First published June 15, 2010

A more apropos reference for this group may be “specialty equipment” dealers — or as they like to be called, “independent” dealers.

Maybe they prefer to be called “independents” because at some point, all of them were linked to one of the full-line machinery manufacturers — AGCO, Case IH, John Deere, New Holland. But for reasons very clear or not so clear to them, the bond was broken. Either the dealer walked away from the relationship or had to have the major’s sign wrestled from his hands. In most instances, it was a painful separation.

The full-line manufacturers have made it abundantly clear that they are, and will continue, consolidating their distribution channels. There will be fewer, but larger, dealership groups serving farmers across North America.

At the end of 2009, the number of dealer terminations by John Deere alone demonstrates how dramatically the rate of cancellations have escalated. There are no indications that the trend will slow down or level off any time soon. More dealers will be looking at life after the majors.

As in any squabble, there are two sides to the dealer-consolidation story. These have been examined time and again in the pages of Farm Equipment.

Top Challenges of Running An Independent Dealership

- Financing Sources (41.6% report major difficulty)

- Manufacturer Selection (34.7% report major difficulty)

- Lost Parts & Service Revenue (29.2% report major difficulty)

- Advertising Promotion (16.7% report major difficulty)

- Administrative Resources (MIS, website, etc.),(12.5% report major difficulty)

- Employee Training (8.6% report major difficulty)

The purpose of this special report is not to examine the “whys” of dealer consolidation, but to layout the “hows” of moving on after the breakup. The aim is to show dealers that are — or will soon be — confronting this circumstance, that there can be life after the majors.

For this report, Farm Equipment editors interviewed several dealers who have been through the cancellation process — from receiving “the” letter to taking old signs down and hoisting new ones. We spoke with dealer consultants who specialize in guiding dealers in the development of business plans and executing exit strategies.

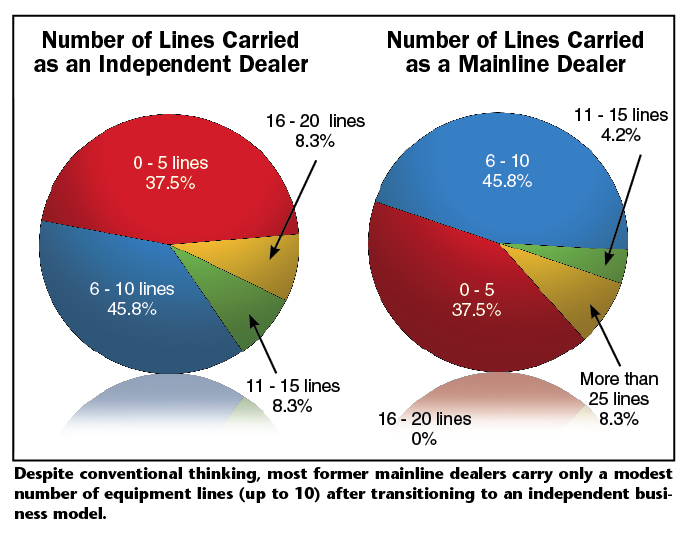

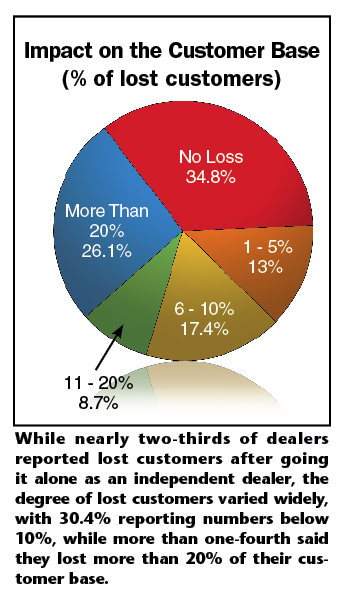

We surveyed shortline-only dealers to get their take on what their colleagues should expect as they move into the new world of retailing specialty farm equipment without the support or benefit that the full-line brands may offer.

Even one dealer association executive weighed in with his insights for Farm Equipment readers.

This report is built around a few fundamental, but essential questions that need to be asked — and answered — to set a course toward being a successful “independent” dealership. These include:

- What are the most difficult challenges farm equipment dealers will face in “going it alone,” and how will they navigate these challenges?

- What is the greatest mindset shift that must occur with dealer-principals and their employees as they move to an independent business model?

- What trends might be ahead with independent farm equipment dealerships in the years ahead?

As it all came together, it confirmed much of what we already knew about independent dealers. First, it demonstrated that this group is a tenacious lot, intent on succeeding.

“Right now we wouldn’t be interested in carrying any of the majors. Our philosophy is that you can’t handle 2 or 3 similar products and do justice to any of them. We’re dedicating ourselves to giving our all to our Kubota and the Vermeer lines,” says Jason Lane of Tri-County Power Equipment.

Second, they are adaptable to a rapidly changing business environment.

Stan Jackson of Jackson Consulting, with 40-plus years in the ag machinery business, may have described these dealers best. He says, “Those dealers who survive in a short-line mode are amazingly resilient people. They have my full admiration.”

And while these newly independent dealers, and those soon to be, may believe the grass is greener, redder or bluer on the other side of the fence, Jackson notes: “It’s fascinating that dealers who supposedly win at consolidation and purchase more locations have as much trauma as those who lose their major brand. It’s an interesting paradox that we end up posing almost the same questions you’re asking of independent dealers to those who are expanding.”

Following is what we’ve learned from the dealers who have and are going through the transition from selling one of the major brands of farm machinery to handling specialty equipment — and succeeding at it.

How Determined ‘Shortline-Only’ Dealers are Making It

These former mainline dealers offer practical advice to those who are starting over without a major equipment supplier.

Every farm equipment dealer who has experienced that face-to-face warning meeting with his or her major supplier or received “the” letter informing them their contract is being terminated, knows the feeling. Those of who have been through it describe a whole array of emotions, from rage to ambivalence. From, “I don’t deserve this,” to “Let’s get it over with.”

Regardless of whether having a supply contract cancelled was a surprise, expected or welcomed, it can be difficult for a dealer who wants to stay in the retail side of the ag machinery business.

If nothing else, those who have experienced it admit that, at some level, their pride took a pretty good hit. But the most resolute among them learned to put their egos aside quickly and move on to “Plan B.”

Forced Separations

Few of the farm equipment dealers who were interviewed for this report were really surprised when the “letter” finally arrived informing them they would no longer be selling the full line of equipment their dealership handled for years, decades or maybe even generations. That is if they hadn’t already walked away from their dealer agreement with their major supplier.

Schmitt Implement in Holy Cross, Iowa, is now a Versatile tractor dealer after Deere & Co. nixed its contract recently with the longtime dealership. “Any problems that we have are taken care of,” says owner Willis Schmitt (left), pictured with his son Jack.

But Terry Townsend and his partner at Panhandle Implement, Brian Farney, were genuinely caught off guard when they found out officially in September 2008 they would no longer be selling Case IH equipment.

Interviewed for this Report: Terry Townsend

Panhandle Implement Co., Perryton, Texas

Established: 1952

Full-line History: Case IH dealer until cancelled in September 2008.

2009 Revenues: $2.6 million ($1.8 million wholegoods, $630,000 parts, $200,000 service, $17,000 other).

Employees: 11 (soon to be 12)

Shortlines: Kubota, Woods, Vesatile, Equipment Technologies, Rhino and Sunflower.

“We were enraged at first, but in time we looked at it as a blessing,” says Townsend. Like many dealers who have been cancelled in recent years, Townsend said market share was cited as the reason for canceling the Perryton, Texas, dealer’s contract.

“We received no prior warning, just the letter that said our contract with Case IH would not be renewed. They wouldn’t even give us a parts contract that would allow us to take care of our customers. We were doing between $100,000-$200,000 a year in parts and the next closest Case dealer was 49 miles away,” he says.

The company did give them a year to phase out of the business, Townsend says. “That helped but it didn’t do much for our pride.”

Failure to achieve a prescribed level of market share was also the reason New Holland gave to Tri-Country Power Equipment of Jefferson City, Tenn., when it was dropped.

Interviewed for this Report: Jason Lane

Tri-County Power Equipment, Jefferson City, Tenn.

Established: 1994

Full-line History: New Holland dealer until

cancelled in 2008.

2009 Revenues: $4.1 million ($3.4 wholegoods, $525,000 parts, $200,000 service, $12,000 other).

Employees: 11

Shortlines: Kubota, Pug, Woods, Simplicity

and Vermeer.

Jason Lane, president of Tri-Country, says the manufacturer did give them a heads up, but he believes it was only a courtesy call.

Despite being one of New Holland’s top-producing hay tool dealers in the state, the manufacturer was only concerned about tractor sales, Lane says.

“It was 2008 and one of the best hay tool sales years we ever had, but they didn’t take any of that into consideration. They gave us a year of what they called ‘cure’ time to improve our market share for tractors.

“We sat face to face with them and they asked us what they could do to help get our market share up,” Lane says. “We told them, but that’s as far as it went. We could see the writing on the wall. They became very hard to do business with and their product reliability was slipping anyhow, so we just decided to move on. We were also selling Kubota tractors and we knew we could make it with them.”

Interviewed for this Report: Doug Spillman

Hanson Equipment Co., Lockhart, Texas

Established: 1947

Full-line History: Originally a White Tractor dealership. Acquired by Doug Spillmann in 1996, cancelled by AGCO in 2004.

2009 Revenues: $1 million plus (30% wholegoods, 50% parts, 20% service)

Employees: 7

Shortlines: SAME Deutz-Fahr, Bush Hog, Gehl, Rhino, Vicon, Zetor and Durabilt.

The biggest hit the dealership took was losing the parts business. “There’s a lot of old Ford product out there. That was our biggest loss from the cancellation.”

The story was much the same for Doug Spillmann, owner of Hanson Equipment of Lockhart, Texas. The dealership has been around since 1947 and handled White tractors before it became an AGCO dealership. Spillmann became the third owner of the business when he acquired it in 1996. AGCO cancelled his contract in 2004 for reasons still a mystery.

“Actually, I really don’t know the reason they cancelled me,” he says. “I guess it might have been for performance. It was a real vague letter they sent and I didn’t care to question them about it.”

By the time Hanson Equipment received its cancellation notice, it was also carrying Deutz-Fahr and Zetor tractors, which had become a much better fit for his rapidly changing customer base, he says.

Spillmann called the split from AGCO “a breath of fresh air” because it allowed him to return a lot of obsolete parts that he would probably never have been able to move. “There’s been an enormous customer shift in our area during the last 10 years or so from big row-crop farming to hobby farms and cow/calf operations,” he says.

Voluntary Separations

Some shortline-only dealers never carried a mainline, and in some cases the dealer tears up the contract. For H.G. Violet Equipment of Delphos, Ohio, and Tweed Farm Equipment of Medora, Manitoba, it was their choice, not the majors.

In 1994, after working in the family business, Violet Implement Sales, a Case IH dealer in Delphos, Ohio, since 1980, Howard Violet decided to sell trucks for Freightliner. That lasted 2 years until he struck out on own in 1996 and opened another dealership selling medium- and heavy-duty trucks, used farm tractors and new J&M grain carts and wagons.

While the family’s relationship with International Harvester went back to 1954, his brother had taken over that business and had moved it to a newer facility. His brother maintained the Case IH relationship until he sold the dealership in 2007.

Violet settled in with his new business at the original facility in Delphos, and rather than trying to hook up with one of the major brands, he focused his efforts on the lines that he believed would provide the best opportunities for margin and volume. Those happened to come from independent businessmen just like him.

“The majors have a control issue with their dealers — pushing market share and sales expectations. That’s not comfortable for me anymore,” says Doug Spillmann. “Today, we have the ability to move back and forth with the market, and dodge the bullets when we need to.”

“We weren’t hamstrung by the dictates of a major line telling us what we needed to be doing or how to run the business.” He knew how it all worked from his 8 years of experience with the family dealership.

In effect, Violet says, he cancelled himself.

For all practical purposes, so did Clark Tweed, president of Tweed Farm Equipment. His dealership’s transition from mainline to shortline-only came out of an opportunity to sell — not from a falling out. “Another dealer wanted to expand his operation, so we took advantage of the opportunity to sell our New Holland dealership in 1999 and kept our other store for shortlines.” Tweed had handled New Holland since 1979 when he first opened the dealership.

He started a second shortline-only dealership — Tweed County Ag — in Bottineau, N.D., in 2003.

Pick Your Fights

Whether it’s a newly cancelled dealer or one that walked away from their major line suppliers voluntarily, dealers that have been through it agree that the first steps in the transitioning to a shortline-only dealership are critical.

Interviewed for this Report: Howard Violet

H.G. Violet Equipment, Delphos, Ohio

Established: 1996

Full-line History: Family relationship with Case IH started in 1962. Howard quit working with Case IH in 1994, but family maintained the relationship until 2007.

2009 Revenue: $10 million

Employees: 10

Shortlines: McCormick, Mahindra, Cub Cadet, Grasshopper, Mayrath, Brillion, Remlinger, Unverferth, Killbros, McFarlane, Mauer, Neville-Bilt, J&M Manufacturing and Woods.

Townsend’s advice to other dealers that get cancelled is don’t waste time fighting with the major.

“If I could go back and do anything differently, I would have spent a lot less time trying to fight the entire scenario. I would have spent more time just moving on, finding my new vendors, finding my new manufacturers and just letting it happen,” he says in retrospect.

“For a dealership that’s losing its major, if you get a letter like I did, it’s obvious Case had no intention of letting us keep anything from the very beginning. We spent a whole lot of wasted time trying to fight it and being defiant, and it just got ugly,” says Townsend.

Dealers who have been terminated say the reasons are usually ambiguous at best, and very difficult to fight anyway. Why a major cancels a dealer is pretty much of a moot point. The fact is they don’t want you representing them anymore.

Unless there are financial considerations (buy-backs, warranty issues, etc.) or a supplier’s actions are clearly illegal, experienced dealers suggest that the first move for those who want to stay in the business need to concentrate on retaining as many of their existing customers as possible, and set up their new suppliers quickly, but carefully.

The biggest challenges those dealers new to the specialty equipment only category is to “redefine yourself as a ‘shortliner’ and still retain the respect of customers and your peers,” says Violet. He adds that shortline-only retailers can expect is to be “dissed” (disrespected) by their brand-name competitors. “It’s frustrating, but you need to ignore it. It’s part of the game,” he says.

Tell Your Customers

Dealers in transition say that once the emotional impact of being terminated is put aside, the next step must be to retain as many of existing customers as possible. In customer retention, dealers identify two key elements: open communications and locating reliable sources for repair and maintenance parts.

The dealers agree that making a news announcement that you’ve lost your contract isn’t necessary.

“We chose not to make a public announcement, but we immediately changed our Case IH advertising and radio broadcasting to promote the fact that we were now carrying Versatile and Kubota tractors,” says Townsend.

“This whole change has given my partner and I a different perspective on this business. It’s our business. Now we can spend the time we used to waste trying to please our major with our customers,” says Terry Townsend of Panhandle Implement.

“That, of course, caused people, including longtime customers, to come in and ask, ‘What’s going on?’ That enabled us to personally explain and put to bed the rumors that were flying. We wanted to do it face to face, to personally reassure them that we would be there for them and they could count on us for their service and parts. This worked very well for us and I don’t feel like we lost any significant part of our customer base.”

To avoid any notion that the dealership might close, Panhandle Implement waited to take the Case IH sign down until the Versatile sign arrived.

“We had the sign company take one panel down and immediately put the new panel up,” says Townsend. “Within a day it was as if nothing changed, but of course, a lot of people noticed and that started another round of people calling, wanting to know what was going on. So, we had another opportunity to explain it all over again. We let everyone know what was happening without making a big story of it. We were able to personally share the news as customers asked.”

Spillmann also took a low-profile approach in letting his customers know that things had changed. “We didn’t advertise it, but we didn’t lie about it, either. We told our customers on a one-on-one basis that we got cancelled but we assured them we’d still be here for them.”

Find a Parts Supplier

But keeping customers on board by promising parts and service may be the trickiest maneuver for a cancelled dealer because the OEM almost always reserves parts contracts for the dealership that it expects to take over the terminated dealer’s sales area.

In this respect, each of the dealers attest to the importance and power of networking and building relationships with other dealers.

“The only revenue area where we saw a drop after being cancelled was in parts sales,” says Lane. “We didn’t have a lot of options when it came to getting New Holland parts, but we had a lot of customers that we had sold blue stuff to. We needed to take care of them if we wanted to keep them coming in.”

“Years ago, dealers were important to the majors,” says Howard Violet. “I really treasure the fact that I grew up in a franchised International Harvester family. You were more in control of your own destiny. Today, the major lines have taken that control away from most dealers.”

First, he turned to the aftermarket, where he was able to get much of what he needed. He managed to secure other proprietary parts from a New Holland dealer that “we had a good relationship with,” says Lane.

He adds that because aftermarket parts are less costly than those supplied from the OEM, he’s been able to increase his overall parts profit margin. So while his total parts revenue has dropped “some,” his profit margin hasn’t changed much.

Spillmann says that he, too, was able to get parts that AGCO would no longer supply from a variety of sources, including other dealers. “It was kind of tricky, and you’re usually going to pay a little more than you did previously, but if you have a good relationship with other dealers, they’ll usually provide pretty good pricing on parts,” he says.

In many cases, the dealers say that dealers most willing to work with you on parts aren’t generally your neighbors. One pointed out that the dealer who’s working with him on parts supply is 2.5 hours away from his store.

In any case, it’s imperative that every cancelled dealer who wants to maintain his service business must find sources for his parts. And they must do it quickly.

Select Suppliers Carefully

Without the backing or market recognition that the big brand name equipment makers bring to the table, it’s vital that independent dealers line up their new suppliers of “must-have” equipment quickly and establish their credibility with long-time customers. At the same time, shortline-only veterans like H.G. Violet and Tweed Farm Equipment, advise to take enough time to make the right selections.

“I’ve built our shortline business slowly and methodically over the years,” says Violet. “Our first step for us was to take on J&M Manufacturing grain carts, and from there we added complementary lines like Woods, Killbros, Mayrath, Maurer and Neville-Bilt grain trailers.”

Besides the addition of Mahindra tractors in 2000, McCormick tractors, and Cub Cadet and Grasshopper lawn equipment, which were picked up in the last 3 years, Violet carries pretty much the same lines that the family dealership handled 15 years earlier. He says it was important to work with companies and products that he was familiar with and had confidence in.

“It may be somewhat nostalgic because I grew up with them, but I wanted to get back a lot of the lines that we had with my dad’s dealership. It was a comfort zone for me, but I also knew all of these lines had the potential for decent margins and growing volume.”

Townsend understands that it’s crucial to be tuned into your market and make customers’ changing needs as the primary criteria in selecting specialty equipment.

Before Panhandle Implement had an inkling that it was in jeopardy of losing its major, it could see that farming practices were changing from conventional tillage to more no-till. Townsend was alert to the fact that this group of growers have a growing need for spraying equipment.

Interviewed for this Report: Rolly Richard

Tweed Farm Equipment, Medora, Manitoba, Canada

Established: 1979

Full-line History: Sold New Holland dealership to another local dealer in 1999.

Annual Sales: $5.7 million ($4.5 wholegoods, $900,000 parts, $300,000 service).

Employees: Currently 8, but adding 2 more.

Shortlines: Bourgault, Bourgalt Tillage Tools, Cub Cadet, Stihl and Bobcat, Free Form Plastic Products, Farm King and Akron. Also carries MacDon and CarQuest auto parts.

“When we picked up the Apache sprayer line about 3 years ago, it was due to the fact that farming practices in this area were moving toward no-till. We felt it was time to look for a sprayer line and we found one in Apache.”

Townsend says that one of the dealership’s primary criteria in selecting shortline manufacturers is that supplier needs to be as hungry as Panhandle Implement.

“Equipment Technologies was a relatively new company and small enough to be responsive to a dealership like ours. We believed that they would go out of their way to serve us and our customers. They were just as hungry as we were. We wanted to sell sprayers and they wanted us to sell theirs.”

He says these same criteria apply regardless of the product. “We want to work with the kind of guys that are going to stand by our side when things go bad or when things need to take place in the field. We need to know that they’re going to send their factory technicians out to help us. Those are the kind of shortline suppliers we’re looking for.”

Townsend recalls that during the last few years with Case IH, it had become almost impossible to get technical support. “As far as we were concerned, when they finally sent someone out, they were sending us office personnel who would show us how to go to the Internet and look up service bulletins to fix major problems. We won’t let that happen with our shortline suppliers.”

Townsend says that it’s vital that shortline-only dealers also keep alert to developing opportunities. For example, when John Deere consolidated a local dealer into a larger group, it forced the dealer to drop its Rhino equipment line. He recognized the potential of signing on with Rhino. “That dealer had handled Rhino for years, and when it was apparent they were closing their doors, we started talking to them. They had put a lot of mowers and other Rhino equipment in the field over the years and we could see good potential in the parts business.”

While Panhandle Implement had not yet finished the paperwork with Rhino but he’s optimistic they would get it done soon.

Know Your Strengths

As important as recognizing opportunities, dealers who are successful as independents, say it’s just as important to know if an apparent opportunity is a fit. Tweed Farm Equipment has only added one major shortline in recent years. According to Rolly Richard, sales manager, the dealership is very selective about picking up specialty equipment lines, and if they’re not working, they give it up and move on rather than trying to force the issue.

“This is our third year for carrying Akron grain bagging equipment and we’ve been pretty successful. We’ve sold 35-40 of those units. So it’s been a big addition to our lineup, and the only significant one that we’ve picked up recently,” says Richard.

At one point, he explains, “We carried Buhler’s Versatile tractors, but we just weren’t selling enough to keep them on the lot,” he says. “With the volume discounts that the dealers carrying major brands like New Holland get, we just couldn’t compete, so we gave up that contract.”

He says that Tweed would consider picking up another tractor line if they could get a brand “that was well built and well priced, and as long as it came with a territory. We’re not going to pick up one that’s carried by a dealer nearby where you’re only competing on price.”

Instead, the dealership chose to focus on becoming a specialist with expertise in seeding and planting equipment. As a shortline dealer, Tweed Farm Equipment has tailored its business to its market as opposed to trying to be everything to everybody. Richard believes this is critical to the success of a shortline-only dealership.

“Bourgault equipment is our bread and butter,” Richard says. “We handle a range of their equipment including grain carts, harrow bars, liquid carts, but it’s their air seeders and air drills that we sell the most of. We’ve been selling Bourgault since about ’80, and that’s what we’ve become known for.”

He says that when they were a New Holland dealer, they were expected to push the company’s drills, but Bourgault had a better product.

“Our people specialize in the equipment and there’s not much we can’t handle. For other dealers, seeding equipment is more of a sideline. It’s the same with anhydrous application equipment. We sell a lot of it and specialize in servicing it,” Richard says.

With their reputation for specializing in that type of equipment, it’s not unusual to have farmers drive 2.5 or 3 hours to get parts from Tweed because other dealers don’t keep them in inventory. “We stock a lot more parts for this type of equipment than most other dealers, and the farmers know it. They’ll pay a little more for it,” he says.

“We probably stock way more parts than the experts would recommend, and we don’t get 3 turns on some of it. And at seeding time, we keep our guys in the field and customers know it,” Richard says. “That’s how we’ve built our business.”

Know Competing Products

Another suggestion coming from dealers who find themselves without a brand name supplier is to study the products you’re competing with.

When Tri-County Power Equipment knew they were going to be dropped by New Holland, they needed to find a line of hay tools.

“The only two lines we’ve added in recent years have been Land Pride and Vermeer. When Kubota and Land Pride formed their alliance, that was basically a no-brainer,” Lane says.

But adding Vermeer was another matter and one that opened the dealership’s eyes.

Their biggest concern after the initial warning was the hay tool business. “We decided to get prepared in case New Holland wasn’t bluffing,” says Lane. “Of course, they weren’t. So we took a hard look at Vermeer. There wouldn’t be a whole lot of competition real close, and it’s a good, well-known brand that had reputation for reliability. They were willing to work with us, so we signed on.”

Having grown its business around New Holland, Tri-County was convinced that there was no better line of farm equipment available. “I grew up on Ford and New Holland equipment,” Lane says. “I thought there wasn’t anything better than a New Holland round baler. But when we started looking at Vermeer’s baler I was amazed at its simplicity.”

Lane says that the New Holland balers became increasingly complex. “There were a lot of unnecessary linkages and gadgets and stuff that made it complicated for the end user and for the shop. As long as it’s working, it’s great. But when something goes wrong, it’s a very complicated piece of equipment to diagnose and repair.”

He says he first started noticing a difference in the product about the time Fiat acquired New Holland and then purchased Case IH. He has his own theory why the line wasn’t the same afterward, but that’s about the time that he started carrying Kubota tractors.

“Sometimes when you’ve got just the one line, you can convince yourself that what you’re selling is the best. And when it was a Ford product, it was a great line. But when CNH took it over, that was a turning point, and you don’t want to lie to yourself. What I’m saying is you need to know what other manufacturers have to offer.”

But it took having their contract cancelled for that message to sink in, he says. He also advises dealers who find themselves in a similar situation to start looking at other lines, particularly in their bread-and-butter segments, and don’t wait until the cancellation takes effect.

Find Your Niche

With the market for farm machinery changing dramatically in the past decade, Spillmann says AGCO terminating his contract probably hasn’t had the same effect on his operation as other dealers who have been cancelled. Not worrying about market share and sales expectations has allowed him to focus on serving the niche markets that are increasingly redefining his sales territory, he says.

“When I came on the scene in 1980, there were 2 dealerships in town. We pretty much exclusively served row-crop operations — corn, milo and cotton. The other dealership was Ford and it pretty much worked exclusively with ranchers.”

Today, he estimates that there are less than 50 row-crop farmers in the area. “There’s a lot of home building in the area. We’re going metro,” Spillmann says.

Instead of crop production, Hanson Equipment finds itself concentrating on land maintenance and light construction, including backhoes, skid loaders and compact track loaders.

As the area changes, Spillmann says they’ve found a lucrative niche in equipment for fence building. “We do a lot of fence-building implements now, and we’re definitely pros at post pounders and posthole diggers and attachments that make fence building easier,” he says.

Margins & Profitability

Generally, shortline dealers that once identified themselves with a major brand report that their annual revenues will drop somewhat, but overall profitability improves. They attribute this to higher margins on their shortline products that can result from various factors that often include less in-line competition and not doing business solely for market share. They also note that expenses can fall pretty dramatically.

For example, Townsend recalls a $1,600 expense during Panhandle Implement’s last month with Case IH for service manuals on equipment the dealership didn’t even handle.

“You won’t even find that equipment anywhere in our region,” he says, “but we were required to pay for these manuals by the dealer’s agreement.”

Spillmann adds that while Hanson Equipment maintained its own computer system, he was required by AGCO to buy their modem and pay a monthly support fee. “Not having the contract freed us up from some monthly bills right there,” he says.

Dealers’ views on profit margins with shortline equipment vs. major brand products vary.

Lane says that overall they haven’t seen a significant shift in profit margins since being cancelled by New Holland. “We’re basically getting the kind of profit margin we like to get and that really hasn’t changed a whole lot with us.”

When it comes to revenues, what has changed for Tri-County Power is in their shop. “Due in part to a lot of warranty issues we had with New Holland, we would just get slammed in the shop and it seemed we were always behind. Today, we can stay a little more caught up in the shop and we don’t have that backlog.”

While it looks like their service business is slower, Lane says the number show there’s not a big difference. “We’re just that much more efficient because we don’t have all the headaches of the nit-picky warranty stuff that the New Holland brought to us. So it’s actually working out pretty well.”

But he adds that the loss of New Holland parts has put a dent in the dealership’s bottom line.

Despite the tough economy the last couple of years, Lane says they’ve managed to keep their head above water. “We don’t have a whole lot of expenses right now. As a matter of fact, we don’t owe for anything other than our floorplan and parts.”

Townsend, on the other hand, says that he’s seeing significantly larger margins than when he called Case IH his major supplier. He estimates that they can range 10-20%. Previously, he thought 2-3% margins were good, when he could get them.

He says the majors’ way of doing business can keep you in a rut. Sometimes you can get stuck in the mindset that 2-3% margins are normal.”

Problem with Shortlines

After nearly 15 years of being a shortline-only dealer, Violet agrees that there’s money to be made with good shortline equipment. But also he cautions that they have a propensity to spread the wealth around. “They’re always looking to have someone else selling their product. You can invest a lot of time, effort and resources in developing a market for a product, and if the supplier thinks there are other dealers in your territory who are interested, they’ll create a lot of inline competition. Then they wonder why dealers aren’t loyal to them.”

He points to a specific product he picked up 3 years ago that, he says, generated the best gross margin of anything he’s ever handled. Then, other major-line dealers in the territory jumped on the “me-too bandwagon,” as Violet calls it.

“It just blows my mind that they’re so willing to throw margin out the window, and say, ‘We got the deal.’ It’s that ‘market-share’ mindset that the majors have driven into their heads,” say Violet. “They also get caught up in the ‘volume bonus mentality.’ If all you’re doing is selling your stuff for cost or near cost and plan on making it off your volume, it might work for Wal-Mart, but I don’t believe that’s a sound way to run a dealership.

“It’s a very risky game, whether your selling the majors’ or shortline equipment, especially when you consider the capital requirements to run a dealership today compared with 10 years ago,” Violet says.

“We’re a small dealership, but we maintain $3 million of wholegoods inventory at any given point in time. It costs a lot of money to have it sitting around, but I don’t believe you can sell out of an empty store. The capital requirements for inventory and the cost of equipment is limiting access into this business. So, you better be making some money if you’re going to make it selling this kind of machinery.”

Watch Your Trades

Violet says that the average gross margin on all of his dealership’s sales generally runs in the 12-14% range. He says they do much better than that on used machinery, which independent dealers can devote more time to.

A mistake he’s seen other dealers make is getting trapped into living and dying by a certain percentage or certain number, and pass up the potential for a good margin. “It’s too expensive to let equipment sitting around, especially if you’re a shortline dealer. You need to move it,” Violet says.

Another Major?

Despite being shunned by the big brands of the farm equipment world, some shortline-only dealers say that given the opportunity, they might consider getting on the majors’ merry-go-round again. But generally, the dealers interviewed for this report say, “Probably not.”

“I would be leery,” says Spillmann. “I would wonder what their intent was. There isn’t a lot of trust with the majors right now. There are other ways to grow without carrying one of the big brands. The majors have a control issue with their dealers — pushing market share and sales expectations. That’s not comfortable for me anymore. Today, we have the ability to move back and forth with the market, and dodge the bullets when we need to.”

Violet gives that question a resounding no. “The freedom we have as an independent is truly satisfying. How would you like it if you had spent your entire life developing a successful business and at the end, having your whole retirement and sale of your business determined by the continuance of your ‘contract’ by your major-line supplier? It can be devastating to say the very least. We’ve done pretty well with them so far. I don’t need someone in a suit telling me how to run my business.”

Tweed’s Richard says, “We might consider it only if we could get a line that was well built and if we believed it was a darn good manufacturer. We wouldn’t pick up something where we had to compete with the same product with someone nearby.”

Lane says Tri-County would not be interested in signing on with another major. “Right now, no, we wouldn’t be interested in carrying any of the majors. Our philosophy today is that you can’t handle 2 or 3 similar products and do justice to any of them. We’re dedicating ourselves to giving our all to the Kubota and Vermeer lines.”

For Better or Worse

Every shortline dealer who once called AGCO, Case IH, John Deere or New Holland their partner understands the advantages of being associated with a big-name brand of equipment. But for better or for worse, each of them is glad to be where they’re at today. They’re surviving and they’re succeeding.

“This whole change has given my partner and I a different perspective on this business. It’s our business. Now we can spend the time we used to waste trying to please our major with our customers,” says Townsend.

“We’ve become more determined to do whatever we can to make sure that we’re making the margins and profits we need to make. We had difficulty doing that with our major. So there’s a part of me that feels very blessed to have had the wherewithal and the gumption several years ago to start picking up some shortlines like Apache and others. I feel like we have waltzed right into this opportunity, and never missed a beat.

Townsend adds that on a day-to-day basis, the biggest change they’ve seen is that they’re a lot less concerned about market share or how many units they’re selling. “We were always trying to impress our major. We wasted a lot of time worrying about that stuff and now we’re devoting that time on building relationships with our customers.”

He says that it’s “hard to see through the smoke until you don’t have it anymore. Now we’re asking ourselves, ‘Why didn’t we do this before?’ We’re spending more time focusing on our higher margin items and not on warranty issues.”

The Way It Was

For the shortline-only dealer today, business is more like the way it was years ago, says Violet. “Years ago, dealers were important to the majors. I really treasure the fact that I grew up in a franchised International Harvester family. You were more in control of your own destiny. Today, the major lines have taken that control away from most dealers.”

Philosophically, Violet believes that as manufacturers force dealer consolidation to create large multi-store entities, sooner or later no one in the organization has a vested interest in the company and its customers except for the dealer-principal. “And they’re getting farther and farther away from it.”

He likens what he’s seeing with dealer consolidation to what he believes is happening in the country. “You keep giving up a little more freedom until you’re no longer free.”

The Success in Shortline Machinery series highlights the best practice strategies employed by top farm equipment dealers to promote and sell shortline equipment. It is brought to you courtesy of Väderstad.

Väderstad, is a family-owned full-line manufacturer of high-speed planters, seed drills and tillage equipment. Together with farmers in 40 countries all over the world, we have spent the last 55 years creating machines that make any farmland find its full potential. Väderstad is seeking independent-minded dealers capable of selling and servicing high quality equipment to professional farmers. If you are looking for the possibility to expand your customer base, contact Larry Wieler at larry.wieler@vaderstad.com or (289) 527-4697.