The North American Equipment Dealers Assn. (NAEDA) released the results of its annual Dealer-Manufacturer Relations survey in May.

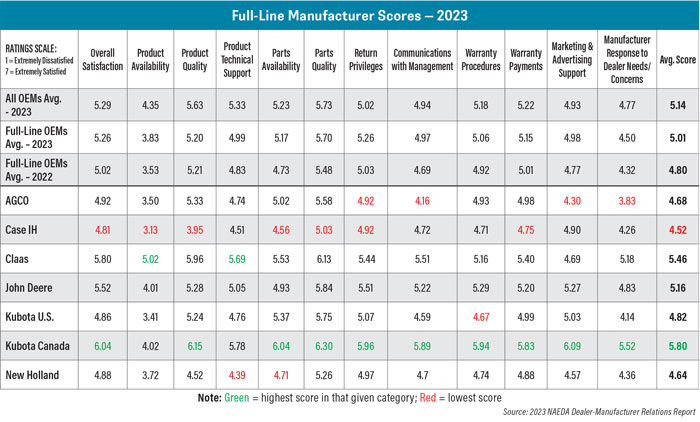

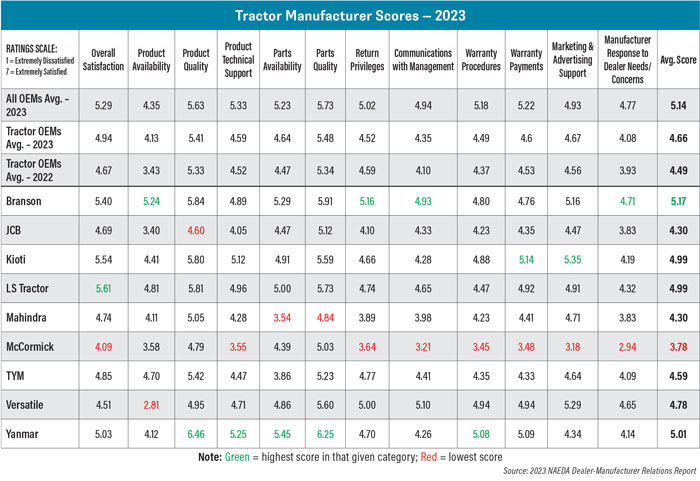

NAEDA’s survey allows North American dealers to rate up to 7 manufacturers they carry and collects data on their experience in 12 categories, including overall satisfaction, product availability, product quality, product technical support, parts availability, parts quality, return privileges, communications with management, warranty procedures, warranty payments, marketing & advertising support and manufacturer response to dealers needs/concerns. Respondents rate manufacturers on a scale of 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

The 2023 report drew 2,493 dealer respondents. These responses came from all 50 states and 9 Canadian provinces. On average, each respondent rated 4 manufacturers.

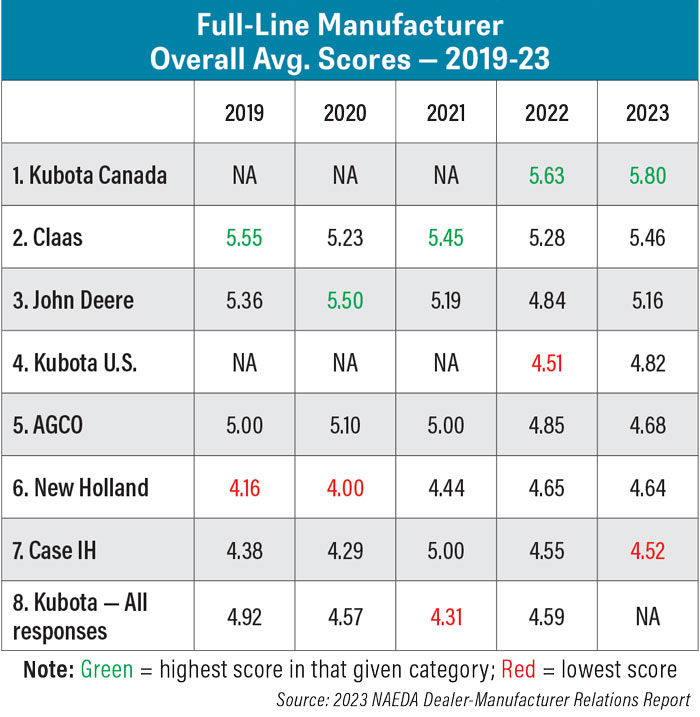

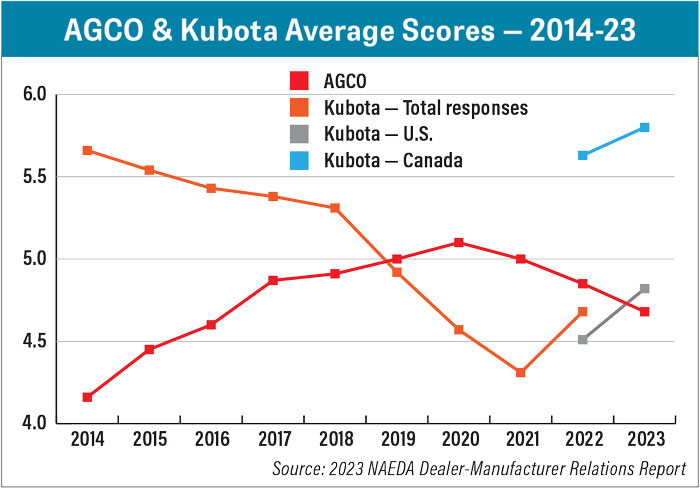

It is important to note the survey results represent a snapshot of dealers’ thoughts in early 2023. This year’s report — for the second time — NAEDA split Kubota responses into 2 categories: Kubota Canada and Kubota U.S., meaning this year’s survey examined 7 full-line manufacturers.

Shortline Manufacturer 2023 Results

- Highest Average Score: Meyer Mfg. (5.92)

- Highest Overall Dealer Satisfaction Score: Bourgault (6.14)

- Average Shortline Manufacturer Score: 5.27

OPE Manufacturer 2023 Results

- Highest Average Score: Scag (5.95)

- Highest Overall Dealer Satisfaction Score: Scag (6.20)

- Average OPE Manufacturer Score: 5.25

Full coverage of shortline & OPE manufacturer performance will be featured in the September 2023 issue of Farm Equipment.

Product availability scores remain low among most manufacturers, though the average for both full-line and tractor manufacturers has improved as supply chain issues begin to ease.

Kubota Canada Continues to Lead

In its second year on the survey, Kubota Canada once again received the highest average score at 5.80. This was not only an improvement from its 5.63 score in 2022 but also the highest average score seen among full-line manufacturers in the last 5 years. This also surpasses both the average manufacturer score of 5.14 and the average full-line score of 5.01. Kubota Canada took the lead in 11 of the 12 categories, with its highest score in parts quality at 6.30 and its lowest score in product availability at 4.02. Claas was the only other full-line manufacturer to have the highest score in a category with a 5.02 in product availability. Kubota Canada saw improvements in 9 of the 12 categories, showing declining year-over-year scores in communications with management, warranty payments and manufacturer response to dealer needs/concerns.

Kubota U.S. once again did not perform as well as its Canadian counterpart but improved its average score from 4.51 to 4.82 in 2023. This lifted Kubota U.S. from the lowest scoring full-line manufacturer in 2022 to the 4th highest scoring in 2023.

Kubota U.S.’s lowest category score was 3.41 in product availability. Kubota U.S. had the lowest score among any of the full-line manufacturers in 1 category this year, a 4.67 in warranty procedures. This is an improvement from it receiving 5 of the lowest scores among full-line manufacturers last year. Kubota U.S.’s ratings rose year-over-year in all 12 categories.

Claas once again had the second-highest average score at 5.46, up from the 5.28 that brought the second-highest average score in 2022. Claas’ 5.46 is its second-highest average score in the last 5 years, topped only by the 5.55 it received in 2019. Claas’ highest score by category was a 6.13 in parts quality and its lowest was a 4.69 in marketing & advertising support. Claas saw year-over-year increases in 11 of its 12 category scores.

John Deere rounded out this year’s top 3 full-line manufacturers with a total average score of 5.16, an improvement from 4.84 in 2022 but still its second-lowest score in the last 5 years. John Deere’s lowest score was product availability at 4.01, while its highest was 5.84 in parts quality. Deere saw year-over-year improvements in 9 of 12 categories.

Now split into its U.S. and Canadian businesses, Kubota’s average score improved in both business segments. AGCO, on the other hand, entered its 3rd year in a row of declining average scores, receiving a 4.68 vs. its peak of 5.10 in 2020.

Case IH is this year’s lowest-scoring full-line manufacturer with an average score of 4.52, its lowest score at 3.13 in product availability (the lowest among full-line manufacturers) and its highest a 5.03 in parts quality (also the lowest among full-line manufacturers). Year-over-year, Case IH saw 7 of 12 category scores improve.

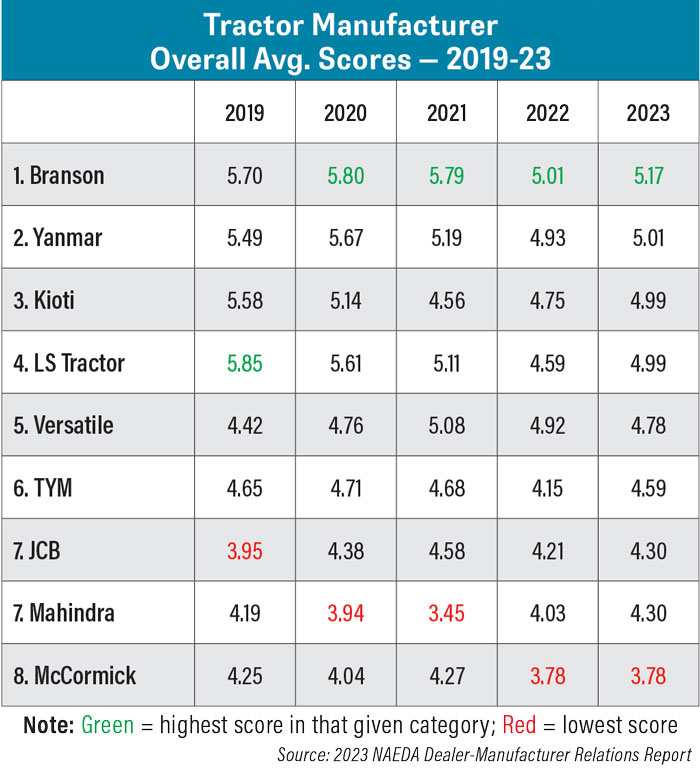

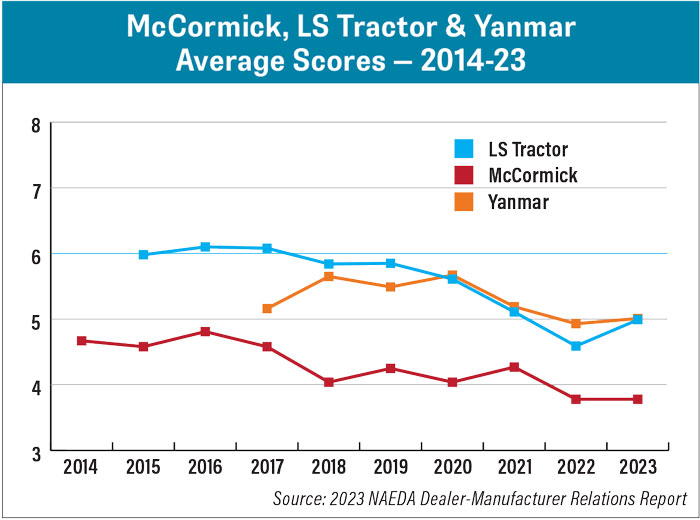

LS Tractor reversed 8 years of mostly declines in 2023, receiving an average score of 4.99 vs. 4.59 in 2022. McCormick held its average score of 3.78 from 2022, yet was the tractor manufacturer with the lowest average score in both years. Yanmar, meanwhile, rose above 5.01 in this year’s report, reversing the decline it saw last year that put it below 5.00 for its first time.

Branson Achieves 4th Consecutive Top Score

Branson received a 5.17 average score from dealers, the highest among tractor manufacturers for the 4th year in a row but its second-lowest score in the last 5 years. Its highest category score was parts quality (5.91) and its lowest was a 4.71 in manufacturer response to dealer needs/concerns (the highest score among tractor manufacturers). Branson also scored a 5.24 in product availability vs. a 3.85 in 2022, the best score in this category among tractor manufacturers this year. Year-over-year, Branson improved in 9 of 12 categories.

It should be noted that all independent tractor types are examined together,evaluating production level units against the smaller and more consumer oriented tractors.

For the 4th year in a row, Yanmar had the second-highest average score among tractor manufacturers at 5.01, up from 4.93 in 2022 but its second-lowest score in the last 5 years. Yanmar’s highest category score was a 6.46 in product quality, the highest among tractor manufacturers. Yanmar’s lowest was 4.12 in product availability. Seven of Yanmar’s 12 scores rose year-over-year.

Kioti received the 3rd-highest average score — slightly above LS Tractor — at 4.99, above its 2021 and 2022 scores but its 3rd time in a row below the 5.00 mark. Kioti’s highest score was parts quality at 5.59, while its lowest was 4.19 in manufacturer response to dealer needs/concerns. Eight of Kioti’s 12 category scores improved in 2023 vs. 2022.

McCormick received the lowest average score from dealers at 3.78, its 2nd year in a row with the lowest average score and unchanged from 2022. McCormick’s highest score was 5.03 in parts quality, and its lowest was a 2.94 in manufacturer response to dealer needs/concerns, the lowest among tractor manufacturers. McCormick saw 3 of its 12 category scores improve year-over-year.

How do these results stack up against your experience with these manufacturers? Share your comments at farm-equipment.com.

2023 Dealer-Manufacturer Relations Report

With 90 pages of data and charts, the 2023 Dealer-Manufacturer Relations Report is available to all NAEDA dealer members and to participating manufacturers. Manufacturers may also obtain data that includes company breakouts by region and their individual dealers’ comments. For information, contact Joe Dykes at JDykes@EquipmentDealer.org