George Annen

There was once a simpler time in the career of George Annen, a used equipment specialist and owner of Annen’s Machinery Ranch Inc. in Arlington, Wis. A typical day before the internet started with a freshly-brewed pot of coffee, a trip to the convenience store to process tractor photos taken on a film camera, mailing them overnight to a set of interested buyers and preparing for a sales trip the next day if the phone rang.

The premise of Annen’s business remains the same today: buying, selling and trading equipment 6 days per week, linking buyers and sellers together with used machinery deals in primarily Midwestern states. But that trip to the convenience store has since shifted to instant photos via smartphone, an online sales post, and hundreds more potential buyers receiving all the information they need in a matter of 15 minutes. Swap a pile of letters with a laundry list of emails, and the rest of the day is often spent tracking equipment shipments and scouting new leads across four different auctioning platforms. The fresh pot of coffee can often seem like the one constant in Annen’s routine.

Today’s scene may seem simpler for Annen until realizing that thousands of sellers, some used equipment specialists (or “jockeys”) like him and others just farmers looking to transition machinery, are flooding the market on many of the same platforms. Factor in the rise of scammers hiding behind screens selling damaged machines or stolen information, and the globalized nature of the industry can hinder more than it helps.

“I’m 60 years old and on the downhill side of this,” Annen says with a smile as he sips from his mug and scans over two auctions at once. “It’s not like I want to wish my life away by any means, but I’m kind of glad I’m on the downhill because it’s a tough business.”

While the internet flipped the script on finding leads, establishing trust with buyers and managing his operation as a whole, Annen adapted to the drastic changes required to stay afloat in the business. In finding the motivation to do so, he beckons back to his father’s advice, whose business Annen would eventually acquire over the course of a career spanning four decades and counting: “You only get one chance to make a first impression. I gave you a name and you only get to use it once. Once that name is tarnished, you can’t polish it back.”

Similar Interests, Different Goals

Annen’s operation consists of himself and 2 employees: one responsible for cleaning and detailing equipment and one that drives the trucks. Having the unique advantage of sharing a parking lot with Johnson Sales, a Case IH, Yamaha and Chevrolet dealer, the two businesses utilize each other’s strengths to succeed. Annen manages the majority of Johnson Sales’ trucking responsibilities in exchange for performing any major reconditioning and repair projects on Annen’s equipment.

Utilizing Jockeys to Spearhead Trade-In Sales

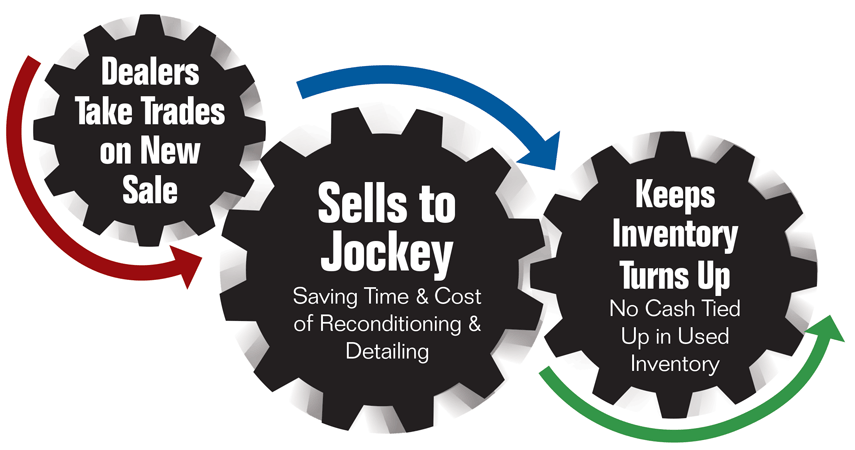

As mainline manufacturers want dealerships to prioritize market share and new equipment sales, used equipment jockeys can be vital source in supplying a consistent trade-in market, says Leo Johnson, president of Johnson Tractor, a 4-store Case IH dealership in southern Wisconsin and northern Illinois.

“Especially if the jockey is outside of the dealer’s trade territory, it may simply be more cost effective for the dealer to wholesale trade-ins vs. cleaning, reconditioning, advertising and financing to end users,” Johnson says. “Manufacturer demands and incentives for reaching a certain dealership status, such as ‘Pinnacle’ for Case IH, require meeting certain financial targets, including inventory turn. This is a perfect scenario for dealers to have a reliable jockey network to market trades immediately.”

Johnson also notes how the rise of online sales platforms, along with a drop in subsidized finance rates from manufacturers, have enabled jockeys to competitively market equipment to end users, using retail financing sources like Ag Direct to offer the same rates as mainline dealers. Through this process, jockeys have shifted from conducting wholesales between dealers to being a retailer of used equipment, with many of them acquiring their own retail lots and advertising budgets.

Yet the changing role of jockeys poses more of a complementary business presence than a direct threat to the bottom line of franchised dealerships, he notes.

“They are competitors of mine, but generally in a friendly way. In any distribution chain, there has to be someone at the top and someone at the bottom. That doesn’t make the links more or less important,” Johnson says. “Is it more glamorous to be a manufacturer than a franchised dealer? Probably. Is it more glamorous to be a franchised dealer than a used equipment jockey? Probably. Are there days when I would like to toss the dealer standards book in my waste can and become a full time jockey? You bet!”

Annen’s previous facility was located roughly 8 miles south of the current location, but when a district decision came down to annex part of his property into a village, he was forced to relocate. Looking to stay in the area, Annen utilized his previously existing relationship with Johnson Sales and moved next door into a smaller facility in 2011. Between the networking and intent to downsize anyway as he embraces the “back-nine” of his career, Annen says the move worked out perfectly for everyone involved.

“Everybody asks us how we get along with Johnson Sales and it’s been a great relationship,” Annen says. “Why does a McDonald’s build next to a Hardee’s? It all works hand-in-hand.”

With Johnson’s primary focus being new equipment and car sales, Annen says the unrelated focus of each business is complementary and prevents conflicts of interest.

“We network back and forth with clientele and inventory,” Annen says. “If I have something that they can make fit to their customer, they can resell it or else they’ll just give me the lead. With inventory, I let them sell their own stuff. I have no desire to be involved with new equipment.”

“I’ve been called a jockey and I’ve been called a scalper. That terminology has been around forever and I don’t mind it. The biggest thing is when you drive onto my lot and see used machinery, the last thing you want to see as a customer is a lot of junk around…”–George Annen

Technological Transformation

The dawn of the modern internet brought seismic shifts to every sales career, and the used equipment industry was no exception for Annen and his colleagues. Annen says he could talk all day about the pros and cons of real-time accessibility and auctioning platforms, but to boil it down, he calls it “bittersweet.”

More than anything else, Annen says the internet has blurred the lines between retail and wholesale, taking what was once the niche of used equipment specialists into a realm of seemingly endless options for machines and regions.

“There used to be a huge difference between wholesale and retail before the internet. Guys like us were the internet,” Annen says. “Years ago, I would take a trip to Illinois to pick up John Deere tractors, haul them back here, and then wholesale them to other Deere dealers up here.”

The rise of online sales has made Annen’s job far more stationary by nature. Between consigning online purchases and verifying certain machines through trusted contacts, Annen estimates he hits the road for about 35,000 miles each year, compared to upward of 75,000 miles per year before the internet. Many of the contacts he networked with before the internet still actively work with him, but a lot of the relationships he’s since built stretch across the country.

“In the old days, I could sell to somebody, deliver it 50 miles away, collect the check and everything was simple,” Annen says. “Nowadays, the most difficult part of the job is often centered around the logistics of getting machinery from ‘point A’ to ‘point B.’”

As for the online auctions, which make up a large percentage of Annen’s daily routine, he typically participates through the primary platforms of AuctionTime, IronConnect and TractorHouse. He says a typical session will last between 60-90 minutes, although some of the larger online events can span between 5-7 hours. The layout of the platforms makes it manageable for Annen to track up to 4 auctions at once across the multiple screens in his office.

“If you know what you’re looking for and have faith in the internet auction you’re attending, you can save a lot of time and money in travel expense and motel rooms,” he says. “But the biggest concern about the internet today is you’ve got to know where you’re buying it from, and if you don’t know who it is, do your homework.”

With two businesses sharing the lot, George Annen manages the majority of trucking for Johnson Sales in exchange for major reconditioning and repair projects on his machines.

Doing Your Homework

Like anyone who participates in as many online purchases as he does, Annen has experienced a few encounters with scammers or misleading sellers withholding vital information. The most recent example came from stolen information on a backhoe that Annen himself previously sold over AuctionTime. A phone call to Annen from a confused buyer revealed a scheme involving a fraudulent seller, stolen pictures and a fake eBay slip.

“Not too long ago, I had a backhoe that I sold on AuctionTime,” Annen reflects. “After it sold, a different guy from Oklahoma called me wanting to know why I had the backhoe he was ‘buying’ from someone else. It turns out that a fraudulent seller stole the information from my AuctionTime post and made up a bogus story to the unsuspecting Oklahoma buyer, claiming he and his wife were moving to Canada and they needed to sell the backhoe quickly. The buyer had purchased it right through eBay for $14,900, receiving a bogus invoice with ‘5 days to reject it.’ He was going to send the guy money prior to calling me.”

Fortunately for the buyer, Annen assumes he came across the previous sales post for the backhoe on AuctionTime while scoping out other options, and that one phone call to Annen likely saved him $14,900. Annen adds, however, that a better job vetting could have prevented such a disastrous possibility in the first place.

“If something looks too good to be true, that’s often what it turns out to be…”–George Annen

“The buyer in Oklahoma obviously didn’t do his homework because he was buying it for $14,900 and I sold it on the auction for $34,100,” Annen adds. “I wasn’t going to be out anything either way, but this guy dang-near lost $14,900. If something looks too good to be true, that’s often what it turns out to be.”

While Annen’s online experiences remain far more positive than negative, those few bad apples motivate him to maximize accuracy and detail when putting any equipment up for sale. This includes a detailed description on the history of each machine.

Knowing a machine’s full history not only gives customers the confidence to invest, but it also plays a pivotal role in his decision to buy and market the machine in the first place.

“On the machinery I have in my yard, I like to have a story behind it, down to where it came from. Was it from a retirement auction, an estate, downsizing operation? For many trade-ins, you can run your serial number and find warranty claims among other important details, but without knowing the full background you can still get burnt, especially with all of the electronics on machinery today. You can spend 12 hours of shop time just to find a loose connection or bad relay.”

Annen sticks to the Midwest for the majority of his purchases, noting the familiarity and trust built with longtime business partners and the pitfalls of long distance expenses to acquire over-advertised machinery.

“A combine out of Arkansas compared to one in Illinois from the same year, model and hours can vary 30-40% in a heartbeat,” Annen says. “But regardless of price, the one in Illinois is normally the better buy because I’ll be able to get an accurate story.”

Dealing with a more distant buyer, he continues, can open a wider door for buyer’s remorse.

“There used to be a huge difference between wholesale and retail before the internet. Guys like us were the internet…” –George Annen

“There are a lot of competitors who will travel into Arkansas or West Texas and bring machinery back up here, but they don’t always make happy customers,” Annen says. “Geography plays a huge factor on value. I’m not saying there aren’t good combines in southern states, but you really need to wade through and pick them out.

Complementing the details on a machine’s history should be a full gallery of photos to prove the legitimacy of descriptions, Annen adds. A powerful visual aid can provide customers with the answers they need on any machine, any hour of the day.

“Post all the pictures you can, because the biggest problem I see is having a guy call me about tire sizes and hours while I’m far down the road from the office,” Annen says. “If I’m not immediately available and certain details are needed to close the deal, I can direct them to the website. There’s a good chance they will find the information they need.”

The ‘Jockey’ Discussion

The term “jockey” has long been associated with used equipment specialists in the industry for decades, and the connotations that come with it are mixed, as well as the reactions of those on the receiving end. For Annen personally, he doesn’t mind the phrase and was even the first to bring it up in a joking manner.

“Twenty years ago us used machinery dealers had the famous nickname of being a ‘jockey,’ but I don’t even ride horses,” he says with a smirk. “I don’t even own a horse!”

To Annen, bigger issues exist than a phrase used to describe his profession. Ultimately, he’s confident in the vital role he and his colleagues play in the sales and continuity of used equipment throughout the industry. The importance of a first impression on individual bases, he stresses, is more important than anything else.

“I’ve been called a jockey and I’ve been called a scalper. That terminology has been around forever and I don’t mind it,” he says. “We’re loved by some and hated by others, but we have our niche in the food chain and try our best to make a fair living. The biggest thing is when you drive onto my lot and see used machinery, the last thing you want to see as a potential customer is a lot of junk around.”

Free from the pressures of market share and contractual restriction, George Annen buys and sells equipment that he prefers, helping the management of inventory.

Unique Advantages

Being his own boss without the demands of manufacturer agreements and contracts, Annen notes his positioning as an independent provides him with unique advantages in the industry despite being a smaller operation. Chief among them is complete control over what he wants to buy, a scenario that traditional used equipment managers find more restrictions with.

“I hear a lot from the OEM dealers I network with that the manufacturers are really controlling their businesses, their finances, signage and building restrictions,” Annen elaborates. “That’s the biggest advantage I have, being able to pick and choose what I want to trade. Manufacturers are always pushing for more market share and trade area. For me personally, it would be extremely difficult to take that approach and enter the trenches as an incomer to that scene.”

Tied into the pressures of market share is the risk of inventory overflow, an issue Annen still struggles with on occasion, but on a smaller and less frequent scale than many of the big-volume operations. While he says high inventory numbers are only an issue if they aren’t being proportionately turned, doing so consistently in the used machinery industry is an increasingly uphill battle.

“If you’ve got a billion dollars worth of inventory, it’s not too much as long as you can turn it,” Annen says. “But boy, I’ll tell you, if you’ve got $2 million and you’re not turning it, that’s too much. When you go on the websites of some of the larger-scale dealership operations, you can search for one model combine and they might have 250 of them in their inventory. I mean what do you do? Lets face it, right now there’s more inventory than there are buyers. You can put that in stone.”