Besides commodity prices and the weather, the topic of land values has probably garnered the most attention from the ag community in recent years (though in recent months "Big Data" seems to be catching up).

Of course, anyone who was around in the early 1980s has an instant knee-jerk reaction to almost any news of a slowdown or dropoff in farmland values and commodity prices. And there's been some of that since the first of the year, but according to two Univ. of Illinois Dept. of Agricultural and Consumer Economics professors, there's really no comparison between the 1980s and today.

In a May 30 post* "Farmland Markets - Comparing the 1980s and the Present," professors Bruce Sherrick and Gary Schnitkey illustrate the significant differences in the landscape of the U.S. agriculture then vs. now.

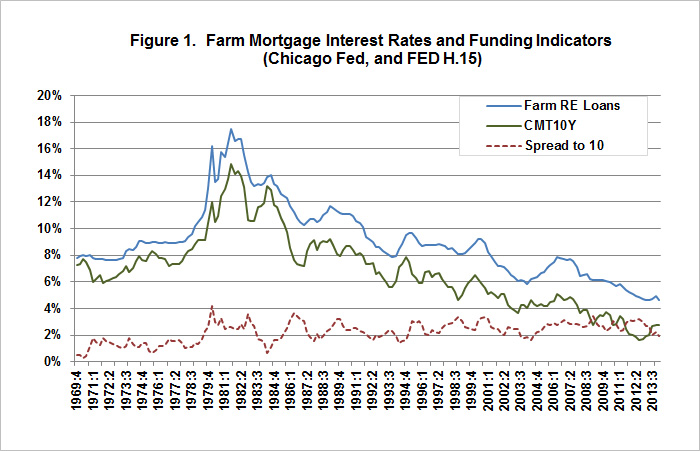

"Among the most important differences between the period leading up to the farm crisis of the 1980s and today are the radically different interest rate and lending environments."

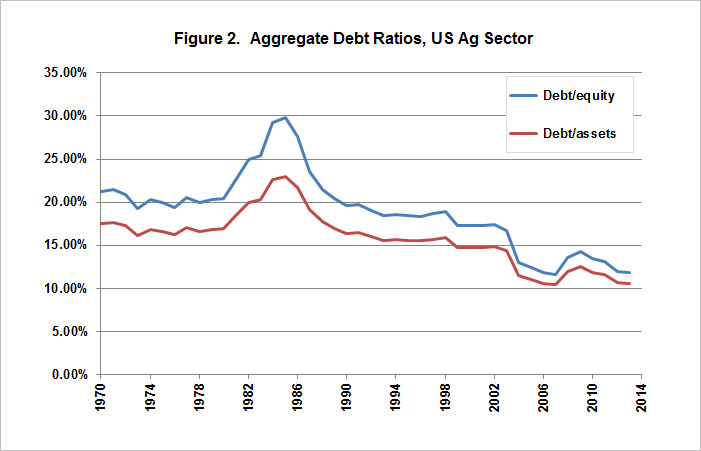

As shown in Fig. 1., in the 1980s, farm mortgage rates peaked at nearly 17.5% and have declined through time with mid-term treasury rates to their present levels. Today, this is combined with the far lower levels of indebtedness (Fig. 2.). "Importantly, the level of indebtedness has also been reduced through time, rendering the sector as a whole less vulnerable to collateral revaluations. As shown in Fig. 2, the sector has very low aggregate leverage. For context, NYSE traded companies aggregate average is around 65% debt," say Sherrick and Schnitkey.

They also point out that typical mortgage loans in the 1980s included longer amortization periods (up to 40 years in some cases) and higher loan-to-value fractions than is typical today.

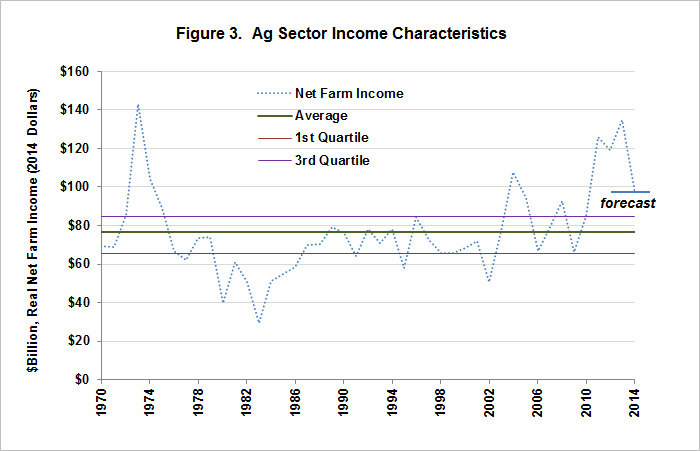

A third factor that needs to be considered is "asset values reflect market participants' expectations regarding income levels and riskiness of income."

They explain: "In the case of farm real estate, there have been several recent years with higher than historic average income, and thus the attendant questions about the ability to continue to generate the same levels." Fig. 3 helps place that question into context.

Sherrick and Schnitkey add that while these aggregate values may not represent individual farm cases well, they say the point is that recent USDA forecasts of income have been reported in some cases as simply "reductions in income." At the same time, it's also true that declines in farm incomes in recent years were still above the historical averages in constant 2014 dollars.

"Whether this level matches well with market participants' views of income is also debatable, but the general pattern of income through time remains important to appreciate, whatever the cause and potential effect," say Sherrick and Schnitkey.

While acknowledging that adjustments in all markets can and do occur, one other important factor has altered the farmland environment marking a significant difference between the current landscape and that of the 1980s. Sherrick and Schnitkey point out that "crop insurance has fundamentally altered the riskiness of income as intended."

Of course, there will always be risks associated with agriculture. But there's another factor that I believe has also helped reshape the landscape of farming that is not often acknowledged. That is the amount and type of information and data available to the entire industry today compared to then. If you're working at it all, there shouldn't be too many surprises. Now, sorting through it all is another matter all together.

*The full Univ. of Illinois report can be found at http://farmdocdaily.illinois.edu/2014/05/farmland-markets-comparing-1980-and-present.html

"