An old Danish proverb says it best: “It is difficult to make predictions, especially about the future.”

Last Friday, Deere & Co. issued its 2018 fiscal year earnings report and, to say the least, the Big Green Machine had a pretty good year. Net sales for its equipment business was up 29% and net income rose by 10% compared to 2017. As for its Ag & Turf segment, net sales were up 3%. Not too bad considering the current state of U.S. agriculture. Looking ahead, Deere is forecasting its U.S. and Canada ag business to be flat to up 5% and Turf & Utility to increase in the same range. I’ve read that most financial analysts liked Deere’s results for this year, but not its outlook for next year.

Ag Equipment Intelligence’s November Dealer Sentiment’s survey shows that U.S. and Canadian farm equipment retailers are looking for about a 1% decline in sales for 2019. This isn’t particularly surprising, especially when you look at some dealers’ comments in the survey. Typical remarks offered this month included these: “There is a ton of uncertainty in the market around equipment pricing, commodity pricing and trade” … “The bulk of our sales increase this year could be attributed to the replacement cycle and those same customers will not be trading next year” … “Interest rates went up and prices keep getting higher. This could really halt customer spending in 2019.”

So, does this outlook indicate that dealers are realists (often code for pessimistic) or conservative (usually code for cautious)?

I think “conservative/cautious” is the better choice and they should be. Each of the dealer comments shown above are legitimate concerns. At the same time, there have been indications that things are tilting upward somewhat.

Take used equipment inventories and pricing, for example. About a year and a half ago, a net 47% of dealers responding to our monthly Dealer Sentiments studies reported their used tractor inventories were “too high.” In the most recent survey, a net 23% of dealers reported their used tractor backlog was “too high.” Three years ago, pricing of used tractors was down nearly 10% year-over-year. Last month it was down less than 2%. Still not great, but significantly better than it had been.

We all know commodity prices have a ways to go before they’re where we would like to be, but again, we’re seeing “some progress.” Based on USDA’s November crop report corn cash receipt forecasts were raised to 7% growth vs. 5% growth last month and wheat forecasts were unchanged at 17% growth. Of course, soybeans have gotten the most attention since the tariff battle with China cut their U.S. imports to zero from very high levels earlier this year. The forecast for soybeans were cut to 4% declines vs. the 2% declines expected last month.

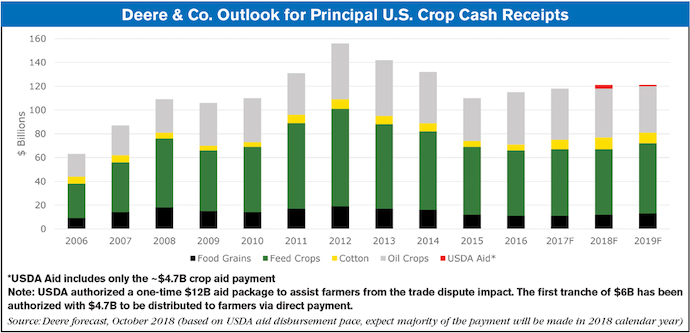

Deere’s 2019 outlook for crop cash receipts looks a lot like their 2018 forecast, which showed slight improvement from the year before and the year before that. (See the chart below.)

Finally, when we conducted the 2019 Dealer Business Outlook & Trends survey in September, we asked dealers how they expected the current year (2018) to finish up in terms of equipment sales. A little over one-half (51%) said they’re sales would be up vs. the previous year. A year ago when we asked how they expected 2018 to go, about 47% of dealers projected that their sales would improve.

Overall, the percentage of dealers who reported higher sales this past year was just slightly better (+4%) than the percentage who projected higher sales a year earlier. That’s pretty good forecasting, if you ask me. For 2019, about 45% of dealers expect overall sales to increase, while about the same number (42%) expect there to be little or no change.

I would say that’s more of a “conservative” approach than it is “realist” approach.