CALGARY, Alta. — Cervus Equipment Corp. today announced its financial results and operational highlights for the three months ended March 31, 2019.

“While the adoption of IFRS 16 added a measure of financial complexity in the quarter, I am pleased with the underlying business performance in our key areas of focus. Our used agriculture equipment sales set a Cervus record for the first quarter and reflects the timely refurbishing and focused marketing of machinery taken on trade during the record new equipment sales of 2018. The first quarter also demonstrated our progress growing customer solutions; the parts, service, rentals, training, and storage aspects of our business,” said Graham Drake, President and CEO of Cervus. “Our Transportation dealerships experienced increased lead-times for factory deliveries shifting the timing of some sales to later in the year. The segment generated gross profit consistent with the same period in 2018 due to improved performance in our parts and service departments. In our Industrial segment, equipment sales more than doubled on a same store basis compared to the first quarter of 2018, and customer solutions revenue increased across all departments. I believe our commitment to efficiently and profitably delivering on our customers’ expectations will be a key factor in Cervus’ continued success in 2019.”

Highlights for the Quarter:

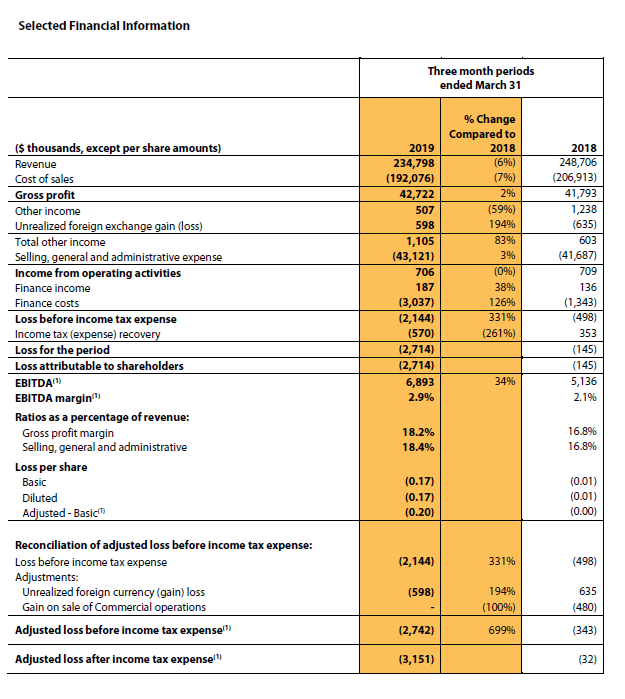

- The Company reported a loss of $2.7 million, or $0.17 per basic share, for the three months ended March 31, 2019, compared to a loss of $0.1 million, or $0.01 per basic share, in the same period of 2018. The initial adoption of IFRS 16 increased the net loss by $1.5 million in the first quarter of 2019.

- First quarter adjusted loss before income tax expense(1) was $2.7 million, compared to $0.3 million in the first quarter of 2018. The current period includes a $0.8 million negative impact from the adoption of IFRS 16.

- Used equipment revenue in our Agriculture segment set a record for the first quarter, increasing 21% compared to the first quarter of 2018. The increased Canadian dollar cost of new equipment was a significant factor in the 19% reduction in new equipment sales from record high sales in the first quarter of 2018.

- The Transportation segment achieved a 10% increase in parts revenue and a 1.6% increase in service gross margin percentage, while timing of new equipment deliveries from the factory reduced new sales by 22% quarter over quarter.

- The Industrial segment achieved a $3.3 million, or 102%, increase in same store equipment revenue compared to the first quarter of 2018, in addition to increased same store revenues in the parts, service and rental departments.

- Overall service gross profit increased by 3.7% compared to 2018, due to continued focus and progress in our service optimization initiative.

- Selling, general and administrative expenses increased 3% in the current period compared to the first quarter of 2018, primarily due to the inclusion of the Red Deer dealership in our Agriculture segment, along with an expanded parts sales team in the Transportation segment.

- Cervus’ Industrial segment was recognized by Doosan, a key Industrial OEM, who presented Cervus with the Doosan Service Excellence Award, the Diamond Parts Sales Award, and the Diamond New Truck Sales Award, all for 2018 performance achievements.

A quarterly dividend of $0.11 per share was declared to shareholders of record as at March 31, 2019, a 10% increase from March 31, 2018.

First Quarter 2019 Financial Highlights

Adjusted loss before income tax expense(1) increased by $2.4 million in the first quarter of 2019, comprised of $0.7 million in Agriculture, $0.8 million in Transportation, and $0.9 million in our Industrial segment. Of the total increase, $0.8 million related to the adoption of IFRS 16, and $0.7 million is due to the non-continuance of the construction dealerships in the current quarter.

On a segment basis, for the Agriculture segment there was no difference between adjusted net loss before income tax expense and loss before income tax expense in the quarter. The $0.7 million increase in Agriculture loss before income tax expense was primarily due to the $0.6 million impact of adopting IFRS 16. Operationally, a weaker Canadian dollar has increased the cost of new equipment, reducing first quarter new equipment demand following the record new sales of 2018. We have been successful in continuing to market the value proposition of well-conditioned used equipment, with sales revenue increasing 21% from the first quarter of 2018. Further, following the difficult Canadian harvest in 2018, parts and service revenue increased 18%, compared to the first quarter of 2018.

In our Transportation segment, the $0.8 million increase in adjusted loss before income tax expense(1) includes $0.2 million related to the adoption of IFRS 16. The remainder related to the scheduling of factory deliveries shifting the timing of first quarter equipment sales, partially offset by a 10% increase in parts sales and a 1.6% increase in service gross margin percentage. Loss before income tax expense improved $0.3 million compared to 2018, mainly due to a $1.2 million increase in unrealized foreign exchange gains, partially offset by $0.6 million increased SG&A expenses and the $0.2 million impact of changes to the accounting standards for leases.

Within our Industrial segment, adjusted loss before income tax expense(1) increased $0.9 million, due to the non-continuance of the four Construction dealerships, which had generated $0.7 million of adjusted income in the first quarter of 2018. Net income before income tax expense decreased $1.3 million, of which $1.2 million related to prior year income from the Construction dealerships. On a same store basis, adjusted loss before income tax(1) increased $0.2 million, including the $0.1 million negative impact of IFRS 16. Total sales increased 41%, offset by a $0.9 million increase in SG&A expenses as leadership and infrastructure previously shared between industrial and construction is now fully borne by the Industrial group. Same store income before income tax expense also decreased $0.2 million.

(1) These non-IFRS financial measures do not have any standardized meaning under IFRS, may not be comparable to similar measures presented by other issuers and are defined and reconciled to their most directly comparable IFRS measure within Cervus’ Management’s Discussion and Analysis for the quarter ended March 31, 2019 under the section “Non-IFRS Financial Measures”, which is available electronically at www.sedar.com under Cervus’ profile.

About Cervus Equipment Corp.

Cervus acquires and operates authorized agricultural, transportation and material handling equipment dealerships. The Company has interests in 63 dealerships in Canada, New Zealand and Australia, employing more than 1,500 people. The primary equipment brands represented by Cervus include John Deere agricultural equipment; Peterbilt transportation equipment; and Clark, Sellick, Doosan, JLG and Baumann material handling equipment. The common shares of Cervus are listed on the Toronto Stock Exchange and trade under the symbol "CERV".

Post a comment

Report Abusive Comment