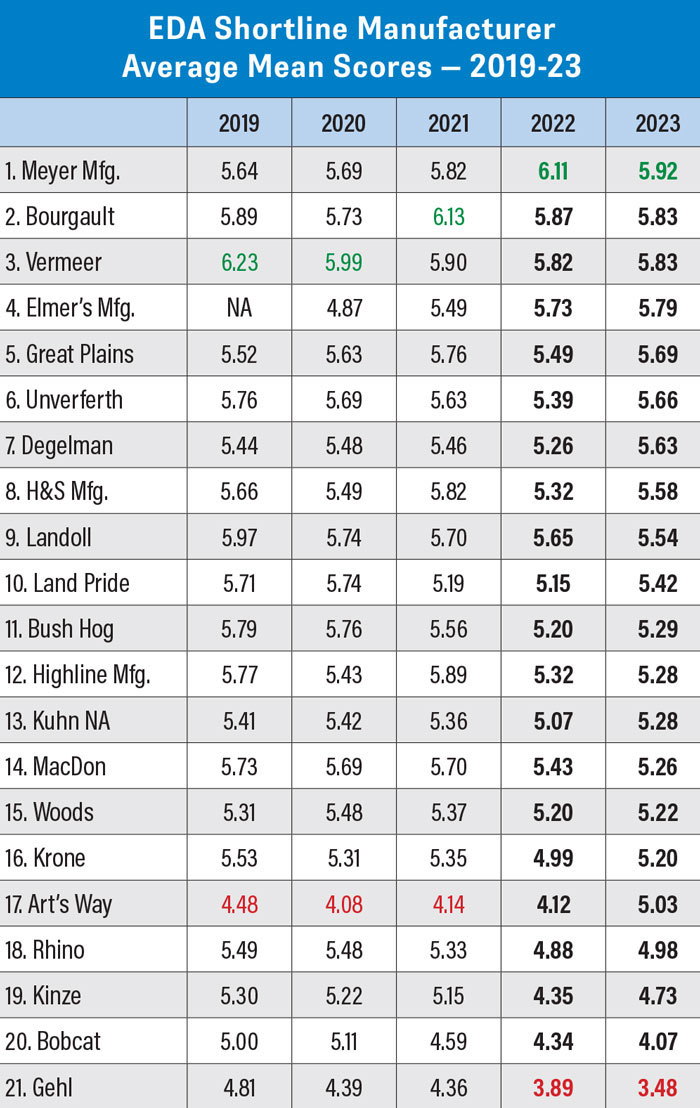

For the second year in a row, dealers ranked Meyer Manufacturing #1 in the annual North American Equipment Dealers Assn. (NAEDA) Dealer-Manufacturer Relations Survey. The hay and forage and livestock equipment manufacturer earned the Dealers’ Choice Award for shortline manufacturers and had the highest average mean score of all manufacturers this year at 5.92.

The 2023 report had 2,493 dealer respondents, drawing from all 50 states and 9 Canadian provinces. Each dealer rated 4 manufacturers, on average.

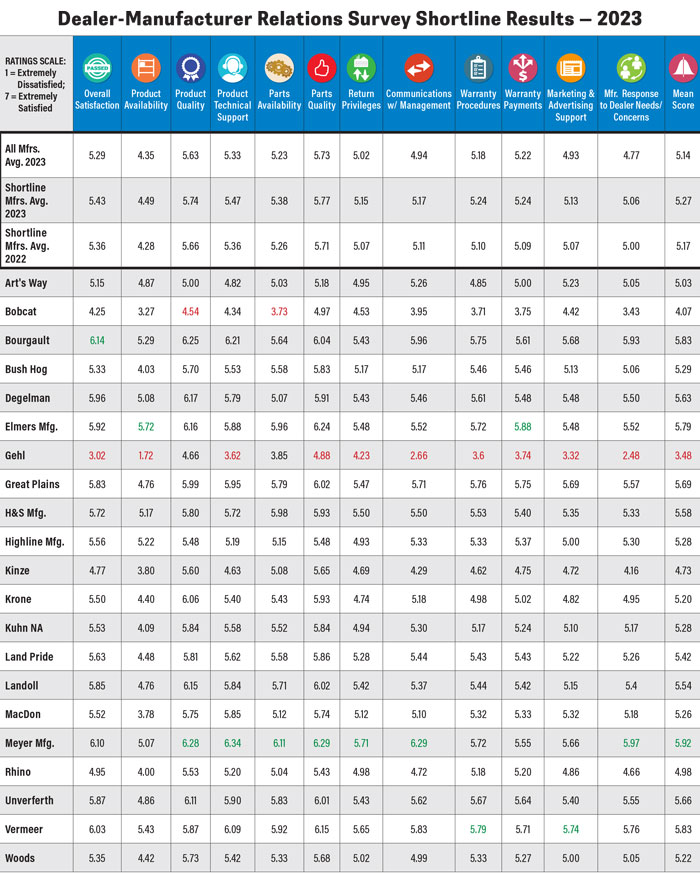

NAEDA’s survey allows North American dealers to rate up to 7 manufacturers they carry and collects data on their experience in 11 categories, including product quality, availability and technical support; parts availability, quality and return policy; communication; warranty and marketing/advertising support with a separate rating for overall satisfaction. Respondents rate manufacturers on a scale from 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

The survey represents a snapshot of dealers’ thoughts in early 2023.

Overall, the average mean score for shortline manufacturers improved over 2022 at 5.27 compared to 5.17 last year. Across the board, the shortline average was up in all categories vs. 2022. Product availability scores improved in 2023, but they continue to be historically low and are impacting overall average scores.

Meyer’s Strong Showing

Meyer received the highest scores in 7 of the 12 categories, including communications with management, manufacturer response to dealer needs/concerns, parts availability, parts quality, product quality, product technical support and return privileges. Meyer’s highest score was a 6.34 in product technical support, down slightly from 6.38 last year but above the shortline average of 5.45.

2023 Dealer’s Choice Award Recipients

Shortline Manufacturer: Meyer Manufacturing

Outdoor Power Equipment Manufacturer: Scag

Full-Line Manufacturer: Kubota Canada

Tractor Manufacturer: Branson Tractor

Gold Level Award Recipients

Shortline Manufacturers: Vermeer, Bourgault, Elmers, Great Plains, Unverferth & Degelman

Outdoor Power Equipment Manufacturers: Grasshopper, Exmark, Bad Boy Mowers, Shindaiwa & Wright Manufacturing

Tractor Manufacturers: Yanmar, LS Tractor & Kioti

For coverage of the OPE manufacturer results, read the coverage of the full-line and tractor manufacturers here!

The company received a 6.29 in communications with management, up slightly from 6.25 last year and above the shortline average of 5.15. For parts quality, the company also received a 6.29. While this was down from 6.34 in 2022, it was still above the shortline average of 5.72. Product quality was Meyer’s next highest rating at 6.28 (down from 6.41) vs. a 5.72 average for all shortline manufacturers.

Meyer’s lowest rating was a 5.07 for product availability, down from 5.56 in 2022, but still above the shortline average of 4.49.

Bourgault and Vermeer tied for the second-highest overall score among shortline manufacturers at 5.83.

For Bourgault, its average mean was down slightly from 5.87 in 2022. Its highest score was 6.25 for product quality, down from 6.30 last year but still above the shortline average of 5.74. Product technical support was its second highest rating (6.21), down from 6.30 last year.

Note: Green = highest score in that category; Red = lowest score Source: NAEDA Dealer-Manufacturer Relations Report

Art’s Way Reacts to Low Scores with Focus on Improvement & Earns Highest Scores in 5 Years

Art’s Way Manufacturing saw improvements across the board in the 2023 Dealer-Manufacturer Relations survey results. The company recorded its highest scores in 5 years in all 12 categories with an average mean rating of 5.03. Those results did not come overnight or without some concentrated attention.

“Shortly after joining Art’s Way 3.5 years ago, we received the results of the survey,” says Dave King, CEO of Art’s Way, “I think we were dead last.”

King says the previous numbers were unacceptable and knew Art’s Way could do better. He saw this as an opportunity to improve dealer relationships and internal processes. And so, the Art’s Way team got to work.

Art’s Way put a concerted effort into determining what the company needed to do to turn things around. “When you receive the survey results and the comments, you quickly realize it doesn’t tell the whole story and we decided to reach out to the dealers to get more insight.”

King says some of Art’s Way’s dealers opened up and discussed the major areas needing improvement.

The company even reached out to non-active dealers for valuable feedback. “We were fortunate enough to get the dealers on the phone to discuss some of their past experiences and what did not go so well. We really took those conversations to heart and started working on the areas where dealers were experiencing frustration.”

Warranty Process

King says one of the biggest areas the Art’s Way team focused on was making the warranty process easier. “I told the team, ‘You need to put yourself in the farmers’ shoes and the dealers’ shoes. If you were them, what would your expectations be?’”

As a result, Art’s Way overhauled the process and made it easier for dealers to work with the company. “While we have improved the warranty process, we still have more to do in this area. We are working on streamlining the warranty process through our dealer portal and linking it directly to our operating system, which is not only easier for dealers but also the internal staff,” King says.

Customer Service

Other changes included hiring additional staff in customer service. King says with the extra staff availability, Art’s Way can provide better dealer support. But it wasn’t just about adding numbers, “We hired the right staff that could actually help dealers with questions from a technical standpoint and also provide more internal support for dealers who have questions about ordering new whole goods and parts.”

Quality Control

To respond to requests for new features and changes to equipment — and to address quality issues — Art’s Way staffed up its engineering and quality departments. “We got our engineers working on the new features dealers had requested over the years that just never got implemented,” King says. He explained that the company is working toward accomplishing those tasks, but they will not happen overnight.

Focusing on the quality of the product and the production process is a top priority for Art’s Way. King mentioned that the hiring of a new quality manager and new quality technician has helped improve the quality process. The manufacturer has also invested in new equipment like welding robots. “That has made our quality better. It’s improved our efficiency, and it helps us maintain costs,” King says.

Emphasis on Communication

All the changes — from staffing to quality control — come down to an emphasis on communication, King says. “During the last 2 years of working through COVID and the supply chain challenges that came with it, dealers were looking for open and honest communication from the company so they could keep their customers better informed.

“We really tried to communicate with dealers on the items that impacted them the most, like updated delivery dates and changes to our production schedule.”

King acknowledges there is still work to be done but says it was good to see the improved survey results this year. “It took us a while to get some of the changes in place and for dealers to notice and appreciate them.

“We still have more processes and improvements to implement, but we are excited that our relationship and communication with our dealers has improved, and we will continue to strive to serve them even better in the future.”

Note: Green = highest score in that category; Red = lowest score Source: 2023 NAEDA Dealer-Manufacturer Relations Report

Meyer Manufacturing Focuses on Problem Solving to Strengthen Relationship with Dealers

For the second year in a row, Meyer Manufacturing has earned top marks from its dealers, earning it the Dealers’ Choice recognition in the annual Dealer-Manufacturer Relations survey conducted by the North American Equipment Dealers Assn. (NAEDA).

Dating back to 2015, Meyer has received high scores in communication with management, with 5.5 being the lowest it’s ever received in the category in 2020 and 2017. In 2023 Meyer’s score of 6.29 was the highest among shortline manufacturers for this category.

“It’s a matter of trying to do a good job in all of the different forms of communication,” says Meyer Vice President Larry Meyer. “Our salespeople and our parts managers, they’re always available by phone and by email — they’re always there. Our owners, like myself and my brother, we’re almost always here. We can take care of problems on the same day the problem develops.”

This is different from some other manufacturers, Meyer says, where a dealer might hear, “Well, we have to wait for a manager to come back from vacation” or “We’ll call you back in a couple days once we find something out.” He says the company doesn’t do that, opting to take care of it right away.

Meyer’s inside salespeople are well-trained and provide accurate and detailed information, he says.

“When the dealer gets done talking to us, he understands where he is at, and he gets freight rates, he gets costs,” Meyer says. “If he wants us to send him a quote, we can send him a quote. Logistically, we give fast, accurate quotes on freight.

“Then we answer all problems. Somebody’s got a problem, and they have some issues going on. We have people here, whether it’s engineers or whether it’s troubleshooting people who take care of those issues, answer those questions. Usually, within the telephone call, they get their problems answered. And if not, it’s a call back within an hour.”

Family Owned Operation

When asked what the key is to maintaining a good relationship with the dealer network and ensuring everyone in the company has that same vision of what is important, Meyer said it comes down to still being a family-owned company.

“I think when you’re family owned, you take a few more precautions to make sure things are done so your reputation isn’t ruined or damaged,” he says. “Reputation matters to us. It matters how we treat our dealers and also how we treat our retail customers. We like to treat people the way we want to be treated, and we expect that from our vendors. So again, I’m sure the dealers expect that from us, and we try to perform for them.”

Meyer describes the team as problem-solvers and prides himself on having a team that takes care of any problems and issues that come up right away. “We have experienced ag engineers who are in communication with our dealers and with the retail customers about different aspects of design and maintenance and reliability and things like that,” he says.

“We’re constantly redesigning and designing new products for the customer’s ever-changing needs. Every year something crops up or some changes need to be made or some updates or new products. We try to stay on top of those things.”

Continuous Improvement

Reflecting on this year’s survey results and areas Meyer Manufacturing could improve, Meyer says the company always tries to improve in every category.

“That’s how we stay on top of it by making improvements and making decisions that help us look in a good light to the dealerships,” he says. “As far as the shortages, we probably did as good as anybody’s done trying to work our way through product availability.”

In 2023, warranty payments was one of Meyer’s lowest scores (5.55). “Warranty payments, that’s a tough one,” Meyer says. “Nobody’s ever happy with the warranties. You’ve got the end user, he’s not happy, and we’re not happy. If everybody’s not happy, you probably did the right thing. But it’s a tough one because everybody wants more, and sometimes you just can’t do some of those things.”

However, Meyer adds when it comes to the warranty category, the company still performed better than a number of manufacturers.

“We definitely do try to improve upon that and try to respond to it faster. A lot of times dealers are upset because these warranty issues get put on somebody’s desk and nobody looks at them for 2 or 3 months … We try to filter through those on a regular basis so that we make sure that they’re updated, and then we can talk about it. We can talk to the dealer, and the dealer can talk to the customer. We’re trying to work our way through it.”

Overall satisfaction was next at 6.14, even with last year and above the shortline average of 5.43. Bourgault’s lowest score was 5.29 for product availability, which was an improvement from 4.80 in last year’s survey.

Vermeer’s average mean was up slightly from 5.82 last year. The company’s highest score was a 6.15 for parts quality, followed by a 6.09 in product technical support and a 6.03 in overall satisfaction.

Vermeer’s score of 5.74 in marketing & advertising support was the highest among shortline manufacturers, but down from a 5.8 last year. Vermeer also received top ratings in warranty payments (5.71 vs. 5.78 in 2022) and warranty procedures (5.79 vs. 5.75 in 2022). Its lowest rating was a 5.43 in product availability, which was still an improvement from 5.24 last year.

Elmer’s Manufacturing secured the third highest average mean score at 5.79, up from 5.73 in 2022. It received the highest score among all shortliners for product availability with a 5.72, down from 5.78 last year but over a point higher than the shortline average of 4.49.

Elmer’s also had the highest score for warranty payments at 5.88, up from 5.51 in 2022. The manufacturer’s lowest scores were in marketing & advertising support and return privileges at 5.48 for both, but still above the average scores in those categories for shortline manufacturers.

2023 Dealer-Manufacturer Relations Report

The 2023 Dealer-Manufacturer Relations Report is available to all NAEDA dealer members and to participating manufacturers. For information, contact Joe Dykes at jdykes@equipmentdealer.org

Unverferth had the fourth highest average at 5.66, up from 5.39 in 2022. Unverferth’s highest score was 6.11 in product quality, an improvement from 5.85 last year. That was followed by a 6.01 for parts quality, also up from last year (5.52). Its lowest rating was 4.86 in product availability, up from 4.64 last year.

Fifth on the list was Degelman with an average score of 5.63 vs. 5.26 in the 2022 survey. Degelman’s highest score was 6.17 in product quality, up from 5.92 last year. Overall satisfaction was the manufacturer’s next highest score at 5.96, also up from last year (5.96). Degelman’s lowest score was 5.43 for return privileges, which is still above the shortline average of 5.15 and up from its score last year of 5.22

Post a comment

Report Abusive Comment