A few readers have asked how Customer Lifetime Value (CLV or LTV) can be used to help drive profitable growth. You can think of CLV as the value a customer brings to your business from first interaction to last transaction, which could span decades, especially in a relationship business like ours. Although it’s a familiar concept, it’s lightly used at most dealerships. Let’s take a closer look to see if CLV deserves more attention from dealer marketers as we work to serve customers better and grow our businesses.

Customer Value Math

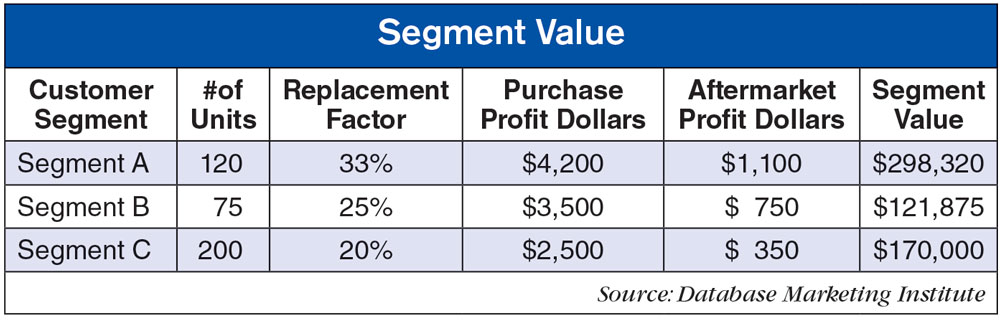

You can find many variations of customer value measurement depending on business type and industry, which can be computed for a specific customer to an entire customer segment (cash crop, livestock, etc.). Arthur Hughes of the Database Marketing Institute shares Alan Weber’s CLV variation that is a good fit for equipment dealers (Google “Customer Value Index Weber”). I’ll condense for brevity here.

Segment Value = # of Units x ((Replacement Factor x Purchase Profit Dollars) + (Aftermarket Profit Dollars))

Where:

- # of Units – How many total units they are likely to buy from you

- Replacement Factor – Annualized replacement cycle (e.g., 5yrs = .20/yr)

- Purchase Profit Dollars – Average profit dollars per unit purchased

- Aftermarket Profit Dollars – Average product support profit dollars per unit

- Segment Value – Annualized customer segment value

Forget about discount rate and acquisition costs for now. Here you have a crisp, forward-looking view of segment profit contribution to your dealership that accounts for replacement demand cycles and ongoing product support. It’s a useful point of departure.

A Stairstep Approach

Most dealers can drill down to this starting point with some additional data gathering, time and analytical effort, but unless you’ve been doing this awhile, resist the urge to overcalculate your segment strategies and start with this step-by-step approach to build momentum.

Step 1: Aftermarket Focus — Especially in our industry, the math reinforces the significant impact of aftermarket sales on CLV and dealer profitability. So, before going too far with segmentation and CLV, make sure that you’ve got a foundation of aftermarket reputation and demand generation campaigns in place along with a healthy equipment inspection program. These will build awareness of and trust in your services, and in the deep expertise of your team, and increase the flow of product support work and resulting loyalty across all customer segments. Focus first on the aftermarket basics of engaging and inspecting.

Step 2: High-Value Retention — In his 1996 book, The Loyalty Effect, Frederick Reichheld wrote that “the smartest of the smart will shift their growth strategies away from new-customer acquisition and toward building and broadening their relationships with the good customers they’ve already won.” Use CLV to identify Pareto’s 20% of current customers that are expected to account for 80% or more of your 3-5 year profitability and make their retention and growth your top priority. Do this for three reasons: (1) The cost of acquiring a new customer is 5X, 10X or even 25X that of retaining today’s customers; (2) Loyal customers spend 67% more than new ones (Inc. magazine); and (3) The smartest of the smart are all doing it. More on retention strategies in a future column.

Step 3: High-Value Conquest — Once you’ve amped aftermarket sales to boost CLV across customer segments and locked in your best customers to bank 25% or better profit improvement (Bain & Co.), you have earned the right to take customers away from your competitors. Earned because you’re already doing what it takes to leverage your aftermarket and keep these customers. So, where should you start? Find more best customers. This is where CLV meets look-alike modeling. Return to your top 20% customers, identify their key characteristics, and find prospects in the market that have similar profiles. Start by matching on farm size and type (USDA data), equipment type and purchase behaviors (UCC data), and distance from your stores (farm location mapping). Keep working down the list of criteria that can be captured from public and purchased data to identify a target set of 20-25 look-alikes per location and validate with your store team. Now, execute your conquest campaign to attract more high-value customers.

Step 4: Prioritized Segments — Most of us can spend the next 2-3 years executing Steps 1-3 with dramatic results for our customers and dealerships and that’s what we should do. For the few ready to go further, Step 4 is where we build the CLV math to include Customer Acquisition Cost (CAC), converting profit dollars to net profit by segment (Segment Value in the table above less all costs to retain and/or acquire). This gives you an ROI-driven basis for comparing and prioritizing each segment. Your resulting list might start something like this (completely dependent on dealer type, geography, market dynamics, etc.):

- Retain midsize family cash crop farms

- Retain large-scale livestock farms

- Acquire midsize family cash crop farms

With this stairstep approach, CLV can be a powerful tool to methodically identify and achieve improved profitability. To get ramped up quickly, focus first on the basics of aftermarket growth (Step 1), followed by a committed retention plan for your very best customers (Step 2). Once you’re effectively supporting and retaining your best customers, find more best customers (Step 3). Finally, prioritize each of your key customer segments to target your next waves of profitable growth (Step 4).

Regardless of where you’re starting, you can use Customer Lifetime Value to focus your dealership on your best customers and deliver what they value most.

The Ask the Expert: Marketing series allows dealers to regularly ask questions and get them answered in real time. It is brought to you courtesy of Western Equipment Dealers Assn. (WEDA).

At the Western Equipment Dealers Association (WEDA), it’s all about YOU! We’re an advocacy association that works tirelessly to advance the interests of our members – more than 2,000 North American agriculture, industrial, forestry and outdoor equipment dealers. Every day, in everything we do, we never take our eyes off one essential question: will it help the dealer? Learn more…