As more industry comments flowed in on the recent Farm Equipment blogs (‘Ripped-Up’ Multi-Unit Trade Deals & Viral Videos’ and 'Industry Weighs in on AHW Canceled-Order Drama’) on the filmed standoff between an Illinois farmer and its John Deere dealer AWH LLC, another Deere dealer doggedly chased me down.

This swamped-during-harvest dealer and I kept missing each other. But you know it’s important when the phone-tag game approaches double-digits — in a single day.

I finally connected with the manager of a large multi-store Deere group near the end of the day. He had no privileged information on the saga involving AHW, but still wanted to express his own thoughts, though he insisted they be off the record.

I was pleased to hear he, as an equipment dealer, considers Farm Equipment to be “his” magazine, yet he was concerned we were failing to see the other side of the story. I shared that our mission, as outlined in the initial memo to our staff in 2004, was to advocate for dealers’ business, as 94% of our qualified circulation identifies as equipment dealers and distributors.

But, I added, it’s difficult to understand all angles when dealers are too afraid to speak up. For this story, I made 3 sincere attempts to AWH leadership, including to correct any errors in the farmer’s story – if any existed. There was no response to the calls and emails.

“I've been in this business for nearly 4 decades and I can count on one finger the times a dealership that I've been associated with has backed out on a deal,” he says. “But I don't have enough fingers and toes to count when a farmer's backed out. Yet nobody makes a big deal about that.”

What bothered him the most was the “I’ll just pull out the Iphone” actions of the farmer. “I feel like everyone was in the room that day to try to find some solution. When it wasn't to the guy's liking, he recorded it. I have a hard time doing business in a world where a guy can whip out an Iphone from his pocket and put on a show to indict a dealer so quickly. That’s scary.”

He added how farmers always appear to win favor in such disagreements, that “it always seems to be the dealership that’s accused of taking advantage of the poor farmer. I hope that people are not framing it up that way,” he says.

No Reaction from AHW?

I asked why his peers at AHW LLC would remain silent and continue to take all the haymaking punches thrown at them. “They probably don’t want to give the guy any more credibility. And I also don't believe that all the neighboring dealers to AHW are going to be running over themselves to do business with this guy. I sure don't want him calling us.”

As others have said, there’s little place for this farmer other than the “former customer” list.

How to Move On?

I understand what he’s saying. I recently saw an unrelated situation unfold where, like the local dealer and this farmer, a longstanding relationship was in sudden jeopardy over what I sense were a result of the high-blood-pressure spikes that accompany times like these.

You’ve seen it too. An emotional and “seeing-red” customer grandstands in front of your peers and staff, spewing half-truths and laying down threats. An understanding of mutual trust can take generations to build, but mere moments to lose.

In situations like these, there may not be enough transactions, or data points if you want to call it that, for parties to move on to restore a relationship that took years to create.

M&A Rumors?

As for rumors about AHW being acquired, he noted that John Deere giant dealer group United Ag & Turf always appears to be “just hours away” from acquiring some other group, including his own company, he laughs. “Most of those rumors get started by farmers,” he says. “And as long as I’ve been doing this, you’ll learn not to get too shook up by what you hear.”

He then added the maxim of “Believe none of what you hear and about half of what you see.”

Two Problems that Dealers Didn’t Cause

This dealer called as a proxy to his dealer peers, and to find out if his concerns were lost on our staff here at Farm Equipment. We, of course, respect him for that.

He did understand and readily accepted my answer that “if something happens in this machinery business, we’ve got an obligation to report on it.” He also acknowledged that he could see why our coverage might get scowled at in places like Moline, Racine, Duluth and Lancaster County, Pa.

“An understanding of mutual trust can take generations to build, but mere moments to lose…”

I reminded him of the “Right to Repair (R2R)” debate, and what others called a sign of courage on our part to choose sides, as half of the Ag Division business here at Lessiter Media is farmer-facing. Executive Editor Kim Schmidt, who penned most of the R2R coverage, was even accused by farmers of being a “shill for John Deere.” (And that’s a laugher considering the amount of times Mother Deere has wagged her fingers at Farm Equipment and Ag Equipment Intelligence for articles she wished were never printed.)

“The only repair farmers really want is to get rid of the emissions and chip up the horsepower. That's the crux of that matter. The government causes these problems with its initiatives, and then it turns around and tries to penalize us for carrying out these initiatives in a responsible way; by making sure those codes are not deleted.”

He went on to say that like R2R, the multi-unit deals that created this current mess also were not the dealer’s idea. “The multi-unit deals were the majors’ doing,” he says. “They created too much used inventory for us. Put together this and the government-imposed problems and we've got a mess. It’s getting to be a tough climb for dealers.”

Final Thoughts

I’ve heard it said that “an industry who vents together, stays together.” Feel free to call when you need to get something off your chest, or to make sure someone out there is still listening. We, as your content generators, can do better for you when we hear from you. You can also use the comment box below, or email me at mlessiter@lessitermedia.com.

Industry Weighs in on AHW Canceled-Order Drama

Posted September 12, 2024

Since the Farm Equipment blog “Ripped-Up’ Multi-Unit Trade Deals & Viral Videos” was posted on Farm-Equipment.com on September 5, the magnifying glass on John Deere dealership AHW LLC has intensified. The day after Farm Equipment’s blog, mass-media and farmer-facing ag publisher Farm Progress released a lengthy report by Andy Castillo on the matter, titled “When Equipment Deals Go Bad.”

At last glance, the “gone-viral” videos posted by Illinois farmer Jake Lieb, in which he “outs” AHW by name, have put 1.4 million eyeballs on the situation.

We’ve since connected with several industry officials and, in the process, received additional education on the protocols a dealer faces.

The term at the center of this matter, and the penalty that is activated upon a too-late cancellation, is commonly referred to as a NARP, or non-authentic retail penalty. According to dealer sources, John Deere put the NARP in place to discourage dealers from placing false orders for equipment that had no real home, and which allowed them to get a leg up on their inline competition to protect their market share.

Prior to the NARP, a dealer could, in theory, attach any name onto the early-order. Yet some dealers secured the order under this pretense and then sold to whomever they wanted once it showed up on the lot. As the story went at that time, the dealer had no retail order to begin with.

According to one Deere dealer-principal, Mother Deere responded to this situation by adding the NARP a decade or so ago. The penalty for cancellation is significant, he says, noting that it’s calculated by the cost of the dealer’s machinery order. Plus, the dealer also loses any bonus application that cannot be claimed on any subsequent orders. “A 5% penalty on a $700,000 dealer-cost order is real money,” he says of the impact of the NARP on a dealer’s financial health.

This dealer-principal says that the AHW situation is highly unusual, though he understands extreme measures may get voiced as dealers are shedding equipment and moving units to auctions at rapid speeds. “You don’t want to go out and sell new stuff just to take on a pile of used inventory you can’t move,” he says.

Case IH Perspective

We collected observations from other colors as well. One Case IH dealer-principal shared that in his experience “extenuating circumstances happen with farmers once in a while where an early-order gets canceled. Most dealers understand that this can happen. A dealer can cancel this wholesale order if it’s done soon enough. Usually what happens is that the order is not cancellable, but the terms can get changed to a stocking order vs. sold retail. The dealer will get some terms when the units arrive but loses out on the early-order discount. When a customer cancels an order, there is usually a compelling reason.

“But when a dealer backs out of a deal, as AHW supposedly did, there needs to be a good explanation. Was the explanation good enough? Probably not.”

Another dealer shared that the rumor mill is “indicating” the Liebs exceeded the hour restrictions stated in the agreement. Upon hearing that charge, we went right to Lieb. “We didn’t have hour restrictions; the deal cited an estimated number of hours that we expected to put on the machine's this fall. Given we haven’t started harvest, there's no way we’ve exceeded anything. The expected hours were an estimate.”

AGCO Dealer Viewpoint

According to Shawn Skaggs, CEO of AGCO dealer Parallel Ag, AGCO’s policy allows dealers to cancel up until the point that the machine is scheduled for production. “At that point, there is no going back for the dealer. They must take the machine or machines regardless of what the customer does.”

An industry analyst, who spoke to yet another John Deere dealer yesterday morning, expressed that the farmer may not have known the difference between a quote and purchase order. As reported previously, Lieb did have a purchase order and an email chain with all the details of the trade.

I’ve seen the language. As far as my 99-cent law degree is concerned, Lieb appears to be in the right. If what I saw doesn’t represent a commitment, then I’ve lost confidence in the act of business itself.

The Depth of the Underlying Problem

“It’s a very scary environment right now to trade for used equipment,” says Skaggs. “The truth is, most dealers are going to lose millions of dollars, and some tens of millions, on trades made over the past year or more. We still honor agreements we make regardless of the market -— and that’s cost us a lot of money over the years. We’ve also had some customers who didn’t honor those agreements when their situation changed, regardless of how it affected us, but that’s by far in the minority.

“At the end of the day, we’re all trying to make decisions to keep our business alive through the next 2 years. I hope dealers and farmers aren’t compromising their integrity to do that. But if it’s a decision between honoring a trade and closing a business or letting lots of people go, then I can understand why one might make that decision.”

Newest Chatter … Acquisition-Bound?

I’ve heard from two independent sources (and another update this morning) that AHW is about to be acquired by the giant Deere dealer group United Ag & Turf. With 97 ag stores, United Ag & Turf is the largest ag dealership in the nation, and has no locations in Illinois where AHW is located.

AHW’s behavior may have been a result of pending negotiations, said one manufacturer. I asked another source what he made of this situation’s impact on M&A, and he replied that it would provide a bargain for the acquirer — especially “if there’s a stack of just-canceled orders that they can fulfill.”

How Would You Have Played It?

“Now is not the time for this kind of thing,” concludes the John Deere dealer-principal. “This business is a two-way street, and it can’t be one-way. Farmers need dealers and vice versa. We need to understand each other and work as if we were partners.”

Another source was shocked AWH has seemingly done nothing to get ahead of and attempt to remedy a terrible situation. AHW is taking a severe PR hit in an area packed with strong inline and non-green competition.

When the Deere dealer was asked about the “all quiet on the Western Front” approach of AHW, he defends their choice of silence. “Once a farmer takes you to TikTok, I’d consider him a forever-lost customer.”

Short of the acquiring dealer group insisting that pending orders be ripped up, I can’t help thinking that a calm conversation, a walk-through of the problem and its impact, and some open dialog on solutions could’ve avoided this whole mess. Many times, my customer has helped me find a solution, even if it involves another customer…

Most dealers and farmers I know are reasonable folks who know they need each other to survive — in order to do business tomorrow, next year and so on. And many farmers, while disappointed with their dealers on occasion, can stomach running their old iron one more year — if they know they’ll be taken care of, that is.

Let’s hear from you. If this was a Harvard Business Case Study assignment, what alternatives to a resolution would you suggest? Use the comment box below, or email me at mlessiter@lessitermedia.com

‘Ripped-Up’ Multi-Unit Trade Deals & Viral Videos

Posted September 5, 2024

I’m guessing that by now, many of you have seen the viral video postings from August 29 that included a video captured from inside the conference room at Illinois’ John Deere dealer group AHW LLC, also known as Arends, Hogan and Walker. To-date, this 71-second video has been viewed 1.2 million times. And another 3-minute, 17-second video posted on August 30, has 143,000 views.

Monticello, Ill., farmer Jake Lieb filmed the conclusion of his meeting with a corporate AHW director. During that gathering, he was informed that AHW was ripping up a multi-unit deal purchase order (P.O.) for spring 2025 delivery that was inked just 2 months ago.

AHW is an 18-store John Deere dealer group that employs 550. According to the Farm Equipment Dealer 100™, AWH is the 44th-largest dealer group in North America.

You can bring yourself up to speed by watching the videos linked below.

Video 1 — Posted on 8-29-24 and to-date has received over 1.2 million views, 83.2k likes, 4,472 comments, 5,033 saves, and 24.6k shares.

Video 2 – Posted on 8-30-24 and to-date has received over 143.7k views, 10.2k likes, 448 comments, 380 saves, and 1,027 shares.

Key points from the videos are summarized below.

“We've just been informed that a deal we made 2 months ago to trade equipment is no longer being honored by AHW because some things have changed in the used equipment market.” says Lieb, who runs a progressive (technology, no-till and cover crops to name a few) corn and soybean operation with his brother Josh. The farm is in its 5th generation of family ownership.

Lieb adds he never had any issue with the local store. In the video, he says, “Now, AHW has close to 20 stores, and I guess they think they're too big to care about honoring deals, which we've got on paper. They're saying they're not going to honor it … that the P.O. is worthless anyway. So, if you, the farmer, have a P.O. and with grain prices being down you feel bad about the agreement you've made, I'd encourage you to just back out of it,” he says, also pointing his fellow farmers to 2 other Deere dealers he mentions by name.

Lieb says he told the AHW director that he was going to post the meeting outcome on social media. “He acted like he didn’t give a s - - -, like I was just a peon, and it wasn't going to matter.”

“I understand that the equipment markets changed. But so have commodity prices and we weren't running to them trying to get out of it. You make these deals, and you’ve got to live by them. If they're in a bad spot moving forward, perhaps they should’ve adjusted their trade-in philosophy moving forward. But you've got to honor the deals that are already made.…” – Jake Lieb, Lieb Farms, Monticello, Ill.

The 8-30-24 video provided an update on how things have blown up since the original posting. Lieb heard from three local farmers who cited similar exchanges with AHW. “This means our local dealership will be one to suffer from corporate decisions. That's the worst part of it.”

From my conversation with Lieb, it sure sounds like he has a solid argument to make and clear documentation to boot. “There was no room for interpretation on anything; it was all spelled out and agreed to. And after all these emails, our last response was ‘AHW acknowledges, accepts and agrees to the terms listed below, and we will begin ordering equipment as the windows open.’ So, we thought we had a deal and 2 months later they called and said they wanted to meet with us.”

Both on the video and my phone call to him, Lieb reinforced his affinity and loyalty for the people at the dealership that he’s known for so many years. He reached out to his salesman — whose position was overruled by AHW corporate — and the service techs to say that it was unfortunate, but AHW would be losing all his business.

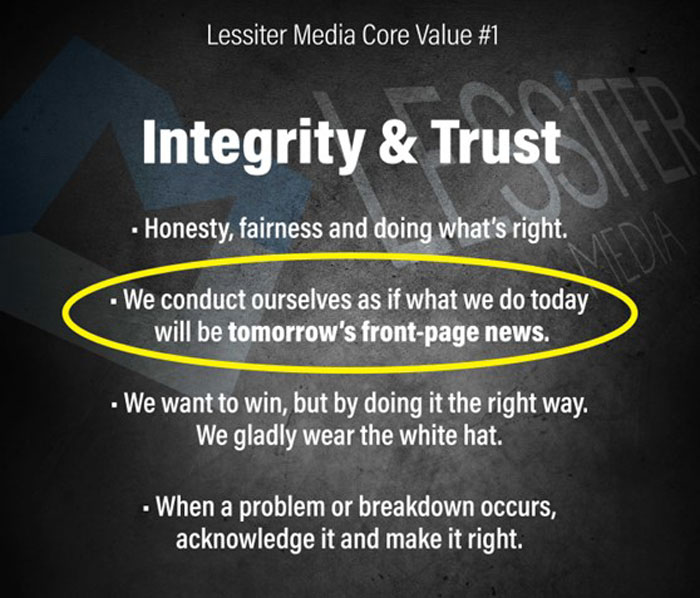

During our interview, I mentioned to Jake what Core Value #1 was at Lessiter Media (and which survived two rounds of Strategic Planning over 17 years). It’s one that we strive for and take seriously. That is, “We conduct ourselves as if what we do today will be tomorrow’s front-page news.” That by itself is a good gut-check for decision-making; to consider the Wall Street Journal recapping the prior day’s action for you and the masses – as you sit down at the breakfast table.

Lessiter Media’s Strategic Planning Process outlined 6 Primary Core Values for the business, with supporting maxims for each. Core Value #1, Integrity & Trust, makes mention of today’s actions appearing in tomorrow’s front-page news…

AHW apparently doesn’t share such a core value or concern, Lieb says. “AHW has had a lot of fallout from this. There's been a lot of people who say they won’t do business with them anymore. I hate it for the local dealer – that's the worst part, I grew up with some of the guys that work there.”

Another industry source confirmed reports that AHW apparently “stepped into a pile” with other multi-unit buyers, too. Another said he’d heard that AHW was asking for twice the price to trade than what was agreed-upon, essentially a “take it or leave it” on combines. If true, he says, this is the kind of mess that could take years to overcome, if possible at all, with 2 well-respected John Deere dealers nearby.

We reached out to two executives at AHW to fact-check what was posted on social media and to hear their perspective, but neither of our calls nor emails were returned. Lieb has not heard anything more from AHW either. We’ll update this article as more is learned on the matter.

Our industry is facing economic challenges where principles will be tested. But remember that integrity cannot be situational. And whether you like it or not, social media is a megaphone for customers to quickly call your business on the table. So, a swift reaction to missteps is a wise move as well.

Update: October 24, 2024

Read a guest blog responding to Mike's 3-part series from Duane Sholten (Sholten's Equipment): "Root Cause of the ‘Ripped Up Deal’ — Volume Discounts"

Update: October 28, 2024

Read a guest blog responding to Duane Sholten's op-ed from October 24, 2024: "Answer Letter ... More Industry Perspective on ‘Root Cause of the ‘Ripped Up Deal’ — Volume Discounts'"