Are you inspired by change or are you just reacting to change? The world has been shut down. Did you let that stop your business? Probably not! Great! But are you taking this time as a good indicator of some changes that you should be making? Are you reassessing your business and adjusting to come out of this profitable and growing? You can do it one department at a time.

Make Progress

This year might be different in adjusting to the crisis and what changes need to be done. I received a call from a company president in California today. He said he was doing his forecasting and figured he might be down 30-50% this coming 6-9 months. He felt, after making a million dollars net profit in the last 6 months, he better tighten up before that happened. He trimmed 30% of this employee count and 25% of his payroll to weather the storm. He was using a financial model that I had taught him, which is integrated between employee productivity and department financial structure. In the meantime, I have talked to other employers around the country that are doing the Payroll Protection Plan, but, while that keeps most of those employees (or at least the headcount) for a period of time, it doesn’t allow as much flexibility if you are not making money. There are decisions to be made in these cases, and there’s not one answer that is correct in all situations.

Everyone is trying to adapt. What I find interesting is how many companies have shifted gears quickly because of this, when they could have done it many years ago with little panic. Restaurants and grocery stores are delivering or bringing your order to your car. Many training functions have quickly gone “online,” and some companies have laid off workers because they needed to trim the staff to get through this time. Most of these changes could have been done 12-36 months ago, but people’s backs were not up against the wall.

• In the equipment distributor/dealership world, some of this comes back to having a flexible financial model.

• How much confidence do we have in why “the financial model” should be the guiding structure, and how committed we are to its structure?

• The purpose of the financial model’s Percentage Structure in each department is that it can work in a strong economy or a weak economy.

• The benchmarks are not built on volume but on a profit structure and the productivity expectations that support that departmental profit target.

I expect you’ve seen the financial model. Maybe you’ve seen the format of it in the industry cost of doing business report. But have you really applied or implemented it into your company’s reporting, goal setting and financial review? What I just discussed on the previous page were some high-level concepts about your company. You need to take that down to very specific issues in each department.

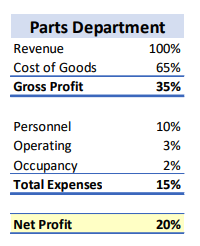

Parts Department Financial Model

You could or should expect 20% net profit. (Administrative expenses are another 10% of this revenue, usually reported in another department.)

You could or should expect 20% net profit. (Administrative expenses are another 10% of this revenue, usually reported in another department.)

One change for consumer distribution I suggest is raising the Operating percentage to 6% to account for the volume of credit card charges in the consumer business (which were not included in the original design of the financial model that was crafted in the 1970s before those were in heavy use).

The productivity target volume is $50,000 a month per parts employee. When volume is down, you need less people, and, when volume is up, you need more. Included in the 10% for personnel is 8% for wages and 2% for benefits. Therefore, $50,000 per month per employee means you can afford about $48,000 a year (on average) per person in the parts department. If you are running lower on productivity, then you are running higher on the personnel percentage. Obviously, you will not achieve the 17%-20% net profit if personnel expense is not controlled.

What level have you been seeing in parts net profit? This just illustrates some high-level issues. There are also more subtle elements, such as the sales mix between counter parts sales (customer direct), internal parts, service billed parts, rental parts usage and manufacturer warranty parts. Likewise, parts turnover should be factored into the expected COGS and inventory investment. No one ever said a distributorship was a simple organization; there are a lot of moving pieces, even in parts.

Changes in Service Department

Just as with the discussion of the parts department above, there are elements regarding service (both shop and field), rental and service contracts. I believe now is a time to be making some strong decisions about the structure of a distribution organization and how it is managed. Being direct and firm is being careful about the future and the future of those employees and their families that will be the backbone of your company into the future. In the last 6 months, I’ve even seen a couple employers doing “outboarding” (helping to place those people they would otherwise lay off into another job).

Let me illustrate results that can be achieved. In Texas we started working with a large company in 2000, when they had about 16 locations and 600 technicians. They were squeaking out a 13% service department net profit. We began doing two-day service department seminars every six months with those location service managers, we created Performance Scoreboards for each one, we got them engaged and competitive with each other, and five years later they had grown to 1,000 technicians and were delivering 26% net profit to the department bottom line. Consistent training, goals and measurement can accomplish this sort of results.

Your Planning is NOW!

Dealing with your company, how are you going to change your goals, expectations, and monitor your results? Do you have clear goals for department volume, personnel expenses, employee productivity, inventory turnover, obsolescence, gross profit and customer satisfaction?

Whether your focus is your parts department, service, sales or rental departments, we have worked in each one and can show you how to establish your measurements and triggers to keep your eye on what is happening daily or weekly. Are you getting paid labor hours posted every day? Are you getting billing out each day, or does 75% of it wait until the last 3 days of the month? That doesn’t help in your cash flow, and payroll doesn’t care when invoices were sent?