With a total mean score of 6.13, Bourgault once again took the lead among shortline manufacturers in this year’s Equipment Dealers Assn. (EDA) Dealer-Manufacturer Relations Survey.

The survey, which enables equipment dealers throughout North America to rate the manufacturer lines they carry in key operational categories, was open from Feb. 4 through March 4, 2021.

EDA’s survey allows dealers to rate up to 7 manufacturers they carry and collects data on their experience in 12 categories, including product quality, availability and technical support; parts availability, quality and return policy; communication, warranty, marketing/advertising support; and a separate rating for overall satisfaction. Respondents could rate manufacturers on a scale from 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

The 2021 survey contains a list of 61 manufacturers that received the minimum number of dealer ratings required to be included in the report, including full-line manufacturers, tractor manufacturers, shortline manufacturers and outdoor power equipment (OPE) manufacturers.

Broken down by occupation, 64% of respondents were dealer-principals, 15% were general managers, 7% were branch/store managers, 9% were sales managers, 3% were parts managers and 2% were service managers.

It is important to note that the survey results were only representative of a snapshot of dealers’ thoughts in early 2021, with the potential for results to “change relatively quickly due to a number of external factors or situations.”

Bourgault Returns to Top Slot

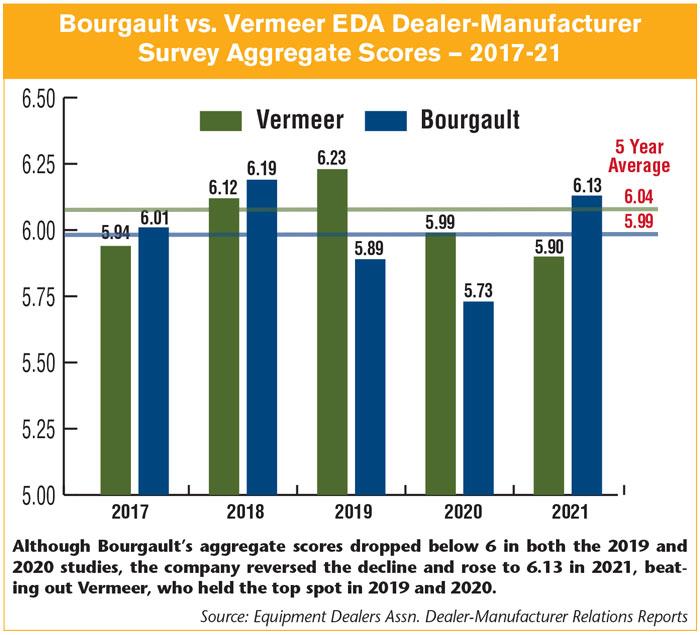

In the 2021 report, Bourgault surpassed Vermeer with a score of 6.13 as the top-rated shortline, denying Vermeer a third year in a row as the top-rated shortline. This year, Vermeer achieved a total score of 5.90, the second-highest score among the shortline manufacturers. Since 2017, Bourgault has taken the top slot in the 2017, 2018 and now the 2021 study, losing out to Vermeer in 2019 and 2020. Bourgault received the fourth-highest aggregate score among shortlines in the 2020 report at 5.73 and the third-highest in 2019 at 5.89.

Though Bourgault has taken first place among the shortline manufacturers in 3 of the last 5 studies, Vermeer has maintained a higher 5-year average at 6.04 vs. Bourgault’s 5.99. Bourgault’s highest score in the last 5 studies came in 2018 with an aggregate score of 6.19, while its lowest score, 5.73, came in the 2020 study. Bourgault’s aggregate scores in the last 5 years have been notably volatile, dropping from 6.19 in 2018 to 5.89 in 2019, then rising from 5.73 in 2020 to 6.13 in 2021.

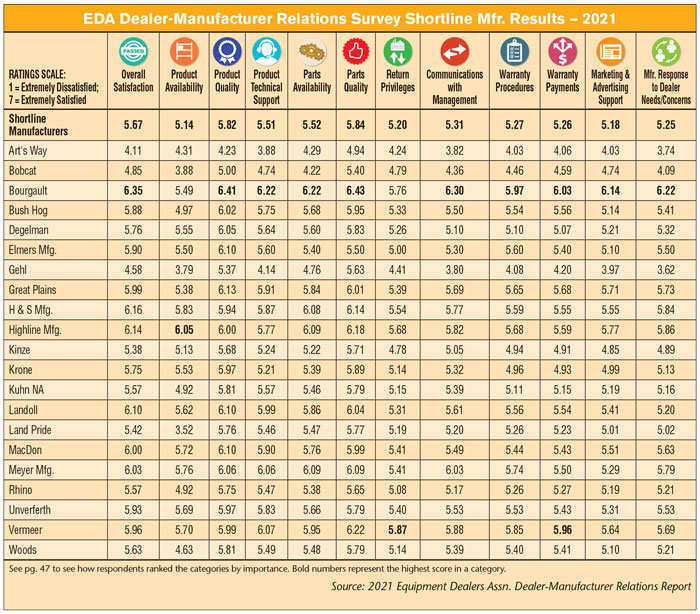

For the 2021 study, Bourgault had the top score among shortlines in 10 of the 12 categories that dealers can rate their manufacturers in, including overall satisfaction, product quality and parts quality, where Bourgault achieved its highest category score of 6.41. Highline Mfg. took the highest score in product availability at 6.05, and Vermeer took the highest score in return privileges at 5.87. In the 2020 study, Vermeer earned the highest score in 10 of the 12 categories, while Bourgault took none.

Bourgault reported year-over-year increases in each of its category scores aside from product availability, which dropped from 5.73 last year to 5.49 this year. Some of the more notable year-over-year increases were in marketing and advertising support (5.58 to 6.14), overall satisfaction (5.85 to 6.35) and parts quality (5.88 to 6.43). Vermeer reported declines in 9 of its 12 categories, including overall satisfaction (6.23 to 5.96).

Highline Mfg. took third in the 2021 report with an aggregate score of 5.89, up from 5.43 in the 2020 report. H&S had the fourth-highest aggregate score at 5.82, an increase from its 2020 score of 5.49. The fifth-highest rate shortline manufacturer in the 2021 report was Great Plains, which scored 5.76 vs. 5.63 in 2020.

Art’s Way had the lowest score of the shortlines in 2021 at 4.14, with its lowest category score being a 3.74 in manufacturer response to dealer needs/concerns. Art’s Way has received the lowest score among shortline manufacturers every year since 2018 (with its highest being a 4.77 in 2018) and was not listed in the 2017 report.

Shortline Manufacturers vs. All Manufacturers

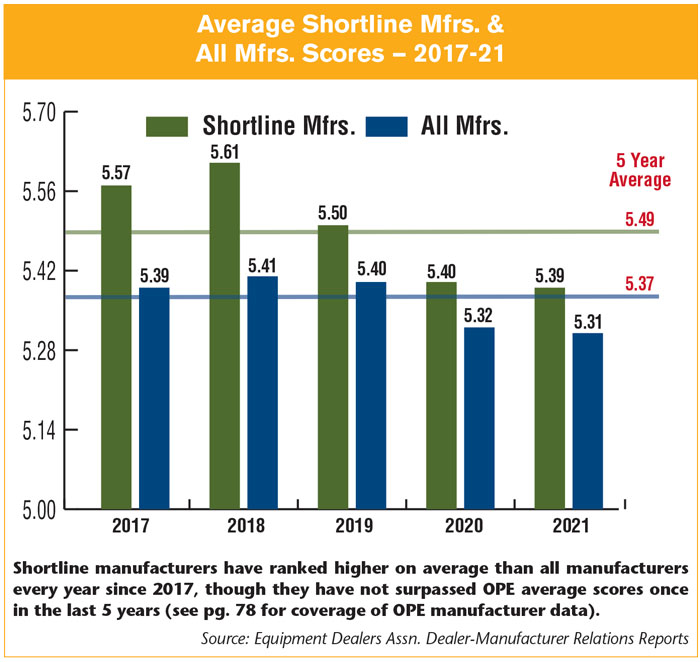

In the 2021 report, the mean aggregate score for all shortline manufacturers was 5.39, above the mean aggregate score for all manufacturers at 5.31. This represents the lowest aggregate score for shortline manufacturers in the last 5 years and the third year the shortline aggregate score has declined. Since 2017, shortline manufacturers have beaten the average score for all manufacturers every year and recorded a higher 5-year average (5.49 vs. 5.37 for all manufacturers). 2021 also saw the aggregate score of all manufacturers reach a 5-year low and its third year of decline in a row.

It’s worth noting that the current supply chain issues impacting the industry have brought product availability scores down across all manufacturer categories. Not accounting for the drop in product availability scores, the aggregate score for all shortline manufacturers actually rose from 5.39 in 2020 to 5.44 in 2021.

Looking at overall shortline manufacturer scores by category in 2021, shortlines ranked highest in parts quality at 5.84 (up from 5.83 in 2020) vs. 5.81 for all manufacturers. The lowest aggregate shortline score by category was in product availability at 5.14 (down from 5.49 in 2020) vs. 4.97 for all manufacturers, though this low score was likely impacted by ongoing supply chain issues. Shortline manufacturers’ second lowest category score was marketing and advertising support at 5.18 (up from 5.08 last year), which surpassed the overall manufacturer score of 5.09.

Looking at category scores among all manufacturers in the 2021 report, a shortline manufacturer had the highest score in communication with management (Bourgault at 6.30), marketing and advertising support (Bourgault at 6.14) and manufacturer responses to dealer concerns (Bourgault at 6.22). A shortline manufacturer also took the lowest score in the 2021 report in product quality (Art’s Way at 4.23).

With nearly 90 pages of data and charts, the 2021 Dealer-Manufacturer Relations Report is available to all EDA dealer members and to participating manufacturers. Manufacturers may also obtain data that includes company breakouts by region and their individual dealers’ comments. For more information, contact Joe Dykes at JDykes@EquipmentDealer.org.

Post a comment

Report Abusive Comment