Current high commodity prices and crop insurance give some reason for dealers to breathe easier, but uncertainties persist.

Photo courtesy of AGCO |

It wasn’t that long ago that the dealers we spoke with weren’t feeling at all certain about their business prospects for the year ahead. Many of their customers who were most impacted by the 2012 drought were in a “bad mood” as they watched their crops wither in the field. Talking about buying new ag equipment wasn’t high on their list of priorities.

But as forecasted crop yields declined with every new government report, the projected price of commodities rose to levels unheard of in agriculture. As farmers absorbed what the impact of rising crop prices combined with their crop insurance payout would have on their bottom lines, their mood improved markedly. As the outlook of their customers improved, dealer confidence followed.

By the time Farm Equipment conducted its annual Dealer Business Trends & Outlook survey during the last week of August through the first week of September, it was obvious dealers were far more optimistic that 2013 would be a decent year after all. At the same time, they’re not quite as confident as they were one-year ago, but most see solid sales prospects during the year ahead.

Reasons for Uncertainty

Click to enlarge. |

Despite the per-bushel price of corn and soybeans rising to record levels, a fair amount of uncertainty lingers as equipment dealers speculate about what farmers will do with crop insurance payouts that they’ve seldom had to consider. USDA estimates 85% of U.S. farmers took out crop insurance for the 2012 marketing year. According to National Crop Insurance Services, farmers invested more than $4 billion to purchase more than 1.2 million crop insurance policies. In total, the NCIS estimates the policies would provide $115 billion in liability protection.

In addition to the traditional concerns with election years, there are several other unknowns that also have dealers scratching their heads this year. Questions many dealers are asking themselves include: “Will ag machinery buyers spend their insurance payments on new or used equipment? Or, out of fear, will they view that money somehow differently and choose to save it for a rainy day — or as “insurance” against another drought year? Along with the fact that farmers have been updating their machinery, at least their high horsepower tractors and combines, at more regular intervals, they may not feel compelled to do so in the next year. Reportedly, some farmers didn’t even take their combines out of the shed this past year.

Click to enlarge. |

Another unknown is how many farmers sold their crops early and will miss the windfall of $8 a bushel corn and $16 soybeans.

And then there’s the other side of the “crop” story. While higher commodity prices and crop insurance should bolster row-crop farmers’ income for 2012 and into 2013, livestock farmers and their equipment dealers aren’t necessarily singing from the same songbook.

For example, in its September 18 report, USDA notes with higher feed costs resulting from the rising price of corn, along with low milk prices, dairy cow slaughter has been running ahead of 2011 levels. Low and costly feed supplies also led beef cattle ranchers to cull their herds. This, on top of the exceptionally high slaughter of 2011, is giving dealers serving these markets something to fret about.

Click to enlarge. |

Again, dealers’ confidence is highly dependent on the weather this fall. With enough moisture to replenish forage production, livestock farmers and their dealers could start feeling better about their prospects come 2013.

Despite these setbacks and the higher level of caution that dealers are expressing about the new year, overall, the picture for new ag machinery sales in the coming year remains solid.

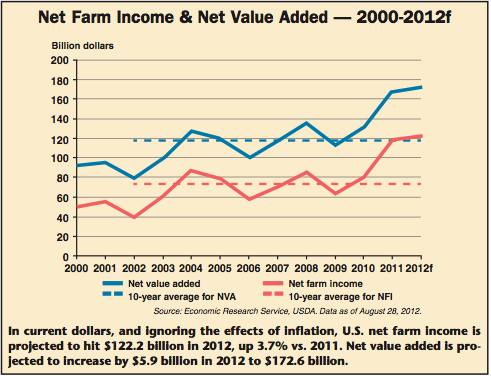

According to USDA, in current dollars, and ignoring the effects of inflation, U.S. net farm income is projected to hit $122.2 billion in 2012, up 3.7% vs. 2011. Net cash income is forecast to reach $139.3 billion, up 3.4% vs. the previous year. Net value added is projected to increase by $5.9 billion in 2012 to $172.6 billion.

In its September report, USDA said, “The expected increase in income reflects large price-led gains in corn and soybean receipts, as well as large increases in crop insurance indemnities. Crop farm gains should be more than enough to offset livestock farmers’ higher feed expenses and a decline in sales of wholesale milk. Extreme hot and dry conditions in the Plains and Corn Belt are drastically cutting projected corn and soybean yields. With corn and soybean supplies for the 2012 marketing year expected to be the lowest in nine years, prices are increasing dramatically, resulting in higher than expected 2012 calendar-year receipts for many crops.”

2013 Dealers’ View

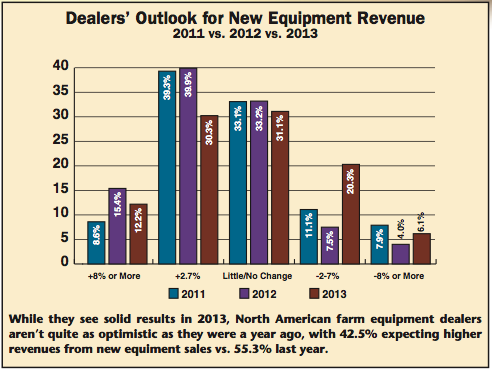

When it comes to the direction of new equipment sales in 2013, nearly 74% of dealers surveyed expect revenues to be at least as good as or better than their sales levels of 2012.

Click to enlarge. |

Based on nearly 200 responses to Farm Equipment’s 2013 Dealer Business Trends & Outlook survey, 42.5% of North American dealers see sales revenue from new equipment rising by at least 2% to more than 8% in 2013 vs. 2012. This is down from 55.3% of dealers who forecast their revenues would rise from 2% to more than 8% last year at this time. Of all respondents, 12.2% see revenues improving by 8% or more and 30.3% expect revenues to rise by between 2-7%.

A little more than one-quarter (26.4%) of these dealers expect that 2013 will be a down year for new equipment sales revenues. Slightly over 20% are anticipating that revenues will drop off by 2-7%, while 6.1% of dealers see sales falling by 8% or more. One year ago, only 11.5% of dealers were projecting lower revenues vs. the previous year.

The remaining dealers, or 31.1%, are projecting little or no change in new equipment revenues in 2013 compared with 2012.

Click to enlarge. |

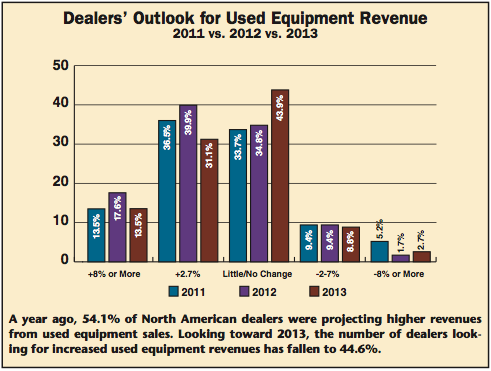

On the used equipment side of the business, a far larger percentage of dealers see solid prospects for increasing revenue than those who see revenues declining. An overwhelming 88.5% of all dealers surveyed are projecting 2013 revenue from the sales of used machinery will be as good as or better than sales of this equipment in 2012.

In terms of purely increasing revenues, 44.6% of North American dealers expect used equipment to rise in 2013 compared to levels seen in the past year. Of these, 13.5% are projecting an 8% or more improvement in revenues, 31.1% forecast a 2-7% rise, while 31.1% anticipate little or no change in used equipment sales in the year ahead.

Only 11.5% see sales of used equipment declining in 2013. Of this group, nearly 9% see sales slipping by 2-7% and the remaining 2.7% anticipate used machinery revenues falling off by 8% or more.

Country Views Differ

Breaking out the North American responses by country, a marked difference between how U.S. and Canadian dealers view sales revenue prospects for 2013 is evident.

Click to enlarge. |

When it comes to new equipment sales, 43.8% of U.S. dealers expect business levels to be 2% or higher in the year ahead, while only one-third, or 33.3%, of Canadian equipment retailers are looking for 2013 revenues to be 2% or higher than in 2012. At the other end of the scale, 27% of U.S. dealers expect 2013 new equipment sales to decline by 2% or more during 2013, compared with 22.3% of Canadian farm equipment dealers.

The major difference between the two dealer groups is 29.2% of U.S. dealers anticipate little or no change between 2013 and 2012 new equipment revenues. For Canadian dealers, that number is a significantly higher 44.4% who are projecting flat sales in the year ahead vs. 2012.

A big difference in revenues from used equipment sales can also be seen between dealers in the two countries, with far more Canadians anticipating slower sales.

Whereas, a similar percentage of dealers from the U.S. (44.2%) and Canada (47.1%) expect used equipment revenues to increase by 2% or more during 2013, a large discrepancy is evident when it comes to decreasing sales.

Nearly 30% (29.4%) of Canadian dealers are forecasting used equipment sales to fall off by 2% or more in the year ahead, only 9.2% of U.S. dealers see sales declining. Nearly half, or 46.6% of U.S. equipment retailers are projecting flat used equipment sales for 2013, about half of that, or 23.5%, of Canadian dealers see little or no change in used equipment sales levels in 2013 compared with the previous year.

Tractor & Combine 2012

Part of the discrepancy in how dealers from the two countries are looking at the new year ahead may be the result of their sales performance through the first eight months of 2012.

Click to enlarge. |

According to the Assn. of Equipment Manufacturers, total U.S. sales of two-wheel drive farm tractors between January and August (latest data available) are up by 8.3% vs. the same period in 2011. At the same time, Canadian sales of two-wheel drive tractors increased in the January through August period by only 2.3%.

The same trends can be observed with four-wheel drive and total farm tractor sales for the eight-month period in 2012. U.S. sales of four-wheel drive tractors were up for the period by 9% and total tractor sales increased by 8.3%.

Canadian dealer sales of four-wheel drive equipment were up 3.4% January through August, and total farm tractor sales rose by 2.4% in this time frame.

Combine sales in both countries were down significantly for both countries, with Canadian sales off much more than those in the U.S. The latest AEM data shows Canadian unit sales of combines were down 18.3% vs. the same period of 2011, while U.S. combine sales fell by 11.8% between January and August.

Tractor & Combines 2013

Click to enlarge. |

If the dealers’ outlook for the year ahead are correct, 2013 should come in at levels similar to 2012, while combine sales will probably struggle to match the past year.

Overall, of all the dealers surveyed, 27.8% see unit sales of under-40 horsepower tractors increasing by 2% or more (U.S. 27.8%; Canada 27.8%), while 13.2% expect sales to decline by 2% or more (U.S. 14.2%; Canada 5.6%).

In the 40-100 horsepower range, 32.1% of all dealers are forecasting unit sales to rise (U.S. 31.9%; Canada 33.3%), while 7.3% of all North American dealers anticipate sales falling below 2012 levels (U.S. 7.5%; Canada 5.6%).

In the row-crop tractor category (100 horsepower and up), 29.5% of all dealers combined are forecasting sales of these units will be as good as or surpass 2012 levels by 2% or more during the year ahead (U.S. 27.5%; Canada 43.8%), with 11.6% expecting unit sales to fall by 2% or more (U.S. 13.3%; Canada 0.0%).

|

Four-wheel drive tractors is where North American dealers see their best prospects going into 2013, as 48.9% of all dealers projecting growth of 2% or more (U.S. 48.7%; Canada 50%), and only 12.4% anticipating a falloff during the year (U.S. 12%; Canada 16.7%).

Combines is where the biggest discrepancy can be found between dealers in the two countries. While only 17.2% of all dealers see growth of 2% or more in the unit sales of combines, 30.8% of Canadian dealers see strong potential for increasing sales of this equipment compared with half that, or 15.1% of U.S. dealers. At the same time, the percentage of dealers who expect combine sales to decline is very similar for the two groups of dealers. Nearly 21% of U.S. equipment retailers project combine sales to slip by 2% or more in 2013, compared with 23.1% of Canadian dealers. Combined, 17.2% of dealers see declining sales of combines in the year ahead.

Best Bets for 2013

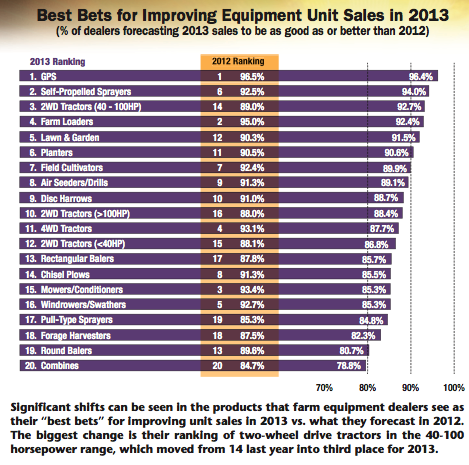

Looking at 20 different ag equipment categories, including tractors and combines, as they have since Farm Equipment initiated its first annual Dealer Business Trends & Outlook survey in 2005, North American dealers see their best potential for increasing 2013 revenues in GPS and precision farming products and systems.

These products are ranked by combining dealer responses of “+8% or more” increase in unit sales with “+2-7%” increase in unit sales and “Little or No Change” in 2013 vs. 2012 in unit sales.

Overall, GPS/precision farming ranked first with a score of 96.4%. It was followed by self-propelled sprayers (94%), which rose from a sixth-place ranking in 2012.

Number three on the list of “best bets” for increasing unit sales in 2013 is two-wheel drive tractors in the 40-100 horsepower range (92.7%), which jumped all the way up from 14 on the list last year. They were followed by farm loaders (92.4%), which was ranked number two in 2012. Lawn and garden equipment also made a significant move upward for 2013 compared with the previous year. Dealers placed this equipment as number five on their list of best bets for the coming year.

Click to enlarge. |

While the impact the 2012 drought was having on corn and soybeans dominated ag headlines through much of the summer, the weather was equally devastating to the hay and forage segment of the industry. So, it should come as little surprise that hay tools found themselves falling out of favor with dealers when they ranked their best prospects for improving unit sales in 2013.

The biggest drops were for mowers/conditioners, which came in at 15 on the dealers’ list after placing third place a year ago. They were followed by windrowers/swathers at 16 after being ranked number five on the best bets list last year.

Rising Costs Top Concerns

There was very little movement in dealers’ biggest concerns for the year ahead compared what was bothering them one year ago. As was the case last year, the three chief concerns for dealers going into 2013 are the rising costs of new equipment, crop input and energy and fuel.

Click to enlarge. |

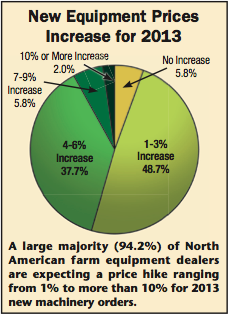

The escalating cost of new farm machinery continues as the most significant issue confronting North American dealers as 93.5% of those surveyed said it was the one matter that they were “concerned” with or “most concerned” with.

In another survey question, dealers were asked if they were expecting a price increase from your mainline supplier on 2013 equipment and what level of price hike did they anticipate.

Only 5.8% of all dealers said they did not expect to see a price increase for new equipment from their mainline supplier in 2013. The remaining 94.2% indicated they have already been told or are anticipating prices to rise from 1-3% to more than 10%, with nearly half (48.7%) of responding dealers reporting new equipment price hikes of 1-3%, another 37.7% reported an expected price increase of 4-6%.

Hiring & Investment — 2013

If adding staff were any indication of how dealers view their business prospects in the year ahead, it would be safe to say that overall they’re looking for solid results. This isn’t necessarily the case when it comes to capital investment, though.

|

Click to enlarge. |

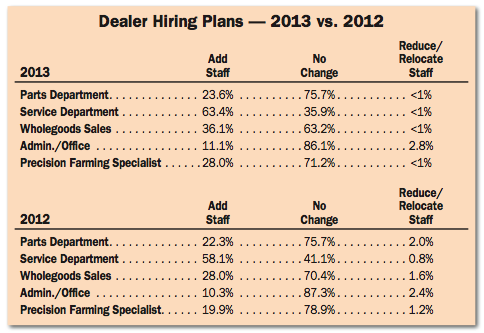

Hiring Up. Coming off another strong year, it appears many North American dealers will be looking to beef up their staffs in the coming year, especially when it comes to precision farming specialists and salespeople.

Perhaps the most striking aspect of the responses to the “hiring” questions was that almost no dealers are looking to reduce staff in 2013. In fact, the only staffing category that dealers are looking to reduce is in the area of administrative/office personnel. Even at that, less than 3% of dealers are considering cutbacks there. In each of the other departments — parts, service, sales and precision technology — less than 1% of dealers are expecting to reduce staff. At the same time, dealers who will be searching for qualified personnel far outnumber those considering cutbacks.

Click to enlarge. |

As has been the case since Farm Equipment launched its annual Dealer Business Trends & Outlook survey, a large majority of dealers will be pushing hard to find and retain qualified service technicians. This year 63.4% of all dealers responding indicate they would like to add staff in the service department. This compares with 58.1% a year ago.

With rapid emergence of precision farming equipment and systems, it shouldn’t come as a surprise that dealers are looking for support personnel who will specialize in servicing advanced technology products. The position of “precision farming specialist” was added to Farm Equipment’s survey last year. At that time, 19.9% of dealers indicated they were looking for people to fill this increasingly important role. This jumped to 28% for 2013. It’s expected this number will continue growing as the search for these rare individuals heats up in coming years.

The number of dealers, who are planning to expand their sales forces in the year ahead grew by 8% compared with the same time last year. Slightly over 36% of responding dealers say they’re looking to enlarge their sales staffs vs. 28% in 2012.

Plans to expand parts department staff are up only slightly, as 23.6% of dealers indicate they’re looking for additional parts people compared with 22.3% last year.

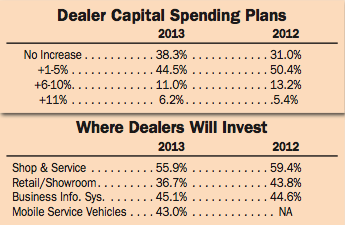

Capital Spending. Unlike the need to staff up in most areas of dealership operations, the number of farm equipment retailers planning to invest in their facilities are down compared to one year ago.

In total, 38.4% of dealers say they have no plans to increase capital investments in 2013. This compares with 31% last year.

As for those with plans to invest in facilities and other business-related products, 44.5% will increase spending in the range of 1-5% (vs. 50.4% in 2012), another 11% will up capital expenditures by 6-10% (vs. 13.2% last year) and 6.2% will raise spending by 11% or more (vs. 5.4% in 2012).

The area that will received the most attention when it comes to investment in 2013 will be the shop and service areas of the dealership, according to the dealers surveyed. But overall, fewer dealers are planning significant investments compared to 2012.

All together, 55.9% of dealers will spend to upgrade shop and service facilities and equipment. This compares with 59.4% last year. Slightly more than 45% will invest in business information systems vs. 44.6% in 2012. Another 36.7% of dealers will spend to upgrade their retail and showroom areas of their dealerships, which compares with 43.8% in 2012.

Added to the “spending” categories this year was mobile service vehicles. More than 40% of dealers say they plan to increase their investment in this area in 2013.

Post a comment

Report Abusive Comment