Farm Equipment

Future-Planned Facilities

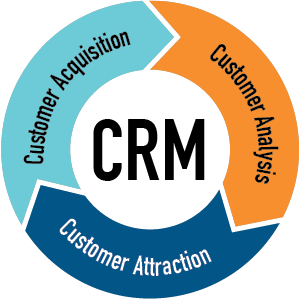

A large industry is evolving that is attempting to collect and analyze data to predict and expand future sales. It’s not just in the car business, but in almost every major industry. That’s because technology now exists to anonymously track the Internet habits of millions of customers. By combining this with what is already known about the average buying habits of consumers and utilizing CRM tools, targeted marketing programs can be sent to likely customers early in the purchasing process.

Like it or not, we live in a world where large amounts of data are available on almost every customer because so many do their shopping, research, pricing — and in many cases, purchasing — online. Every click is being monitored. By comparing the Internet habits of vast amounts of people, the culmination of the shopping cycle can be predicted in a fairly consistent manner. It’s called predictive analytics and it’s being pursued extensively by the automotive world.

Like it or not, we live in a world where large amounts of data are available on almost every customer because so many do their shopping, research, pricing — and in many cases, purchasing — online. Every click is being monitored. By comparing the Internet habits of vast amounts of people, the culmination of the shopping cycle can be predicted in a fairly consistent manner. It’s called predictive analytics and it’s being pursued extensively by the automotive world.

Predictive analytics experts are using big data to answer the question, “What do people who have been doing what they’ve been doing tend to do next?” They’ve found that the majority of information gathering for car shoppers starts about 6 months before the purchase. The typical customer goes through several periods of intense online shopping, and when they reach a fairly common point, they’ve made a decision and will likely purchase within 72 hours.

Eric Brown is CEO of Dataium, a firm that specializes in gathering vast amounts of data for the…