|

Past Dealer Business

|

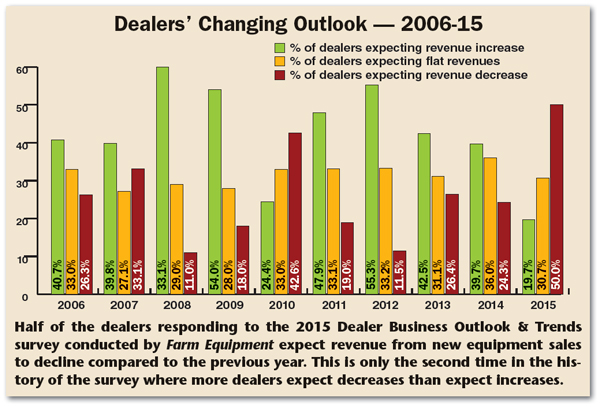

Half of the slightly more than 300 North American farm equipment dealers responding to Farm Equipment’s “2015 Dealer Business Outlook & Trends” survey expect sales revenues to decline in the year ahead compared with the year passed. The last time a larger percentage of dealers expected sales to fall than to rise was in 2010 following the economic crisis brought on by the collapse of the U.S. housing market, which took most of the economy down with it. This time around, the falloff in equipment sales is largely the result of declining crop prices, though other factors also appear to be contributing to an overall slowdown.

The outlook for the years 2010 and 2015 represent the two least optimistic forecasts during the 10 years Farm Equipment has surveyed dealers in the U.S. and Canada.

Despite a similar tenor to the sentiments expressed about their sales prospects in 2010 and 2015, fewer dealers, 19.3%, believe sales revenues will increase in the year ahead than they did 5 years earlier, when 24.4% forecasted growth. At the same time, more dealers expect a dropoff in 2015 (50%) compared with 2010 (42.6%). As has typically been the case over the 10 years we’ve conducted this survey, about one-third of dealers (30.7%) are calling for little or no change in the next year vs. the previous year.

Even combining the percentage of dealers who expect revenue growth with those projecting little or no change for 2010 and 2015, the disparity is significant. For 2010, the percentage was 57.4%. For the year ahead, it’s one-half, or 50%, of North American dealers who are projecting sales revenue will grow or stay about the same as 2014.

In its latest dealer poll, UBS Investment Research produced similar results to those of Farm Equipment’s. In that August report, analyst Steven Fisher remarked, “Dealers are largely neutral on their business conditions. On a scale of 0-10, dealers responded with an average of 6.24, indicating a largely neutral perspective on their business conditions. We believe this may indicate that dealers have been preparing for an eventual downturn in demand, and may also be a reflection of recent consolidation among dealers; larger scale and thus better equipped to handle a downturn.”

New Equipment Revenues — 2015

Comparing dealers’ sentiments from a year ago shows a significant shift in how they view the year ahead with their outlook a year ago.

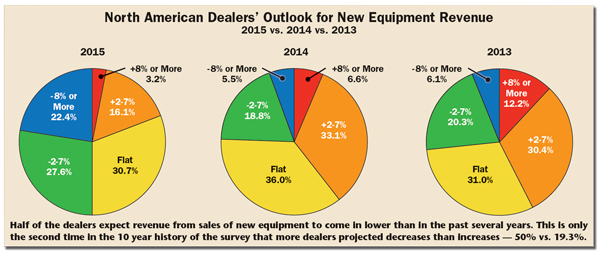

Last year at this time, 75.7% of dealers expected sales of new farm machinery to be better than or as good as those in 2013, with the remaining 24.3% projecting decreased sales revenues. This year, it’s an even 50/50 split with 50% forecasting revenues will be as good as or better than what they saw in 2014 and 50% predicting sales revenue will decline in 2015.

How Did Dealers Fare in 2014?

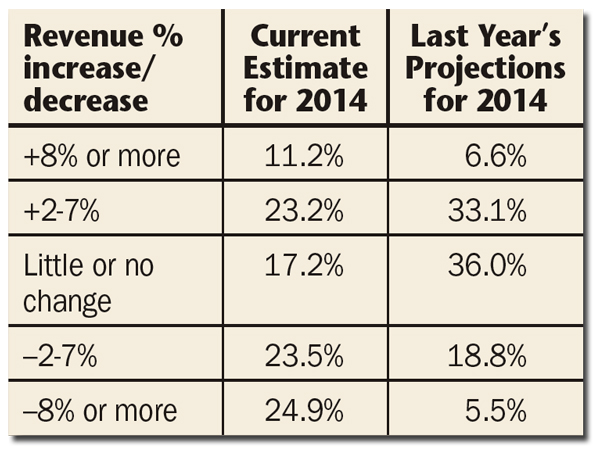

While we typically don’t query dealers about their new equipment sales during the past year, for the 2015 Dealer Business Outlook & Trends survey we asked, “What is your best estimate of your 2014 NEW equipment revenue vs. 2013 NEW equipment revenue?” Of the 285 dealers who responded specifically to this question, 34.4% reported that by year-end they expect their new equipment revenues to have increased vs. 2013. Of the remaining dealers, 17.2% say there will be little or no change this year compared with the previous year, and nearly half, or 48.4% anticipate lower revenues in 2014 compared to 2013. The breakdown and comparison is shown in the table above. Last year at this time, 39.7% of dealers were forecasting a dropoff in new equipment revenues for 2014. The percentage of dealers’ whose current estimate for a revenue increase isn’t too far their outlook for last year at 34.4%. The big difference comes in dealers who now estimate that new equipment revenues will decrease for 2014 vs. their forecast a year ago. In September 2013, only 24.3% of dealers projected lower revenues for 2014. With this year’s survey, nearly double that number, 48.4%, are estimating declining new equipment revenues for the full year 2014. Of course, the wide difference between the two comes in the “little or no change category.” A year ago, 36% of dealers in the survey projected essentially “flat” new equipment revenues. At this point, only 17.2% expect “little or no change” for all of 2014. |

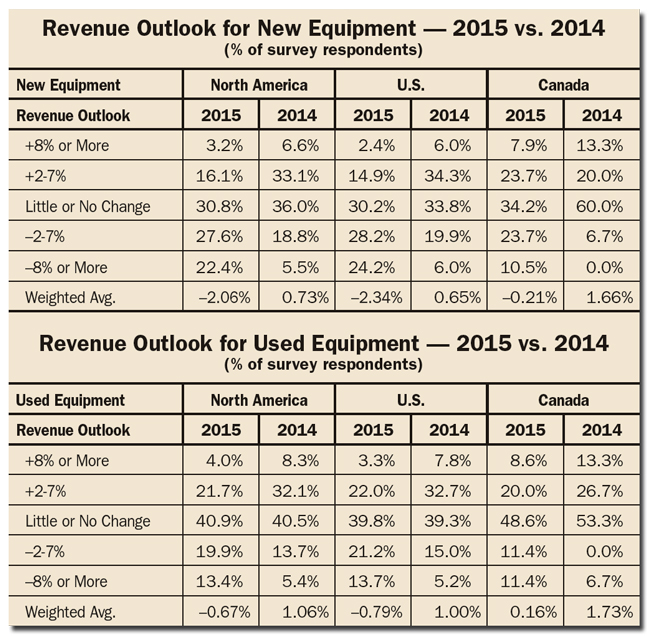

A year ago, of the 75.7% of dealers with a positive or neutral outlook, 39.7% anticipated revenue increases. In this group, 6.6% forecast growth to be 8% or more, while 33.1% projected increases of from 2-7%. For those 24.3% who projected declining revenues for 2014, 5.5% projected decreases of 8% or more and 18.8% estimated revenues would fall by 2-7%.

Looking ahead to 2015, of the 50% of dealers who anticipate increased or flat sales for the year, only 19.3% expect growth. Of that group, 3.2% are projecting increases of 8% or more and 16.1% are forecasting rising revenues of 2-7%. Of the 50% of dealers calling for falling revenues, 27.6% anticipate a dropoff of 2-7% and 22.4% see sales revenue tailing off by 8% or more.

On a weighted basis, overall dealers anticipate a -2.06 average decline for new equipment revenues in the year ahead. This compares with a weighted average of +0.94 in 2014 and a +2.37 in 2013.

Factors Impacting Sales

In addition to the continuing descent of crop prices from a year ago (-27.2% corn, -28.2% soybeans, -27.1% wheat in mid-September), other factors are also weighing on dealers’ attitudes as they look ahead.

One of the concerns most often expressed by dealers is the rising price of new ag machinery. Dealers say that it’s been difficult to pass along price hikes in the past year and they don’t expect it’s going to get any easier in 2015.

Top executives from two of the major full-line farm equipment makers told Farm Equipment that they recognize the rising prices of new machinery are causing problems for their dealers. One estimated that overall prices have risen by nearly 25% over the past 5 years. Another said it’s probably closer to 30%.

Dealers say it wasn’t as difficult explaining the price hikes associated with the new Tier 4 Interim equipment, as significant gains in engine performance and fuel efficiency were easily quantifiable. That’s not the case with Final Tier 4 engines. While the equipment with Final Tier 4 engines was subject to robust price increases, little or no significant improvement in performance and efficiency over the earlier Tier 4 Interim engines could be demonstrated.

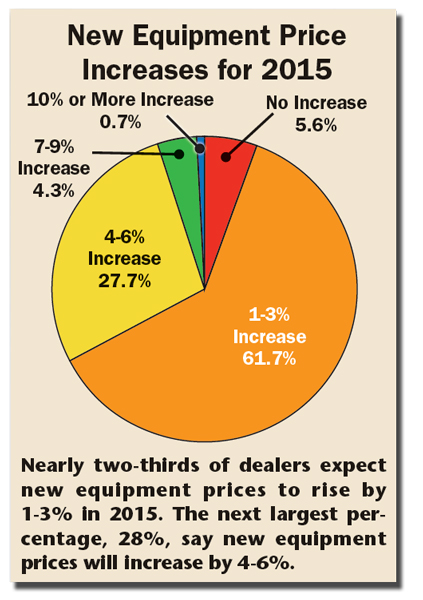

According to the results of this year’s survey, it would seem price increases for 2015 equipment could rival those seen in 2014. Overall, 97.8% of dealers say they are expecting another price increase on new equipment in the year ahead. This compares to 94.4% of dealers last year.

A breakdown by the size of increase for 2015 (vs. 2014), shows that nearly two-thirds of dealers, or 61.7%, say price hikes will be in the range of 1-3% (vs. 50.8%). Another 27.7% expect price hikes for new machinery will ranger between 4-6% (vs. 40.4%), while 4.3% say increases will be 7-9% (vs. 4.9%). Less than 2% of the dealers report prices for new equipment will exceed 10% (vs. 0.7%).

Only 2.2% of dealers expected no price increases a year ago. This compares with 5.6% of dealers who do not anticipate a price hike in the year ahead.

In addition to declining crop prices and rising new equipment costs, many dealers also say that another headwind they are confronting is the newness of the existing farm fleet. Analysts from RW Baird estimate that the age of the mid-range and high horsepower tractors and combines operating in North America today is probably the youngest they’ve been in 30 years.

So many farmers have upgraded their equipment in the past 5 years or so, they can afford to sit out a year or two without purchasing new machinery or affecting their productivity.

According to analysts with RW Baird, far more high horsepower and 4WD tractors are less than 5 years old considering unit sales of these units increased by 34% between 2008 and the end of 2013. For the same period, sales of mid-size tractors (40-100 horsepower) were down by 24%. With this being the case, the age of row-crop and 4WD tractors is probably younger than indicated here.

In any case, using the latest USDA (2012 Ag Census) and Assn. of Equipment Manufacturers data, the percentage of combines aged 5 years or less had increased to between 17-19% in 2012 from 12% in 2007. Tractors, excluding those in the 40 horsepower or less category, had increased to 13% in 2012 from 12% that were age 5 years or less in 2007.

On a more positive note, strong livestock and dairy prices have given dealers serving those market segments a nice pick up in the sale of mid-range tractors (41-100 horsepower) and hay tools.

Early Orders Down

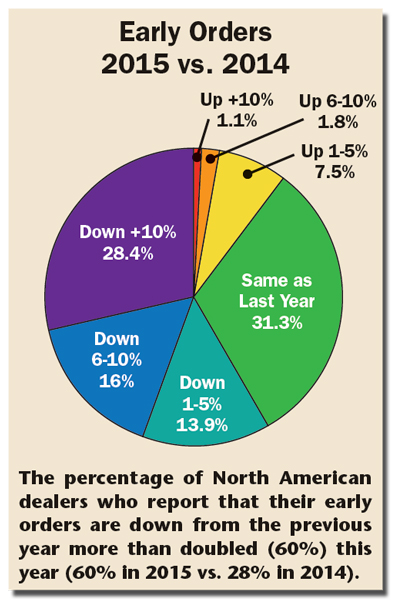

Another signal that it will be a softer market for new equipment sales in 2015 is the presells or early orders for equipment are lower at this point in the year compared with a year ago.

Nearly 60% of dealers say early orders are below the level they saw a year ago at this time: 28.4% down 10% or more, 16% down 6-10% and 13.9% down 1-5%. This compares with 27.8% who reported presells were down at this point last year.

Only slightly more than 10% of dealers are reporting a higher level of presells than last year: 1% up more than 10%, 1.8% up 6-10% and 7.5% up 1-5%. A year ago, 27.2% of dealers said their early orders were up.

This year, 31.3% say their new equipment presells are at about the same level they were in 2013. A year earlier, 45% said they were at the same as the year before.

Used Equipment Revenues — 2015

Declining prices and rising backlog of used ag equipment, particularly high horsepower tractors and combines, has been a major concern for North American dealers for the last several years. Nothing much has changed in the past year to alleviate their concerns. As a result, dealers’ sentiments about their prospects for improving used equipment revenues in 2013 were somewhat less optimistic than they were a year ago.

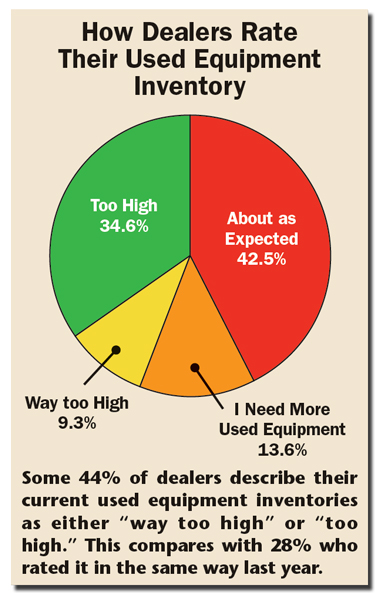

Asked to rate the status of their used equipment inventory, 42.5% said it was about as expected, which in this case, most likely means it’s larger than the dealers would like. That response was just slightly better than the 43.9% of dealers who rated the used equipment backlog as “way too high” (9.3%) or “too high” (34.6%). Less than 14% reported that they “need more used equipment.”

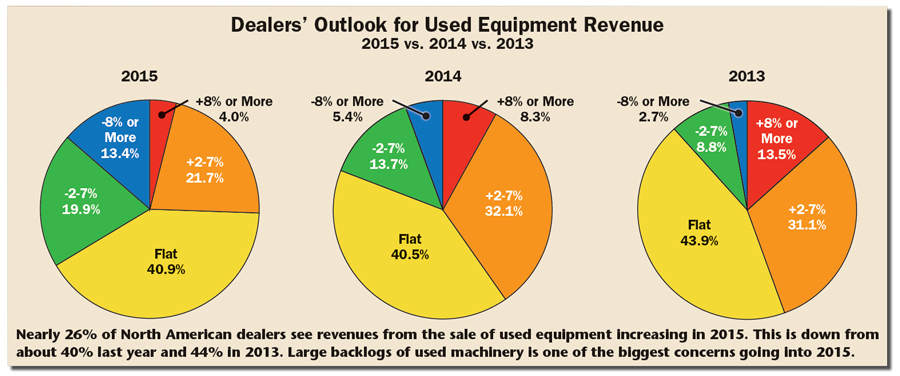

Going forward, slightly over one-quarter (25.7%) of U.S. and Canada dealers expect revenues from the sale of used machinery to increase in 2015. Of this group, only 4% are forecasting revenues to increase 8% or more, while 21.7% anticipate revenues to rise 2-7%. Compared to a year ago, this is down nearly 5%, when 30.4% of dealers expected to see an increase in used equipment revenues (8.3% up 8% or more, 32.1% up 2-7%).

Those dealers forecasting used equipment revenues to decline rose significantly. For 2015, a solid one-third of dealers (33.3%) are forecasting falling revenues, while only 19.1% were projecting declining revenues from used machinery for 2014.

Of those forecasting decreased revenues in the year ahead, 13.4% see sales dropping by 8% or more and 19.9% project revenues to come in 2-7% lower than in the previous year. This compares to 5.4% who anticipated revenues to fall by 8% or more a year ago, and 13.7% who predicted used equipment sales would decline by 2-7%.

The percentage of dealers who are forecasting little or no change in used equipment revenues was about the same for 2015 (40.9%) as a year earlier (40.5%).

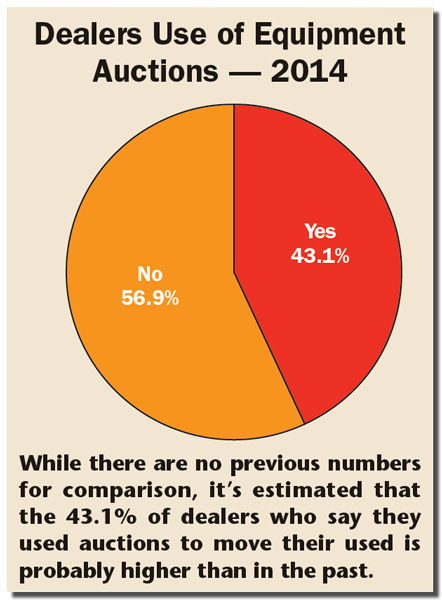

With the emphasis on moving used equipment during the past, we posed another new question to dealers this year regarding their use of auctions to increase the turns of trade-ins. While we have no earlier numbers for comparison purposes, we suspect that dealers are utilizing commercial auction services more than in the past.

Responding to the question “Has your dealership utilized a commercial auction service — either public or online — to reduce its inventory of used equipment during the past year?” 43.1% of dealers say they did make use of a service during the past year. The remaining 56.9% said they did not.

HHP Tractor & Combine Sales Slowing

The equipment categories that garner the most attention when it comes to overall equipment sales, larger, high horsepower tractors and combines, are the ones that have slowed the most in the last year, a trend that looks like it will continue throughout 2015. But it’s the smaller and mid-range tractors that are demonstrating the most sales vigor going into the new year.

Through the first 8 months of 2014, unit sales of row-crop tractors (100 horsepower and higher) and 4WD tractors declined in the U.S. by 8.8% and 14.4%, respectively. In Canada, row-crop tractor sales are up 1.1% through August but 4WD equipment is down by 24% for the first 8 months of the year.

U.S. sales of compact tractors (less than 40 horsepower) January through August are up by 6.3% and sales of mid-range units (40-100 horsepower) have risen by 4.7% compared to the same period last year.

Canadian sales of compacts are down 1.5% through August vs. the first 8 months of 2013, while mid-range tractor sales are up by 5.7%.

Sales of combines in both the U.S. and Canada continue to tank. In the U.S. sales are off by 17.3% compared with the January through August timeframe of last year. During this same period, Canadian combine sales have declined by 25.2%.

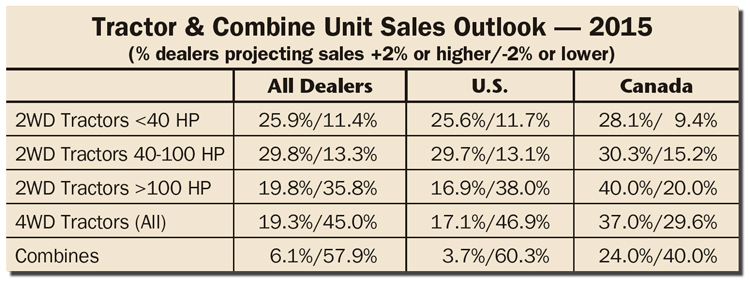

While U.S. dealers see the 2014 sales pattern continuing on into 2015 for the most part, as a group, North American dealers see good growth potential for compact tractors with nearly 26% projecting an increase in unit sales in 2015 and only 11.4% forecasting lower sales. For the mid-range tractor category, nearly 30% expect higher unit sales in the year ahead, while 13.3% anticipate lower sales.

A significant gap exists between what U.S. dealers expect in unit sales of row-crop and 4WD tractors and the volume of sales Canada dealers are forecasting for the year.

Only 17% of U.S. dealers see the potential for growing sales of row-crop tractors and 38% anticipate 2015 sales will fall below 2014 levels. With 4WD equipment, 16.9% of U.S. dealers are projecting higher sales, while nearly 47% are projecting lower sales in the year ahead.

Canadian dealers’ outlook for high horsepower tractors, on the other hand, is significantly more upbeat. Some 40% of dealers in Canada see higher unit sales of row-crop tractors in the next year and only 20% see a decrease. For 4WD units, 37% of dealers in Canada expect increasing sales and a little less than 30% see sales of 4WD equipment declining.

Together, only 6.1% of North American dealers see unit sales of combines increasing during the year ahead and nearly 58% see sales declining. Projections from the U.S. dealers are even more dire with less than 4% seeing any chance of growing sales in 2015 and more than 60% forecasting decreasing sales. But nearly one-quarter (24%) of Canada’s dealers are projecting an increase in combine sales compared with 40% who expect sales to decline.

Demographics of 2015 Survey Respondents

Some 301 North American dealers participated in Farm Equipment’s “2015 Business Trends & Outlook” survey. The charts below show how the participants broke out by country, regions, mainline suppliers and dealer revenue sources. This year 86% of the respondents were from the U.S. and 14% from Canada.

Best Product Bets for 2015

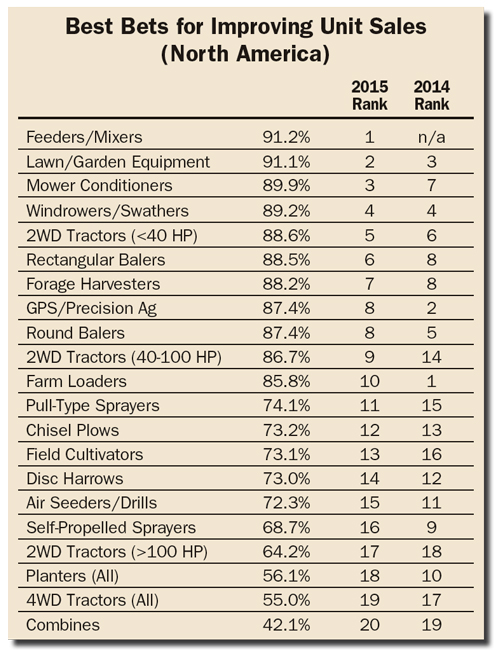

When it comes to which products have the most potential for increasing unit sales in the next year, of the Top 10, seven involve hay and forage equipment, including mid-size tractors. This would appear to indicate that dealers are acknowledging the strength of the livestock and dairy segments, which up until the last year or so, hasn’t had a lot to crow about. With demand rising and tight supplies of meat, livestock producers are getting back on their feet and spending money to upgrade their equipment.

After holding the #1 or #2 spot on the Best Product Bets list since the inception of the Dealer Business Outlook & Trends survey, GPS and precision farming equipment this year dropped down to #8 for 2015. In all likelihood, this reflects a combination of the slowing in large equipment sales during the past year, as well as more equipment coming with precision systems factory installed. This is reducing the volume of aftermarket systems being sold by dealers and forcing them to look for new areas of revenue growth in the precision farming segment.

For the first time since we started the survey, feeders/mixers were included as a product category and it occupies the top spot on the dealers’ list of best bets for the year ahead. Other hay and forage equipment in this year’s Top 10 include mower/conditioners (#3), windrowers/swathers (#4), rectangular balers (#6), forage harvesters (#7), round balers (tied with GPS/precision farming at #8) and 2WD tractors in the 40-100 horsepower range (#9) that are typically used by livestock and dairy producers.

In addition to GPS/precision farming, the only other products to crack the Top 10 list were lawn and garden equipment (#2) and tractors 40 horsepower and smaller, which would seem to mirror the recovery of the housing market.

At the bottom of this year’s list, as you might expect, are products associated to row-crop production and big ag. Easily coming in last, as it did last year, are combines (#20). The backlog of low hour harvesters is many dealers’ biggest challenge going into the new year. Several dealers have reported that they will not take combines in on trade until they can get their inventories in working order.

Not too far behind combines at the bottom of this year’s Best Bets list are 4WD tractors (#19), planters (#18), 2WD tractors in the 100-plus horsepower category (#17), self-propelled sprayers (#16) and air seeders/drills (#15).

2015’s Biggest Concerns

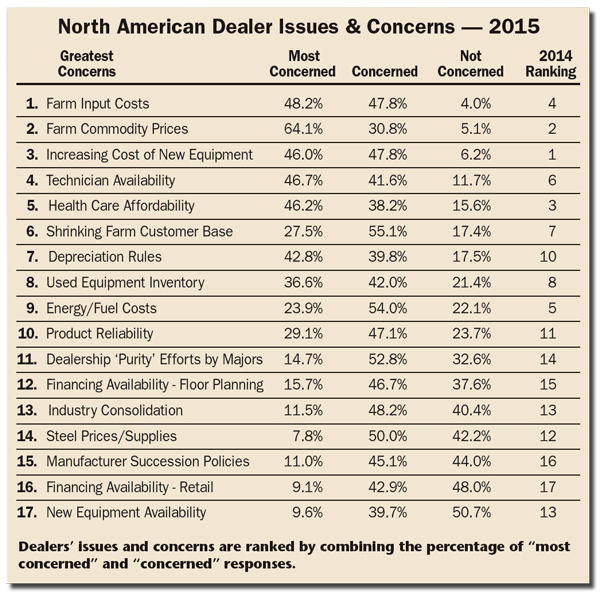

Essentially, dealers’ most vexing concerns for the year ahead are, in large part, the same ones they worried about last year and the year before that. There has been some rearranging of the biggest concerns for the year ahead, but the only issue to fall out of the top five is energy/fuel costs, which slipped down to the eighth spot for 2015.

This time around, farm input costs topped the dealers’ list of major concerns for the coming year. It barely edged out farm commodity prices.

We believe that worries about input costs center on high land rents, which along with falling commodity prices, could result in many farmers finishing this year in the red.

According to published reports, the high rents, which are based on the high commodity prices in recent years, will need to be renegotiated for 2015 or farmers will be forced to dramatically reduce their production and acreage in the next planting season.

Falling crop commodity prices is also high on the dealers’ worry list going into next year and could further stunt ag equipment sales. The increasing cost of new ag equipment, which occupied the top spot a year ago, slipped to #3 on the list — but not by much.

The availability of qualified technicians came in at #4, while health care affordability rounded out the top 5 biggest concerns for dealers.

Post a comment

Report Abusive Comment