June 25, 2013

The word on the street is John Deere will once again allocate combines in 2014 and may even reduce its allocations to help its dealers get their arms around the used combine situation that’s been making a lot of dealers nervous for at least the past 3 or 4 years.

No one should be surprised by Deere’s decision and don’t be surprised if they reduce the allocation to dealers who are struggling to get their inventories under control.

Ag Equipment Intelligence’s June “Dealer Sentiment’s & Business Conditions Update” report indicates that 46% of North American dealers continue to rate their used combine inventories as “too high.” This is up from 36% in the previous month and the driver in Deere’s decision to restrict the number of new combines it will make available for next year.

This compares with 32% of dealers who say their overall used equipment inventory remains too high.

And, of course, the age-old dealers’ adage that used equipment seldom appreciates in value over time is also proving to be the case, particularly with combines.

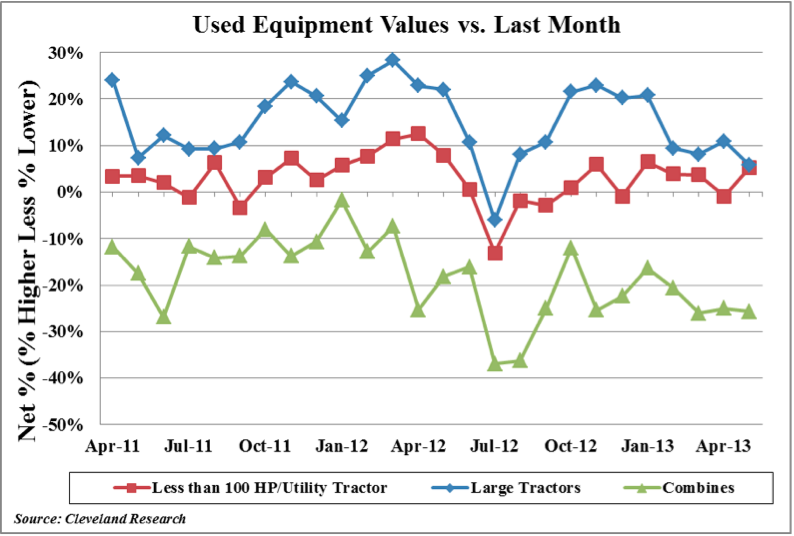

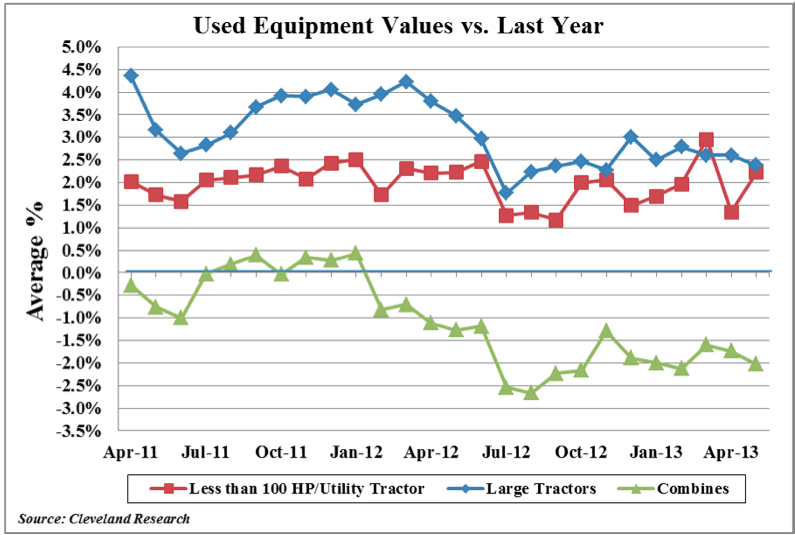

According to the most recent Dealer Sentiments report, 26% of dealers say used combines values are lower than they were in the previous month. Year-over-year, the value of these units continue to decline as shown in the adjacent charts, while the value of used tractors are holding their own.

If you’ve read our interview with Univ. of Purdue professor Mike Boehlje in the June issue of Farm Equipment, you’ll note that those who were hurt the worst in the last “big” farm equipment downturn in the early 1980s were not farmers as many would have you believe. It was the equipment dealers when one out of every four of them closed their doors or were “merged out of business.”

Those who lived through that period say that what got many of those dealers was their high used equipment inventories. Considering how the value of ag machinery has escalated since then, dealers can find themselves in an even more tenuous situation.

I don’t think dealers need to be reminded that when an agricultural downturn hits, most farmers have a government safety net that provides them with a soft landing. Dealers don’t. As Boehlje says, in his own way, “That situation hasn’t changed. This is very problematic if we think about what could happen going forward.”

|

Dave Kanicki Executive Editor Farm Equipment dkanicki@lesspub.com |