New Equipment Inventories Reach New Lows in November

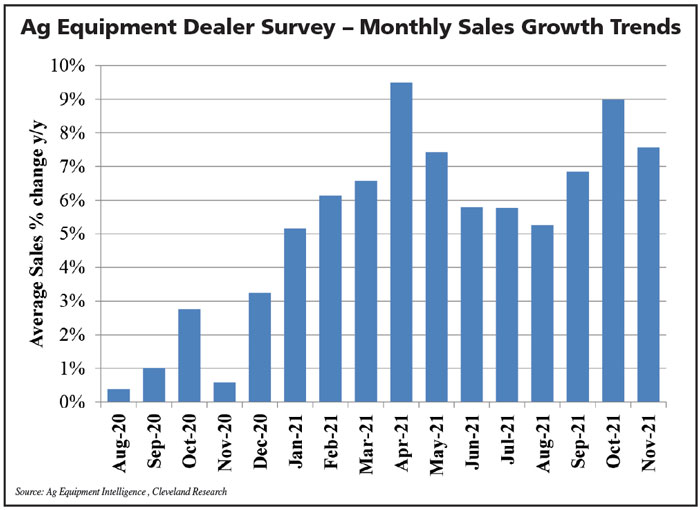

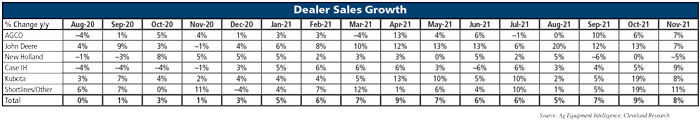

Average dealer sales were reported up 8% year-over-year in November, down from the 9% reported the month before. A net 16% of dealers beat their sales budgets in November vs. the net 19% who beat their sales budgets the previous month.

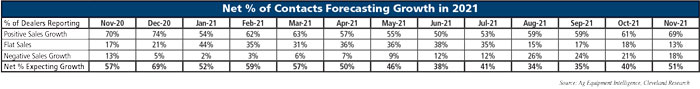

The 2021 dealer sales forecast is for sales to be up 9% year-over-year, in line with the forecast in the previous 2 months, with a net 51% of dealers expecting growth.

New equipment inventory levels were down in November with a net 96% of dealers reporting inventories “too low.”

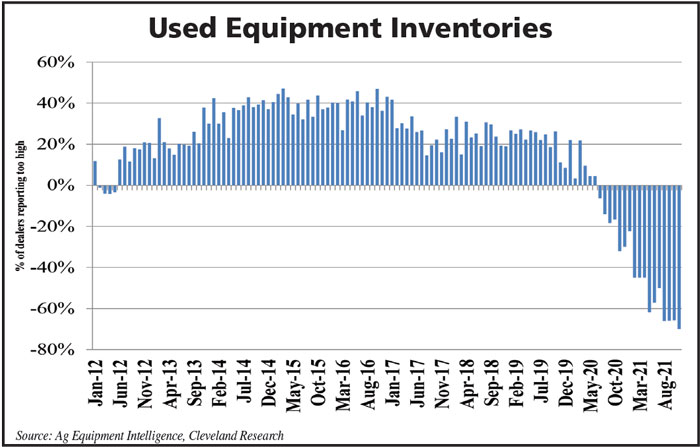

A net 70% of dealers reported used equipment inventory was “too low” in November vs. a net 66% reporting used inventories “too low” the previous month.

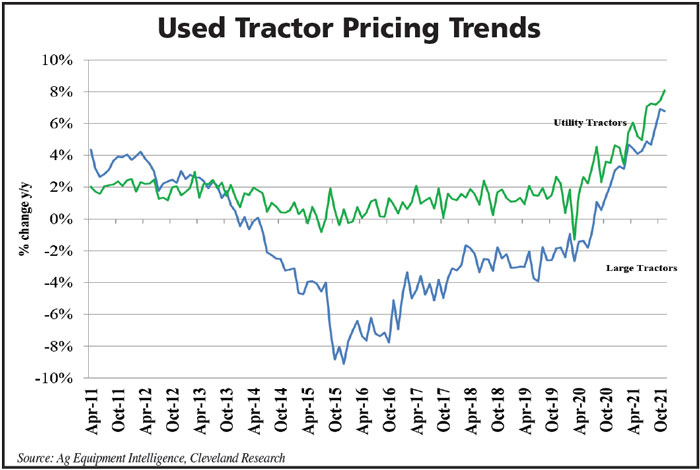

Used equipment pricing was up 7% in November, in line with the previous month, while new equipment pricing remained up around 3% year-over-year.

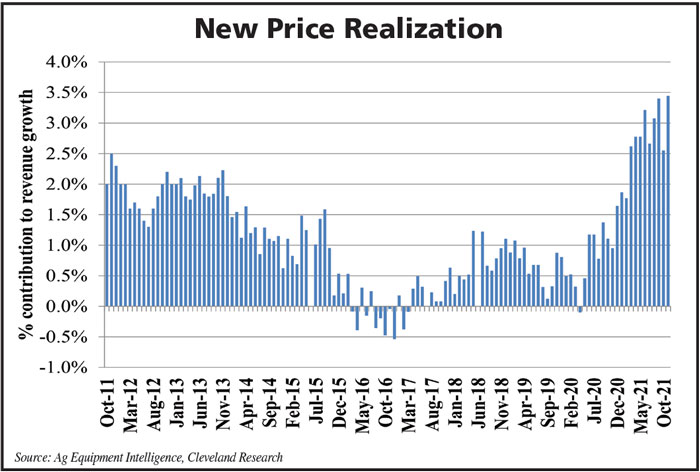

New price realization was up 3.4% in November, surpassing the 2.6% increase reported in the previous month.

Dealers Optimism Declines for Third Month in a Row

Our Dealer Optimism Index, which measures sentiment among dealers compared to the prior month, declined for the third month in a row in November. Sentiment came in at –13% (18% more optimistic, 51% in line and 31% less optimistic) vs. –10% (22% more optimistic, 46% in line and 32% less optimistic) in the previous month.

2021 Outlook: Dealers Continue to Forecast 9% Sales Growth

The 2021 sales forecast was for sales to be up 9% year-over-year in November, in line with the 2 previous months. The 2022 forecast is for sales to be up 4% vs. up 5% in the previous month, with a net 37% of dealers forecasting sales growth in 2022 vs. 34% expecting growth last month. John Deere dealers had the highest 2021 sales forecast in November at +13%, while New Holland dealers forecast the lowest growth rate at +4%.

In November, a net 51% of dealers reported they expect growth in 2021 vs. 40% who expected growth last month. Some 69% of dealers forecast growth in 2021 in November, up from 61% expecting the same in the previous month.

NEW EQUIPMENT TRENDS

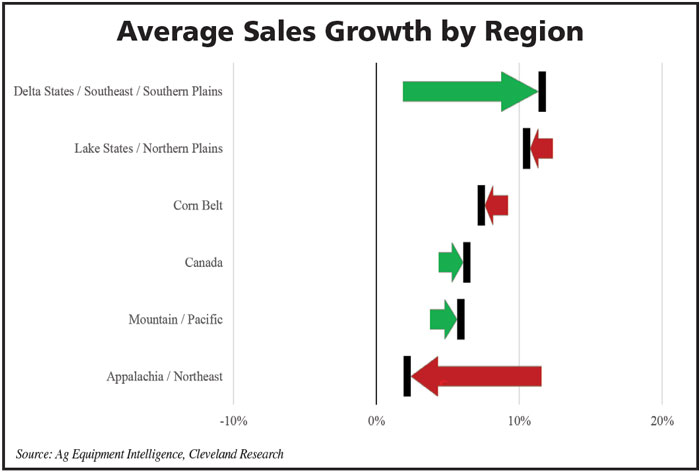

Of the 6 regions, 3 saw sequential acceleration in November. The Delta States/Southeast/Southern Plains region was the strongest, while the Appalachia/Northeast region was the weakest in the month.

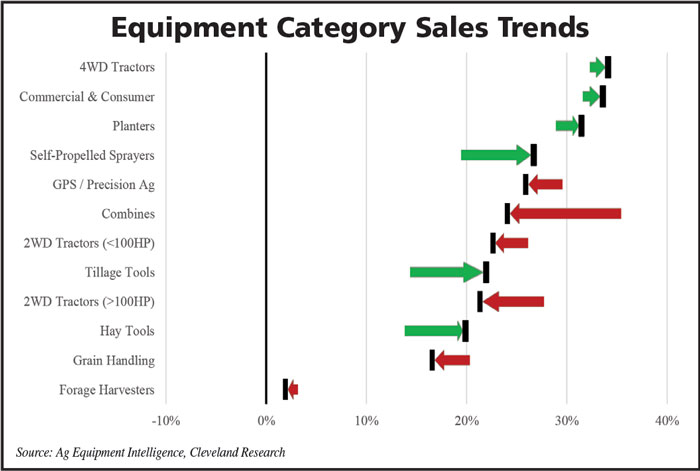

When looking at sales trends by product category, 6 of 12 categories showed acceleration in November. The most notable sequential acceleration was in tillage tools and self-propelled sprayers, while combines showed the greatest deceleration.

Price contribution was up 3.4% in November, up from 2.6% in October. Commentary suggestions the increase in price remains the result of freight and material surcharges.

New equipment inventory levels remained unchanged in November, with a net 96% of dealers reporting inventories “too low” (0% too high, 4% in line, 96% too low) vs. 87% of dealers reporting inventories “too low” (1% too high, 11% in line, 88% too low) the previous month.

USED EQUIPMENT TRENDS

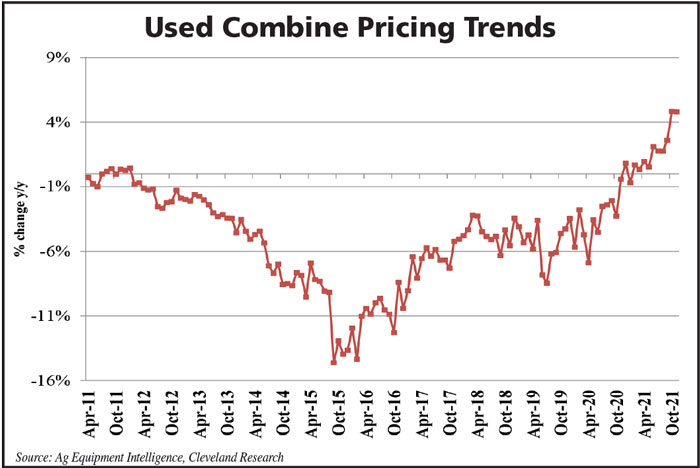

Used combine pricing was up 5% year-over-year in November, unchanged from the previous month, remaining the highest year-over-year used combine prices increase recorded since the survey began in 2011.

Dealers reported used equipment pricing was up around 7% year-over-year in November, unchanged from the previous month. Used compact tractor pricing was up 7% year-over-year for the fifth month in a row. Used 100+ horsepower tractor pricing was up 7% year-over-year for the second month in a row.

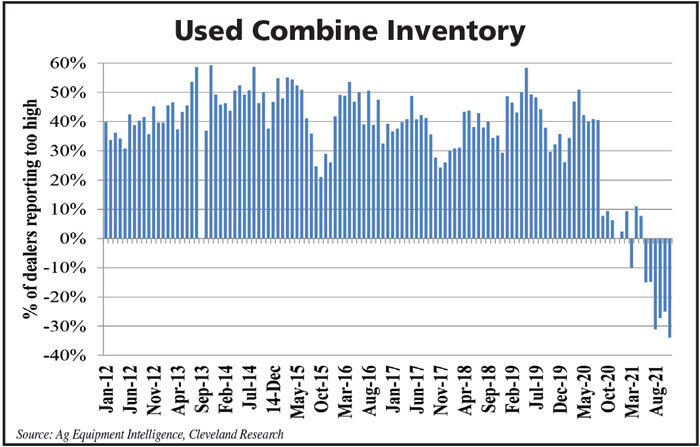

Used combine inventory reached a new low in November, with a net 34% of dealers reporting inventories as “too low” (8% too high, 50% in line, 42% too low), slightly below the previous month’s 25% reporting used combine inventories “too low” (13% too high, 49% in line, 38% too low).

A net 70% of dealers reported used equipment inventory as “too low” (0% too high, 30% in line, 70% too low) in November (a record low), down from the net 66% who reported inventories “too low” in the previous month (0% too high, 34% in line, 66% too low).

Executive Summary

Executive Summary is part of a 25-page report issued each month to paid subscribers of Ag Equipment Intelligence.

Brought to you by Steffes.

Post a comment

Report Abusive Comment