their home turf. “Who knows what the future may bring? Ten years from now, some of the big organizations may wish to specialize and divest some stores. We’ll just work to be prepared for whatever it might be.

Preston feels good about the future and the dealer’s important role in equipping farmers through its people assets. “While the equipment and technology we sell and service may automate, a dealer organization is still going to require lots of people with diverse and important skills. We’re not in a business that is going to automate itself into obsolescence.”