Ronnie Barnett, Chief Financial Officer

Years with Organization: 26 (joining the company just 4 years after its founding). Worked for a regional CPA firm for 3 years before joining H&R, one of his accounts. (“I joke with Wayne Hunt that I knew how bad he needed me before he did,” says Barnett.)

Role: “Pretty much anything that involves money,” which Barnett says spans personnel to operations to finance through customer service. He oversees 25 staffers comprising accounting, asset management, legal/compliance, marketing/communications, IT/Systems and HR. “Most of my time lately has been with acquisitions (6 locations in the last 2 years), namely the due diligence, contract negotiations and then the integrations.”

To be honest, I couldn’t tell you if Chief Financial Officer Ronnie Barnett can play or read a single note of music (although there are photos of Barnett, the Hunts and other H&R staff in a Lynyrd Skynyrd lip sync performance at a United Way event). But after observing Barnett and the role he plays within H&R Agri-Power, one could draw a conclusion that he could do well with a baton in his hand.

If the responsibilities of the orchestral conductor are to unify the performers, set the tempo and pace, and give clear preparations, well that sounds like Barnett and what he does at H&R.

Growing up on a small tobacco, row-crop and cattle farm in Kentucky, he watched his dad do business with Wayne Hunt both at Agri-Chem (fertilizer, chemical and seed retailer) and H&R. While he didn’t join the company until it’s fourth year of existence in 1994, he’s been part of it virtually from the beginning, as his CPA firm handled the company’s books before Hunt brought Barnett into the dealership.

Quiet and soft-spoken, Barnett “conducts” an operation that is different than most in the industry. For starters, it’s a large-scale operation (third largest group in the Case IH network), a business that went from private ownership to partial ESOP to full ESOP and made 4 acquisitions in the last 2 years -- with little sign of slowing down. And the firm’s systems, processes and now technology are so sought after in the industry that a mobile app (Power EQ) for quoting is now available to other dealerships.

100% Employee Ownership ... Big Advantage in M&A

H&R Agri-Power is widely known for embracing the Employee Stock Ownership Plan (ESOP), including a presentation that Ronnie Barnett made to Dealership Minds Summit attendees on succession planning theme back in 2015.

In 2014, the employees owned 18% of the company (new stock was issued with Wayne Hunt retaining the remaining shares).

With the growth the company had incurred and the plans on the horizon, H&R considered going public like their friends at Titan Machinery of North Dakota had done to fuel the acquisition growth. Ultimately, they opted to go with a 100% ESOP in 2014 when they learned from a consultant (BKD of Bowling Green, Ky.) that they could sell the business to employees yet still control it.

As Barnett discussed the timeline of acquisitions since the move to an ESOP, it’s clear that the ESOP model has been advantageous to a consolidator like H&R (See Acquisitions Timeline on Intro page).

“As an ESOP company, we aren’t as worried about deductions as most companies are, because we’re basically an exempt organization. We can structure the deal such that it’s advantageous to the seller.”

Most of the transactions are asset deals, because that’s what the buyer wants. “Buyers want asset deals, where the basis of those assets gets stepped up and they can depreciate the assets for better cashflow.”

On the other hand is the stock purchase. “Obviously a stock sale is attractive to the seller,” Barnett says. In a stock transaction, the buyer doesn’t get a step-up in basis on those assets, so it can’t take as much depreciation, which in turn affects cashflow. But for us, as an ESOP company, we’re not worried about depreciation. The ESOP eliminates the negative tax implications of a stock purchase. It doesn’t matter that we’ve got an asset sitting on our books that we can’t depreciate, because we don’t need that expense anyway. Our tax rate is effectively zero. It’s helped us to get some deals done.”

Barnett says H&R knew an ESOP would give the company and advantage in acquisitions (“There’s no better vehicle for a company to sell to than an ESOP company,” he says), but perhaps was surprised by how important the people side became. “We didn’t anticipate how important the people side would be with the emotional attachment that owners have for their employees, and what a good tool it would be for the idea of bringing them in under the umbrella.”

If the seller cares about their employees in a transaction (“most everybody does,” says Barnett), then it’s relatively easy to show H&R Agri-Power will be a good fit. “They can feel good about employees being taken care of and actually know their employees are going to gain a benefit that the seller itself couldn’t offer them. What better way to transition your company than for your employees to be able to own part of it?”

“I know for a fact that the two bigger acquisitions we did last year were a result of not only being able to structure the deal financially, but for their employees to be able to reap the benefit of it. It worked well for us. Employees in an acquisition are always going to feel some apprehension. To have such a big benefit helps mitigate those feelings of uncertainty.”

Coming to Define the H&R Way

The company had existed for only 4 years when Barnett joined in 1994. H&R had just brought on its fourth location and had grown revenue 10 times in a 4-year period (from $3 to $30 million). “Wayne brought a new level of customer service into the business, and farmers recognized that and wanted to do business with us,” Barnett says of the rapid growth.

But the dealership was struggling with integrations and systems.

“The business was doing well but it was too much growth, too soon and Wayne knew that business had gotten somewhat out of control,” says Barnett. “A lot of folks like to focus on the top line sales, and obviously that’s important, but cash is king. It’s not as fun to manage the balance sheet, inventory turns and debt-to-equity ratios as it is to get that charge from selling. But sometimes the best deal you make is the one you walk away from. You can sell yourself out of business in this world.”

In addition to challenges with used inventories, that era of rapid growth also brought other “wild west” problems that needed correction. “There was inconsistency in how things were being handled from a business standpoint,” Barnett recalls. “Or if they were handled consistently, in some cases they were wrong. We found out quickly how slim the margins were in this business. When you’re trying to keep 2-3 cents on $1, there isn’t room for many mistakes — and you can make some big ones in this business.” Barnett’s entrance allowed him to set a new cadence for the company, which he’d learned would require more of him as it continued to grow to new heights.

Focusing On, Teaching Game-Changing Principles

A big part of Barnett’s role is teacher. If an organization is going to go “open book” as H&R has, employees must know what they’re looking at. Enter Barnett. “We need to educate our people for them to be as good as they can be. You don’t send a soldier to war without a weapon, that’s how we look at it.”

When asked for examples of how he teaches the troops, Barnett described one of his favorite topics, parts and service absorption, which continues to be an area where opportunity exists.

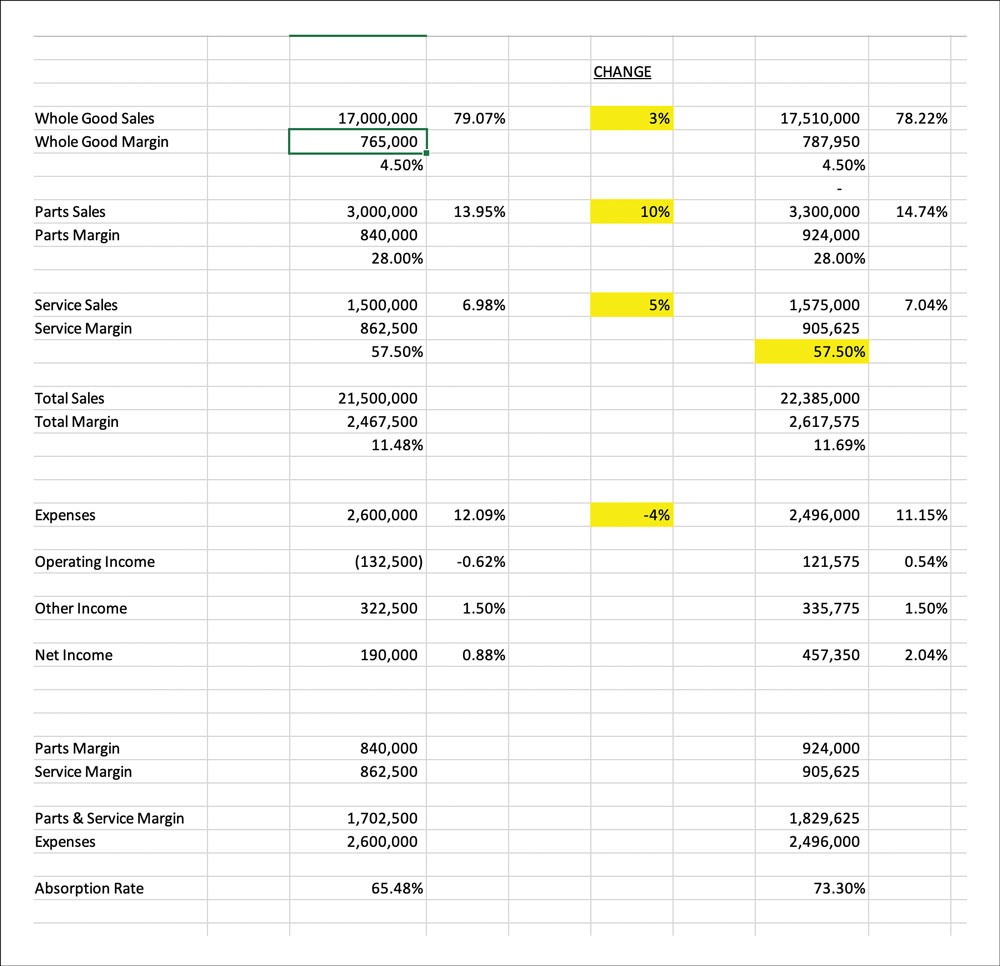

He has a templated spreadsheet (see image below) that he uses as both a teaching and planning tool. It starts with a discussion on wholegoods sales, and realistic views of what’s possible for the coming year. “They might say ‘We think we can do 3% more’ and enter it. Then with service, we’ll discuss productivity. ‘Do you think productivity in your service department could be improved by 5%?’ They usually agree that it’s possible.”

The columns in yellow show the variable entries that can be discussed and entered during a meeting. In this example (showing a store with $17 million in revenue), a 3% increase in wholegoods sales, a 10% increase in parts sales, a 5% increase in service sales and a reduction of 4% in expenses equates to a net income gain of $267,350 and an absorption rate increase of 7.82% (to 73.30%). Visit www.DealershipMinds.com/H&RAgri-Power for a downloadable and enterable tool to use with your own teams and in-store data.

Then, Barnett walks them through expenses. “I’ll ask what they think is possible in expense reduction and we’ll plug in their answers.”

It isn’t unusual, he says, to see the absorption goal improve by 10 points based on the numbers presented during that same meeting. “It has a dramatic effect on them and their understanding.”

Barnett says putting benchmarks into context of a larger plan is the key to understanding and executing. “It’s one thing to say absorption should be 80%, or that used inventory turns need to be 3.0-plus, but the words alone don’t have real impact. When it’s within the context of a detailed plan, they realize how a 3.0 inventory turn means less interest expense and higher used margins. It’s here that they realize the impact of these benchmarks on the whole operation and how to drive results toward them. Because it isn’t just something that we or Dr. Jim Weber say. It’s something that truly is going to help them.”

Planning & Accountability Processes

H&R has long had a detailed planning process in place, but it’s evolved over the past 15 years to end with each store location going through a work-through with the board of directors and leadership team. Presenting plans and answering to them has kept ratcheting up the accountability, says Barnett.

Enlisting the Help of Consultant & Dealer Peers: ‘Best Decision Ever’

Longtime executive Ross Morgan (today serving in Special Projects capacity) suggested the business get involved with a 20 Group (dealer peer group) to surround itself with the best ideas and practices for the growth chapter ahead. In CFO Ronnie Barnett’s first year, H&R Agri-Power signed on to join Dr. Jim Weber’s dealer group. “It ended up being the best thing we ever did,” he says, citing the relationships with other dealers as well as the tutelage of Weber.

Barnett recalled what they attacked first in those years.

- Internal Controls. “Once the books were accurate and we had statements we could rely on, we had to control things to be sure money wasn’t walking out the door. First you’ve got to know where you are to be able to do anything about it.”

- Establishing Benchmarks. Once the books were accurate, it was about trying to drive the numbers where they needed to be. “Dr. Weber helped us see those benchmarks and where we needed to get, and what we needed to be focusing on and managing toward. We started looking at gross margins, productivity, inventory turns, all those sorts of things.”

- Inventory & Balance Sheet Management. While the dealership grew its revenue 10 times in 4 years, Barnett notes, “You can also sell yourself out of business.” The biggest key in this business is to manage your inventory. Driving the top line sales is important, but cash is king. We really focused on balance sheet management.”

“We don’t believe in putting a budget together, giving it to the employees and saying, ‘Here, you need to do this.’ We feel strongly that’s the wrong way to do it. Our planning process goes deep into employees at the store level.”

Barnett prefers the word “plans” over budgets because, as he says, “there’s activities behind those plans.” For instance, a salesperson’s plan for 3 new combines is also going to include the names of the prospects that will result in 3 sales.

Few dealer groups take the location-by-location exercises and in-person presentations as seriously as H&R, something that its peer group members continue to study and ask about at meetings. “More are looking at doing something similar,” says Barnett, but they must be willing to invest the time.

Barnett explains how the process starts at each store location, for sales, parts and service.

Sales — The process starts with a template and each salesperson is asked how many units they expect to sell of each piece of equipment. “They’ll plug in how many of each kind of tractor, combine and implements they’re going to sell. Once they plug those numbers in, it rolls up to a full plan for that salesman. And then, we can roll up those salesmen’s plans together for each stores wholegoods plan.”

Service Techs — A similar process and plug-in template is then followed for the technicians. Barnett says techs are asked questions like “How many hours are you going to work? How productive are you going to be? What’s your billing rate? What type of work are you working on -- customer or internal? Warranty work?”

Say a technician says he is going to bill $250,000 next year. “We’ll know how he’s going to do that. The service manager has worked in concert on these plans with the tech, so he knows what he’s accountable for.”

Parts — The exercise for the parts staff covers questions on the quantity of tickets and the average value per ticket and plans for change for the coming year. “If a parts person did 500 tickets last year and says he’s going to do 600, we’re going to find out how he plans to drive that result. Similarly, if the average ticket was $100 and they’re forecasting $125, we’re going to be looking for a narrative on what they’re going to be doing differently to achieve that plan.”

The formality of the process — at each stage — also serves to eliminate the presence of sandbagging. “We ask some pointed questions when we feel like that’s the case. If they say sales are going to be down next year and we don’t agree we’re going to ask them why. They’re going to get challenged on their assumptions if we don’t think they’re being aggressive. In planning, being overly conservative is just as bad as being overly aggressive.”

More Information on ESOPs in Farm Equipment Dealerships

When asked why the industry hasn’t moved toward more of an ESOP ownership model, H&R Agri-Power CFO Ronnie Barnett says it’s still viewed as a complicated concept. “It takes getting the right consultants involved to do everything right. While it hasn’t been adopted as quickly as many believed, Barnett maintains that it’s an ownership vehicle that will continue in the dealership world, he says, pointing out the Bane-Welker dealer group in Indiana is now a 100% ESOP.

- Exploring the Possibilities of Employee Stock Ownership Programs (H&R Agri-Power, Agri-Service and Livingston Machinery from Dealership Minds Summit), Dave Kanicki, March 2015 Farm Equipment, Click here.

- Employee Ownership (ESOPs), Clint Schnoor Agri-Service, March 2013 Farm Equipment, Click here.

- Webinar: Is An ESOP Right for Your Dealership? Clint Schnoor, Agri-Service, July 2014. Click here

Presenting to the Board

After the individuals have done their template work and put together their detailed action plans, the store manager, service manager and parts manager come to Hopkinsville each December to present their plan to the board of directors. Each meeting generally takes 2-3 hours and the board will have as many as 4 meetings in a day.

Barnett says it’s a time-consuming but worthwhile process, especially now that there are two independent board members (Dr. Jim Weber and Tom Yohe, formerly of Hoober’s Inc., a Case IH dealer in Pennsylvania, were appointed to the board in 2018.) “We’re in the middle of it every day, so they bring an outside perspective and ask questions that have added another dimension to the presentations.”

For those of you who’ve seen Dr. Weber in action (including a special 3-hour workshop at the 2019 Dealership Minds Summit, see www.Farm-Equipment.com/WeberWorkshop), you can anticipate what the board meetings might be like for the ill-prepared or sandbagger. “Yes, he’ll call him on the carpet if the assumptions don’t make sense. He isn’t shy about telling them that, nor reminding them of what they might have promised at the last meeting. He’s vocal about the need to justify plans.”

Below, Barnett describes the structures of the meeting.

- Parts Manager. “He’ll detail the sales budget and margin budget, and then move downward into inventory turns, obsolescence goals and how to manage toward them, inventory turns, fill rates, everything related to the parts department. He’ll go through the objectives for each area in about 45 minutes, with time for questions.”

- Service Manager. “The service manager will go through every technician he has, detailing how many hours each is going to work, how productive he expects each is going to be and the type of work each is focused on. Of course, we’re looking at historical data, so we can ground truth in the plan vs. what reality would indicate. Then, the service manager would go into expense control, with discussions on things like rework expense, warranty adjustments, shop supplies -- everything that’s under that service manager’s control. He shares the objectives and how he intends to manage them.”

- Store Manager. “From there, we’ll roll into sales. We go through everything related to the sales for that store, and to each salesman’s budget. We’ll look at things like used inventory turn goals for the store and margins. Following the sales discussion and questions, the store manager will wrap things up with his team’s ideas about how to make the store better. It could be a new service truck, an improvement or modernization to the facility, or a service truck -- whatever may be needed to achieve all these goals. He’ll present those ideas, along with a cost estimate on what he thinks it would cost to get it done. He’ll also have the floor to talk about anything else on his mind, and the same for us about any concerns we have and discuss ideas about addressing them.”

By the last of the store location meetings, Barnett will be “pretty close” to a corporate budget ratification. “We can make those decisions at the table if the managers properly presented things, justified what they needed it and provided cost information. Occasionally, a store manager will be sent back to fill in a missing gap of information as soon as he gets home, but Barnett says the group is prone to acting in the meeting and usually he’ll have everything he’ll need to roll up a corporate budget within a week of those meetings.

H&R Agri-Power’s Home-Grown Inventory Management App

Ronnie Barnett, H&R Agri-Power Chief Financial Officer, says a key to the dealership’s success has been the development of the company’s quoting tool, which is now branded as Power EQ Software, and available for other dealers to license. Read more about this home-grown solution for real-time data on used equipment inventory at www.farm-equipment.com/H&RPowerEq

Doing 17 store meetings is grueling and they may do 3-4 per day for nearly a week, often spilling over onto a Saturday. Still, Barnett enjoys the meetings because of the interaction with managers, department managers and board members -- and a time when everyone is in the room together working on that location’s business.

Barnett says the process is a valuable tool for establishing accountability. “Again, this isn’t about someone else’s nebulous budgets being forced down on them. It’s the culmination of the store’s own plans. So, when the regional managers are at the location a month later, they aren’t going to be hearing things like ‘That was your plan, not mine.’ They know they’d better have a good answer if things get off track.”

That said, Barnett says it’s remarkable how close H&R Agri-Power has been hitting its plans and numbers. “It’s because the plan has an impact on them; they know what they’re responsible for, and they’re going to drive toward it.”

What If an Employee-Owned Dealership is Sold?

Farm Equipment: Let’s say a large dealer group, who had a more conventional ownership structure, wanted to buy another dealership group that was an ESOP. Would it make that acquiring company run for the hills?

Ronnie Barnett, H&R Agri-Power CFO: “It does add a layer of complexity to the deal. The main thing is employees must be treated fairly. If the deal is fair to the seller, and the employees are getting at least the fair market value for the company, then there’s not any additional complexity to the deal. That would be the only thing; to prove that the employees were treated fairly, and that got at least the fair market value for their stock.”

Farm Equipment: So, all those employees who had been hearing “you’re an owner” are going to lose that and it would introduce a negative, right?

Barnett: “Yes, it could. We have experience with the other side of that, too, in the fertilizer company that Wayne sold. He sold 50% of it to the cooperative in 1998, and then he sold 30% to the ESOP in 2006. Then, in 2012 the cooperative bought out Wayne’s remaining 20%, and at that time it didn’t want to deal with the ESOP, so it bought out the 30% of the ESOP, what it owned. Yes, there was some resistance. Employees didn’t like to see that benefit go away, but at the same time they cashed out their investment, and they were very pleased with the money that they got from the transaction. If employees feel like they got a fair price, you can overcome that negative.”

Dealership Minds 2020 Overview: H&R Agri-Power

Dealership Minds: Leading the Charge

Dealership Minds: Sage Wisdom from A Dealership Lifer

Dealership Minds: Building H&R Agri-Power’s Culture, Profitability

Dealership Minds: CFO: ‘Conducting’ the Orchestra

Dealership Minds: Measuring Sales Success Through Customer Satisfaction

Dealership Minds: Creating a Reputation that Sells Equipment

Dealership Minds: Connecting On-Farm Experience with Customer Engagement

Dealership Minds: Managing the Measurables of a Precision Business

Dealership Minds: Financing Solutions to Keep Sales Selling

Dealership Minds: Coaching the Sales Team to Dealership-Wide Success

Dealership Minds: Maintaining High Standards of Service

Dealership Minds: Following the Data & Managing Relationships to Order Equipment Properly

Dealership Minds: Leading by Example in the Parts Department