The North American Equipment Dealers Assn. (NAEDA) has released the results of its annual Dealer-Manufacturer Relations Survey to equipment dealers.

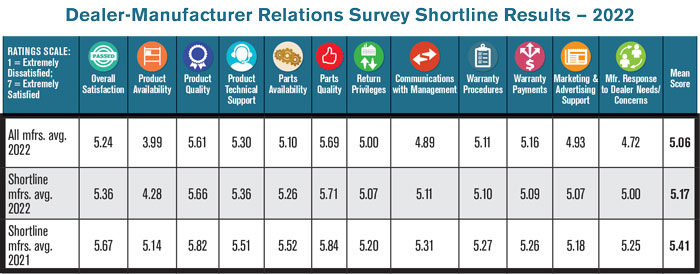

NAEDA’s survey allows North American dealers to rate up to 7 manufacturers they carry and collects data on their experience in 11 categories including product quality, availability and technical support; parts availability, quality and return policy; communication, warranty, marketing/advertising support and a separate rating for overall satisfaction. Respondents rate manufacturers on a scale from 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

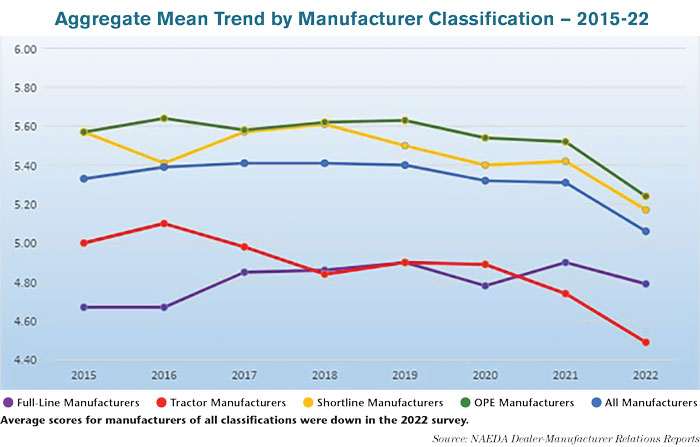

The 2022 report contains a list of 61 equipment manufacturers that received the minimum number of dealer ratings required to be included in the report, including full-line manufacturers, tractor manufacturers, shortline manufacturers and outdoor power equipment (OPE) manufacturers.

Breaking down responses by occupation, 63% of respondents were dealer-principals, 14% were general managers, 7% were branch/store managers, 9% were sales managers, 4% were parts managers and 3% were service managers. It is important to note the survey results represent a snapshot of dealers’ thoughts in early 2022.

Dealer’s Choice Awards

Full-Line Mfr.: Kubota Canada

Tractor Mfr.: Branson Tractor

Shortline Mfr.: Meyer Manufacturing

Outdoor Power Equipment Mfr.: Grasshopper Mowers

Scores dealers gave for product availability were notably low among most manufacturers in this year’s survey, likely due to ongoing supply chain issues keeping dealers from receiving equipment. This should be kept in mind when comparing overall scores and results year-over-year.

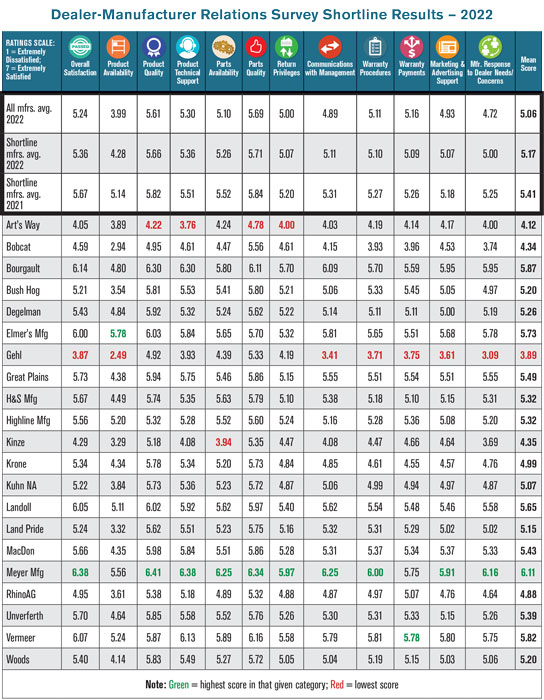

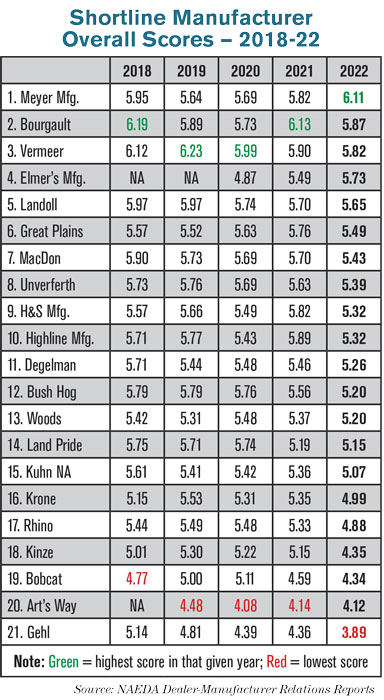

Meyer Takes First Through Quality & Support Scores

Meyer Mfg. was the top-rated shortline manufacturer in this year’s report with an overall score of 6.11, up from 5.82 last year and its second-highest score in the last 8 years (just below a 6.16 in 2015). This year’s report saw Meyer’s overall score beat both the average shortline overall score of 5.17 and the average overall manufacturer score of 5.06 and was its third year-over-year increase in a row.

Meyer’s highest category score was a 6.41 in product quality, and its lowest was a 5.56 in product availability. Year-over-year, Meyer improved in every category except product availability and took the highest score among shortlines in all categories except product availability (Elmer’s Mfg.) and warranty payments (Vermeer).

2022 Dealer-Manufacturer Relations Report

With 90 pages of data and charts, the 2022 Dealer-Manufacturer Relations Report is available to all NAEDA dealer members and to participating manufacturers. Manufacturers may also obtain data that includes company breakouts by region and their individual dealers’ comments. For more information, contact Joe Dykes at JDykes@EquipmentDealer.org

Bourgault earned the second-highest shortline overall score at 5.87 this year, down from the first-place score of 6.13 it received last year. Bourgault also saw year-over-year declines in all its category scores, save for an increase in its product technical support score to 6.30 vs. 6.22 last year.

Bourgault’s highest category score was a 6.30 in both product quality and product technical support, and it’s lowest was a 4.80 in product availability (see p. 58 for an Executive Q&A with Bourgault).

The third-highest shortline manufacturer overall score was Vermeer’s 5.82, down from the 5.90 it scored in 2021 and its third year in a row of decreases. The company saw increases in the following categories: manufacturer response to dealer needs (5.75), marketing & advertising support (5.80), overall satisfaction (6.07) and product technical support (6.13). Vermeer also took the top score in warranty payments with a 5.78, though this was Vermeer’s fourth year in a row of declines in this category.

Shortlines Traditionally Score High in Parts Quality, Low in Return Privileges

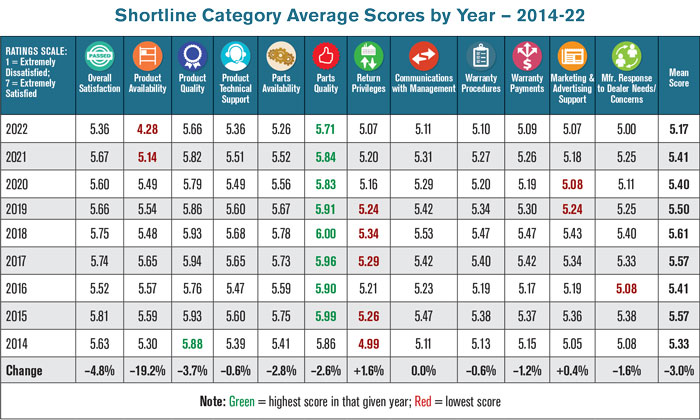

Examining the average scores dealers gave their shortline manufacturers by category shows shortlines have traditionally performed best in parts quality and lowest in return privileges.

From 2015 to 2022, the highest average category score every year was been parts quality, which peaked in 2018 at 6.00 and came in at 5.71 in 2022. Only in 2014 did shortlines receive their highest average score in a different category: a 5.88 in product quality. Since 2014, the average shortline parts quality score has declined 2.6% from 5.86 to 5.71.

In 5 of the last 9 surveys, shortlines ranked lowest on average in return privileges, which recorded a record low of 4.99 in 2014. Shortlines received their lowest average score in manufacturer response to dealer concerns in 2016 (5.08), marketing & advertising support in 2019 (5.24, tied with return privileges), marketing & advertising support in 2020 (5.08) and product availability in 2021 (5.14) and 2022 (4.28). Since 2014, average return privileges scores for shortlines have increased 1.6%.

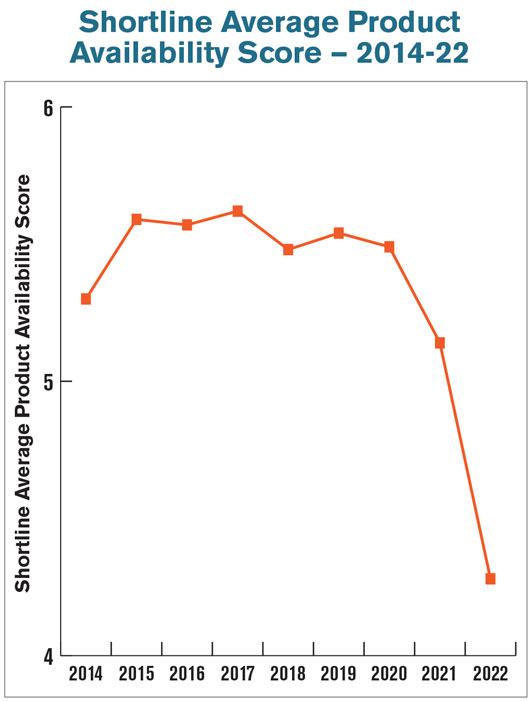

Average product availability scores have dropped the most since 2014, down 19.2% from 5.30 to 4.28 in 2022. It should be noted that supply chain constraints likely played a significant role in the lower product availability scores seen in 2021 and 2022. Only two categories have seen their average score increase over the last 9 years for shortlines: return privileges up 1.6% and marketing & advertising support up 0.4%.

The overall mean score for shortline manufacturers has fallen 3% from 5.33 in 2014 to 5.17 in 2022 (the record low) and peaked at 5.61 in 2018.

Prior to 2021, the average shortline manufacturer product availability score had remained above 5.30 and peaked at 5.65 in 2017. Supply chain issues in the ag equipment industry have seen product availability scores droppimg among most manufacturers, with the average shortline score dropping 16.7% year-over-year in this year’s report to 4.28.

Source: NAEDA Dealer-Manufacturer Relations Reports

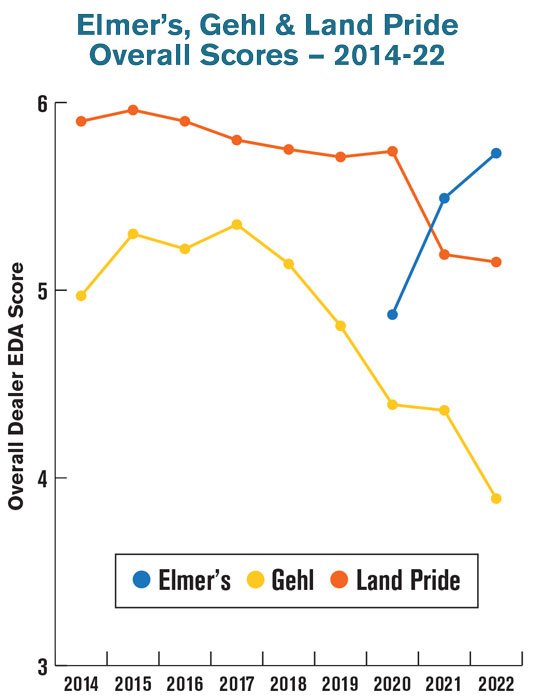

Elmer’s Mfg., now in its third year on the report, took the fourth-highest score at 5.73, up from 5.49 last year. Aside from Meyer Mfg., Elmer’s was the only other shortline whose overall score increased year-over-year. Elmer’s saw year-over-year increases in all its category scores, aside from a decline in product quality from 6.10 to 6.03. Despite the drop, this was Elmer’s highest category score this year, and it’s lowest was 5.32 in return privileges. Elmer’s took the highest score in the product availability category, where it scored a 5.78 vs. 5.50 last year.

Landoll was the fifth-highest ranked shortline manufacturer this year with an overall score of 5.65, down from 5.70 last year and its third year in a row of decreases. Landoll’s highest category score was a 6.05 in overall satisfaction, while its lowest was a 5.11 in product availability.

Landoll saw improvements in the following category scores: communications with management (5.62), manufacturer response to dealer needs (5.58), marketing & advertising support (5.46) and return privileges (5.40).

Gehl was this year’s lowest-ranked shortline with an overall score of 3.89 vs. 4.36 last year, its lowest ever and its fifth year in a row of decreases. Gehl took the lowest score among shortlines in the following categories: overall satisfaction (3.87), product availability (2.49), communication with management (3.41), warranty procedures (3.71), warranty payments (3.75), marketing & advertising support (3.61) and manufacturer response to dealer needs (3.09). All Gehl’s category scores were down year-over-year.

The average total score for shortline manufacturers in this year’s report was 5.17, down from 5.41 in the 2021 report. Year-over-year, the average shortline score dropped in all 12 categories, the lowest being a 4.28 in product availability, down from 5.14 in 2021.

Among shortline manufacturers rated in NAEDA’s report, Gehl and Land Pride have exhibited notable declines in their overall scores, including prior to 2021, when the pandemic began to notably affect manufacturers’ scores. Gehl’s 2022 overall score of 3.89 was down 21.7% vs. scoring 4.97 in 2014. In the same time period, Land Pride exhibited a less severe but still steady decline of 12.7% to 5.15 from 5.90 in 2014.

Elmer’s Mfg., however, has seen only increases in its overall score since first appearing on the report in 2020. Elmer’s reported a 5.73 in the 2022 report, a 17.7% increase from 2020.

Source: NAEDA Dealer-Manufacturer Relations Reports

Dealer Association Name Change

It should be noted that between the publishing of the dealer-manufacturer report and the publishing of this article, the Equipment Dealers Assn. merged with 3 other regional equipment dealer associations to become the North American Equipment Dealers Assn.

Additional Coverage

Full coverage of OPE manufacturer performance and Coverage of the full-line and tractor manufacturer results can be found on Farm-Equipment.com.

Meyer Mfg. Takes Top Spot Through Manufacturing Investments, Strong Dealer Relationships

Larry Meyer, vice president at Meyer Mfg., attributes the manufacturer’s first place score among this year’s shortlines to three things: good planning, good people and timely delivery of a quality product.

“Our goal is to treat our dealers and their retail customers like we want to be treated,” he says. “And we instill that in all our staff, managers and manufacturing workforces. We get our orders delivered on time. It was a challenge this year, but we still built a quality product and support it.”

Meyer scored 5.56 in product availability, the highest among the shortlines in this year’s report and an unusually high score given ongoing supply chain issues. Investments in manufacturing infrastructure played a significant role in this, according to Meyer.

“We made some major investments to improve our manufacturing processes and do more in-house than we ever did before,” he says. “We added more CNC machines and lathes, as well as a double-arm robotic welder.”

Meyer says the company has also been sure to put invest in the basics to keep things running smoothly: inventories and staff.

“We’ve invested in more inventory this year than we ever have before. If we had a chance, we might buy twice as much of something as we needed, just because we could get our hands on it at the time,” he says.

“We’ve also raised wages and benefits considerably, which has helped us make more on-time deliveries. In most cases, I would say we make our schedules. Currently, our retail sales are being told to expect 3-4 months for a delivery, we’ve worked to bring that down quite a bit.”

Meyer’s lowest score after product availability was a 5.75 in warranty payments, though this was the second-highest score in the category among shortlines, just below Vermeer’s 5.78. Meyer says the company is working to improve this category and has added staff to its warranty department, though he admits it’s a tough category score to work on.

When asked how Meyer Manufacturing’s relationships with its dealers are unique, Meyer mentioned the following points:

- We treat our dealers with respect and respond to all questions in a timely manner with knowledgeable people.

- We try to give our dealers straight answers on lead times and when we get the order, every effort is made to make an on-time delivery.

- When our dealers call, we get them to someone who can answer their questions now, not next week.

- I believe what dealers appreciate most about us is our knowledgeable salesmen and excellent parts and service departments.