Updated Nov. 22, 2021 with additional analysis and interviews with dealers.

In this most unusual year of high farm incomes, rising inputs and a scarce supply of nearly everything, Farm Equipment and Ag Equipment Intelligence (AEI) conducted a 48-hour survey from November 15-17 on the year-end situation.

Farmers’ Year-End Tax Decisions

The “Year-End Tax Decision-Making Survey” asked farmers how their year-end tax-plans will be different for the final 6 weeks of 2021.

For everyone making a living in the farm equipment business, the responses show there’ll be high competition for their dollar through year-end.

As noted in the November 2 Purdue/CME Group Ag Economy Barometer producers are deeply concerned over the “rapid run-ups in input prices, especially fertilizer.” About one-half of farmers in Purdue’s monthly survey expect input prices will jump 8% over the next 12 months, and another one-third expect increases to exceed 12%. Since last spring, nitrogen prices are up 40%, with potash and phosphate showing similar figures, according to the Purdue report.

As the AEI year-end survey showed, farmers are planning significant pre-purchases for all major farm consumables, led by liquid fertilizer, as more than one-third of growers are increasing their normal pre-paid purchases before December 31.

The “Year-End Tax Decision-Making Survey” shows farmers’ are increasing looking to prepay their consumables this year.

Pre-purchase plans for hard goods is a different story, however. While 31% of farmers plan to stock more parts than they typically would at year-end, most farmers are significantly reducing their big-ticket equipment pre-purchases in all categories, either because of choice, availability or both.

The farmer survey indicated that equipment pre-purchases would be well below last year’s level, though nearly one-third showed that farmers hoped to stock up on parts they would need in 2022.

The emphasis on consumables is no surprise, says Mark Foster, a retired executive from the Birkey’s Farm Store Case IH dealer group. “Cash-flowing these expenses is manageable, and the tax advantages are evident. With favorable net farm income, I’d assume being able to expense these items in advance of prices most likely rising is a factor.”

Foster believes farmers’ downwardly adjusted equipment purchasing plans are explained by previously made orders that have already been pushed into 2022. Purdue’s Farm Capital Investment Index from November 2 notes that 40% of producers cited tight inventories as the primary reason for holding back on equipment purchases.

Since last spring, nitrogen prices are up 40%, with potash and phosphate showing similar figures, according to the Purdue report.

Another place some farmers are eager to spend is in grain bin modernization and/or new bin construction. Nearly 17% of farmers in the AEI survey will spend measurably more in this area, putting this spending only behind parts, tires/tracks and trucks/vehicles among areas of measurable increase in desired spending.

Land purchases weren’t covered in the survey, but Leo Johnson, president, Johnson Tractor, notes it’s also drawing resources from the farmer’s wallet. “Land is absolutely insane right now,” he says. “Land that was worth $12,000 at 2013 highs is now bringing $18,000-$20,000.”

He attended a southern Wisconsin land auction in mid-November and saw 160 acres sold for $14,250. “Similar land was sold a year ago for well under $10,000,” Johnson says.

For more detail and breakouts on the farmer survey, visit www.no-tillfarmer.com/2021yearend

Equipment Dealer Survey: 6-Questions on the Next 6 Weeks

Most dealers (58.44%) report that a typical December normally brings in 11-20% of the year’s total wholegoods income. Yet most dealers are forecasting a disappointing December for 2021.

Shown are the percentage breakdown of survey respondents by primary line. The 48-hour “flash survey” drew dealers from 27 states and 4 Canadian provinces.

More than one-half of dealers expect to finish 2021 with a month that falls below 10% of their year’s total sales. In other words, the percent of dealers who’ll earn less than 10% of the year’s revenue in December is more than doubling this year.

It’s not unheard of for December to bring big dollar levels. A former Midwestern dealer shared that historically, the month of December at his dealer group could account for 30-35% of the total revenue for the year, with 60% of that revenue coming from new wholegoods.

Earlier this month, Casey Seymour of 21st Century Equipment (John Deere dealership group) told AEI that a doubling of normal levels to that 30% range could be a possibility this year. “If a lift of new machines get delivered (which he says was a possibility even before the UAW’s strike of John Deere ended), there will be a bunch of used getting sold,” says Seymour, who also oversees Moving Iron LLC.

According to the survey, only 2.5% of dealers project a December 2021 that could bring a sales level equal to 30% or more of the year’s wholegoods business. This number is 3.5 times less than the number of dealers who would normally fall into that 30%-plus area for a normal December’s performance.

Six weeks out from year-end, the Equipment Dealer Year-End Survey shows that the majority number of dealers expect to have a December that will represent less than 10% of the year’s total wholegoods revenue. In normal years, 58% report December’s wholegoods revenue to fall with 11-20%, with another 19% reporting typical levels above 21%.

Johnson, president of Wisconsin and Illinois-based Johnson Tractor, says several factors are contributing to dealers’ lower expectations for this December. “First, there isn’t much inventory to actually sell. Many more pieces were on the lot to sell last year. Second, pre-sell has replaced the last-minute tax buying. Third, most farmers feel comfortable, as do their tax accountants in pre-paying seed, fertilizer, rent and others to reduce current year tax liability. It’s a little dicier with pre-paying a new tractor or combine.”

Commentary on December 2021: “Iron will be one of the last items on the list where growers intend to spend their money. Fertilizer, seed and land rent will beat us out (Case IH dealer) ... Inventory availability will limit end-of-year sales; will cost us 20-30% of our typical December surge (Deere dealer) ... We don’t have many units on site, but we’re set to receive a good number of presold units in December (Case IH dealer) ... The last few Decembers have been underperforming at year-end (Case IH dealer)” ... If we had new and used inventory available, our December 2021 would be 21-30% of the year’s sales (Deere dealer) ... Not much of a change. With inventory low, customers need to purchase months in advance to get products, not just year-end (Deere dealer) ... Sales are stronger, but inventory is running behind (AGCO dealer).”

Dealers: Pre-Purchased Parts Roughly the Same at Year’s End

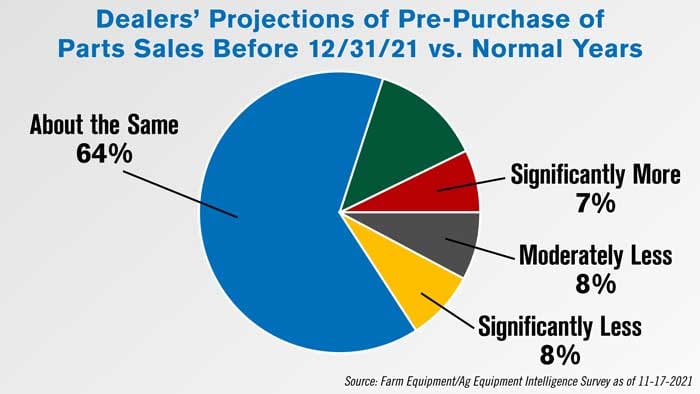

While the farmer survey showed a sizable portion who intend to increase their parts pre-purchases before the year is out, dealers aren’t nearly as optimistic, perhaps because of their knowledge of availability of which farmers may not yet be fully aware. About two-thirds of dealers expect farmers’ pre-purchase of parts to be the same as normal years. About 20% of dealers are forecasting measurably more pre-purchased 2022 parts by farmers before the end of the year.

While farmers surveyed showed a desire to stock up on parts before the end of the year, two-thirds of dealers say it won’t be any different than normal years. Slightly more dealers (20%) expect some increase than those who expect the revenue to fall (16%)

Commentary on 2022 Parts Sales in 2021: “It’s too early to tell. We know they are buying fertilizer and chemicals before the price increases, so we suspect that’s where most will spend (Case IH dealer) ... I could see this picture changing in the next 30 days as inventory on wholegoods becomes tighter and customers need to use it as an expense — if wholegoods inventory isn’t available to pursue (New Holland dealer) ... We encourage customers to order ahead to make sure they’ll have the parts they need since we aren’t able to order as much as we did in years prior (Deere dealer) ... Very few of our growers pre-pay on parts anymore. There’s more talk about ordering parts for next year's harvest already (Case IH dealer) ... Other input costs are high so the money is going there, plus customers are waiting to sell crops (New Holland dealer) ... Pre-buying while product is available, but not pre-paying. Our biggest parts sales month of the year is February (Case IH dealer) ... Supply chain issues suggest we should early-order, but we had a severe drought in 2021 and parts sales were down 12% so we have some carryover (New Holland dealer).”

‘Ready-to-Sell’ Inventory by Price Range

Through questions about on-hand inventory and respective price range, it’s clear that dealers have a real dearth of both used and new pieces that are priced above $100,000. With under $100,000-priced units being the only exception, most dealers report 5 or fewer pieces on-hand in each of the other 3 larger price categories surveyed.

For equipment priced between $250,000-350,000, 5 or fewer pieces on the lot are reported by 79.49% and 77.50% for used and new, respectively. For units priced above $350,000, the numbers reporting 5 or fewer units on-hand jump to 87.50% for used and 83.78% for new.

Dealers are experiencing a dearth of on-hand inventory of big-ticket items. Average on-hand pieces of more affordable equipment (less than $100,000) is only 11.5% and 13.1% for used and new, respectively.

Johnson adds that farm retirement auctions are setting new records daily for values of quality units, which a Machinery Pete article on November 15 also confirmed. “A 2014 Case IH 315 tractor sold on November 18 in central Illinois for $40,000 more than it sold for when new, $191,000,” Johnson says. He bought several of the same units 3 years ago from a credit company — for $100,000 each.

Commentary on Used Inventory: “We’re basically sold out of all used that is available for year-end purchase (Case IH dealer) ... We have zero units above the $100,000 price (Case IH dealer) ... We don't have much used to sell at all (Case IH dealer) ... Nothing to commit to selling at this time (Case IH dealer).”

“If a lift of new machines get delivered, there will be a bunch of used getting sold...”

— Casey Seymour, 21st Century Equipment

Commentary on New Inventory: “We’ve sold all new equipment in these categories for year-end availability (Case IH dealer) ... We’re starting to see resistance in new purchases (New Holland dealer) ... We don’t anticipate any over-$100,000 units for the next 18 months that aren’t pre-sold. (Case IH dealer) ... Compacts have been hard to get and really hurt those sales in 2020 (New Holland dealer).”

Will 2021 Deliveries Arrive?

Overall, dealers were negative on the prospects of deliveries of 2021 orders — from both their mainline and shortline suppliers — arriving before New Year’s Eve. For both types of equipment arriving over the next 6 weeks, dealers’ confidence is in the low 30% range. Note: Most of the completed surveys came in before it was known that the Deere strike had ended.

The survey showed almost no optimism. Just one-fourth of dealers believe there’s a better than 50% chance of seeing their new mainline inventory orders arrive this year, with only slightly more who expect shortline manufacturers to perform any better than the majors.

Some dealers expressed their frustrations. Wrote one Case IH dealer: “The big OEMs are going to magically clear their books to the greatest extent possible by December 31. If a piece of equipment is close to being off-line, it’ll be invoiced regardless of how complete it is. Then it will sit on the factory yard for a month waiting for a truck. Instead of enjoying New Year’s Eve this year, we’ll be settling equipment that invoices on 12/31.”

Another red dealer adds: “On wholegoods orders, 6 months turned in to 9 months in the first part of 2021. Now 9 months has turned in to 12 months at the end of 2021. To add insult to injury, OEMs are telling us to put ‘customer names’ on inventory orders so we can get them ‘quicker.’

"Sounds like a fantastic plan for the OEM but a not-so-good plan for the dealer managing floor plan interest expense. Let’s be honest; OEMs are making record profits at the current output, so unless demand falls or China loosens the screws on our supply chain issues, nothing is going to change any time soon.”

Dealers are pessimistic about their 2021 orders arriving before December 31. Average confidence levels for both mainline and shortline wholegoods is only in the 30% range.

Commentary on 2021 Deliveries: “Overseas incoming deliveries are expensive. We may cancel orders due to the quadrupling of the cost of container freight from Europe, and the reality that they won’t arrive until after the sales season (Case IH dealer) ... Shipments have slowed in last 60 days; we haven’t seen any improvement. (Kubota dealer) ... Very few shortline orders are on order for December 31 (New Holland dealer) ... We’re looking to see a run on the shortlines, mainly tillage and support equipment (Deere dealer) ... If demand is close to the same as last year, we are starting from empty shelves (Kubota dealer).”

How About 2022 Equipment Deliveries?

If the ag equipment business was looking forward to a turning of the calendar after a year of poor delivery performance, more sobering news awaits. Nearly two-thirds of dealers expect a worse year for new wholegoods deliveries in 2022.

Nearly two-thirds of dealers agree that 2022 deliveries are going to be worse than what was seen in 2021.

“The problem now is that we have less than 30 days of supply of wholegoods inventory,” says a Kubota dealer. “Every month this year, the days of supply has shrunk. Now we’re dependent on current shipments to supply retail. That is not going to change overnight. At current retail levels, it’ll take, at minimum, a full year to get stock levels close to ‘normal,’ whatever that’ll be going forward. If retail drops 50%, it would still be 4-6 months until we reached one-half of our old stock levels.”

Major Concern: Planter Deliveries for Spring Use

The dealer survey inquired about 2022 seeding equipment orders, and to what extent dealers expect ordered planters will show up in time for their customers to take to the field next spring.

Fewer than one-third of equipment dealers expect they’ll get all their pre-ordered planters in time for spring use. More than 70% expect some portion of their orders will fail to arrive, with 27% saying as many as 30% of planter orders won’t get delivered in time for farmers’ use.

More than 70% of dealers expect some portion of prior planter orders will fail to show up for spring planting, with more than one-half now expecting 10% or more of their ordered planters won’t arrive in time. The concern is even more critical for some dealers, with 27% projecting that almost one-third or more of their planter orders will fail to arrive in time.

Analysis of the results shows the dealers most concerned about planter orders failing to show up for spring use. In descending order are the dealers (and their primary brands) expecting 20% or more of their orders might now show up:

- Case IH: 45%

- AGCO: 37%

- John Deere: 30%

- New Holland: 35%

- Other/Shortline: 20%

- Kubota : 7%

It remains to be seen how big of a mess it will cause. “Our rule, if machinery was going to be short or delayed, was that we would never let the trade be sold or even taken from the customer until a firm production date could be confirmed,” says Foster. “That really creates anxiety from all parties.”

He adds that dealers who didn’t have such guidelines (or veered from them) got “caught” with this year’s harvest. “They had to loan augers and carts and combines as well, racking up more hours than planned due to production delays.”

Not only will there be stresses to sort out for next spring, but also long-lasting impact on the trade and washout cycle delays that it’ll bring.

Commentary on Late-Arriving Seeding Equipment: “We haven’t yet been warned by manufacturers to expect delays, but listening and reading concerning supply chain issues, it stands to reason some will be late. (New Holland dealer) ... They’ve already cut back my orders. I expect to receive all remaining orders the factory accepted (Kubota dealer).”

“Back in the days of everyone chasing market share, manufacturers had programs in place that if one dealer had inventory and another dealer needed it, the first dealer had to pay for it — or transfer it. How will the dealer’s year-end volume bonuses be affected by lack of inventory, since market share has been such a significant factor in volume bonuses?”

— Mark Foster, retired dealer executive

from Birkey’s Farm Store

Get the Techs Ready

The AEI survey focused on wholegoods and didn’t inquire about service sales before year-end. But Seymour expects a major push as farmers look to spend before their books close. If that’s the case, and if dealers can find the capacity, a lot of labor hours and the accompanying parts sales could ring the cash register, assuming that dealers have the needed parts in stock.

“I’d plan to have a significant jump in service toward the end of the year,” he says, and far busier for year-end than in the past. “There really isn’t any equipment to speak of to buy. Moreover, if what they planned for the spring is delayed and they need to start with the equipment they have, it’ll need to be in good working condition. I don’t see anything that points a different outcome.

“Farmers aren’t likely to find the combine or planter they want to trade into,” says Seymour, “but some will be happy to bring in their combine for the inspection and prepay the $25,000 in 2021 to ensure the work will be done before harvest.”

7 Differences in John Deere Dealer Results Vs. All Others Brands

Given the impact of the 5-week- strike, AEI isolated John Deere dealers from all others from the “Equipment Dealer Survey: 6-Questions on Next 6 Weeks” for a direct comparison. Deere dealers represented only 12.82% of the survey results. This low response rate may be due to the strike and/or, as was heard, directives sent from Moline, Ill., for dealers to remain “low profile” while the strike was ongoing.

The “All Others” category described below includes: Case IH, AGCO, New Holland, Kubota and Other/Shortline. Editor’s Note: The strike was settled on the evening of November 16 with production returning on the November 17, the same date as the close of the survey.

Below are 7 of the most notable differences between green dealers and all other brands.

- Deere dealers were 10% more likely (60%) to project a December 2021 that would result in 10% or fewer of the year’s total wholegoods sales.

- Deere dealers were more likely to report year-end purchases that would be measurably down vs. normal years (20% vs. 15%)

- Though still at very low numbers overall, Deere dealers (via a study of weighted averages) reported higher on-the-ground pieces in inventory for each of the 4 used equipment price categories vs. all other dealers.

- Deere dealers reported less new machine inventory in all units under $250,000, but slightly more availability in $250,000 and higher new wholegoods.

- Deere dealers lacked optimism in receiving new factory deliveries before December 31. Only 10% of dealers projected a 50% or better confidence for getting new machinery delivered before December 31. Comparatively, the other brands included 50% or better odds for new mainline wholegoods (12.12%) and new shortline wholegoods (17.91%).

- Not unexpectedly due to the strike still underway as the survey closed, no dealers reported an expectation that new wholegoods deliveries would improve in 2022 vs. 2021. Meanwhile, the other brands included 15.15% and 13.43% who expected new 2022 deliveries of wholegoods would improve for mainline and shortline deliveries, respectively.

- Deere dealers showed the most concern over high numbers of spring 2022 seeding equipment not arriving. One-half of Deere dealers expect more than 16% of their planter orders will not arrive in time, vs. 43.23% for other brands. About 30% of Deere dealers say 31% or more of their planters are unlikely to show up, vs. 26.57% for the other brands

Post a comment

Report Abusive Comment