North American farm equipment dealers’ level of optimism followed the deceleration of tractor and combine sales in July, but their outlook for the full year remained intact from previous months.

According to the August 2013 “Dealer Sentiments & Business Update” report released to Ag Equipment Intelligence subscribers last Friday, our Dealer Optimism Index, which measures sentiment among dealers compared to the prior month, continued to fall with another drop in July. A net 0% of dealers reported a more optimistic outlook for the year (21% more optimistic; 58% same; 21% less optimistic). This compares to a net 2% of dealers in June who reported a more optimistic outlook.

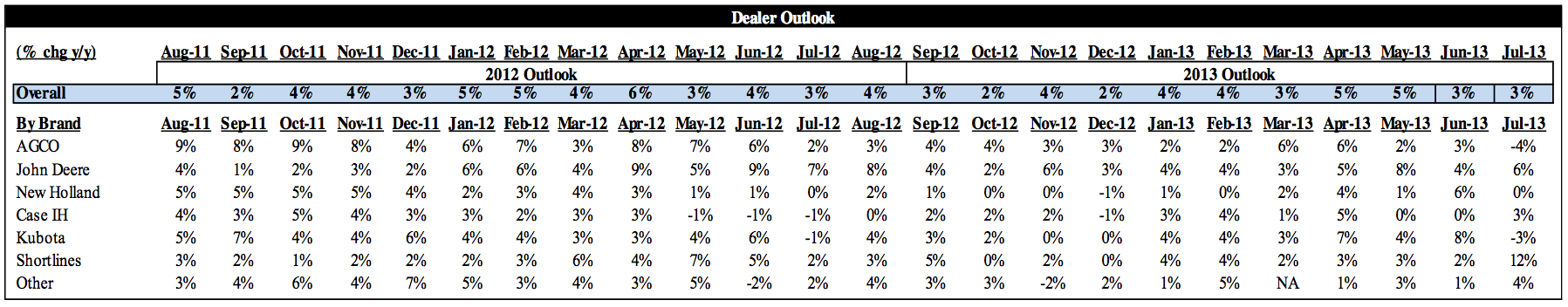

This follows a reported slowdown in incoming orders. Ag equipment dealers reported year-over-year sales grew 3% on average in July, down from 5% the prior month. “Other” ag dealers saw the highest growth at 13%, while AGCO was the weakest with sales down 1%. A net 24% of dealers reported better than expected (38% better, 48% inline, 14% worse) results for July. This is the highest positive reading since December 2011. Last month’s reading was -4%.

Incoming orders were flat (0%) on average in July, stable from June’s reading. Shortlines saw the highest orders growth at 9%, while AGCO saw orders decline 5%.

For 2013, dealers are forecasting 3% sales growth. This is about the same as the previous month. “Shortline Only” dealers are the most optimistic (11%), while the AGCO dealers hold the weakest outlook (-1%).