In its Feb. 4 Ag Finance Databook and Feb. 15 Ag Credit Survey report, the Federal Reserve Bank of Kansas City characterized current credit conditions as “stabilized modestly but continuing to show signs of weakness … despite signs of stabilizing in the fourth quarter, bankers’ expectations were for loan demand to strengthen and loan repayment rates to weaken slightly in the first quarter of 2018.”

According to the KC Fed, farm lending at commercial banks increased sharply in the fourth quarter, and “all types of loans except farm machinery and equipment increased significantly from a year ago. The total value of operating loans and livestock loans increased almost 50% from the fourth quarter of 2016 but was still below 2014 and 2015 levels.”

Farm Credit Perspective

While the report notes that farm equipment loans did not increase in the past year, Brian Legried, senior vice president of AgDirect, says the volume of machinery loans was very similar to what the lender saw a year ago. “We haven’t seen any significant uptick, nor have we seen any softening in the marketplace.” And as far as the loan mix of new equipment vs. used, he hasn’t seen a significant shift. Overall, he says, used equipment values have firmed up and inventories have been reduced.

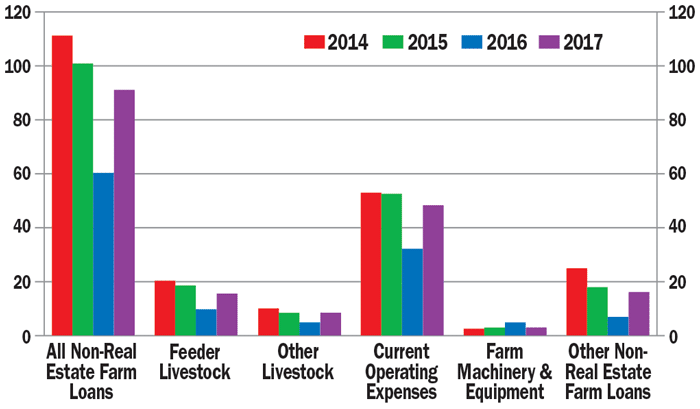

Non-Real Estate Farm Loan Volumes by Purpose — 4Q17

Demand for all types of loans except farm machinery and equipment increased significantly from a year ago, as overall farm lending increased in the fourth quarter 2018.

Source: Agricultural Finance Databook, Fed Reserve Bank of Kansas City

Looking ahead, Legried says, “While the current environment is challenging, the changes that producers have made — and continue to make — to their cost structures will position them to be all that more profitable when margins improve. It also will help American agriculture to be more competitive globally.”

Working out of the Mid-Atlantic and eastern regions, Mary Henry, vice president and district sales manager for Farm Credit Express, says, “We were pleasantly surprised with the volume that we did last year.” She noted strength in late mode, used equipment. “We also saw solid volume numbers in both farm implements and new shortline units. In general, farmers started replacing equipment and are really looking for value,” which she says resulted in an uptick in borrowing for good used machines.

At the same time, Henry adds, the overall mix was very good. “In the past year, we had the opportunity to serve the part-time market, which was coming back. We saw a nice push on irrigation equipment at the beginning of the year,” she says, “The end of the year was OK, but farmers pulling the trigger to buy, started extremely late. Overall, we were pleased that with the volume in the pipeline coming into this year.”

At this point, Henry adds, the dynamics are different than a year ago, with tax reform, stock market corrections, and rising interest rates, as well as other important policy issues in play. “I think the Fed’s intent is much the same as last year, which included three adjustments to the short term rates of a quarter percent each.”

Subtle Changes in Lending

On the other hand, Troy Price, a former equipment auction company executive, says he has seen a subtle shift in lenders’ approach to ag lending. “Even into the fourth quarter of last year, lenders, particularly community and regional banks, were telling us their ag portfolios were clean and they weren’t experiencing any stress. But as we come into the first of the year, lenders say they’re seeing changes that will change the way they provide ag loans. This tells me that the bankers are seeing a change in cash receipts and some farmers aren’t able to service their debt, which is making the lenders start to take a closer look.”

There is a second factor that Price says also appears to be weighing into current credit conditions. He says traditionally, when it comes to borrowing money, agriculture has been on the honor system. “Farmers typically turn in a balance sheet and an asset list to their banker with what they think are the value of the assets. But, all of a sudden, lenders are beginning to question those asset values.

“As a result, we started seeing an increase in requests for appraisals. In other words, they are re-evaluating those values, which were overvalued for quite a while, and checking to see if they’re accurate. So, banks are tightening their credit policies and increasing loan requirements. When farmers are below a certain score, their operating line gets pulled. Or, in some cases, banks are telling them to sell excess assets to create some cash.”

This is also happening with dealer inventories, says Price. (See also “Lenders Looking Closer at Ag Loans” below.)

Lenders Looking Closer at Ag Loans

Much like the Kansas City Fed’s most recent ag credit report, the February report from the Federal Reserve Bank of Chicago noted further deterioration in agricultural credit conditions in the fourth quarter of 2017. “District states saw a continuation in the tightening of credit standards relative to a year ago, as 46% of the survey respondents reported their banks tightened credit standards for agricultural loans in the fourth quarter of 2017 relative to the fourth quarter of 2016 and 54% reported their banks kept credit standards essentially unchanged.”

A senior business economist for the Chicago Fed says a Wisconsin banker provided an interesting take on this matter: “While credit standards are not tightening, we continue to be more disciplined in gathering quality financial information on a regular basis and monitoring accounts.”

His report went on to say that “18% of responding bankers noted that their banks required larger amounts of collateral for customers to qualify for non-real-estate farm loans during the October through December period of 2017 relative to the same period of a year ago, and none required smaller amounts. As of Jan. 1, 2018, the average interest rates for farm operating loans (5.34%) and feeder cattle loans (5.44%) were at their highest levels since the first quarter of 2012. The average interest rate for agricultural real estate loans (4.93%) was last higher during a spike in the fourth quarter of 2013. However, after being adjusted for inflation with the Personal Consumption Expenditures Price Index, all these interest rates were at their lowest levels since the first quarter of 2017, as an uptick in inflation was higher than the increases in farm interest rates.”

A John Deere dealer surveyed by Farm Equipment has already noticed how tougher scrutiny is impacting customers’ ability to acquire loans. “Local banks are influencing customers’ decisions to buy even when they would use manufacturer lending. Local banks are tightening spending controls on their customers’ operating loans.” Another Deere dealer added, “Higher rates are raising the amount growers pay and banks are saying no go!”

There is a third trend that has started to emerge in ag lending in recent months that involves dealer financing, according to Price. “We’ve started to see an increase in suppliers, particularly fertilizer and seed companies, picking up operating lines of credit for growers after their bank stops loaning them money. Those suppliers are taking on some additional risk by extending lines of credit or increasing its availability so their farmers can get the inputs they need to plant a crop. Fortunately, money is still cheap, so the risk isn’t as great as it was in the ‘80s, but I am concerned.”

Are Rising Rates an Issue?

The wild card in the current lending conditions outlook seems to be the inevitable increases in interest rates. It’s a given that higher rates are coming, and this is a worry for a lot of bankers and farm equipment dealers.

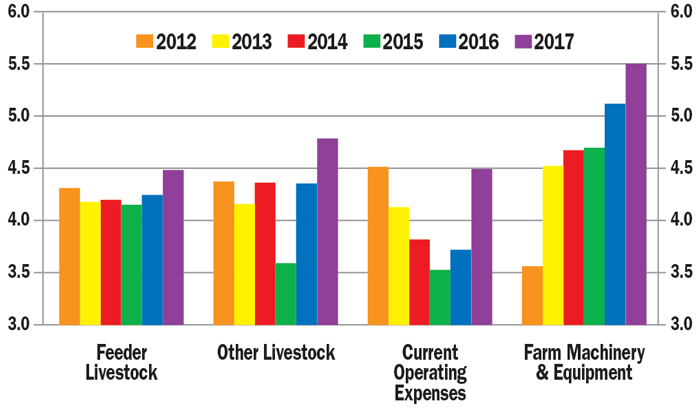

According to the Ag Finance Databook report, the average size of farm loans at commercial banks increased alongside rising interest rates during the final part of 2017. “Interest rates on all types of farm loans increased in the fourth quarter, continuing a trend of recent years. Rates on loans used to finance current operating expenses increased nearly a full percent, from 3.7% in 2016 to 4.5% in the fourth quarter of 2017. In addition, for the first time since 2014, more loans were issued with interest rates greater than 6% than loans with rates of 3% or less.”

Interest Rates on Non-Real Estate Farm Loans — 4Q17

According to USDA, in 2017 real estate interest expenses were expected to be the highest since 1989, and non-real estate interest expenses were 23% higher than in 2013.

Source: Agricultural Finance Databook, Fed Reserve Bank of Kansas City

Earlier, USDA reported interest expenses on farm loans have risen steadily since 2013. “In 2017 real estate interest expenses were the highest since 1989, and non-real estate interest expenses were 23% higher than in 2013.”

While the pace of decline in farm loan repayments rates slowed in the latter part of last year, the higher rates are putting ag lenders somewhat on the defensive. The KC Fed report goes on to say, “As farm loan demand remains strong, higher interest rates will lead to an increase in interest expenses for some borrowers. In addition, higher interest rates could put some downward pressure on farmland values over time.”

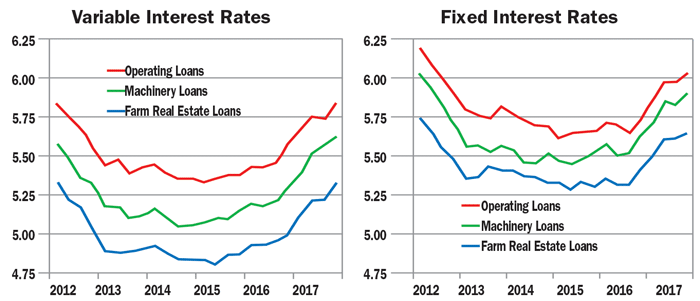

10th Federal Reserve Bank District Avg. Interest Rates

Fixed interest rates on all types of farm loans have increased since the first quarter of 2015, and variable interest rates have increased almost 40 basis points since 2016. As farm loan demand remains strong, higher interest rates will lead to an increase in interest expenses for some borrowers.

Source: Agricultural Finance Databook, Fed Reserve Bank of Kansas City

So far, it’s been the relatively stable value of farmland that has kept ag lenders’ pocketbooks open. But rising interest rates does give them one more thing to think about. Which means equipment dealers have more to think about, as well. Not only will retail financing cost more, putting pressure on farm customer’s bottom lines, but, in all likelihood, the expenses associated with dealer floorplans will also take a hike.

Dealers Expect Higher Rates

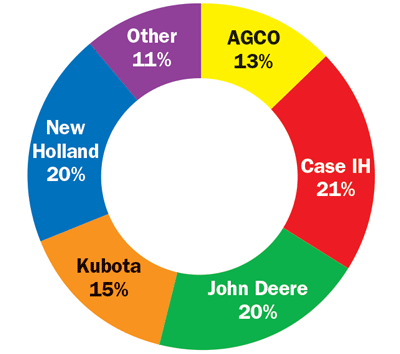

Dealer Credit Conditions Survey Participation

Each of the major equipment brands were represented in the dealer survey of ag credit conditions conducted by Farm Equipment in early Feb. 2018.

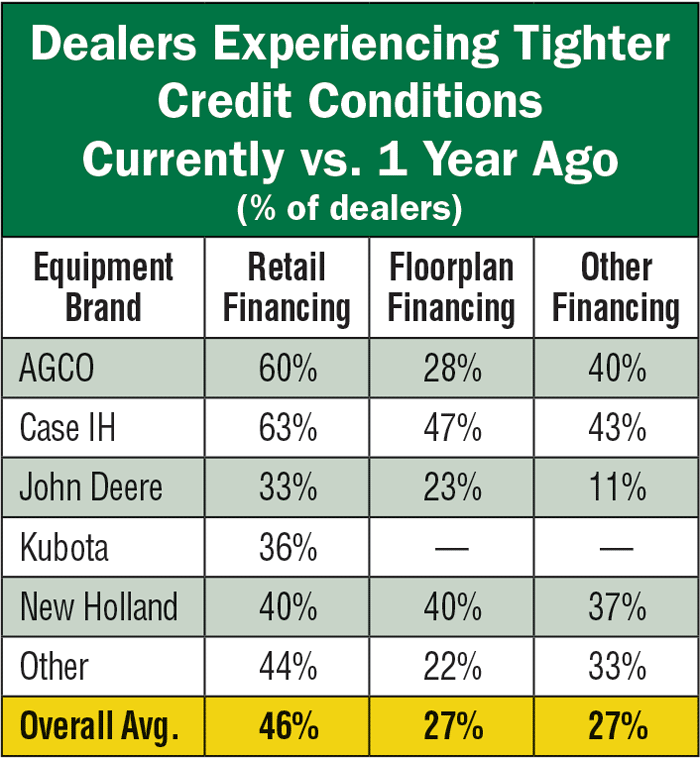

Overall, most farm equipment dealers surveyed by Farm Equipment during the first week in February, see interest rates rising in 2018, but less than half of them say they’re experiencing tighter credit conditions than they were a year ago. Only 46% of the dealers report tightening conditions for retail loans, while, even fewer, 28% say conditions for floorplan financing have gotten tougher.

On average, dealers say their current interest on retail financing is about 5.56% and 5.91% for floorplan credit. Admittedly, these are “very rough” estimates at best, as some dealers indicated their typical interest rate was variable, others reported their rates were prime plus a varying percentage. Others explained interest rates they were paying are different depending on whether the loan originated from their supplier or from a bank. In these cases, bank rates were typically lower than that offered by the dealer’s supplier.

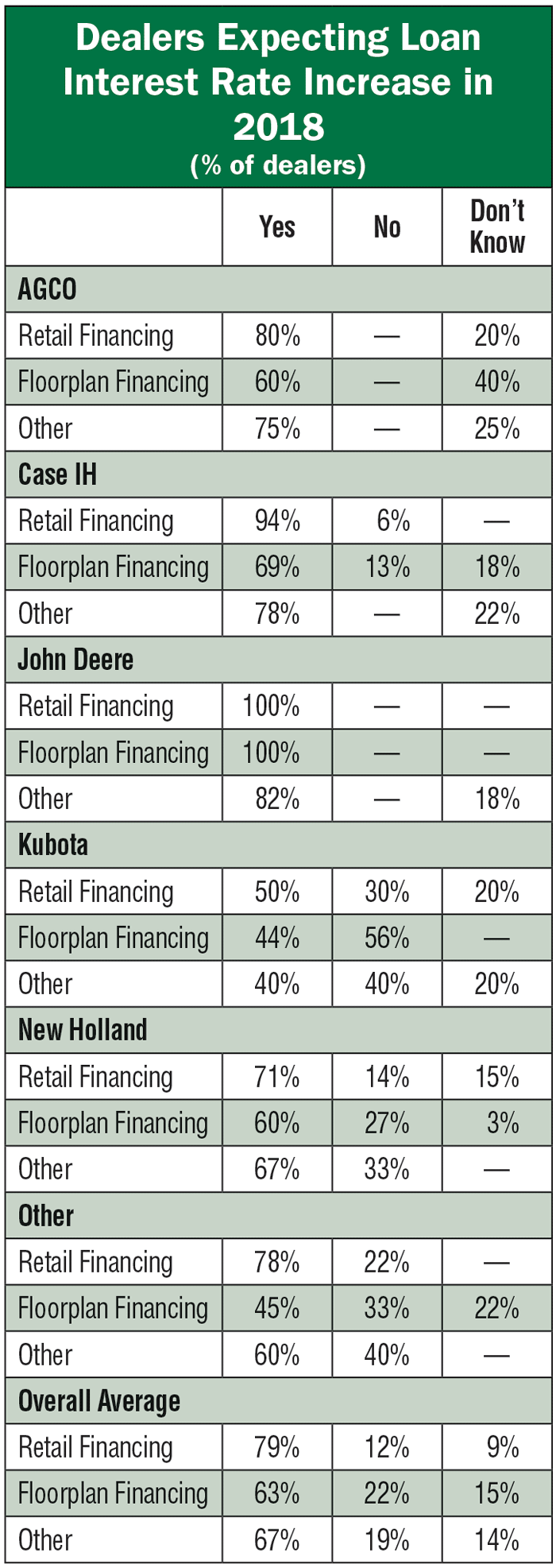

As for their expectations about the state of rates in the year ahead, 81% of dealers anticipate financing for retail loans to get more expensive, 11% do not think they’ll see a rate increase in 2018, while 8% don’t know.

Most dealers also expect floorplan financing to be more costly this year. Overall, 65% are planning for higher rates, 20% aren’t projecting an increase for their floorplanning, and 15% don’t know.

For most in the financial world, interest rate hikes in the months ahead are a foregone conclusion. Dave Hoyt, vice president of finance and treasurer for Farm Credit Services of America, says, “The financial markets currently anticipate 3 short term rate hikes of 0.25% each, with the first expected in March.”

Impact on Buying Decisions

Hoyt goes on to say, “While higher rates could have a slight negative impact, we would expect other factors impacting producer profitability, such as commodity prices, to play a bigger role.”

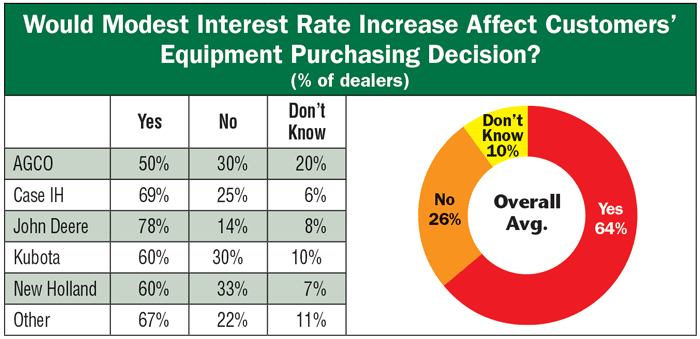

Many dealers agree with Hoyt’s sentiments, but most anticipate higher rates will give equipment buyers reason to pause before signing on the bottom line for a new machine. In fact, two-thirds (67%) of farm equipment dealers surveyed believe that even a “modest” interest rate increase will affect their farm customer’s decision whether or not to purchase equipment in 2018.

Echoing Hoyt’s comments, one Case IH dealer adds, “Interest rates and borrowing conditions are small issues compared to the prices they [farmers] are paid for corn, soybeans, milk, hogs and cattle.” But another says, “With low commodity prices and narrow margins, rates are a big concern.”

According to another Case IH dealer, the farmer’s cashflow is the key. “The purchase is always about the payment. If the customer can cashflow the payment they will buy. If they can’t, they don’t buy.” A John Deere dealer adds, “Due to the heavy debt load of dairy customers, an increase in interest may cause them not to have the cashflow to afford more debt. Many farmers cannot afford an interest rate shock of more than 0.5-1%.”

Several dealers add that any rate hike will be tough on those customers who got used to the 0% financing package that some manufacturers have been offering. “I’m not sure we can ever get above 0% financing,” says a Kubota dealer. “Manufacturers can’t seem to work together long enough to ever break the 0% cycle.” One shortline dealer agrees. “Customers have gotten so used to these 0% rates, I am concerned that we may see deals lost as consumers adjust [to higher rates].”

Changes Ahead

In his February 2018 report, David Oppedahl, senior business economist for the Federal Reserve Bank of Chicago, seemed to sum up the state of agricultural lending in 2018, at least in his district, which includes Michigan, northern Illinois and Indiana, and much of Wisconsin and Iowa.

Will Higher Interest Rates Shock Millennials?

Mary Henry says that she’s begun hearing rumblings about interest rates rising “to the sixes again.” That’s 6% rates on loans. Henry, vice president and district sales manager for Farm Credit Express, part of the Farm Credit System, says, “That’s a level we haven’t seen for a long time.”

What that means, she says, is “We are faced now with a generation (the millennials) that have only seen low rates. Baby Boomers and some others had to manage through the early 1980s when interest rates were in the teens. But we have a generation now that hasn’t seen anything like this.”

And there’s another dynamic to the current trends in borrowing that this generation has gotten used to, she says, “When it comes to equipment and other major purchases, everyone has gotten used to long buy downs from manufacturers. It went from 3 to 4 years prior to rates reaching all-time lows, to 5, 6 and 7 years in some cases. This generation of buyer has only seen cheap money because the buy down power was so great.”

She wonders how they will react when changes in that dynamic occur, which could be sooner than many anticipate. “I think the new rate environment may shock them.”

“Given the challenging times facing agriculture, it’s not surprising that an Iowa respondent stated, ‘Several area banks are putting pressure on producers with tight margins to either sell land or refinance with another bank.’ More surprisingly, survey respondents indicated that only 2.5% (lower than a year ago) of their farm customers with operating credit in 2017 were not likely to qualify in 2018; however, this proportion was 4.9% in Michigan and 3.2% in Wisconsin.

“Responding bankers expected non-real estate agricultural loan volumes to be higher in the first quarter of 2018 relative to the same quarter of a year earlier, as volumes for operating loans and loans guaranteed by the USDA’s Farm Service Agency were forecasted to be higher.”

Commenting on capital expenditures, including ag equipment, Oppedahl adds that loan volumes for grain storage, farm machinery, feeder cattle and dairy loans are forecasted to be lower in the January through March 2018 compared to the same period of 2017. The majority of survey respondents (agricultural banks) anticipated capital expenditures by farmers would be lower in the year ahead compared with the year just ended — for the fifth year in a row.