A year like the one we’ve just had can change a lot of minds, but considering where the U.S. and world economy has been, it’s might be surprising that most North American farm equipment dealers remain confident — though far more cautious — about equipment sales going into 2010.

Last year at this time, 81.7% of dealers forecast that their revenues from equipment sales would be as good or better going into 2009 than they were in 2008. This year, 57% expect 2010 revenues to be as good as or better than 2009.

At the time, the industry was still in the midst of a “generational” year for equipment sales. Within weeks, it was clear that the banking and housing markets were in a crisis and the overall U.S. economy began to deteriorate.

By late in the year, despite maintaining high sales levels in big farm machinery, dealer confidence in sales for 2009 had declined precipitously. With this latest survey, equipment dealers are exhibiting a significant improvement in their confidence levels compared to just 5 months ago when Ag Equipment Intelligence conducted a follow-up survey in early January

Results of that poll showed that less than half of dealers — 47.4% — believed that ’09 sales would be as good as or better than those of the year prior. This was down more than 34% from just 4 months earlier.

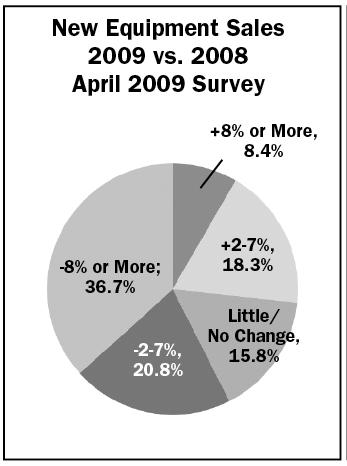

Further deterioration was seen in the annual mid-year dealer survey conducted in April, as only 42.5% of dealers saw business being as good or better in 2009 than 2008.

No Sales Records

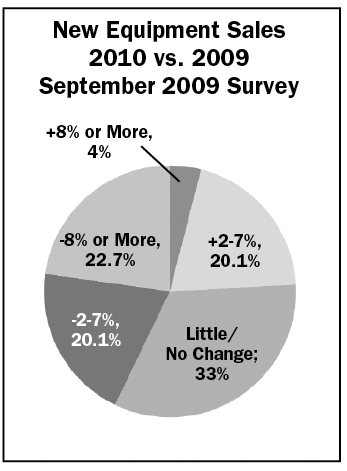

While most dealers are anticipating a solid year in 2010, it’s evident that they’re not expecting to set any sales records. Only 4% are forecasting an improvement of 8% or more. Another 20.1% see new equipment revenues increasing between 2-7%, while one-third see sales coming in at about the same level as 2009.

Rising Equipment Costs

The biggest issue that equipment sellers expect to confront during the next selling season is the rising cost of new equipment. This is up from a fourth-place ranking in 2008 and third place in 2009.

AEI editors have heard planned price increases for 2010 ranging from 5.5-10%. In most cases, these price hikes don’t reflect the expected hefty costs associated with meeting Tier IV engine emission standards that will show up with the 2011 equipment models.

With grain prices falling dramatically from all-time highs in 2009 and dairy and livestock producers continuing to struggle with lower than break-even pricing, it comes as no surprise that 94.3% of dealers are “concerned” or “most concerned” about commodity prices, making it their second biggest concern going into 2010.

Overall, revenue from new equipment sales is expected to fall by 1.5% in 2010.

— From the September 2009 issue of Ag Equipment Intelligence.