Traditionally, farmers are known to be dogged loyal to certain products and this has been particularly true when it comes to their brand of equipment. While dealers and others in the ag equipment business might insist that brand loyalty has greatly diminished in recent years, this isn’t what farmers say.

Every 3 years beginning in 2011, Farm Equipment magazine has conducted a survey of farmers across 12 states encompassing the Corn Belt, Lake States and Northern Plains regions of the U.S. The same states were included in each of the studies.

The survey is aimed at determining how growers see themselves when it comes to their brand loyalty toward farm machinery. The survey included the four major brands of ag equipment typically found in a row-crop operation, including AGCO (Massey Ferguson and Challenger), Case IH, John Deere and New Holland. Results of the surveys show that farmers today are more loyal to their preferred brands than they were even 3 years ago.

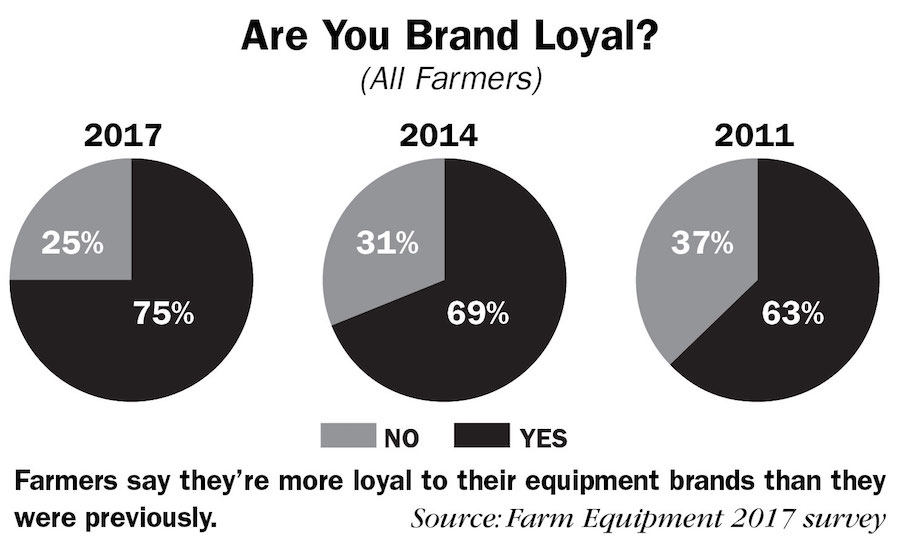

In total, 276 producers completed the 7 question survey this year. Overall, 75% answered the question “Are you brand loyal?” with “Yes.” That’s up from 69% in 2014 and 63% in 2011.

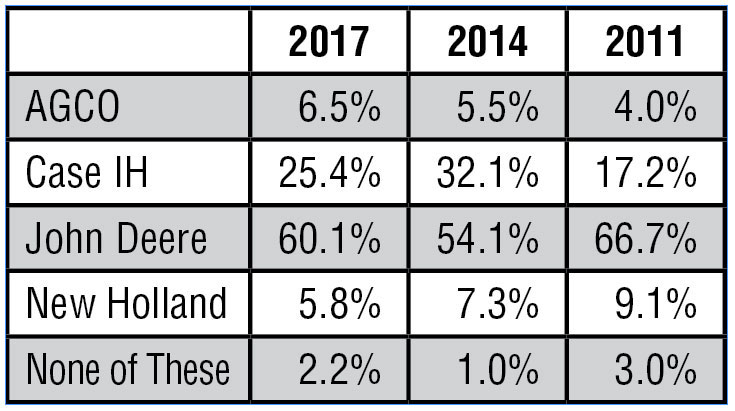

In fact, loyalty to three of the four brands covered in the study improved since 2014, while the fourth stayed even with its score from 3 years ago. Each of the survey respondents was asked to indicate the “primary brand of tractors and combines on your farm.”

Farmers were limited to one choice. Based on the farmers’ choice, the breakdown of total responses for the 2011, 2014 and 2017 studies were:

Brand Loyal or Not?

The farmers were asked, “Would your describe yourself as brand loyal when purchasing farm machinery?”

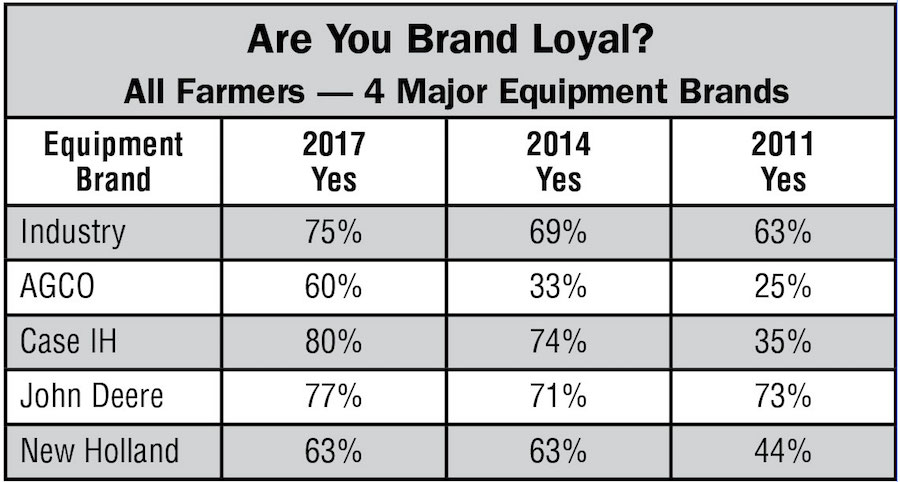

A breakdown by major equipment brands, compared to 2014, AGCO has made the most progress in garnering a higher level of loyalty among farmers who said that AGCO equipment was their primary brand. It improved its score by 27% in the past 3 years. Nonetheless, it still lags the other major brands, as well as the industry’s overall average level of customer loyalty.

When it comes to customer loyalty, John Deere farmers have been the most consistent since the first study in 2011, ranging from 73% in 2011, 71% in 2014 and 77% in the most recent survey. The 6% gain over the past 3 years was equal to that of Case IH during the 2014-17 period.

Case IH edged out John Deere — 80% vs. 77% — in terms of the total percentage of each company’s customers who say they are loyal to “their” brand.

The same percentage of New Holland farmers, who reported being loyal to New Holland equipment in 2014, 63%, reported being loyal in 2017. While the manufacturer of blue tractors didn’t gain, they also didn’t lose any of their farm base over the past 3 years.

Past & Present

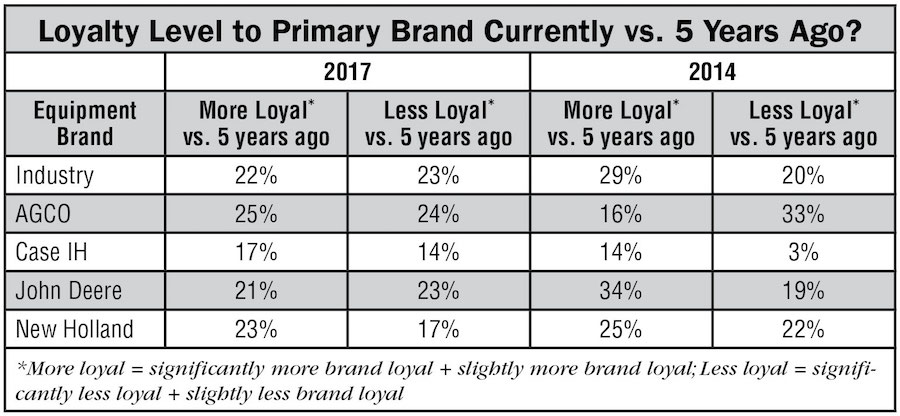

The farmers were also asked to describe their feelings about their primary brand today vs. 5 years ago. They could choose only one of 5 responses: Significantly more loyal, Slightly more loyal, About the same, Slightly less loyal or Significantly less loyal.

Overall, the manufacturers lost some ground in this area. Industry-wide, without regard to brand, 21% of farmers reported being “more” loyal and 23% reported being “less loyal.” Over half, 56% said they feel about the same as they did 5 years ago.

AGCO farmer responses in the most recent study slightly favored “more loyal” (25%) vs. “less loyal” (24%). But it was a huge improvement over the 2014 survey when only 16% said they were “more loyal” and 33% said they were “less loyal.”

The loyalty level of Case IH’s farmers improved by a net 3% in 2017, as 17% said they were overall “more loyal” and 14% reported they were “less loyal” compared to 5 years ago. In 2014, 14% of farmers claimed to be “more loyal” vs. only 3% who said they were “less loyal” than they were 5 years earlier.

In the 2017 study, fewer John Deere farmers said they were “more loyal” (21%) than reported being “less loyal” (23%). This is markedly different than the previous survey when 34% of John Deere farmers claimed they were “more loyal,” while 19% reported being “less loyal.”

New Holland fared somewhat better this time around than it did in 2014. In the 2017 study, 23% of New Holland farmers said they were “more loyal” and 17% reported being “less loyal” for a 6% net gain. This was better than the levels they saw in the previous survey when 25% said they were “more loyal” and 22% said they were “less loyal.”

Considering a Change?

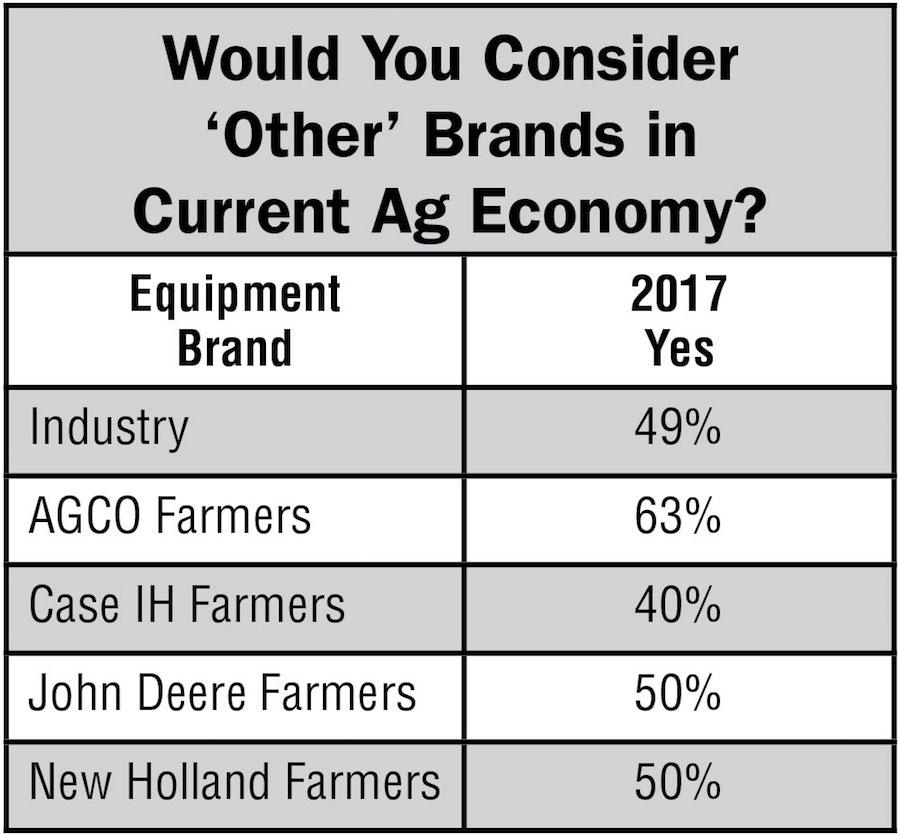

The only new question added this year asked farmers if, in light of the ongoing low commodity price environment,” would they be “more willing to consider brands other than the one that you would typically prefer?” Overall, nearly one-half, 49%, of farmers responding to the poll said “yes” they would be willing to consider another brand of equipment.

Nearly two-thirds of AGCO farmers (63%) reported that they would be more willing to consider another brand of equipment; and 40% of Case IH farmers also said they would consider other brands in the current ag economy.

John Deere and New Holland farmers were split evenly with 50% willing to look at other brands of farm machinery considering the current state of U.S. agriculture.

The extended report appears in the September 2017 issue of Farm Equipment. The full report, including has farmers rated their individual brands appears online only at www.Farm-Equipment.com following release of the September issue.

Post a comment

Report Abusive Comment