Technological advances, sustainability initiatives and labor shortages are among the significant trends driving the agricultural equipment market. Growers’ use of equipment is indispensable in running their operations, but it also increases the impact that economic and financial conditions like interest rate increases, tightening credit and supply chain issues have on their bottom line. The Equipment Leasing and Finance Assn. (ELFA) and its affiliate, the Equipment Leasing & Finance Foundation (Foundation), provide timely research and business intelligence that focus on issues around equipment acquisition and its financing.

Equipment Investment Growth Forecast

Overall equipment and software investment growth was strong in the second quarter of 2023, expanding at a 5.3% annualized rate after contracting in Q1. However, due to tightening credit availability and a pullback in expansion plans by businesses in anticipation of slower economic growth, equipment and software investment growth is expected to slow through the remainder of the year. According to the Foundation’s 2023 Equipment Leasing & Finance U.S. Economic Outlook, the estimate for equipment and software investment growth is 3% annualized, and annual GDP growth of 2.3% is forecast in 2023.

Equipment Investment Activity

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor identifies turning points in the investment cycles of 12 key equipment investment verticals. The October 2023 release shows one vertical is expanding, 8 are recovering, and 3, including agricultural machinery, are weakening. Investment in agricultural equipment improved 29% (annualized) in Q2 2023, but was still down 25% from its year-ago level. The October Momentum Monitor indicates that agricultural machinery investment growth is likely to remain weak or negative over the next 6 months.

On the production side, agricultural machine producers will continue to experience slightly improving supply chain conditions in the near term. The increasing availability of inputs such as natural rubber for tires and tracks, seat cushion foam and wire harnesses will ease some of the delays for new equipment carried over from the peak of the pandemic, according to a new Foundation supply chain study.

Equipment Finance Activity

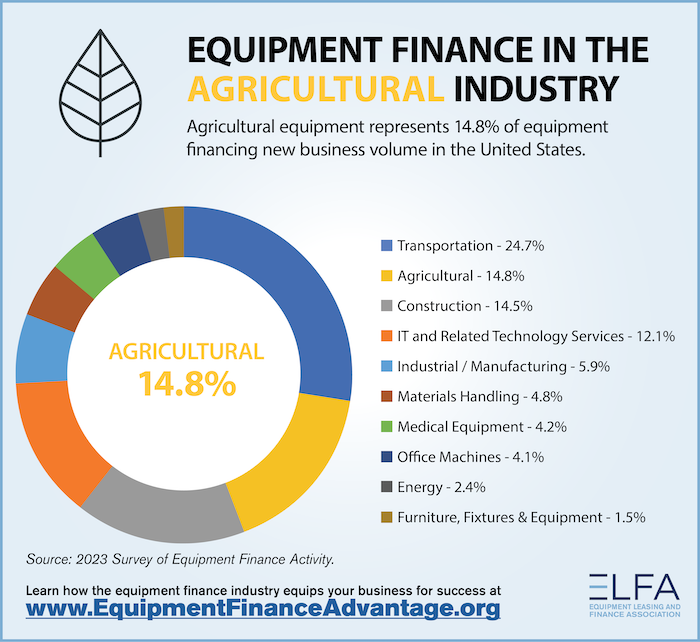

Nearly 8 in 10 U.S. businesses use equipment leasing and financing to acquire the productive assets they need to operate and grow. The agricultural sector is consistently among the top users of equipment finance, and agricultural equipment is among the top-financed asset types. In 2022, the agriculture industry was the second ranked end-user industry representing 16.4% of new business volume reported by ELFA member companies. Agricultural equipment represented 14.8% of equipment financing new business volume making it the second most-financed equipment category in 2022.

The ELFA’s Monthly Leasing and Finance Index, which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed that cumulative new business volume in September 2023 was down 5% from September 2022, and up nearly 2% year to date from 2022.

Why Finance?

Following are among the key benefits of equipment financing to consider for your customers:

- Flexibility. Financing solutions — especially leases — are flexible and can be customized to specific accounting, tax or cashflow needs. Some types of leases allow for seasonal business fluctuations, or lower monthly payments while a project is ramping up (or a crop has yet to be harvested) and revenue is not yet being generated from the equipment.

- Improved expense planning. Instead of considerable capital outlays resulting in huge budget fluctuations, financing enables even expense planning.

- Up-to-date technology. Funding equipment acquisitions through term financing enables growers to acquire more and better equipment than they could have without financing. Certain leasing programs can also allow for technology upgrades or replacements within the term of the lease contract.

- Asset management. Many financing companies offer asset management programs that track equipment throughout its life cycle from delivery to installation, use and maintenance, to de-installation and disposition.