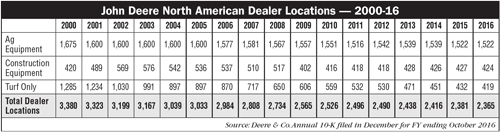

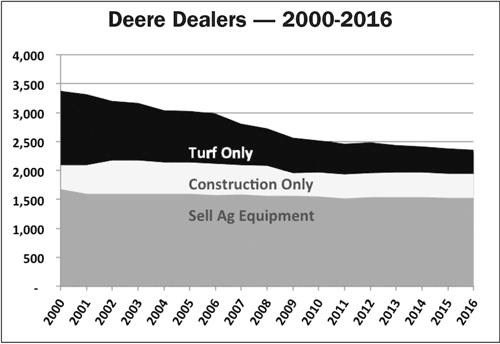

There’s little doubt that there are fewer farm equipment dealers than there were a decade ago, but, in the case of John Deere dealer locations, the change isn’t as significant as you might think. The biggest reduction in Deere dealers has come in the retail locations handling the company’s turf equipment.

As reported in the 2017 Big Dealer report, compiled by Ag Equipment Intelligence editors and the Machinery Advisors Consortium, since 2000, Deere & Co. dealerships, including ag equipment, construction equipment and turf products, in total have decreased by nearly 30%.

During the timeframe, the number of Deere ag equipment dealers have declined by less than 10%. (See table below.) At the same time, the company’s construction equipment dealers are up by 2%, since 2000. But they had increased by 156 locations between 2000-03, when they peaked at 576 locations. Since then, CE dealers have decreased by 149 stores, or about 26%.

The biggest loss of Deere dealers came in those handling turf equipment. From a high of 3,380 dealers in 2000, Deere’s turf equipment dealers declined by more than 1,000 store locations by 2016. Today, the number of retail locations handling Deere turf products is down by about 66% since 2000.

“JD turf dealers have always struggled to make money,” says George Russell, co-founder of the Machinery Advisors Consortium, and co-author of the Big Dealer report.

This information is excerpted from Ag Equipment Intelligence’s 2017 Big Dealer report