As a retailer, you must have inventory. But do you know the costs of holding machines and parts in stock? In my experience, most farm equipment dealers don’t know the hidden costs of carrying inventory — the number can be difficult to determine and most guesses are way too low.

Farm equipment dealers hold around 80% of their assets in inventory (higher for smaller dealers, lower for bigger dealers). This is about 15% more than the industry best practices. The majority of inventory is new and used wholegoods, and 8-10% is in parts. There’s a big gap and big opportunity to reduce costs.

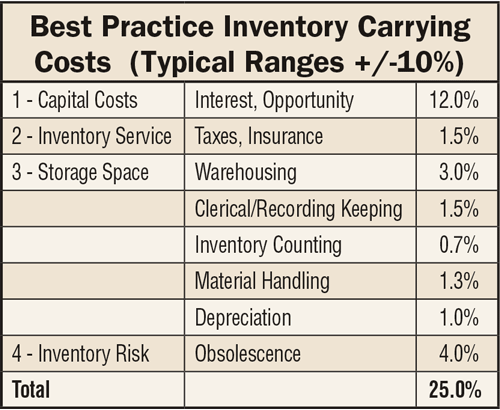

Inventory carrying costs are expressed as a percentage of the average dollar value of inventory over a fixed period — usually a year. Depending on several factors, the total can be as low as 25% and can run as high as 40%.

The term “Inventory Carrying Cost” is incredibly deceptive. It gives a false impression that the cost of holding inventory is one big sum and that little can be done about it. Breaking down and identifying each separate cost percentage allows you the opportunity to rein in those costs. It also allows you the opportunity to significantly impact your bottom-line — one single bite at a time.

Below are the four, broad categories of inventory carrying cost.

1. Capital Cost

Your company’s capital cost is what you spend on carrying inventory, and includes two factors: inventory financing charges and opportunity losses. Calculating your financing costs should be easy and straightforward — either the interest lost on the cash used to purchase inventory or the interest paid on a line of credit used to purchase inventory. Opportunity costs include both the opportunity missed because your money is invested in obsolete or under-performing inventory, and the opportunity missed for ALL money invested in inventory. For every dollar in a slow turning part, the opportunity missed is investing that dollar in a fast moving part instead.

Source: Dr. Jim Weber, Weber Consulting*

2. Inventory Service CostYour capital cost should be the largest portion of your total carrying cost and should typically range between 6-12%. A 12% capital cost on the average parts inventory level of the typical dealer reporting to the Western Equipment Dealer Assn. Cost of Doing Business Study is about of $600,000, so this means $72,000 per year.

Service costs include insurance to cover your inventory and taxes paid to both local and federal governments. Purchasing insurance is not a sexy topic but it is an important decision. You need to evaluate the various, available premiums and the value of what you are insuring. Taxes are unavoidable, but you do have the ability to decrease taxes levied by decreasing your total inventory.

3. Storage Space Cost

This includes all fees associated with renting or purchasing space to store your inventory: rent or mortgage, lighting, heating, air conditioning, janitorial services, equipment upkeep and all of the costs included in the handling of your inventory. Inventory needs a place to sit and it doesn’t put itself on a shelf. Whether you own the space or rent, you are still paying monthly to store your product. You also need to consider the cost to secure your facility. Security systems cost money and many insurance policies require them. These expenses may also be made up primarily of wages and benefits, but may also include the depreciation or expense on scanners and other related equipment, as well as any miscellaneous expenses directly related to your inventory control team.

4. Inventory Risk Cost

Holding inventory inherently comes with risk, and you need to acknowledge the potential cost. Product you carry — that has not yet been sold — is a gamble. If you carry inventory that quickly depreciates in value or quickly becomes obsolete, there is considerably more pressure to turnover your stock. If you’ve miscalculated the need for an item and your turnover is slower than expected, you could be carrying inventory that has lost a large percentage — or worse — all of its value. This inventory mismanagement significantly impacts your risk cost.

The potential for inventory obsolescence is the greatest portion of your inventory risk cost. Included in your total risk cost is inventory shrinkage and damage. Inventory shrinkage is the loss of products between the point of manufacture or purchase from a supplier and the point of sale. The term shrink relates to the difference in the amount of margin or profit a retailer can obtain. If the amount of shrink is large, then profits go down. While most shrinkage is attributed to theft, other causes include administrative errors, vendor fraud or cashier and price check errors.

Converting the 25% to a monthly number means the cost of carrying a part for one month is over 2% of the value of that part. This means a part carried for one year virtually eliminates the ability to make any money on selling it.

It’s well worth your time to know your inventory carrying cost and to make sure your dealership takes aggressive steps to reduce those costs.

*This data was calculated by and is used by Dr. Jim Weber of Weber Consulting. The writer apologizes for using his data without permission.

Related Content

-

How Leverage & Inventory Turnover Keep the Balance Sheet in Order

This executive shares his approach to teaching employees throughout the dealership the importance of leverage and turnover, the guard rails for keeping the balance sheet — and dealership — on track.