Miller Farm Equipment

Founded: 1924.

Major Line: Case IH Ag. (Also has the construction equipment contract for Case Skid-Steers in Moosomin).

Shortlines: Bourgault, Apache, Westward, Degelman, Bale King, Honeybee, Brent, Summers, Farm King and Kubota.

Locations: 6 (Moosomin, Saskatchewan, which serves as current headquarters; and Shoal Lake, Dauphin, Brandon, Killarney, Boissevan, Manitoba).

Employees: 91.

2007 Sales: $103.2 million ($85.9 million in wholegoods, $9.3 million in parts, $5.9 in service and $2.1 million in other).

2007 Return on Assets: 11.4%.

2007 Market Share: Case-IH 100-hp and over tractors and combines: 38.5% (Case IH national average: 26.3%).

2007 Parts/Service Absorption Rate: 73.1% (North American average: 61%).

2007 Awards: CNH Gold Sales Club (for precision farming sales), Apache Equipment Technologies Dealer of the Year, Bourgault Industries' High-Volume Dealer of the Year, Farm Credit Corporation Top Canadian Dealer, Top Three CNH Capital Physical Damage Insurance Dealers and MacDon High-Volume Dealer of the Year.

Key Staff: Kevin Miller and Doug Heritage, partners; Lorraine Boyd, controller; Dwight Logeot and Willie Yarema, store general managers.

Simple on the outside, complex on the inside. Easy enough to understand, but hard to copy.

These words describe Miller Farm Equipment (MFE), the 2008 Large Multi-Store Dealership of the Year, which has 6 stores in Saskatchewan and Manitoba, Canada.

The owners and employees at Miller Farm Equipment are all regular folks, the type of grown-up farm kids you immediately feel comfortable having a few beers with after work. Despite their landmark successes, they genuinely believe they haven't "arrived" yet. Yes, there's plenty of inventory on their yards, but nothing that would hint at industry-leading success. And facilities are are certainly not Taj Mahals, instead looking like most other well-maintained stores in rural America. In other words, this dealership gives little indication of what it is actually accomplishing on the inside.

Let's review the facts. After 70 years as a single-store, this organization managed the transition to a multi-store operation, including four acquisitions in the last 7 years — without accepting $1 of outside capital. It runs a tight ship while achieving a benchmarking-leading $1.1 million in revenue per employee (perhaps triple the national average). It posted a 6.5-point gain in market share (38.5%) for combines and tractors last year, with a goal of 42% for 2008.

One of the oldest surviving agricultural dealerships in Western Canada, this dealership bucks industry norms in many ways: it pays no commissions to salesmen, employs dedicated product support specialists who neither sell nor turn wrenches, prices everything internally on a cash-price system (staff never sees the costs), stocks $1 million in parts per store, and has a "work hard, play-hard" and results-based culture that even the owners can't quite explain.

The secret ingredient? An aggressiveness — borne out of tougher times — that was never relinquished. In 2001, the partners (fourth-generation Kevin Miller and the upstart Doug Heritage, now 50 and 36 years old, respectively) learned some lessons about themselves as they faced some dark days. Faced with high inventories, declining values and a depressed farm economy, the pair determined that the only way to survive was to aggressively sell their way out of a bad market.

At a time when other dealers were paralyzed by indecision and had retreated from placing equipment orders, MFE found an open path to try and make things happen themselves.

That aggressiveness paid off, and they emerged in a far better position than before. But a funny thing happened when things finally got better. No one told them to stop, and MFE hasn't taken their foot off the pedal since.

Lessons Learned from Lean Times

When asked for a defining moment in their dealership's history, Miller and Heritage cite 2001, when the pair bought out a third partner to be equal owners. The lessons learned during that dark farm economy would set the course for the future. According to the owners, that chapter taught them the following lessons:

- How to aggressively sell their way through an inventory glut.

- The market, not the dealer, sets used equipment values.

- Salesman should be selling the market, not selling their bosses into a bad trade.

Heritage, who was in only his fourth year of the farm equipment business as a 29-year-old at the time, recalls the day he sold four combines and lost $88,000 on paper, yet still came to grips that the smart thing to do was unload them. "We had 30-some combines at two stores, paying interest. No one was buying," he says. "Kevin and I didn't like what we were seeing, and said we're not going to make any more money by holding on. We took a hit, but went back and made that money back as fast as possible by going to customers and talking to them about trading in equipment.

"It was a dismal market to sell into, but a good one to buy. We sold our way out of a combine glut."

Noting that they were aggressive "when others said you can't," they did a lot of trades, bought a lot of units at a low price (many through auctions) and re-sold them. Able to average out the losses with profits, they would forever focus on inventory management.

Leah Wood, Case IH business manager, who has called on MFE for 16 years, says it's the aggressive posture in the market that most impresses her. "They don't like to lose. They want their name known and they're interested in expanding and getting bigger over time. They want a larger customer base, and they also want people wanting to work for them."

Another lesson learned during that era was the art of pre-selling, which was not yet in vogue at the time. As deals were made to take on trades, they got the trade-in info to the salespeople ASAP. The salesmen then went to farmers to let them know they could buy it now for X-price and a deposit — even if it wouldn't be handed over for 4-6 more months. "Their biggest successes have been in pre-selling equipment, and they were doing it long before anyone else," says Wood. "They've done a phenomenal job sewing up trades in advance."

If another glut came on tomorrow, Miller and Heritage say they'd cut the price and keep going, not commiserate about what they should have gotten. "Those times put a lot of dealers down, but it set the stage for our growth," says Heritage. "It made us the aggressive dealership that we are today."

Miller notes that the experience spurred greater attention on expense control, as well. "We never forgot about parts and service," he says, noting that the firm currently maintains a 73.1% absorption rate, despite the fact that wholegood sales has grown so rapidly in recent years. "We focused even stronger on parts/service after wholegoods was fixed. In bad times, if we have good populations and market share, we'll always do OK."

Valuing Equipment

MFE found a need to streamline its system for used equipment evaluations and trades. "Back then, we were buying too high on trades," recalls Miller. "By the time some of those units got to our yard, they looked like they'd fallen off a truck."

First, they stopped accepting the fact that the values in the published guide books were the gospel. "They're guides, that's all," says Miller. "For the last 5 years, we've come up with our own evaluations and base everything on what it's worth as a cash value, or what the industry can handle at any given time."

Equipment evaluations are done internally via the experience of the MFE sales team. Managers conference call to review each unit and its condition and test each other on what the market will bear. Because the team assigns a value, there's no finger pointing later if it wasn't accurate. "We spend a lot of time researching," says Heritage, who adds that auctions can also be a very good indicator of true market values.

Once a cash price is determined, all salesmen receive a spreadsheet file on Tuesdays that lists all the inventory, what lot it is sitting on, a condition rating from 1-10, with a listed cash price. What this means is that the only information the salespeople see is the cash price — not the costs. The image above shows the price list that the salesman carries in his pocket.

Heritage explains: "If you show the salesmen the cost, they'll walk the customer right up to it." Margins moved up immediately the day they made the change, he says.

Today, the dealership doesn't advertise a retail price, only the cash price at which the farmer can leave with the equipment. "Farmers don't like retail pricing schemes," says Heritage. "They know that a combine that's listed retail for $500,000 isn't going to be sold for that."

Heritage stresses that MFE is capable of immediate reaction to forces affecting equipment pricing. "If we were to see a drop in the price of hay equipment tomorrow, we'd move immediately, not wait and hope to get back what we think we deserve. With our volume of wholegoods, you've got to be right. If it's interest-bearing, we'll get out of it as soon as possible."

No Commissions

Insisting that equipment be properly valued came another revelation — that salespeople should be compensated on straight salary. Seven years ago, the company stopped paying sales commissions, and instead raised the base salaries for the salesforce, which leveled out the peaks and valleys. "They're making a comfortable living without the highs and lows," says Heritage. "There are a lot of things in this business that are outside of their control, like frost, drought and interest rates. We're handling the ups and downs for them.

"When you have the right salesforce, they live and breathe to sell iron. The really good salespeople are motivated by getting a deal done, not by the dollars they pocket per transaction. We don't care who sells it. Other than manufacturer spiffs and odd programs, it's straight salary. When your salesman accepts this concept, you know have the right sales guy."

The biggest benefit of the system, say Heritage and Miller, are that salespeople are no longer selling them on a trade that shouldn't be made. "Now we have salespeople walking away from deals instead of trying to convince us to make a deal we shouldn't make just because the salesman's had a bad couple of months," says Heritage.

While unconventional, the structure seems to be working. And it's hard to argue with a dealership collecting more than $1 million in sales per employee. Miller points out that it hasn't caused an exodus of staff, nor any evidence of a loss of motivation among the 21 salesmen. "They're all overachievers, and have allowed us to grow without adding a whole lot of people," he says.

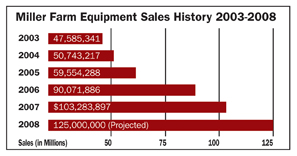

Miller Farm Equipment has achieved rapid sales growth in recent years, up to this point without outside capital. A new store was added in 2006 and another two more in early 2008, bringing total locations to 6.

Dedicated Product Support Specialists

Two of the keys for MFE's success are its product support specialists and a commitment to demos, which is where the value of the product support specialists really shine through.

Like other things, necessity was the mother of invention. When the Case IH 8010 combine presented problems following its initial launch back in 2003, MFE chose to "zig" when others were "zagging." "There were big problems initially, separation problems, air losses, etc.," says Willie Yarema, GM of the Dauphin store. "Neighboring dealers were giving up on it, concentrating instead only on tractors and older combines.

"We said we have to make it work. We hired a couple of guys specifically as combine experts. That first one spent day and night testing numerous modifications to nearly every component on the combine. It was a complete trial-and-error learning experience. We figured out how to make it work, and Case IH even made changes based on our input."

That experience gave them a leadership status in combine troubleshooting, and also led to a change in structure — to the product support positions they have today.

The product support specialists at MFE have one foot in sales and one in service, but have an entirely different job description. Put simply (which risks understatement), their job is to know everything about equipment (with special attention on combines, sprayers and air drills) in order to assist the farmer in his application.

"These guys spend their winters doing computer research, learning new products and training customers," says Yarema. "Then, in the spring, fall and summer, they're out in the field for demos and helping the salesmen. Sales can't know everything, but these product specialists do. They know the ins and outs of the machines and also the competitive units. Sometimes, they know more about competitive units than their own salespeople."

Heritage adds that these positions are not inexpensive, but dealers still must provide a certain level of service, and there's a price no matter how you slice it. "Before we had product specialists, you'd see on the work order that a tech was going out to a farm for half a day to do things like showing a farmer how to use his monitor or level his drill. That meant that an hourly rate of $90-$100 wasn't getting billed. If he'd stayed in the shop, we would have billed those dollars."

Miller adds that the product support specialists free up both the techs and salesmen to do what they do best, and make the company the most money. "Plus, since we added product support specialists, we've seen a significant reduction in the number of service calls on new units," he says.

MFE currently has two product support specialists, with another two coming on board shortly. The overhead is picked up by the sales department. ("Having a good product guy is like having an extra sales guy around," explains Dwight Logeot, GM at the Brandon store). To fill the positions, MFE looks for individuals with farm backgrounds who are mechanically inclined yet can also teach and communicate with farmers.

"Instead of hiring more sales staff, we're looking to hire more product specialists right now," says Heritage. "Justifying the extra sales help will come as a result of it."

Demos Deliver Sales

MFE is also a big believer in demonstrations, often full-day ones, and believes the expense is well worth it. On any given day, a loader, tractor, baler, combine or sprayer is headed out to a farmer's field for a test run.

Showing the advantage of the equipment is only one of the objectives, however. The other is to showcase the product support specialist, which further differentiates the dealership.

"With the salespeople and product support guys out there, we really show the support side that customers can expect from us," says Logeot. "When the product support specialist spends an afternoon with the farmer, crawling around on the ground, that's the deal clincher. They've shown their knowledge for the entire demo, explain everything down to how to run the monitor, and then give them their cell number to call when they have any problem."

The passion to know the equipment doesn't stop with the product support people. With Case IH's new 88 series combine for 09 and new 7120 and 8120 units going online in October, MFE recently commissioned a tech to Oklahoma to work with custom harvesters for 10 days.

"Especially when you have a new product, we want to learn everything we can before our season starts," says Heritage. "When something is wrong in that custom operator world, you learn real quick how to resolve it." Having just returned in mid-June, he's now preparing the rest of MFE on the new units as well as a briefing of the type of problems seen — and the remedies.

Aftermarket Disciples

In its more recent history, the wholegoods side of the business has boomed, propelling MFE's growth. But Miller and Heritage have ensured that parts and service — long the firm's forte in its 84-year history — never left their sights. Even with the rapid growth of the dealership, the firm maintains a 73.1% parts and service absorption rate, compared to the national average of 61%.

To Miller, that shop efficiency must be there, but so does the machine population. "When times are bad, we'll be OK because parts and service is what carries the business," he says. "New sales is the gravy, the fun part."

And with a steady increase in GPS sales (see sidebar: "Aggressively Pursuing GPS Brings 'First-In' Dividends"), the addition of many new technicians and a strong parts incentive plan, the owners see MFE's absorption rate continuing to rise.

While managers say service has always been good, the new MFE has been more open to new ideas and willing to take some risks. "You can't be complacent in this business," says Yarema. "Our goal now is to keep getting better results every year, and it comes from looking at new ways of doing things."

Heritage notes that it's the service side of the business where the dealership really thrives. "Whether it's in tools, trucks or people, we're adding a lot of support you don't always see at other dealerships. There's a cost to it, but it pays back in dividends. A lot of dealers are service-oriented, but we really stretch ourselves in this area."

One example is in the $5 million of inventoried parts that it carries. With 6 locations, that's probably 1.5 times the national per-store average. Even so, MFE realizes a 2.44 parts inventory turns, and recently added a truck courier system to move parts between stores. Says Miller: "We've always been known for having the oddball part — that goes a long way."

Another example is the equipment held for a problem repair. "We keep a spare in every store, in case there's some unforeseen parts issue," says Yarema. "We'll get another tractor loaded on the trailer and headed to the farm right now if we don't think a problem can be fixed immediately. It's not an easy thing to do from an overhead perspective, but you've got to keep that customer going." Back when the 8010 combine was having problems, MFE held back combines to keep users going. Even today, it held back many 4WD tractors this spring.

"When you're closing a deal, we bring that up," says Logeot. "Anything that's built by humans will break. It makes no difference what color the equipment is, but there is a difference in what kind of support the farmer gets on the back end."

Running the Business Like It's a Single Store

Interviews with managers and employees revealed that the owners have managed the transition from being a small-store to a multiple-site operation. They've found a comfort zone in delegating, supporting the people they've put in charge, and accepting that some mistakes will be made along the way, but not to repeat them.

And their entrepreneurial spirit hasn't faded with growth. For one, managers say the desire to improve means that no one really thinks they're doing that great, even when employees earn a "Dealership of the Year" award. Second, corporate bureaucracy has been locked outside. "If we see a need to do something, we don't just talk about it, we say 'let's do it,'" says Yarema.

Because of the large geography served, it's not practical for the owners to be at the stores every day, but they are on the phone with managers 2-3 times per day, and store managers are in regular contact with each other.

Also unique about MFE from other multiple-store operations is an insistence that that the business be run like a single store, says Yarema. "Each store gets an equal opportunity for equipment, there's no favoritism. And there's no protection of equipment, regardless of who took it in or what lot it's on."

No scorecards exist that rank stores or managers against each other. While a comparative department analysis is shared, it's not dwelled upon. "Decisions are made for the greater good of the organization," says Heritage. "There's one bottom line, one picture — Miller Farm Equipment."

Adds Miller: "In this business, things can drop in one area, but that doesn't mean you didn't do a good job. If one store is having trouble with combines, we'll lend some help from another store for a few days."

Financials are not shared companywide. What's important to employees, say the owners, is that they see MFE is growing, buying tools, expanding shops (as it did at two locations in 2005), purchasing 12 new trucks and 3 tri-axle delivery trailers (2006), and overhauling all yard sites (2007).

While wholegoods is managed by Heritage, operations control is centralized in the Moosomin headquarters and looked after by Lorraine Boyd, controller. She oversees payables, payroll and receivables. Using the DIS computer system, she can see what is happening at all the sites, and prepares timely reports for the management team, something that's been more critical with each acquisition.

With Miller stationed at the Moosomin dealership and Heritage working largely from the road and a home office, much of the visionary work they do occurs during the time shared in their travel between stores or to meetings. And, they admit, they haven't succumbed to the world of business plans yet.

Looking back to 2001, Heritage says, "We didn't think we'd be this far 7 years later. We didn't have an expectation of $100 million in revenue. There wasn't any nailed-down vision — we just expanded when the opportunity presented itself."

The firm has now comfortably added corporate-level management help, something that was needed for the next chapter of the business. "You can't go further until you perfect business systems and controls," says Heritage.

What's next? Even before the Rocky Mountain Dealership's offer to acquire MFE, growth and additional sites was in the cards. Now, with the cash readily available, additional acquisitions will likely be fast-tracked, giving MFE an even larger footprint to support its aggressive growth platform.

Miller Farm Equipment to Be Acquired This Month

At press time, it was announced that the owners of Miller Farm Equipment signed a letter of intent to sell the shares of the company to publicly-held Rocky Mountain Dealerships, Inc., one of Canada's largest ag and construction equipment dealerships, with 14 branches in Alberta.

The business will continue to be known as Miller Farm Equipment, and owners Kevin Miller and Doug Heritage both signed long-term employment contracts.

In a memo to employees, MFE reported that "The market strength of the Miller team combined with the financial assets of Rocky Mountain Dealerships will create an enduring organization and a base for further acquisitions."

The deal is expected to close at the end of July, subject to approval from Case IH.

What the Judges Say about Miller Farm Equipment…

- "$1.13 million per employee, best overall by a large margin."

- "Tremendous growth rate of 70% over 3 years and maintaining a strong market share."

- "Strong parts sales and ROA, solid ROI (11%) and absorption rates (73%) as one of the largest Case IH dealers in North America."

- "One of just 7 North American CNH dealers to earn Gold Sales Club status for precision farming sales in 2007."

- "Ranked number 2 in Canada, and number 4 in North America, according to Case-IH settlements."

- "Recognized by others outside the industry (Ernst & Young's Entrepreneur of the Year nominee) for achievement."

Aggressively Pursuing GPS Brings 'First-In' Dividends

"There are not many ways to grow the ag business," says Dwight Logeot, Brandon store manager, "but GPS technology is one of them. It's a big business, and the fastest-growing segment."

He describes how a parts manager saw the opportunity and jumped in and made things happen with precision farming over the last 3 years. "He ordered lots of units and then just went out and did demos."

In addition to employing two GPS specialists (guys who troubleshoot and offer practical solutions, not just installers, says Logeot), the firm set up an RTK base station network to sell subscriptions to growers, the first in the area to do so. "It's bringing in new customers and getting us onto farms we haven't been before. We're selling EZ Steers even for tractors you'd think are antiques. Also, because we have the first network around here, we're getting invited onto farms that have historically run all Deere equipment."

When asked why other dealers hadn't yet embraced it, Logeot says they're unsure of whether they can recoup the costs. "It's a headache initially, as there can be a lot of problems, unknowns and lots of training involved. The investment isn't cheap, running about $100,000 for 20 operators, but MFE felt the benefits outweighed the risk.

"The profit isn't huge because of the service involved, and in some ways it's a loss-leader business. But if you don't have it, you can't get the rest of what you're able to by getting onto those yards."

Responsibility is left with the parts counter, which makes sure the vehicles are on the road and doing the demos.

Last January, MFE brought in more than $1 million in sales of precision farming equipment and parts, reaching CNH's Precision Farming Gold Sales Club status. MFE was one of just 7 Case IH and New Holland dealerships out of 3,500 in North America to surpass the $1 million threshold in 2007.

Another Perspective on Miller Farm Equipment...

John Schmeiser, executive vice president of Canada West Equipment Dealers Assn., shares his observations on MFE.

- "They've become masters at turning inventory, quickly liquidating what isn't suitable for their area and purchasing used that they can sell at good margins. In some respects, they're following the model of the car industry where if the used or trade doesn't move within a short period of time, it goes to auction."

- "They undertook a large expansion to their parts department that has put them in a position to have a large inventory and high fill rate, which is also bringing more wholegoods sales."

- "When they've acquired dealerships, they've done it very strategically — not too fast and always fitting within their structure."

- "They're showing that a high-volume dealer can also be very profitable."

6 Critical Success Factors at MFE

Here's a short list of what Kevin Miller and Doug Heritage view as factors critical for Miller Farm Equipment's success:

- Turn Your Inventory. "Watch inventory on a daily basis. It's moving every day and can make you or break you. When it's not where it belongs, look to marketing and on-farm visits to quickly drum up sales. The best dealers don't hold onto it." MFE is averaging 4.7 turns on the used equipment and 3.0 on the new.

- Cash Flow is King. "Lots of profitable companies can still go belly up. In a capital-intensive business like this, you must maintain a positive cash flow."

- No Clock Watchers. "This is not an 8-5 business. If any of us need to go out to a farm at night, we're there. It's how we grew the business and how we've reached this level of sales. We're here 7 days a week during the season. That said, it's one thing to get out of bed early, and another to work smart."

- Tight Fixed Expenses. "You want to create a company that can weather the bad times. The downturn will come again at some point. We'll be able to get through it because of our tight fixed expense structure."

- Go With Your Strengths. "Concentrate on what you excel at, not on trying to shore up your weaknesses."

- Honest, Down-to Earth Dealings. "Treat the customer the same whether he's farming 1 acre or 30,000. "There are always issues with customers, but if you try and take care of them and give them an honest effort, they'll come back to you 99.9% of the time."

Building a Culture: Perhaps the Biggest Success

If there is one thing other dealers might most like to clone about Miller Farm Equipment, it may be the culture ó one of fun, achievement and embracing change. Spend a few hours at their stores and it's clear the results are there, but the energy is one that burns from the bottom up. The managers say that while Miller and Heritage expect results, they are anything but fist-pounders. Instead, says Willie Yarema, GM, Dauphin store, the work force puts pressure on itself to succeed. "When you have the right people, they'll put pressure on themselves," he says. "They want to succeed. You lay out the job to their best abilities and let them go."

Dwight Logeot, GM, Brandon store, says that success has taken on epidemic proportions among all employees. "It's catchy and keeps things going."

"It's a true team atmosphere," adds Yarema. "Everyone backs each other up. You jump in and get it done. And people are genuinely having fun. If you're not, you shouldn't be in this business. That's how we get people to produce the way they do and how we can achieve these levels with fewer people."

It stems from pride, the store managers say. If MFE loses a deal, employees stop and demand to know why. That pride and competitive spirit aren't traits that are easily checked. In fact, several MFE people admitted, "If there's a barfight, it's likely that our guys will be right in the middle of it."

Logeot says the manufacturer territory managers can't believe it when they see a half-dozen people mulling around at 9 p.m., and not on the clock. Or when there's a guy moving equipment at 10 p.m. so the lot looks good in the morning. "They ask, 'don't you people ever go home?'"

According to Leah Wood, Case IH Business Manager, the MFE friendship and teamwork are things she simply doesn't see every day. "When there's a training event, they don't send one or two salesmen like other dealerships, they send 20. And they always take the opportunity to get together afterward, growing that friendship. It's a true team atmosphere."

Another reason for success is the company's ability to navigate change, which, as much as anything, may have initially been a survival mechanism. "As we grew, we had to deal with things very fast because we knew there'd be another decision to make tomorrow," says Doug Heritage, partner.

"Change has been happening so quickly, it's almost effortless," says Logeot. "We don't talk for 2 years before doing something. If we have the right people here to do something, then we'll be doing it in a month. At other places, even the smallest change can be painful because there's so much resistance. Here, we get after it, and it always seems to work out."

The company's comfort with making change may stem from the fact that the owners are such students of the industry, watching and reading about other dealers' business and seeing what they can borrow from leading dealers. Heritage serves on the Case IH Dealer Advisory Council, where he is exposed to fresh ideas from top dealers. "They're always open to suggestions, whether it's from a company person, from Racine headquarters or anyone," says Wood. "They listen, weigh it and may try it."

When it comes to staffing, MFE searches for people who have a strong work ethic, people skills and a personal commitment to the customer. "We can give people tools to improve in other areas, but they need to have those traits." Lorraine Boyd, controller, adds, "They know that you need good people in key areas. And if they aren't good, they deal with it before it gets too late."

"If we do our job in sending customers away happy, they'll keep coming back," Heritage says "It's a repeat business, and that stems from the people they're doing business with everyday. Out in the country like we are, we can't have a city mentality to the customer."

The History of Miller Farm Equipment

MFE was founded in 1924 in Rocanville, Saskatchewan, when J.W. Miller acquired an International Harvester contract. This location was the only Miller store until it relocated to Moosomin, Saskatchewan (also the corporate headquarters), in 1979, at which time, the ownership was composed of Gerry Miller, Kevin Miller (currently representing the fourth generation of family leadership) and Bob Davidson.

MFE did not start expanding until 1994, when it purchased a Case company store in Shoal Lake, Manitoba. In 1998, one year after joining the company as a sales rep, Heritage (whose father, Don, owned a two-store White dealership up until the late 1980s), bought in as a partner as Gerry Miller retired. In 2001, Kevin Miller and Heritage bought the shares of the remaining partner, Bob Davidson, and are now 50-50 partners.

Since that time, the MFE sign now flies above four more locations in Manitoba, including reopening a dealership that had been closed for 11 months (Dauphin, 2001), acquiring another store that had its ups and downs (Brandon, 2006) and acquiring stores this year (Killarney and Boissevan, 2008).

The six locations, which cover about 400 miles, offer good diversification for the firm. "Mother Nature won't get us all in a single year," says Heritage. At the time of the interview, the firm's southern customers were done seeding, the central area was mid way through and northern area had just started. "We start with heavier inventories in the south and move them up north as the season progresses," says Heritage.

In MFE's neck of the woods, 3,000-4,000-acre farms are typical. Wheat and canola is the big business, along with barley, oats, peas, sunflowers and potatoes. There are also many cattle and hog producers in the dealership's area of responsibility.

For More Information

For more insight into Miller Farm Equipment's success, you can find web-only articles and videos online at www.farm-equipment.com.

"The History of Miller Farm Equipment" and "Building a Culture: Perhaps The Biggest Success" are two web-only articles that can be viewed at www.farm-equipment.com.

Additionally, a 7-part video series on Miller Farm Equipment starts this month at www.farm-equipment.com, with video segments on:

- A Cash-Based System for Valuing Used Equipment.

- An Industry-Leading $1 Million in Sales Per Employee.

- A Commission-Less Sales Staff.

- Veterans of Pre-Selling, and Pre-Selling Their Way Out of a Glut.

- Appointment of Dedicated Product Support Specialists.

- Increasing Market Share.

- People & Culture 'Make' a Dealership of the Year.

Industry's Best Dealerships Recognized in 4th Annual Award Program

LARGE, MULTI-STORE OPERATION: Miller Farm Equipment, Moosomin, Saskatchewan

ONE- OR TWO-STORE OPERATION: Vincennes Tractor Inc. Vincennes, Ind.