The Equipment Dealers Assn. (EDA) has released the results of its annual Dealer-Manufacturer Relations Survey to equipment dealers.

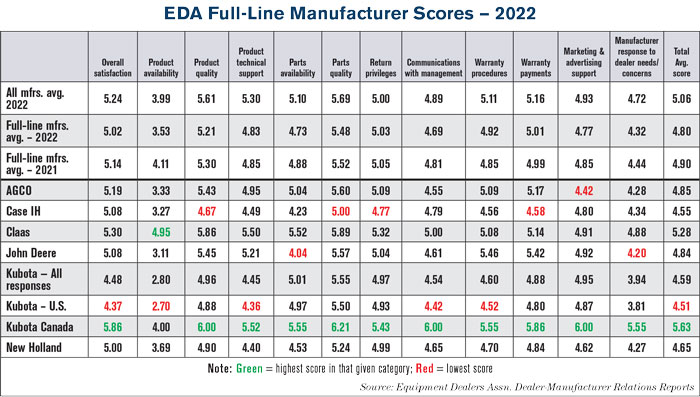

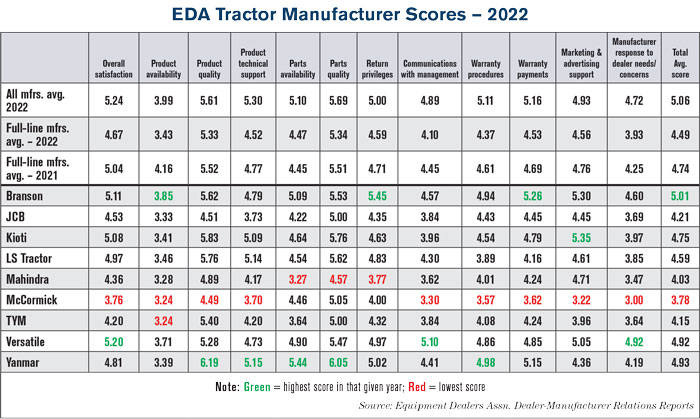

EDA’s survey allows North American dealers to rate up to 7 manufacturers they carry and collects data on their experience in 11 categories including product quality, availability and technical support; parts availability, quality and return policy; communication, warranty, marketing/advertising support and a separate rating for overall satisfaction. Respondents rate manufacturers on a scale from 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

The 2022 report contains a list of 61 manufacturers that received the minimum number of dealer ratings required to be included in the report, including full-line manufacturers, tractor manufacturers, shortline manufacturers and outdoor power equipment (OPE) manufacturers.

Dealer’s Choice Awards

Full-Line Mfr.: Kubota Canada

Tractor Mfr.: Branson Tractor

Shortline Mfr.: Meyer Manufacturing

Outdoor Power Equipment Mfr.: Grasshopper Mowers

Shortline Mfrs. 2022 Results

Highest Total Score: Meyer Mfg. (6.11)

Highest Overall Dealer Satisfaction Score: Meyer Mfg. (6.38)

Average Shortline Manufacturer Score: 5.17

Full coverage of shortline manufacturer performance will be featured in the September 2022 issue of Farm Equipment.

OPE Mfrs. 2022 Results

Highest Total Score: Grasshopper (5.79)

Highest Overall Dealer Satisfaction Score: Scag (6.04)

Average OPE Manufacturer Score: 5.24

Full coverage of OPE manufacturer performance will be featured in the September 2022 issue of Farm Equipment.

Broken down by occupation, 63% of respondents were dealer-principals, 14% were general managers, 7% were branch/store managers, 9% were sales managers, 4% were parts managers and 3% were service managers.

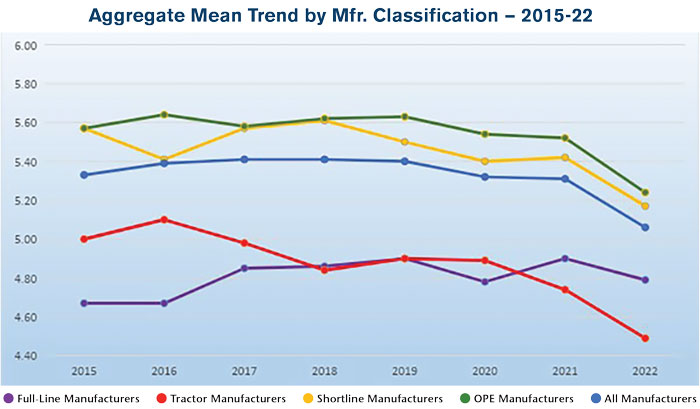

Average overall scores for manufacturers in all categories were down year-over-year in the 2022 survey.

Source: Equipment Dealers Assn. Dealer-Manufacturer Relations Reports

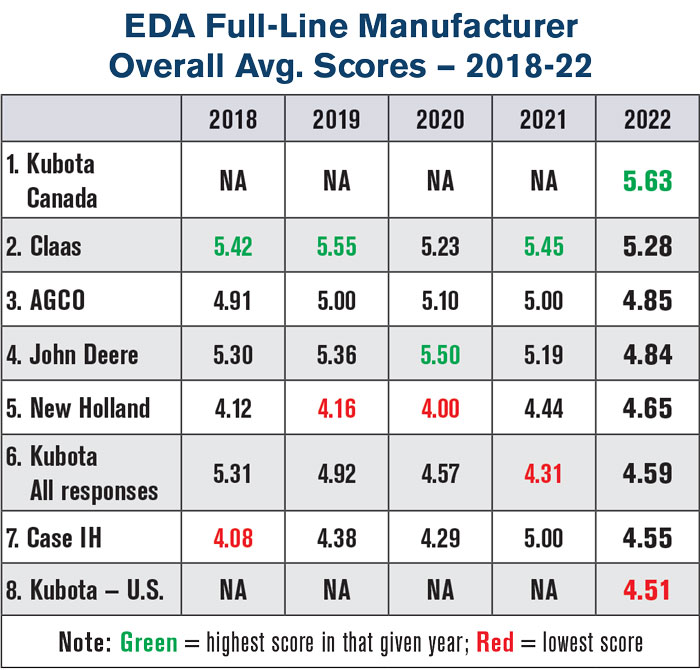

It is important to note the survey results represent a snapshot of dealers’ thoughts in early 2022. Additionally, in this year’s report for the first time, EDA split Kubota responses into 3 categories: Kubota (all responses), Kubota Canada and Kubota U.S., meaning this year’s survey had 8 full-line manufacturers.

Product availability saw notably low scores among all most manufacturers in this year’s survey, likely due to ongoing supply chain issues keeping dealers from receiving equipment, which should be kept in mind when comparing overall scores and results.

Kubota Canada Tops List of Full-Line Manufacturers

Kubota Canada, in its first year on the survey, took the lead in the full-line category with a total score of 5.63, above Kubota U.S.’s score of 4.51 and the total Kubota score of 4.59. This surpasses both the average total full-line manufacturer score of 4.80 and the total manufacturer average of 5.06. Kubota Canada took the lead in 11 of the 12 categories, with its highest score in parts quality at 6.21 and its lowest score in return privileges at 5.43. Claas was the only other full-line manufacturer to have the highest score in a category with a 4.95 in product availability.

Kubota U.S. did not perform as well as its Canadian counterpart, becoming the lowest-ranked full-line manufacturer in its first year on the report with an overall score of 4.51. Kubota U.S.’s lowest category score was 2.70 in product availability (a running theme throughout the report as supply chain issues continue worldwide), and the lowest score in any category among all full-line manufacturer in the 2022 report. Overall, Kubota U.S. had the lowest score in 5 of the 12 categories: overall satisfaction (4.37), product availability (2.70), product technical support (4.36), communications with management (4.42) and warranty procedures (4.52).

Kubota’s combined responses saw a mean score of 4.59, up from 4.31 in last year’s study. This included year-over-year increases in all category scores.

Claas reported the second-highest full-line average score of 5.28, below the 5.45 it scored last year. This was also Claas’ second-lowest overall score in the last 9 years. Claas’ highest score by category was a 5.89 in parts quality and its lowest was a 4.88 in manufacturer response to dealer needs/concerns. Claas saw year-over-year declines in its scores in all 12 categories.

2022 Dealer-Manufacturer Relations Report

With 90 pages of data and charts, the 2022 Dealer-Manufacturer Relations Report is available to all EDA dealer members and to participating manufacturers. Manufacturers may also obtain data that includes company breakouts by region and their individual dealers’ comments. For more information, contact Joe Dykes at JDykes@EquipmentDealer.org

The third-place spot went to AGCO with a total average score of 4.85, below the 5.00 it scored last year and its second year of overall decline. This was also AGCO’s lowest score in the last 6 years. AGCO’s highest category score was a 5.60 in parts quality and its lowest was a 3.33 in product availability. The manufacturer saw declines in all its category scores vs. 2021 aside from slight increases in its warranty payments, warranty procedures scores and return privileges scores. AGCO also took the lowest score in the marketing/advertising support category with a 4.42.

John Deere had the fourth highest overall score at 4.84, a decline from the 5.19 it scored last year and its lowest overall score in 8 years. Deere’s highest overall score was 5.57 in parts quality, while its lowest was 3.11 in product availability. Deere also saw year-over-year declines in all its scores by category, aside from an increase in its warranty procedures score from 5.36 last year to 5.46 in 2022. Among the 12 categories, Deere took the lowest score in parts availability (4.04) and manufacturer response to dealer needs/concerns (4.20).

Case IH had the second-lowest overall score in this year’s report, coming in at 4.55 vs. 5.00 last year. However, this was Case IH’s third-highest overall score in the last 9 years, with a 9-year low of 4.08 reported in 2018. By category, Case IH’s highest score was a 5.08 in overall satisfaction, and its lowest was a 3.27 in product availability. The company saw year-over-year declines in all 12 categories. Case IH had the lowest score among full-line manufacturers in 4 categories: product quality (4.67), parts quality (5.00), return privileges (4.77) and warranty payments (4.58).

New Holland was the only full-line manufacturer to see an increase in its overall score, up to 4.65 vs. 4.44 in 2021. This was New Holland’s highest overall score in 9 years. New Holland also saw year-over-year increases in 11 of its 12 category scores, with each being a record high over the last 9 years. New Holland’s only year-over-year category decline was in product availability (3.69 vs. 4.09 in 2021).

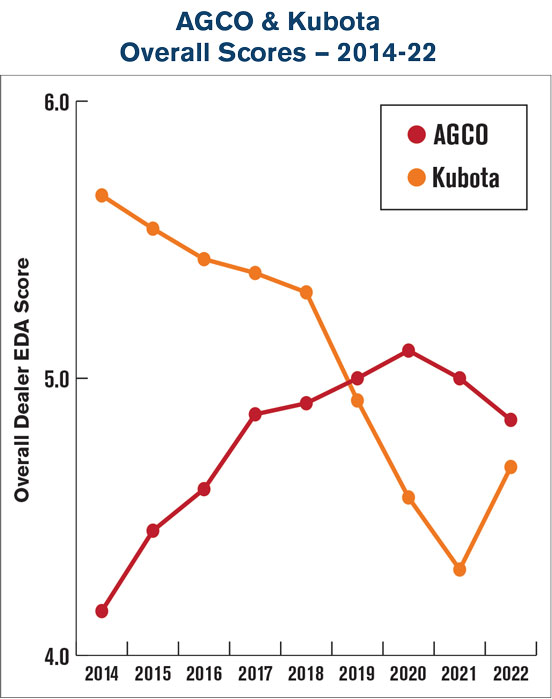

AGCO and Kubota have seen some of the most notable shifts in their overall dealer EDA scores among full-line manufacturers in the last 9 years. AGCO recorded a 23% increase in its overall score (4.16 to 5.10) between 2014 and 2020, while Kubota reported a 24% decline (5.66 to 4.31) from 2014 to 2021. More recent surveys have seen both manufacturers buck these trends, however, with AGCO reporting declines in 2021 and 2022 to an overall score of 4.85, and Kubota

reporting its first increase in 9 years in the 2022 survey to 4.68.

Source: Equipment Dealers Assn.

Dealer-Manufacturer Relations Reports

The average total score for full-line manufacturers in this year’s report was 4.80, down from 4.90 in the 2021 report but above the 4.78 recorded in 2020. Year-over-year, the average full-line score dropped in 10 of the 12 categories, excluding increases in warranty procedures (4.92) and warranty payments (5.01) average scores.

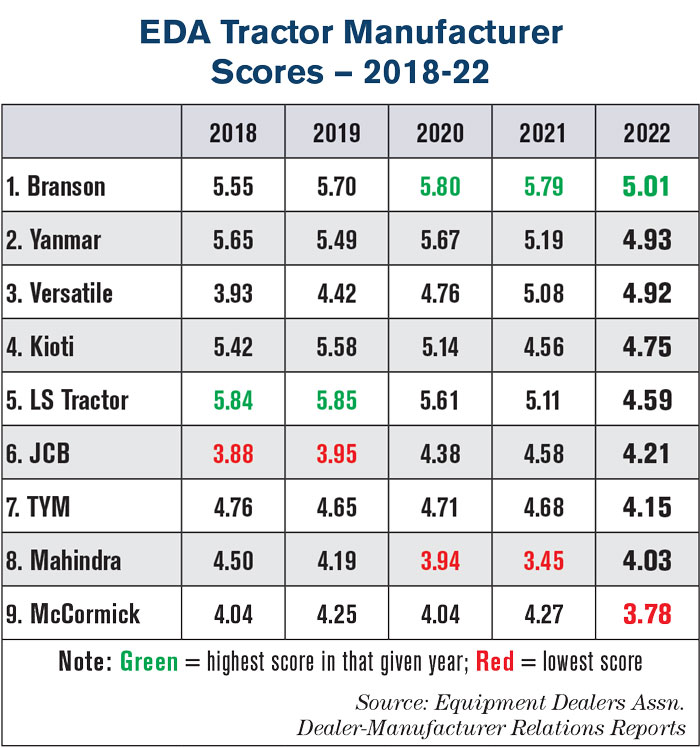

Branson Once Again Top-Rated Tractor Manufacturer

Branson kept its first-place spot in the EDA report for the 3rd year in a row with an overall score of 5.01, down from a score of 5.79 last year and its lowest score in 9 years. Branson saw year-over-year declines in all category scores, with its highest score being a 5.62 in product quality and its lowest a 3.85 in product availability. However, Branson’s category scores beat the average for all tractor manufacturers in every category. Branson also took the highest score among tractor manufacturers in product availability (3.85), return privileges (5.45) and warranty payments (5.26).

Yanmar had the second-highest overall score for the 3rd year in a row, reporting a 4.93 vs. 5.19 last year. This was Yanmar’s lowest overall score in the last 6 years and its first to fall below the 5.00 mark. Despite this, Yanmar reported year-over-year increases in 3 categories: return privileges (5.02), parts quality (6.05) and parts availability (5.44) and maintained an unchanged score of 4.98 in warranty procedures. All other categories were down year-over-year. Yanmar also took the highest score among tractor manufacturers in 5 categories, including product technical support (5.15), parts availability (5.44), parts quality (6.05), warranty procedures (4.98) and product quality at 6.19, the highest category score among all tractor manufacturers.

Versatile was the third-highest ranked tractor manufacturer with an overall score of 4.92, down from 5.08 last year but its second-highest overall score since 2015. All of Versatile’s category scores have risen since its first appearance on the EDA survey in 2015, aside from product availability (5.27 in 2015 vs. 3.71 in 2022). Versatile also took the top score among tractor manufacturers in 3 categories: overall satisfaction (5.20), communications with management (5.10) and manufacturer response to dealer needs/concerns (4.92).

With an overall score of 4.75 (its second-lowest in 9 years) vs. 4.56 last year, Kioti was the fourth-highest rated tractor manufacturer, avoiding a 3rd year in a row of overall score declines. Kioti saw improvements in 10 of its 12 category scores, minus a decline in warranty payments (4.79) and warranty procedures (4.54). Kioti took the top score among tractor manufacturers and marketing/advertising support (5.35).

LS Tractor came in with the fifth-highest overall score at 4.59, its 3rd year of decline. This was also LS Tractor’s lowest overall score in 9 years, down from a peak of 6.10 in 2016. This included year-over-year declines in all 12 category scores, with its highest score being a 5.76 in product quality and its lowest a 3.46 in product availability.

JCB’s overall score declined for the first time in 3 years, dropping to 4.21 vs. 4.58 in 2021. The manufacturer saw only its warranty payments score rise year-over-year, up slightly to 4.45 vs. 4.40 last year. JCB’s highest category score was in parts quality at 5.00 and its lowest was in product availability at 3.33.

At 4.15, TYM’s overall score hit a 6-year low in the 2022 survey vs. 4.68 in the previous year, generated by year-over-year declines in all of the manufacturer’s category scores. It should be noted, however, that all of TYM’s category scores are up vs. its 2015 scores, the first year it appeared on the survey. The company’s highest category score was a 5.40 in product quality and its lowest was a 3.24 in product availability, which tied with McCormick for the lowest product availability score among tractor manufacturers.

Mahindra ended 6 years of decline with an overall score of 4.03 vs. 3.45 in 2021, the only other tractor manufacturer besides Kioti with a year-over-year increase in its overall score. This was made possible through year-over-year improvements in all its category scores, with its highest being a 4.89 in product quality and its lowest a 3.27 in parts availability.

McCormick was the lowest rated tractor manufacturer in this year’s survey with an overall score of 3.78, its lowest score in 9 years and its first to fall below the 4.00 mark. Scores were down in all categories, save for an increase in parts availability to 4.46 vs. 4.07 last year. McCormick also received the lowest scores in 9 of the 12 categories among tractor manufacturers, with its lowest being a 3.00 in manufacturer response to dealers needs/concerns.

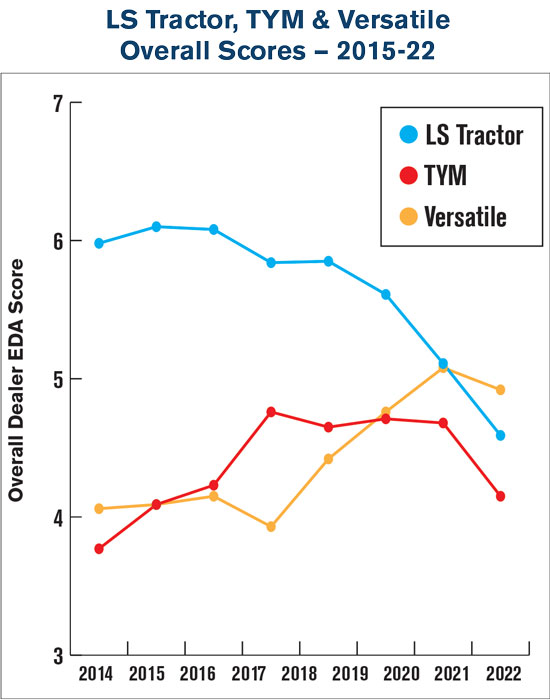

Before the 2022 report, TYM and Versatile had been 2 of the tractor manufacturers with more notable improvements on their overall scores since first being included in the EDA report in 2015. TYM saw a 25% increase in its overall score between 2015 and 2020 to a peak of 4.71 before dropping in the next 2 years to 4.15. Versatile recorded another 25% increase between 2015 and 2021, with only a slight decrease in overall score to 4.92 in 2022. On the other hand, LS Tractor’s overall score has declined 25% from a peak of 6.10 in 2016 to a low of 4.59 in 2022.

Source: Equipment Dealers Assn.

Dealer-Manufacturer Relations Reports

The average overall tractor manufacturer score was 4.49 in 2022, down from 4.74 in 2021. Scores were down in all categories, with the highest average tractor manufacturer score being 5.34 in parts quality and the lowest 3.43 in product availability.