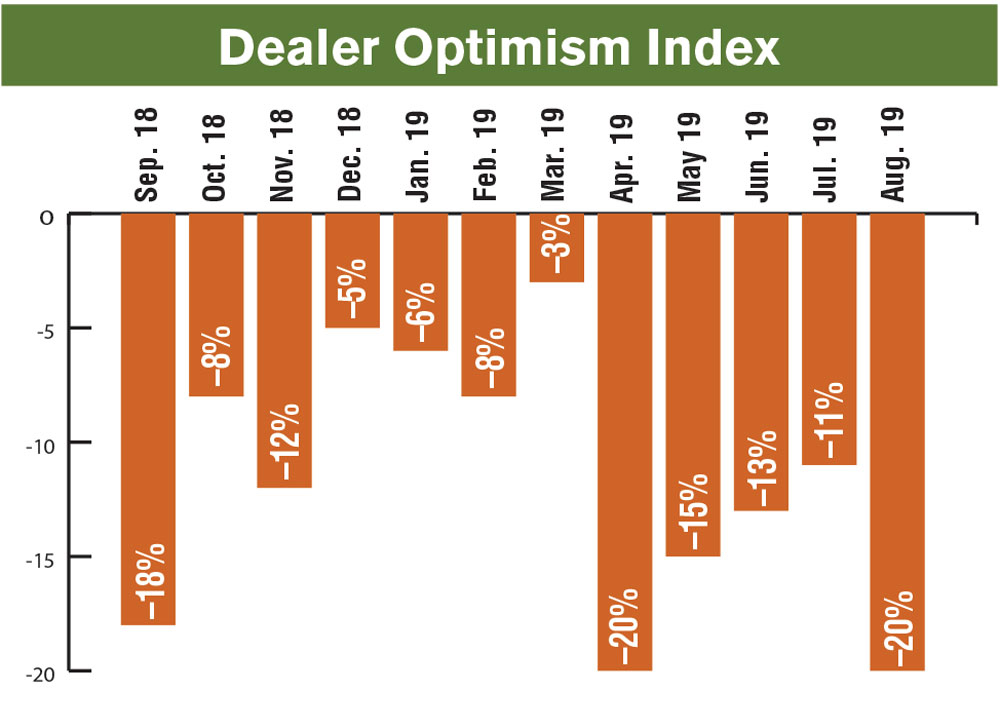

In the past year, the Ag Equipment Intelligence “Dealer Optimism Index,” which measures sentiment among dealers compared to the prior month, has yet to move into positive territory. The index is based on a monthly survey of North American farm equipment dealers that asks if they are more or less optimistic about their business prospects or feel about the same as they did in the previous survey. The highest score in the past 12 months was –3% registered in March (23% more optimistic, 52% about the same, 26% less optimistic). The lowest score for the year came in August when the index registered –20% (13% more optimistic, 54% about the same, 33% less optimistic).

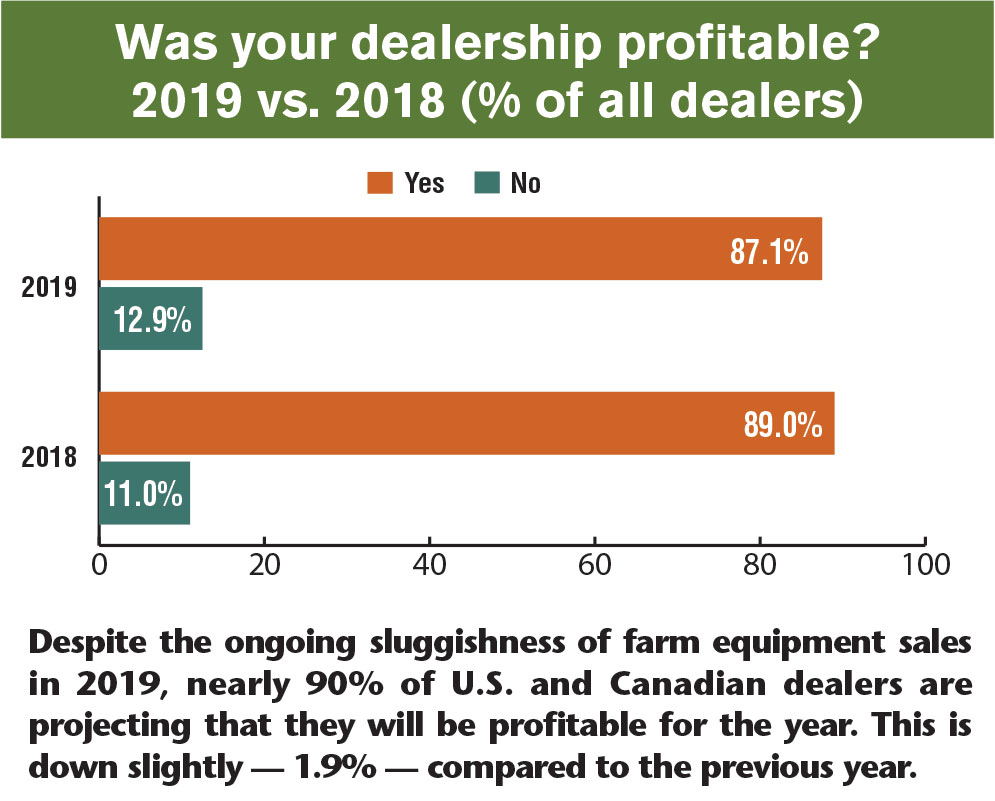

Nonetheless, despite their waning confidence, an overwhelming number of dealers — 87.1% — are reporting that they expect to be profitable in 2019. This is just a notch below the 89% who expected the same outcome a year ago. Of course, the degree of profitability is probably the more important question. This determination is still months away.

As for 2020, faced with more uncertainty than usual, generally dealers are slightly less optimistic than they were a year ago. Spring flooding that hampered, and in some cases prevented, farmers from getting in their fields during planting season, along with stagnant commodity prices are challenges that are not new to farming. The industry has dealt with these bumps in the road time and again.

This year’s weather may pack a bigger impact due to the volume of unplanted fields. Farm Market iD, which describes itself as a provider of farm and grower data that covers more than 2.8 million farmers, estimates that this year’s weather has resulted in millions of “lost acres.” According to the firm, “In total, 17.4 million crop production acres have been lost in key broad-acre states compared to 18 million acres reported by USDA in the same states.”

Between low commodity prices, poor planting weather and trade disruptions, it has been challenging for North American farm equipment dealers to muster a lot optimism about business levels in 2020. Source: Ag Equipment Intelligence, Cleveland Research

Lost acres include fields and acres that are normally planted and now have a failed crop, were never planted or contain a cover crop.

But the ongoing trade conflict in which the U.S. is currently embroiled with China has caused a major drop off of North American exports of farm products that is totally out of the industry’s hands. This is a major factor in the frustration and uncertainty dealers have to contend with going into 2020. One dealer summed up the current China situation like this: “This has created a holding pattern in the market and much uncertainty about if or when to make [buying] decisions.”

Higher Farm Income & Government Programs

Despite the generally dour mood currently in North American agriculture, at least two factors could improve the industry’s outlook for 2020.

In the U.S., the Farm Income Forecast, released by USDA on Aug. 30, showed net farm income is forecast to see a $4 billion increase or a 4.8% improvement in 2019, following increases in both 2017 and 2018. Adjusted for inflation, that amounts to $2.5 billion or 2.9%. Net cash farm income was also forecast to rise by $7.6 billion or 7.3%; adjusted for inflation, this amounts to $5.8 billion or 5.4%. If this increase is realized, that would put net cash farm income at $112.6 billion, 4% above its 2000-18 average. In addition, farm production costs are estimated to rise less than 1% this year, which will also contribute to a healthier bottom line for producers.

USDA’s Market Facilitation Program is also expected to relieve some of the financial burden growers are currently under as a result of lost export sales from ongoing trade disputes. Payments are expected to surpass $19 billion, the highest level in 15 years. If estimates are correct, this could account for more than 20% of net farm income in 2019.

2020 New Equipment Sales

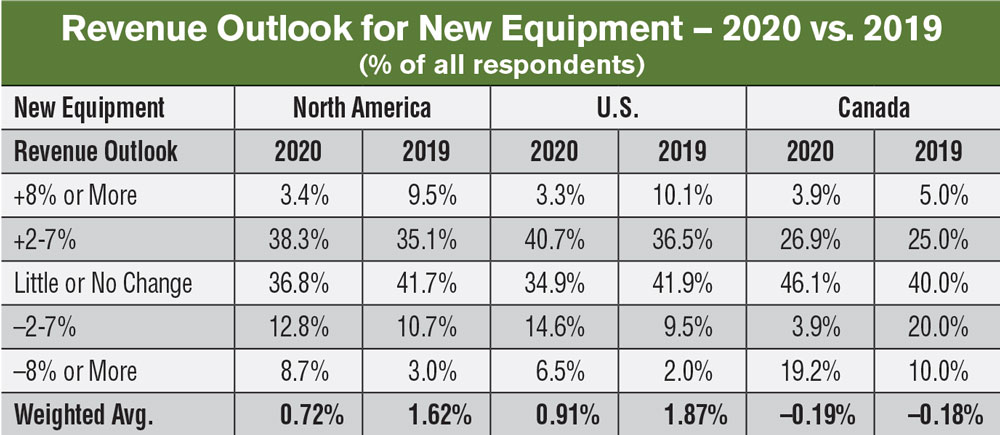

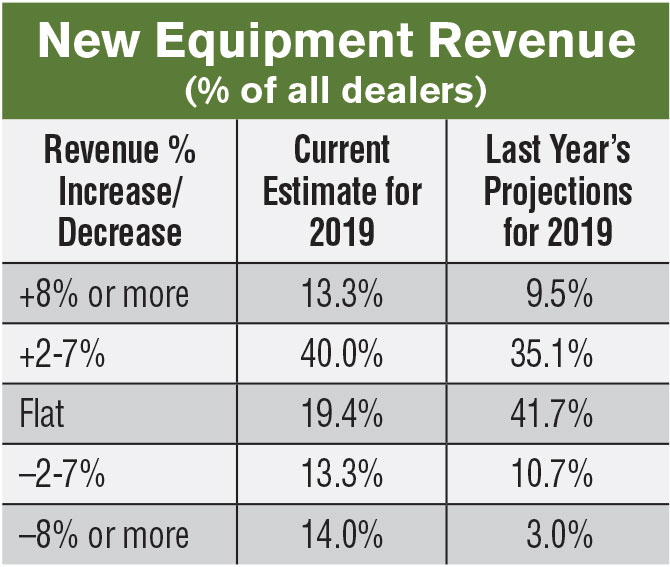

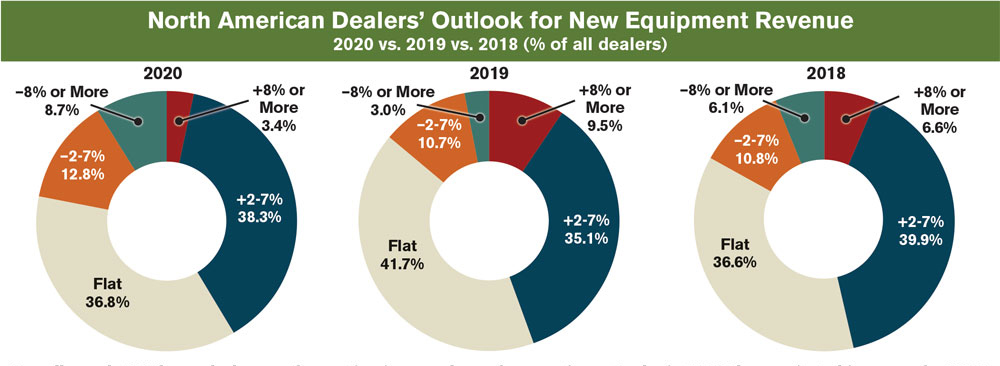

Based on the results of the 2020 Dealer Business Outlook & Trends survey, ag equipment dealers are slightly less optimistic about their potential to improve revenues in the year ahead compared to a year ago. The survey, which was conducted during the last week of August and first two weeks of September, shows that 41.7% of U.S. and Canadian dealers expect a pickup in new equipment revenues in 2020. Broken down further, only 3.4% of respondents expect revenues to increase by 8% or more, while 38.3% are projecting an improvement in the 2-7% range. This compares with 44.6% in last year’s study, where 9.5% of dealers had forecast an 8% or more increase and 35.1% anticipated growth in the 2-7% range.

Overall, nearly 3% fewer dealers are forecasting increased new farm equipment sales in 2020 than projected increases for 2019. Just under 42% expect revenues from new equipment sales to improve during the year ahead. A year ago, nearly 45% forecasted sales to improve in 2019. When it comes to dealers who anticipate declining sales in 2020 vs. 2019, the variation increases significantly. For 2020, nearly 22% are projecting a fall off compared with less than 14% last year.

Nearly 13% of this year’s respondents expect new equipment revenues to decline 2-7% and 8.7% see sale revenues falling by 8% or more. More than one-third (36.8%) of dealers have a flat outlook for 2020 vs. 41.7% who anticipated little or no change a year ago at this time.

U.S. & Canada New Equipment. Comparatively, U.S. dealers are significantly more confident going into the new sale year than are their Canadian counterparts. Overall, 44% of U.S. ag equipment retailers are expecting an uptick in new equipment sales in 2020 vs. about 31% of Canadian dealers.

The divide between the two countries isn’t nearly as wide when it comes to expected drop off in new equipment revenues in the year ahead, but the Canadians see a steeper fall off. In the U.S., 21.1% of dealers are anticipating declining revenues, 14.6% by 2-7% and 6.5% by 8% or more. Some 23% of dealers north of the border see new equipment sales dropping, 3.9% by 2-7% and 19.2% by 8% or more.

The divide between dealers in the two countries is also significant when it comes to their outlook for flat sales in 2020. While about 35% of American dealers anticipate little or no change during the year ahead, slightly more than 46% of Canadian retailers are forecasting flat sales for the year.

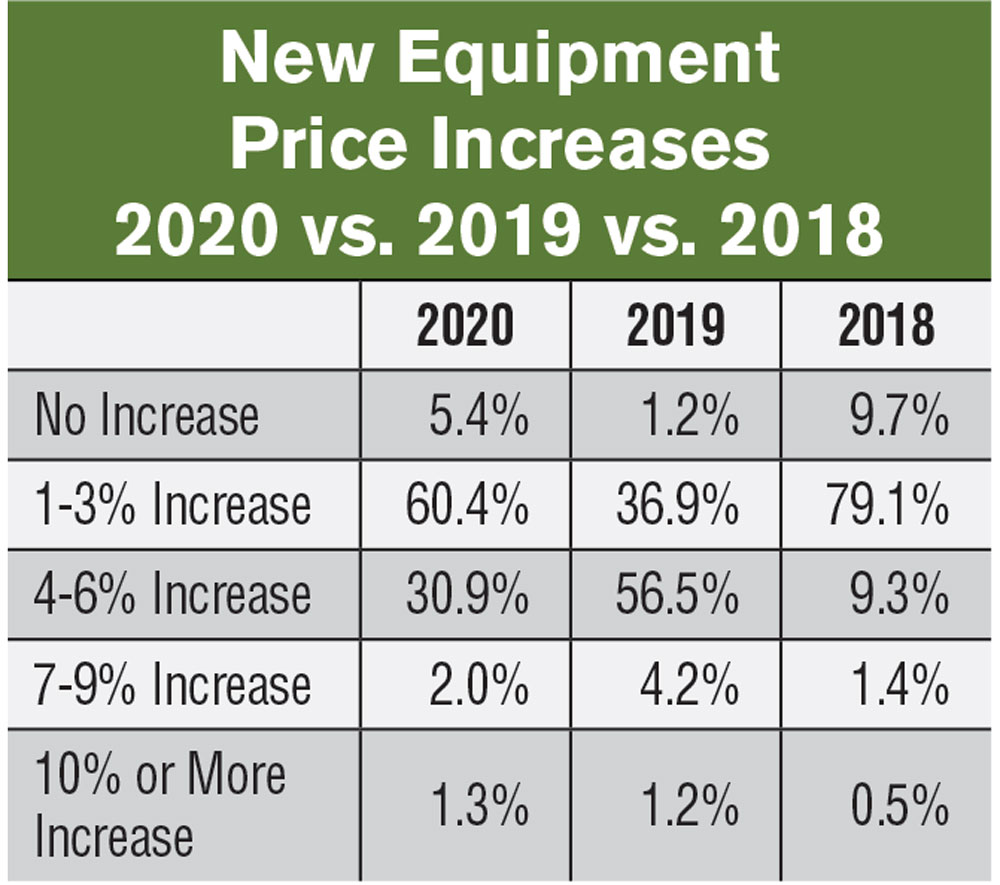

Price Increases Ahead. A large percentage of dealers say they are expecting some pretty hefty price increases on 2020 model equipment from their manufacturers. In fact, the increasing cost of new equipment ranks second on the dealers’ list of major issues and concerns (see p. 23) for 2020. It was also ranked the number 2 biggest issue in last year’s survey.

Nonetheless, in spite of sluggish sales, only 5.4% of dealers indicate they do not expect a price increase on new equipment in the coming year. Of the remaining dealers, 60.4% are projecting increases in the 1-3% range, 30.9% anticipate a hike in the 4-6% range and 3.3% are looking for increases of more than 7%.

2020 Used Equipment Sales

It was only a few years ago when rising used equipment inventories were among the top five concerns for North American ag machinery dealers. In this year’s study, it slid to 10 on the list of 19 major concerns facing dealers.

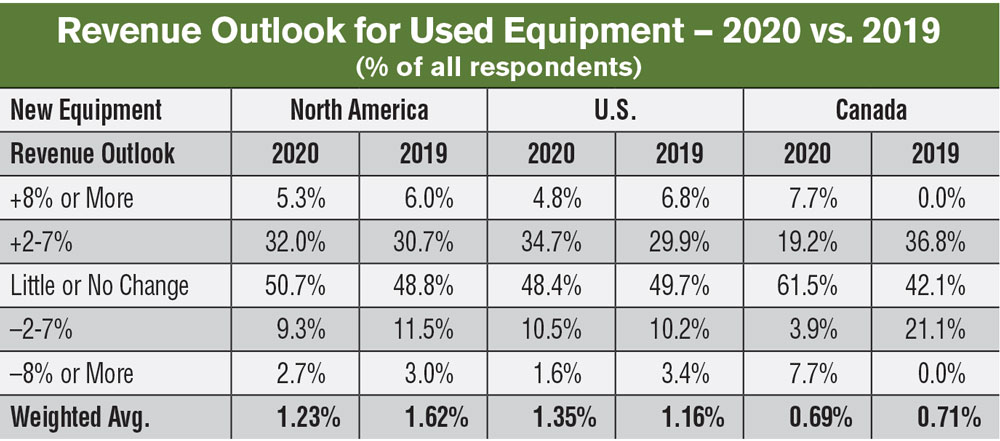

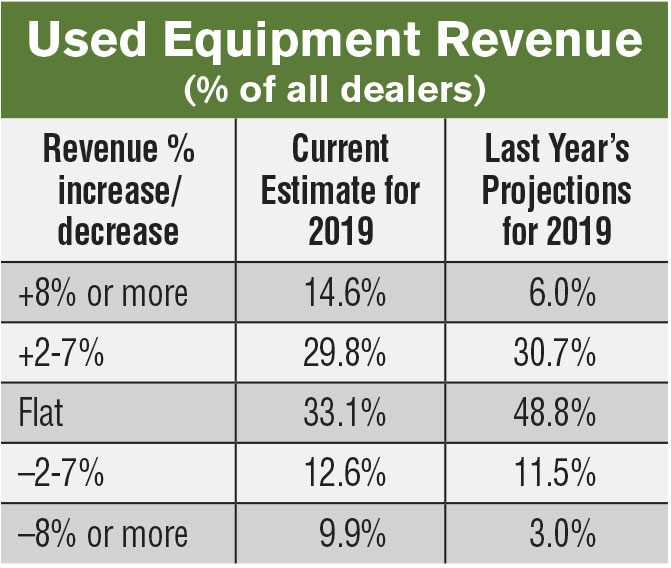

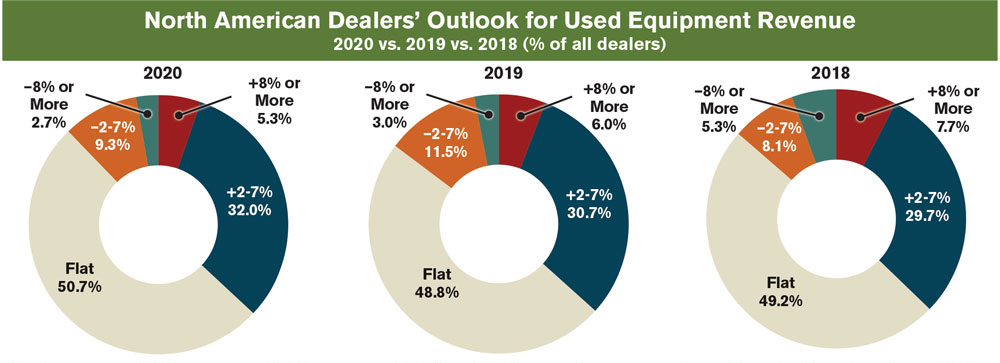

Dealers surveyed this year are slightly more optimistic when it comes to revenues from the sale of used equipment. The percentage of dealers looking for an increase in revenues in 2020 from the sale of used machinery — 37.3% — is up slightly from 36.7% who projected a pick up a year ago. Those expecting a drop off were also down slightly, from 14.5% a year ago to the 12% who projected a decline in 2020.

For 2020, slightly over 37% of U.S. and Canadian dealers expect sales of used machines to increase; 5.3% by 8% or more and 32.0% by 2-7%. The dealers’ outlook for used equipment sales is reflective of their outlook a year ago when 36.7% expected sales to pick up in 2019; 6% by 8% or more and 30.7% by 2-7%. In the year ahead, nearly 51% of dealers are projecting flattish sales of used equipment vs. 49% last year.

U.S. & Canada Used Equipment. When comparing the U.S. and Canadian dealers’ outlook for used equipment sales in 2020, it’s obvious that U.S. dealers have a far higher level of confidence going into the new year than that of their Canadian counterparts.

Slightly more than 39% of U.S. dealers see revenues tied to used machine sales rising in the next year. Of these, 4.8% forecast previously owned equipment sales to grow by 8% or more and 34.7% by 2-7%. On the other hand, nearly 27% of Canadian dealers are projecting growth in used sales. Less than 8% of the dealers in Canada see these sales growing 8% or more in the year ahead, while slightly more than 19% expect sales to improve between 2-7%.

When it comes to declining revenues in this segment of their businesses, the results were similar. Some 12.1% of U.S. dealers anticipate a fall off (10.5% dropping 2-7% and 1.6% declining 8% or more). Some 11.6% of Canadian dealers are expecting lower revenues from used sales (3.9% by 2-7% or more and 7.7% by 8% or more.)

In last year’s survey, 36.7% of U.S. dealers were projecting an increase in used machine sales (6.8% up 8% or more, 29.9% up 2-7%). Some 13.6% expected used sales to decline and just under half were looking for sales to be flat.

In Canada, a year ago, just under 37% of dealers forecasted an increase in used machine sales and 21% said sales would decline. Slightly over 42% called for flat sales for the year.

Early Orders Remain Flat

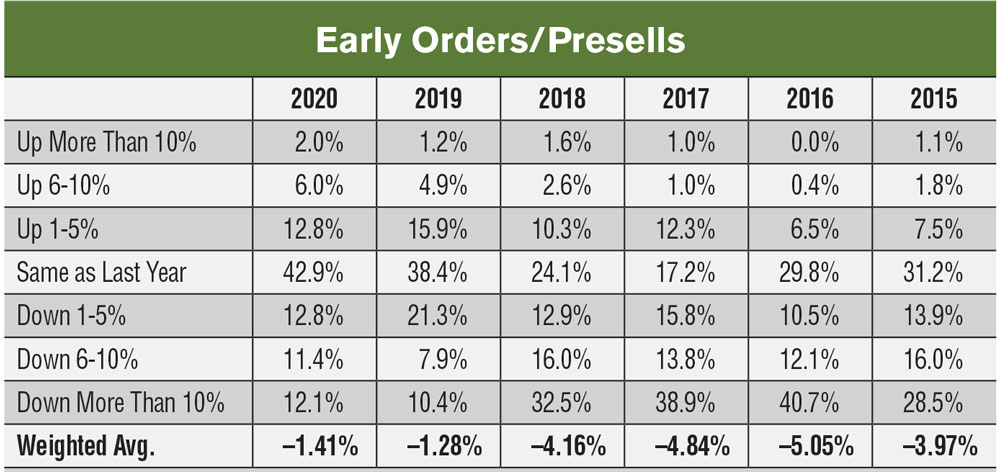

After improving a year ago, dealers are reporting the level of early orders of farm machinery for the 2020 selling season remained essentially flat.

Based on the dealers' overall sentiments about their business prospects for 2020, their level of equipment early orders for the year ahead seem surprising. Going into the new year, they are essentially flat (20.8% up) compared with a year ago (22% up).

At this time last year, 22% of dealers reported that early orders, or pre-sells, had increased. For the year ahead, 20.8% say their early orders are up going into 2020. Exactly 2% report orders are up by 10% or more, 6.0% up 6-10% and 12.8% up 1-5%. This compares with the previous year when 1.2% reported early equipment orders were up by 10% or more, 4.9% up 6-10% and 15.9% up 1-5%.

For the year ahead, 42.9% of dealers say machine pre-sells are at about the same level as they were in the previous year. A year earlier, 38.4% said early orders were flat compared to 2018.

Though fairly minor, the biggest shift came in the percentage of dealers reporting lower early orders. Going into 2020, a little over 36% of dealers report a lower level of presold equipment, while a year earlier, nearly 40% said early orders had declined vs. the previous year.

Aftermarket Revenues on the Rise

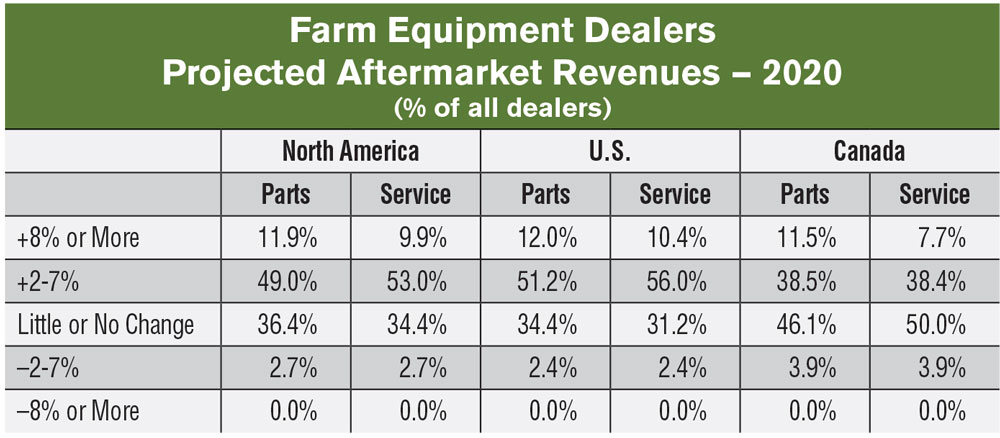

A new question about aftermarket revenues — parts and service sales — was added to this year’s survey. While aftermarket revenues have always been critical to the financial health of farm equipment dealerships, with the slowdown in sales of new and used ag machinery, these revenue sources have taken on increased importance.

On top of the need to shore up their bottom lines with aftermarket revenue, the gross margins on parts and service sales are significantly higher than margins earned on new and used wholegoods. For example, according to the latest data from the Western Equipment Dealers Assn., the gross margins for new and used equipment are 6.7% and 4%, respectively. The gross margin on service work is nearly 63% and 30% for parts.

Overall, North American farm equipment dealers have a high level of optimism about rising revenues from parts and service sales in 2020. Combined, 61% of U.S. and Canadian dealers expect their parts business to increase in the year ahead: 12% by 8% or more and 49% by between 2-7%. Just over 36% are forecasting flat revenues from the sales of parts in 2020. Less than 3% are projecting a decline in revenues from this segment of their business.

For service work, nearly 63% of dealers are projecting rising revenues during the next 12 months. Over one-third (34.4%) are looking for flat revenues from their service departments and less than 3% anticipate declining revenues.

Tractors & Combine Outlook Declines

The most recent figures from the Assn. of Equipment Manufacturers shows that through the first 8 months of 2019, the year-to-date U.S. unit sales of farm tractors and combines are at or above sales levels for the same period of 2018. The same cannot be said for sales in Canada, which are significantly down from the previous year levels.

In the U.S., unit sales of tractors Jan.-Aug. 2019, show total farm tractor sales are up 3.5%, while sales in Canada are down 6.3% for the year. U.S. combine sales so far in 2019 are flat with the same period in 2018, but Canadian combine sales are down “big time” at –28% so far for the year.

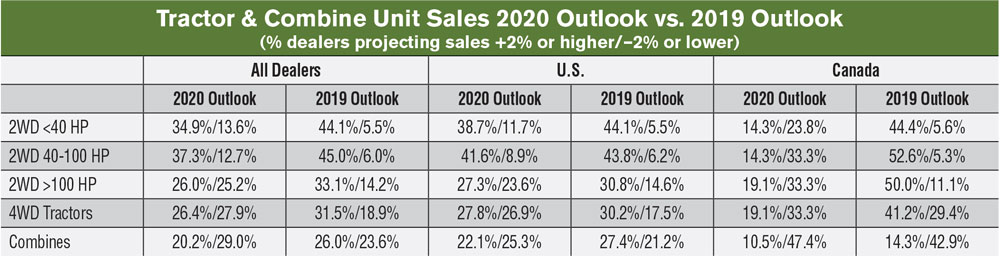

The dealers’ outlook for 2020 sales of tractors and combines are down compared to their forecasts from a year earlier. Taken together, 35% of U.S. and Canadian dealers expect turnover for compact tractors (less than 40 horsepower) to increase, while a little under 14% of dealers are forecasting slower sales. For mid-range tractors (40-100 horsepower), 37.3% of dealers are calling for improving unit sales in 2020, while just under 13% anticipate sales to be down.

For the higher horsepower equipment, more than a quarter (26%) of dealers see unit sales of row-crop equipment (100-plus horsepower) increasing in the year ahead, while nearly the same percentage (25.2%) see sales dropping. For 4WD tractors, 26.4% of dealers are forecasting increasing sales, while a higher percentage (27.9%) are projecting that sales will fall off during the next 12 months.

The outlook for combine turnover isn’t particularly promising either. A little over 20% of dealers are estimating combine unit sales in 2020 will improve, but nearly 29% are forecasting declining sales during the year.

‘Best Bets’ for 2020

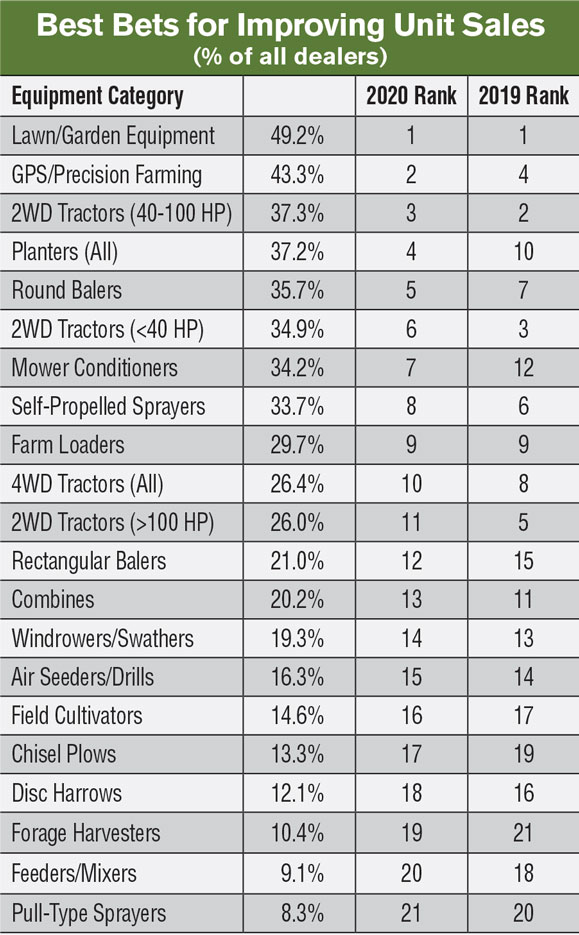

Dealers were given a list of 21 product lines and asked to rank them in terms of the best prospects for improving unit sales in the year ahead. With some variation, the ranking for 2020 is somewhat similar to the dealers’ list from 2019.

Rankings for “Best Bets” are based on projected unit sales growth of 2% or more in 2020.

Heading the rankings this time around is lawn and garden equipment as it was a year ago. This year, a little less than one-half (49.2%) of ag equipment retailers see the most potential in lawn tractors, mowers and other grounds maintenance products.

Moving up to the second slot from fourth place a year ago is GPS/precision farming products with 43% of the dealers’ vote. Next, in third place with 37.3% of dealers, are mid-range tractors (40-100 horsepower), which ranked #2 last year. Dealers ranked planters as having the fourth best potential for increasing sales in 2020. This equipment jumped from #10 last year. Rounding out the top 5 in this year’s list are round balers (37.2%), up from the #7 slot a year earlier.

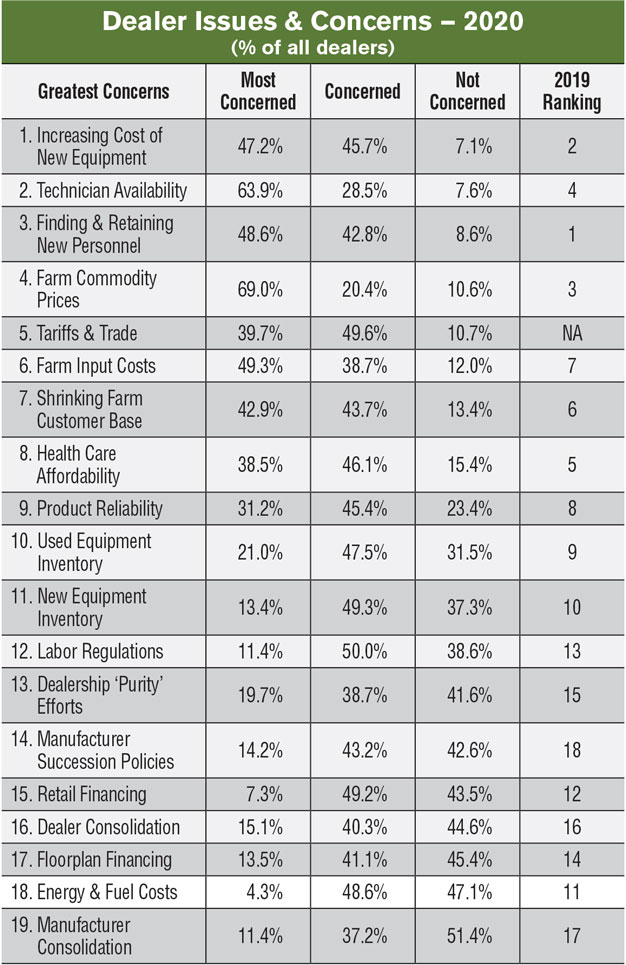

Dealers Biggest Concerns

Two of dealers’ biggest worries moving into 2020 remain the same: people. The availability of service techs always ranks high on their major concern and this year is no different. With sluggish sales of wholegoods, more focus is put on aftermarket revenues, which requires capable service technicians. Add in the growing demand for new precision technology on farm machinery, and the pressure to find and retain talented individuals grows.

As the business of equipment dealerships grows more sophisticated, and in some cases more complex, the need to recruit and retain talented people throughout the business is also stressing dealers. Number 3 on the dealers’ biggest concerns for the coming year is finding and retaining new personnel.

The increasing cost of the new machinery is also challenging dealers. This is #1 on their list of major worries, which is a step up from its #2 ranking a year ago.

The next two issues on the dealers’ list of concerns may be the most worrisome because they involve uncertainty: low farm commodity prices and the current trade disputes. There’s few things that dealers fear more than uncertainty.

How Did North American Ag Equipment Dealers Fare in 2019?

As in the past, in addition to asking North American farm equipment dealers about their outlook for the coming year, they were also asked to estimate how they would finish the current year in terms of increased or decreased revenue from new and used wholegoods sales vs. the previous year. They were also surveyed about how they would finish up 2019 in aftermarket revenues, profitability and how they did in regard to gross margins.

At the time the 2020 Dealer Business Outlook & Trends survey was conducted in early September, some 53.3% estimated actual revenues from the sales of new wholegoods would be up by year-end 2019. A year earlier (2018), a little less than 45% expected revenues to improve during 2019. For the past year, 13.3% projected revenues would be up 8% or more and 40% projected increases of 2-7%. This compares to a year earlier when 9.5% projected sales revenues would improve by 8% or more and 35% who forecasted revenue growth in the 2-7% range.

A year ago, 13.7% of dealers anticipated lower revenues from new wholegoods, but at this point, nearly double that number (27.3%) estimate that 2019 will finish up with lower revenues from new equipment sales.

In terms of used wholegoods, a year ago nearly 37% of dealers anticipated improved sales revenues. A year later, 44.4% estimate they’ll finish 2019 with higher revenues for used equipment. At the same time, last year, 14.5% projected lower sales from used machines. The most recent survey shows that nearly 22% will see lower sales for the full year.

A large majority of equipment dealers report that aftermarket revenues were up in 2019. Nearly 70% say that revenues from the sale of parts increased in the past year and about 12% say they declined. Less than 20% report flat part revenues in the past year.

Service revenues were also up for a significant majority of U.S. and Canadian dealers, with 63% reporting an increase for service sales and 12% indicating a dropoff in this area. Less than 25% say service revenues were flat for the year.

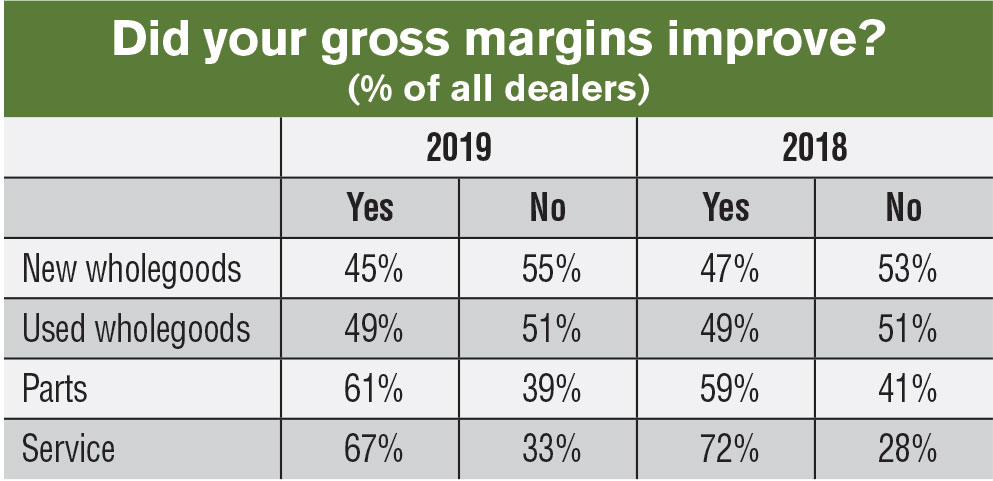

Gross margins for new and used wholegoods was a different story. Less than half (45%) of dealers say they saw improvement in gross margins on new machinery sales in 2019 and nearly one-half (49%) report a margin increase for used equipment.

Better results came from dealers’ aftermarket efforts. Some 61% indicate margins on parts sales improved in 2019 and 67% report that margins were up on service work.

When it is all said and done and despite the challenging agricultural environment in 2019, 87.1% of dealers responding to the 2020 Dealer Business Outlook & Trends survey say they will be in the black when 2019 accounts are squared away. This is down about 2% compared to the previous year, but it would seem to indicate that dealers have managed their business well during these trying times.

Despite the ongoing sluggishness of farm equipment sales in 2019, nearly 90% of U.S. and Canadian dealers are projecting that they will be profitable for the year. This is down slightly — 1.9% — compared to the previous year.