It may seem that brand loyalty is disappearing, but farmers say they're as loyal to their ag equipment dealers and brands as ever.

There are two things all of us know about customer loyalty: it takes an ongoing, sustained effort to earn and maintain it, but almost no effort whatsoever to lose it. Whether it's your dealership or the brand of equipment you carry, customer loyalty isn't forever.

While many farm equipment dealers believe that loyalty to specific equipment brands of ag machinery has diminished over the years, (see Part 2 of this report on p. 60) and has been replaced by demanding, price shopping farm operators, that's not what a majority of farmers themselves say.

If anything, farmers report that their allegiance to "their" equipment brand is as solid as it was 5 years ago. That's what they told Farm Equipment when they responded to our latest brand loyalty survey this past November.

When we conducted our first survey of U.S. farmers 3 years ago, it was in response to ongoing conversations our editors were having with dealers about the level of farmers' allegiance toward their favorite brands of ag equipment. When the results of the survey were published in the January 2011 issue of Farm Equipment, we promised to do a follow-up survey in 3 years to determine if farmers' steadfastness to their "brand" was standing up or shifting over time. This article is the follow-up to that initial report.

Dealer Takeaways

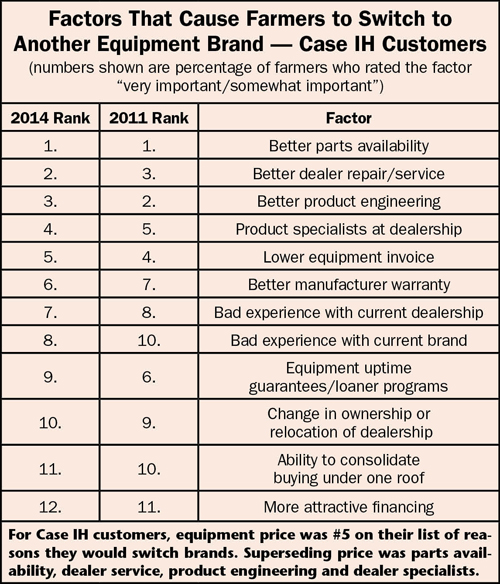

- Farmer survey affirms that parts availability and dealer service are absolutely imperative to build customer loyalty.

- "Color conversions" are difficult, but possible. Over half of the farmers cited 4 "very important" reasons why they would switch brands, and 3 of them directly involve dealers.

- Price is seldom a key factor in farmers' switching brands. Lower invoice price was #6 on farmers' list of reasons to change brands.

Similar to 3 years ago, the most recent survey was sent randomly via email to farmers who work a minimum of 1,000 acres in 10 states throughout the Corn Belt and Lake States agricultural regions. The 6 questions were identical to the questions posed 3 years earlier, and the brands covered were the same as well. These were comprised of AGCO Corp. - including Massey Ferguson, Challenger and Gleaner - Case IH, John Deere and New Holland equipment.

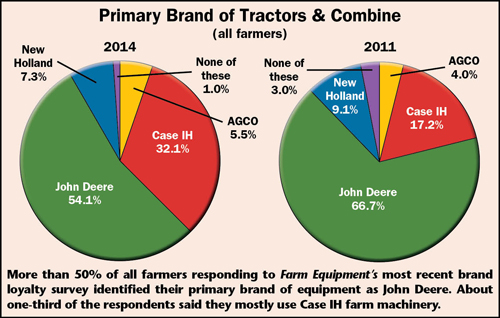

Customers who relate most closely to New Holland equipment made up 7.3% of total responses vs. 9.1% in 2011, and 5.5% of respondents identified themselves as AGCO users compared to 4% in the earlier survey. Only 1% said "none of these."Of the total responses, 54.1% of farmers said their primary brand of tractors and combines was John Deere. In the 2011 report, 66.7% of the responses came from John Deere customers. Case IH customers comprised 32.1% of all responses vs. 17.2% the last time around.

Following is a report on the results of Farm Equipment's most recent brand loyalty survey with comparisons to the 2011 report.

Levels of Loyalty

Based on their responses, it's clear that not only are farmers still loyal to their color of choice, but they may have become even more firmly attached to their favorite brand of ag machinery since the last survey.

Farmers were asked, "Would you describe yourself as 'brand loyal' - purchase the same brand year after year - when purchasing tractors, field equipment or combines?"

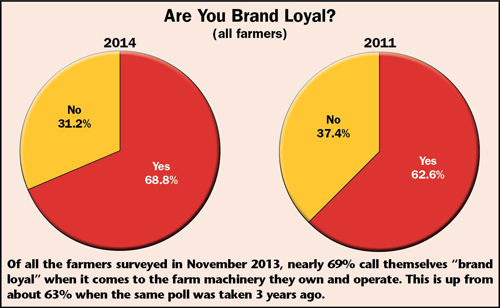

Nearly 69% of all respondents labeled themselves as "brand loyal," while the remaining 31.2% said they were not when buying farm machinery. This is up from the 2011 report when 62.6% defined themselves as "brand loyal" and 37.4% who didn't consider allegiance to any specific brand of farm equipment.

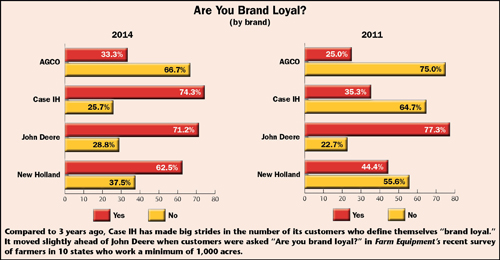

Broken out by the different brands, three of the four full-line machinery makers saw loyalty among their customer base improve. Case IH made the biggest strides in raising the level of allegiance among its customers.

Three years ago, slightly over one-third (35.3%) of farmers who purchased Case IH farm machinery referred to themselves as "brand loyal." This time around, more than double that percentage, 74.3%, reported loyalty to their red machines.

New Holland ranked second when it came to improving loyalty among the farmers who purchase its equipment, increasing to 62.5% from 44.4% in the original survey. Only 33.3% of AGCO customers label themselves as "brand loyal." However, this is a significant improvement over the 25% who considered themselves brand loyal to AGCO branded equipment 3 years ago.

John Deere was the only one of the four full-line farm equipment makers who saw a decline in customer loyalty levels from 3 years ago. The last time around, 77.3% of farmers who considered Deere as "their brand" said they were "brand loyal." This slipped to 71.2% in the most recent farmer survey.

More or Less Loyal?

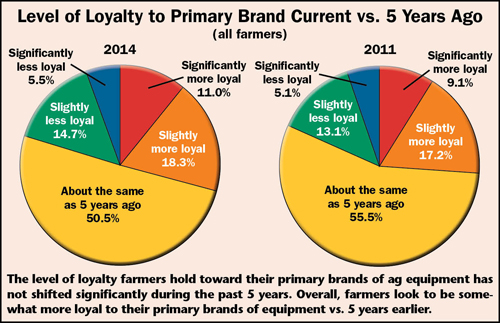

To determine if farmers feel differently about the equipment they operate today compared to the recent past, we asked them to "Describe your feelings about your primary brand preference today vs. 5 years ago."

As a whole, the farmers' responses did not differ significantly from the earlier survey. Based on the total responses, 11% described themselves as "significantly more loyal" compared to 9.1% who said the same thing 3 years ago. Some 18.3% said they were "slightly more loyal" vs. 17.2% in the 2011 report; 14.7% indicated they were "slightly less loyal" compared to 13.1% 3 years ago; and only 5.5% said they were "significantly less loyal" vs. 5.1% in the earlier survey.

About one-half, or 50.5%, said their level of brand loyalty was "about the same as 5 years ago." This compares with 55.5% who offered the same response 3 years earlier.

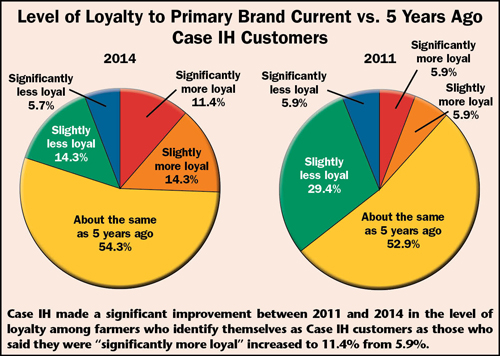

By equipment brand, the biggest jump in loyalty came with Case IH customers. Three years ago nearly 30% of farmers who identified themselves as Case IH customers said they were "slightly less brand loyal" vs. the previous 5 years. This percentage dropped to 14.3% in the latest poll, indicating that fewer of its customers were dissatisfied with Case IH branded equipment in recent years.

The Purchasing Process

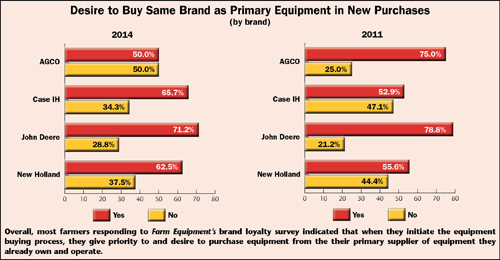

The depth of brand loyalty is first evident when the customer initiates the buying process. To gauge how farmers begin shopping for new equipment, we asked, "When you purchase new (not used) farm equipment, do you begin the process with the desire to purchase the same brand as your tractor/combine?"

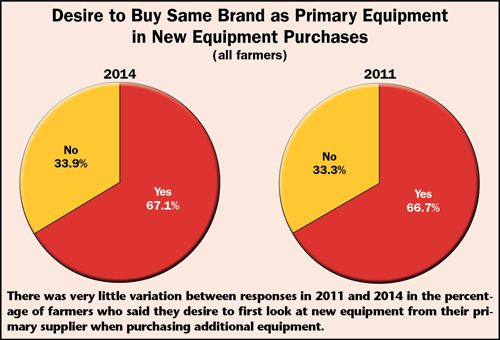

Overall, 67.1% of the farmers indicated they start their decision making process by first considering the brand they already own. This percentage is almost identical to the results of the survey 3 years ago at 66.7%.

John Deere customers were the only customer group to surpass the overall average as 71.2% that begin the process by first looking at what the company is offering. This is down somewhat from the previous survey when 78.8% was reported.

Looking Past Their Primary Brand

Despite their initial intentions, farmers will often purchase other brands of equipment not manufactured by the supplier of their primary brand.

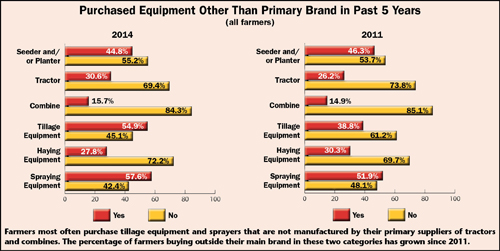

To get at what types of equipment a farmer is most apt to buy that doesn't match the brand they would normally buy, we asked, "Have you purchased any of the following items that were NOT manufactured by your primary-brand line in the last 5 years?"

Based on the overall survey results, it would appear that dealers looking to win color conversions should focus on tillage equipment and sprayers.

Overall, nearly 58% of farmers indicate that in the past 5 years they bought a sprayer that was a different brand as their primary supplier. This is up from about 52% from 3 years ago.

Tillage tools ranked second among equipment types that farmers will buy outside of their primary brand of equipment. In the past 5 years, nearly 55% of farmers purchased another brand of tillage equipment - up significantly from the 39% 3 years ago.

When it comes to seeding and planting equipment, about 45% of farmers have purchased a brand of equipment that didn't match their "primary" brand. This is down slightly from 3 years ago when 46.3% answered the question in the same way.

Slightly over 30% of the farmers indicated they have bought tractors of a different brand other than that of their "primary" supplier. This compares with 26.2% from 3 years ago.

Slightly less than 28% have purchased a different brand of haying equipment vs. 30.3% who reported they did so in the 2011 report.

Farmers are least likely to purchase a brand of combine other than the brand that they already own or operate. Only 15.7% report buying a combine that wasn't manufactured by their primary supplier in the past 5 years. This is up only slightly from the 14.9% who reported doing so 3 years earlier.

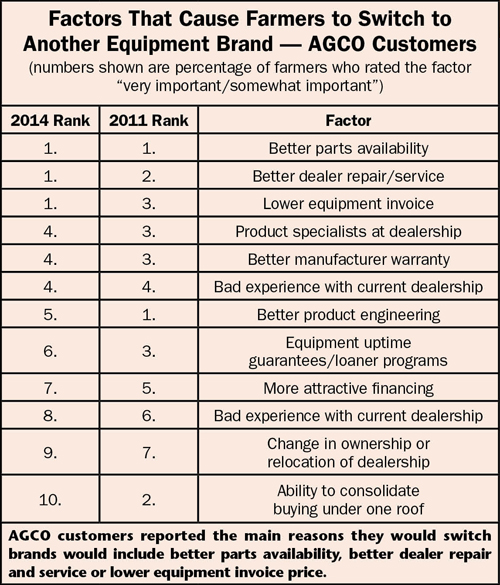

Reasons to Switch

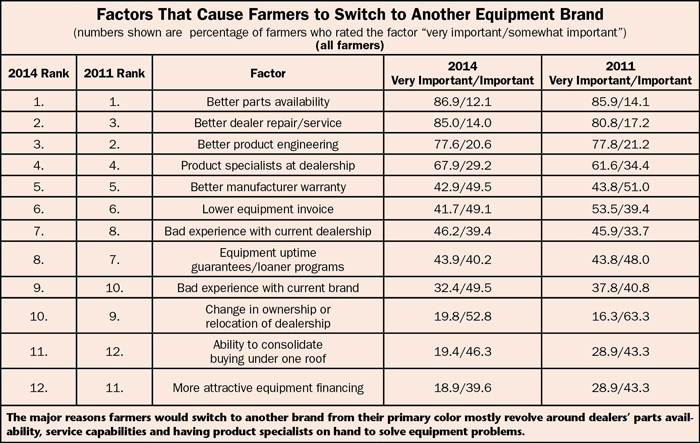

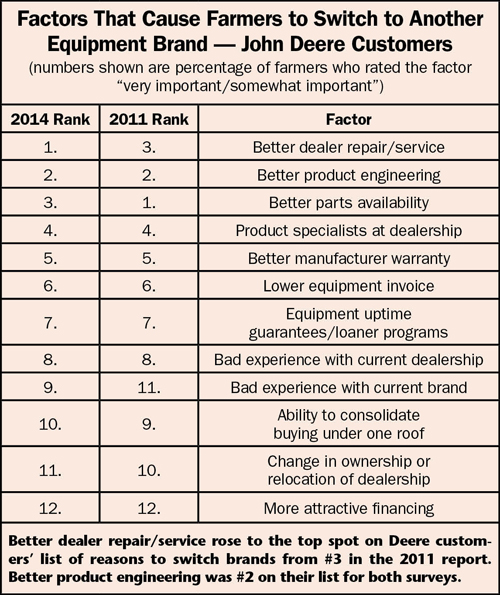

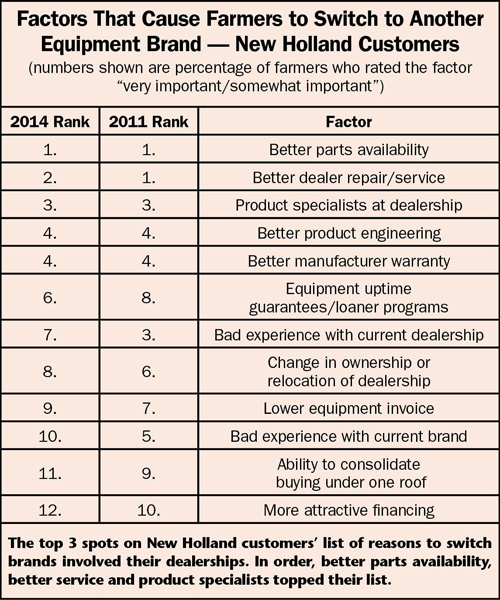

If U.S. farmers are as loyal to their choice of farm equipment as the survey results indicate, what, if anything, could get them to switch brands?

While it would be tough to switch equipment brands, farmers indicated they would if necessary, and three of the top five reasons center on the dealership they're working with.

The final question of the survey asked farmers to "rate the following factors for their potential to cause you to switch from your primary brand to another."

In order of importance, their reasons included:

- Better parts availability

- Better dealer repair/service

- Better product engineering

- Product specialists at dealership

- Better manufacturer warranty

- Lower equipment invoice price

- Bad experience with current dealership

- Equipment uptime guarantees/loaner programs

- Bad experience with current brand

- Change in dealer ownership or dealer location

- Ability to consolidate buying under one dealership roof

- More attractive financing

If nothing else, farmers have been clear and consistent in their expectations for the farm machinery. As was the case in the earlier survey, their main priorities are to keep their equipment running. Their responses also leave little doubt that their equipment dealers are absolutely essential to accomplishing this aim. Even the most loyal farmers will dump their favorite brand if their dealers aren't able to keep their equipment in the field.

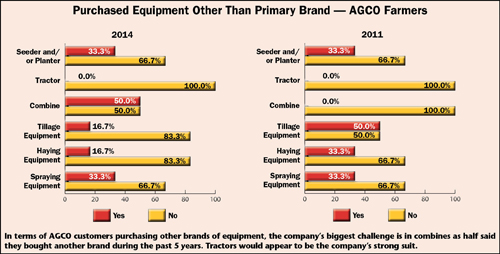

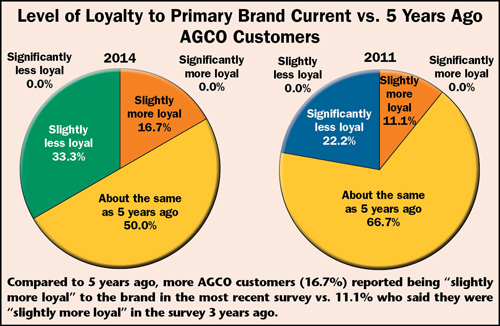

AGCO: Making Progress

AGCO, with a less than a 25-year history, has the biggest challenge in establishing its brand, but the company appears to be making progress.

Three years ago, only 25% of farmers who identified one of the AGCO lines of equipment (Massey Ferguson, Challenger, Gleaner) as their primary brand labeled themselves as "brand loyal." According to the results of the most recent Farm Equipment survey, that percentage has jumped to 33%, which is still low compared with the other full-line equipment makers.

AGCO customers also indicated an overall higher level of brand loyalty compared with the earlier survey. None of its customers indicated they were "significantly more loyal" in either survey. Those that said they were "slightly more loyal" increased to 16.7% in the most recent survey vs. 11.1% 3 years ago.

In the 2011 report, 22.2% of AGCO customers said they were "significantly less loyal" than they were 5 years earlier. This time, nearly no AGCO customers were "significantly less loyal."

The company has also made progress in serving customers who buy outside the AGCO brand. In the 2011 report, 50% of AGCO customers had bought other brands of tillage tools. This dropped to only 16.7%. The same trend is seen for haying equipment and sprayers. However, it appears the company lost ground with combines.

Farmer Commentary. Asked about why they look at AGCO equipment first when they're shopping for new equipment, AGCO customer responses were fairly typical. One farmer said, "I'm familiar with the features and the dealer." Another added, "I'm familiar with the brand." Another AGCO customer replied, "I look for the best quality for the price."

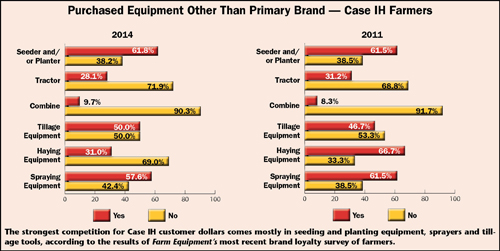

Case IH: 'Feel-Good Brand'

When asked why he starts the process of buying new equipment by first looking at his primary brand, one farmer who is a Case IH customer said, because it's a "feel-good brand."

While it's anyone's guess why this particular farmer feels that way, it's clear from the results that Case IH made significant progress in improving the level of loyalty that its customers feel toward red equipment. Of those farmers polled who consider themselves Case IH customers, 74.3% said they're "brand loyal." Three years ago, only 35.3% described themselves as "brand loyal."

In addition, 11.4% said they're "significantly more loyal" to Case IH-branded products today vs. only 5.9% 3 years ago. Also, 14.3% reported they were "slightly more loyal" this time around compared to 5.9% in the earlier survey. But the biggest leap in perception came with those who referred to themselves as "slightly less loyal." In the newest survey, 14.3% classified themselves as such compared to 29.4% who said they were "slightly less loyal" in the 2011 report.

In terms of Case IH customers purchasing other brands, their biggest vulnerability is in seeding and planting equipment, as well as sprayers.

Nearly 62% of farmers who favor Case IH's red equipment have bought a different brand of planting equipment, a nearly identical percentage (61.5%) as 3 years ago. When it comes to sprayers, 57.6% of Case IH farmers purchased a different brand, down a little from the 61.5% in the 2011 report.

One-half (50%) of Case IH customers also reported they have purchased a competing brand of tillage tools in the past 5 years. This is up from 46.7% who said they did so 3 years ago.

Farmer Comments

Commentary from the farmers who identify themselves as Case IH customers would seem to indicate their dealership plays a major role in why they look at red equipment first before considering other brands. Selected comments regarding the role of dealers include: "I'm dealing with friends and I like red paint" ... "Familiar with the brand, like the people I deal with" ... "Dealer location and staff are pleasant to work with" ... "Trust the dealer; better equipment at a more affordable price" ... "Closeness of dealership, familiar with the operation of that color of equipment; dealer support" ... "To get better service" ... "We look for needed features and value as well as a reliable dealer" ... "Dealer has great service department if needed" ... "To maintain a good relationship with my dealer for service."

Other comments reflect a more practical approach. "I like the brand, understand it and have parts for it" ... "I want the equipment that does the best job, not the closest to my operation" ... "We look at what we want it to do first, then price" ... "My father and grandfather have always tried to purchase red equipment and that is what I grew up with" ... "I stick with one brand for combines. I know how to adjust them and have spare parts and I can depend on a nearby dealer. I'm a bit more flexible on tractors, having switched a couple times between dealers and brands" ... "Always have had good luck with them so why change?" ... "We stay with what we know and with the technology in today's machines, it's hard to switch even when they say their stuff works in a competitors' machine."

John Deere: Brand to Beat

In the farm equipment world, no equipment maker has come close to matching John Deere's branding capabilities. Deere was ranked #83 of Forbe's 2013 Most Valuable Brands. It and Caterpillar (#60) were the only heavy equipment makers to make the list. Deere customers' allegiance to green equipment is legendary and there's little indication that their loyalty is diminishing in any meaningful way.

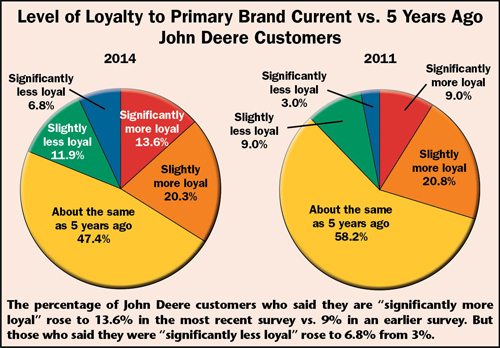

At the same time, the percentage of farmers who claim loyalty to the company's equipment was down somewhat in Farm Equipment's most recent poll of farmers. In the 2011 report, 77.3% of respondents said they were brand loyal to green. This slipped to 71.2% in the most recent survey.

That same number, 71.2%, said they start their equipment buying process with the desire to buy John Deere equipment. This compares to 78.8% 3 years ago.

The results were mixed when green farmers were asked if they were more or less loyal vs. 5 years ago. More said they were "significantly more loyal" (13.6%) compared to 5 years ago (9%). The percentage of those in the "slightly less loyal" category crept up to 11.9% vs. 9% in the earlier survey. Those who said they were "significantly less loyal" also increased to 6.8% from 3% in the report 3 years ago.

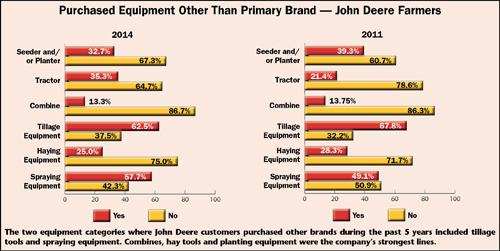

Tillage equipment and sprayers are Deere's weakest areas when it comes to its customers switching brands. Of all those farmers who claim John Deere as their brand, 62.5% purchased tillage equipment in the past 5 years that was not branded by Deere. This was down from 3 years earlier when 67.8% of Deere customers bought a different brand of tillage tools.

Sprayers are another area where it appears that Deere, like the other full-line equipment makers, are vulnerable. In the latest poll, 57.7% of Deere customers reported buying another brand of sprayer in the past 5 years. This is up from the 49.1% who reported purchasing another brand of sprayer in the 2011 report.

Farmer Commentary

Three common threads ran through Deere customer comments on why they look to green equipment before shopping around for ag machinery: strong dealer network, resale value and the company's reputation. But it was Deere's dealers who garnered the most comments. "A good dealer is close by, all high-tech electronics are compatible" ... "Dealer support" ... "Good local dealer with good service" ... "The service we get from our local dealer" ... "It is easier to maintain and work on. Plus you can go to one dealer and get all your parts and service" ... "I like the quality and the local dealers" ... "A good dealership and great service" ... "Closeness of dealer" ... "Service from the dealership and the distance for parts and service."

Farmers who purchase Deere equipment also say its high trade-in value is another key factor. "Best trade-in value for current equipment when trading for the same brand" ... "resale value, like the equipment" ... "It has the best value in performance and resale."

For many Deere equipment customers, it comes down to past performance and their perception that green equipment represents a high level of quality. Typical comments included: "Past experience" ... "Past results" ... "Due to past positive experiences with that particular brand" ... "Familiarity with the operation of it and proven performance" ... "Knowing the line of equipment, not a lot of new things to learn" ... "Familiar, reliable!!"

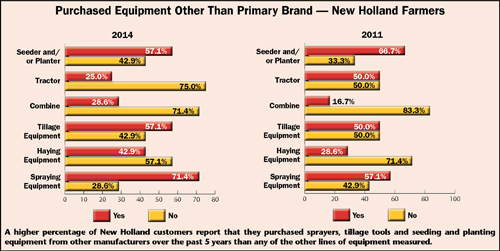

New Holland: Improving Loyalty

Three years ago, only 44% of farmers who identified themselves with New Holland labeled themselves as "brand loyal." Results of the most recent survey show that number has grown significantly to 62.5%, an improvement of nearly 20%. Like so many "loyal" customers of ag machinery, much of their loyalty is based on the service of their local dealer.

In terms of improving levels of loyalty, New Holland saw good improvement in this area, as well. While no customers responding to the most recent survey said they were "significantly more loyal" to the New Holland brand, 25% indicated they were "slightly more loyal," which is up from 11.1% 3 years ago.

Also, 3 years ago, 22.2% of New Holland customers said they had become "significantly less loyal" during the preceding 5 year period. None reported to be "significantly less loyal" but 25% said they were "slightly less loyal" than they were 5 years earlier.

New Holland also saw good improvement when it comes to customers wanting to look at the company's products first when they're getting ready to buy new equipment. This rose to 62.5% this time around vs. 55.6% 3 years ago.

When it comes to New Holland customers purchasing other brands, New Holland needs to focus on planting equipment, tillage tools and sprayers.

More than 71% of farmers who labeled themselves as New Holland customers said they had acquired spraying equipment not manufactured by their primary supplier. This is up considerably since the 2011 report when the result was 57.1%.

Slightly over 57% of New Holland customers also said they had bought planting equipment and tillage tools manufactured by another company during the past 5 years.

This percentage was an improvement in the planting equipment category, as 66.7% reported purchasing a different brand of seeding products in the 2011 report. But the percentage of New Holland customers buying tillage tools from a competitor rose to 57.1% in the most recent poll from 50% 3 years earlier.

It also appears that the company needs to pay attention to its combine product line as well. Whereas only 9.7% of Case IH customers and 13.3% of John Deere equipment advocates purchased a combine from another manufacturer during the past 5 years, nearly 29% of New Holland customers reported that they bought another brand of combines during that period. This is up from only 16.7% who reported doing so in the 2011 report.

Farmer Commentary. Comments from New Holland customers pretty much follow along the lines of loyal customers of the other brands of farm machinery, with dealer parts availability and service playing a key role in maintaining brand loyalty. "Cost and dealer service" ... "Parts service from one dealer" ... "We like the service and have no reason to change" ... "Normally the best price to get the best equipment. May change dealers but normally same brand" ... "Because of the locally owned dealership" ... "To use the same hydraulic oil."