Agriculture and construction equipment auctions reached $18.5 billion in gross sales revenue in 2008, according to the National Auctioneers Assn. (NAA). That figure is up from $17.3 billion in 2003, and represents a growing opportunity for farm equipment dealers to move used equipment inventory and improve liquidity.

Thanks to high commodity prices and growing demand from farmers to upgrade older equipment, auctioneers and dealers have seen record prices for used equipment at auctions the last few years. “The great thing about auctions is that they set a new market price,” says Bill Shibley, vice president of commercial lending for Northwest Farm Credit Services of Pasco, Wash.

“Auctions are the purest form of price discovery there is,” says Scott Musser of United Country Musser Bros. Auctions & Real Estate, Pasco, Wash., and president of the NAA. “The number one reason people go to auctions is to get a good deal,” says Roger Paul, general manager of Steffes Auctioneers’ Litchfield, Minn., office. “It’s a wholesale market with the opportunity for retail.”

Certain strategies — and “dos” and “don’ts” — can help equipment dealers get the most return when selling at auction, be it on-the-ground, online or a combination of the two.

Why Turn to Auctions?

Cash flow concerns, heavily used equipment taken in on trade, equipment slow to move off the lot and equipment not common to an area — these are all reasons dealers give for utilizing auctions.

“Like retail, auctions should be another tool in your tool belt,” says Kevin Tink, vice president of the agricultural division for Ritchie Bros. Auctioneers, Vancouver, British Columbia, Canada.

“Some units are just right to be sold out of our territory due to condition, hours and just a quick sale,” says Garry Anderson, agriculture division manager, Kelly Tractor, a Caterpillar dealer in Fort Myers, Fla.

“We incorporate it into our annual marketing plan,” says Michael Karczmarczyk, president of Agritrac, a Case IH dealer with three locations in Alberta, Canada. He estimates they sell $5 million in used equipment at auctions each year, and adds that online technologies have helped him reach those numbers. Prior to that, he says it was difficult to move even $1 million of used equipment.

Midwest Machinery, a John Deere dealership with locations in Central Minnesota, held an on-site auction in 2008 when they acquired another dealership. They sold $1 million of used equipment from that dealership and added another million from their existing operation. The auction did more than reduce inventory.

“About 600 to 700 people were at our store that day,” says Andrew Swenson, Midwest’s new and used equipment manager. “All these people now know about our dealership and they’ll be back for equipment or parts in the future.”

Now, Swenson uses auctions to move equipment that has been on the lot for 120 days or more. He would have already re-priced that equipment at 60 days and then at 80 days on the lot. Swenson estimates he sells 10-20% more at auctions than 5 years ago.

“As dealers, we’re getting a lot smarter about ‘turns’ and how they affect our bottom line,” Swenson says. He explains that the availability of online market information has tempered extreme high and low prices, making auction prices more predictable than in the past. He’s even considering hosting his own online auction, as the costs are relatively small compared with the amount of equipment that could be moved.

Byron Wacker, used equipment buying manager for farm machinery for Titan Machinery in Fargo, N.D., both buys and sells at auctions.

“Mostly I monitor the auctions to see if something sells for under market value,” Wacker says. Like many other dealers, he’s found online auctions have made a big difference in how and what he is able to buy. He estimates he buys 50% more equipment at auctions today than 5 years ago. He’s in touch with Steffes Auctioneers about once a week to check on upcoming events.

“The advantage to our dealership is that we market in every class of farm machinery,” he says.

He adds that Titan is also considering hosting its own auctions as a way to turn inventory faster and broaden its marketing reach.

Gathering Market Intel

Paul of Steffes Auctioneers says auctions can provide market intelligence as well, as “dealers develop a higher level of comfort in equipment they take in on trade.”

Brian Roe, an ag economist at Ohio State Univ. (OSU), says dealers can use online consumer auction sites, such as eBay, to test prices. They can post equipment on the site for a nominal fee and still keep it on the retail lot.

A study he and other OSU researchers conducted from June 2005 to March 2006 led to some interesting comparisons. “For tractors that sellers think will sell above the $20,000 limit of the eBay buyer protection program, our calculations suggest that in-person auctions generate greater total seller revenue,” he says. “For the internet-savvy seller with older tractors to sell, eBay may be an attractive sales outlet.”

Roe is beginning new research on farmer’s attitudes toward the Internet and their online buying tendencies.

Timing the Auction

Traditionally, farm equipment auctions have been held in the spring and fall to move equipment ahead of the season. Seasonal demand still plays a role, but the impact has lessened somewhat. Today, dozens of auctions are held year-round, with equipment advertised 24/7 on auction web sites.

“As supplies have gotten shorter, people are buying out of season to get a good piece of equipment,” says Tink of Ritchie Bros.

Auction timing also relates to when a dealer should begin working with the auctioneer. The earlier the better, experts say, in terms of preparing the equipment and making sure it’s included in advertising — including printed pieces, online posts and direct sales methods. They also advise dealers to not automatically turn away from auctions if they’ve missed advertising deadlines. If the auction has similar equipment, there may be buyers in the audience, experts say.

Choosing the Method

In terms of when to choose one auction format over another, it’s “dealer’s choice.” There are many options for on the ground, online and a combination of on the ground with internet bidding, such as a simulcast.

“Today, 95% of farm equipment sold at auction is still sold on site, and 5% online only,” says Musser. “In the blended model, 20-25% of the buyers will be online. The best model today is a hybrid. It’s the best of both worlds.” Karczmarczyk says the hybrid approach is moving agriculture equipment auctions — and their reputations — into a new era. Better equipment is being sold at auctions, providing dealers with a true market value.

Expert opinions differ on whether equipment condition should dictate the method.

“With older equipment, there’s no substitute for kicking the tires,” says Tink, adding that online buyers sometimes have a local contact to inspect machinery. Because of the high price tag of some of the items, Karczmarczyk says, farmers often need to “touch and feel” equipment, especially with a high price tag.

And there’s an urgency with inperson bidding, Roe adds. Even conservative buyers may bid higher than intended when they’re on site. “They don’t want the risk of spending time traveling to and attending the auction and leaving with nothing.”

Wacker says the psychology of bidding against a person standing next to you and looking right at the auctioneer is a big consideration. “You don’t have the latitude of playing the auctioneer — or him, you.”

Changing Online Auctions

Online auctions are compensating, however, and drawing huge audiences. Paul Blalock, vice president of agricultural sales for IronPlanet, an online auction site, says they often have as many as 17,000 bidders for their farm and construction equipment auctions. During the auction, their customer service department phones bidders who have dropped out, encouraging them to reconsider.

Blalock says they offer a field inspector service and detailed inspection reports and photographs, as well as their IronClad Assurance buyer guarantee. The dealer also has the advantage of not having to transport equipment to an auction site.

Equipment sold through IronPlanet is inspected for general appearance all the way through oil and fluid sample analysis. As many as 50 photographs are taken to show the condition of each unit.

“We have over 450 inspectors in North America and most are within 50 miles of the equipment,” says Blalock. “We stand behind our guarantees because bidders are buying off of the inspection reports.”

“We believe that Internet-based auctions are the future,” says Anderson of Kelly Tractor, who has used both on-site and online auctions. “In many cases, buyers all over the world purchase units. It’s a better deal for the buyer as well.”

Preparing for Auction

Experts agree that today’s buyers want and deserve detailed information regarding equipment condition, especially for online auctions. Numerous photos help show the condition — anywhere from 20-70 photos are appropriate.

“Take photos of each side, the hydraulic hook-ups, the hitch, the interior, close-up of the hour meter, the engine,” Musser says.“You need to replicate what they would see in person.”

Roe says some dealers take videos of the equipment being started so bidders can verify the condition.

Clean equipment is key to that good first impression. From there, auctioneers and dealers can work together regarding other equipment prep.

“Items that bring the most are job ready,” says Tink. The goal, he says, is that for every $1 spent in repairs dealers can earn $2.

Karczmarczyk completely reconditions the equipment he brings to an auction. In fact, his dealership is now known for selling premium equipment at auction. He says his goal isn’t to get retail prices, but to get the highest price at the auction for that equipment.

“Cleaner and touched-up units give us a better return. Paint and a little elbow grease pay big dividends,” says Anderson.

Musser, on the other hand, advises against certain repairs, such as a new paint job, which could indicate the dealer is hiding something.

Blalock says, “We don’t encourage dealers to spend any money to make the equipment ready.”

Swenson of Midwest Machinery doesn’t have a firm process regarding equipment preparation. It depends on whether his service technicians are busy.

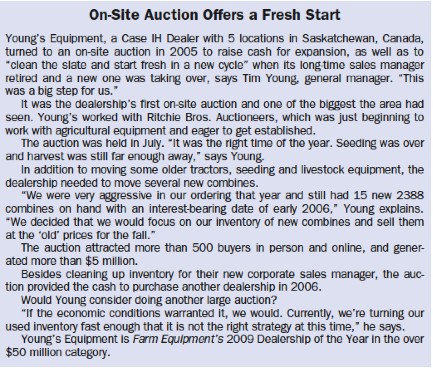

Tim Young, general manager of Young’s Equipment, a Case IH Dealer with 5 locations in Saskatchewan, Canada, sells equipment at auction that is older, of poorer quality or that he doesn’t have time to fix. For those pieces, he makes sure they’re started and cleaned up. He also tries to have complete units.

“For some pieces where I’m not really sure of their condition and can’t give them a ‘thumbs up,’ I just tell them that I don’t know,” he says.

Auctioneers also say that condition is relative and buyers may not share your opinion of high hours or heavy use. For instance, Steffes has sold to buyers in Antarctica, and Ritchie to buyers in the Ukraine. IronPlanet sells 53% of its machinery to international buyers.

Auctioneer Reputation

Regardless of the auction type or equipment condition, auctioneers can make or break an auction. Swenson says auctioneers who may have used less-than-ethical tactics, such as fake bidding, were quickly discovered and lost audiences.

Swenson and Wacker have had good relationships with auctioneers over the years.

Karczmarczyk says the emergence of auctioneers capable of handling large volumes of equipment have taken farm equipment auctions to the next level in terms of technology, reach and overall auction quality.

Musser is a second-generation auctioneer who remembers when auctions were social events, drawing buyers from a 30-mile radius.

“Today, auctions are fasterpaced and business driven,” he says. Sometimes he lists timeframes when certain equipment will be sold to ensure the right buyers are in the audience.

“Auctioneers used to bring a great cadence. Now they bring a network,” says Shibley of Farm Credit.

Dealers should verify that network by asking about the auctioneer’s database, where and when advertising and promotion will occur and what other marketing outreach is planned. Be clear regarding commission rates, services and responsibilities and auction options, such as guaranteed price arrangements.

“A lot of things start with a handshake, but we try to get the paperwork done as soon as possible,” says Young. “It’s not a matter of disputing words, but the meaning of those words.”

The National Auctioneers Assn. provides guidelines in its code of ethics regarding auctioneer responsibilities to their clients:

• Members should discuss all aspects of the services to be provided and include them in written form where appropriate. This should include: duties and obligations of the parties; services provided by the member; liability insurance, theft and casualty loss; use of a buyer’s premium, if applicable; handling of funds received and controlled by the member; sales tax, if applicable; and form of buyer payment.

• Members must provide the client with a timely, detailed written accounting of the sale. This must include information concerning the handling and timely disposition of all funds received or controlled by the member.

Expect the Unexpected

Musser suggests an absolute auction — one where the equipment is sold to the highest bidder with no limiting conditions, such as a floor price — will attract the most potential buyers.

“Sell to the highest bidder and don’t start out at sticker price,” he says.

That means dealers need to prepare themselves for the final price.

“Expect the unexpected,” says Paul of Steffes. But he adds that a good auctioneer will work to set reasonable expectations. Sometimes, that means saying “no” in terms of what equipment should be sold.

“Sometimes they’ll send me a list of 60 pieces of equipment and we’ll narrow that down to 20 items. It needs to be a win-win,” he says.

Experts advise dealers to look at revenue from overall auctions sales, not for individual pieces. That’s why Karczmarczyk regularly brings many pieces. He says the highs and lows equal out to a better average overall.

“You really need to be realistic,” says Swenson. “A lot of times you get emotionally attached to what you think a piece is worth, but the market is never wrong. At the end of the day, would you rather have a machine sitting on your lot doing nothing or have the cash to use?”