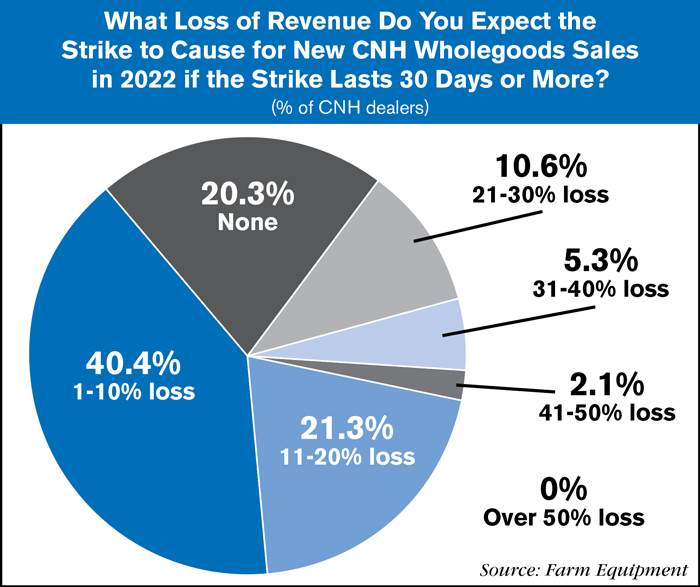

A recent survey from Farm Equipment, conducted from May 3-4, found that 79.7% of CNH dealers (both Case IH and New Holland dealers) forecast some degree of lost new wholegoods revenue if the ongoing strike lasts 30 or more days.

Over 40% of surveyed CNH dealers forecast a new wholegoods revenue loss of 1-10% should the strike last 30 days or more, while 21.3% forecast a loss of 11-20%. A little over 10% of dealers forecast a loss of 21-30%, with just 5.3% forecasting losses of 31-40% and 2.1% forecasting a loss of 41-50%. A little over 20% didn't project any new wholegoods revenue loss.

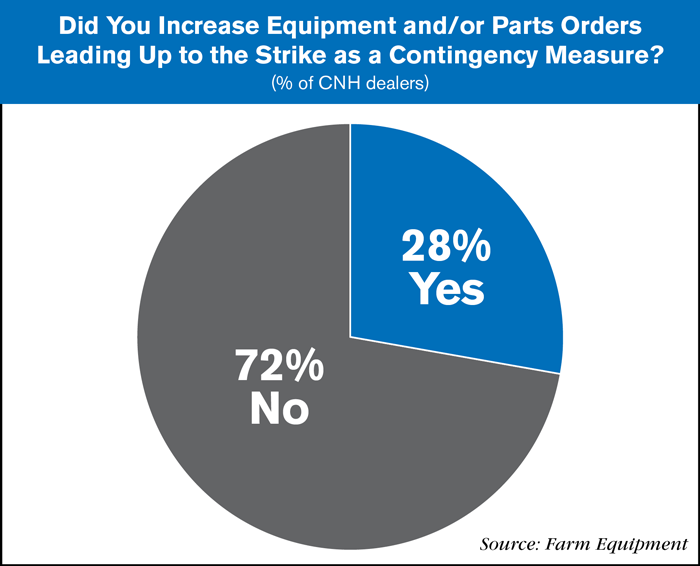

Only 28% of surveyed CNH dealers said they had increased their equipment and/or parts orders leading up to the strike.

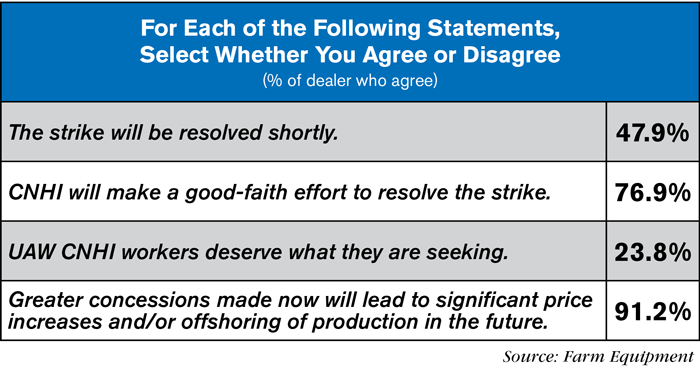

Dealers of all brands were asked to agree or disagree with a series of statements related to the strike. The statement that saw the most agreement from dealers asked if they agreed that concessions made at this point in the strike would create price increases and offshoring of production in the future, where 91.2% of dealers agreed. Another 76.9% of dealers agreed that CNH Industrial would make a good-faith effort to resolve the strike.

Just under half (47.9%) of all surveyed dealers said they believed the strike would be resolved shortly, while just 23.8% said they believe striking workers deserved what they are seeking in negotiations.

When looking at only responses from Case IH and New Holland dealers, 51.9% said they believe the strike will be over shortly and 83.5% said they believe CNHI will make a good-faith efforts in negotiations.

How Will Customers' Purchasing Plans be Affected?

When asked how they anticipated their customers' planned purchases to be impacted by the strike if it lasted 30 days or more, responses from Case IH and New Holland dealers were mixed. Many felt the impact of the strike would do little to affect an already difficult supply chain situation, with one New Holland dealer saying, "My customers already know we are not going to get much until fall anyway, and that was going to be very limited since we are a NH dealer."

Another Case IH dealer agreed, saying, "Equipment is already sold through fall, so impact would be on Q4 2022 / Q1 2023. With equipment already in short supply, I don't think this will change behaviors."

Still others were more concerned about the outcome, where one Case IH dealer stated, "Customers are reaching a point where price increases are starting to be met with less reception. Couple that with the unions demanding more while ag inputs are up and margins are down is not good image. I do not feel this will make my customers want to buy equipment."

More than one CNH dealer mentioned the possibility of their customers moving on to other brands if unable to get equipment from them. "Customers will go to whom ever has the equipment they need/have to have..No inventory no sales," said one New Holland dealer. Another Case IH dealer said, "Our competition (Deere/AGCO) have caught up and are well supplied. This is being used against us at this time."