Trying to value planters can be a tricky process. According to Andy Campbell, industry analyst with TractorZoom, he’s even had one dealer tell him it gives them night sweats. To help dealers make sense of the market, Campbell and TractorZoom Data Scientist Hank Mandsager sat down for a webinar in March hosted by Farm Equipment to dive into the data that makes the planter market tick. Here are 5 key takeaways from the webinar to help you manage your used planter sales.

1. Dealer planter sales premium averages at 20%.

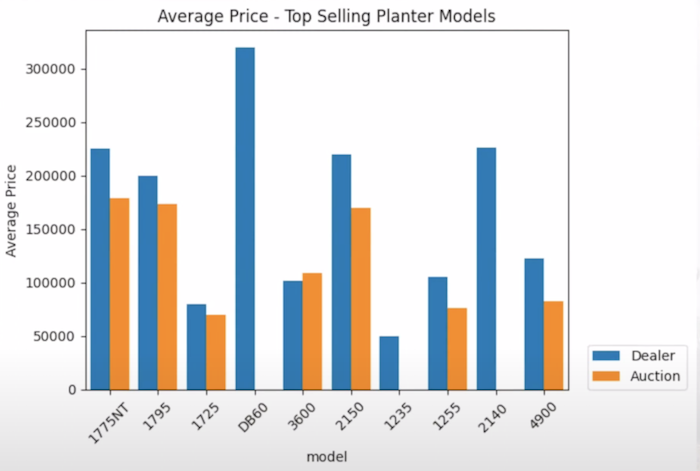

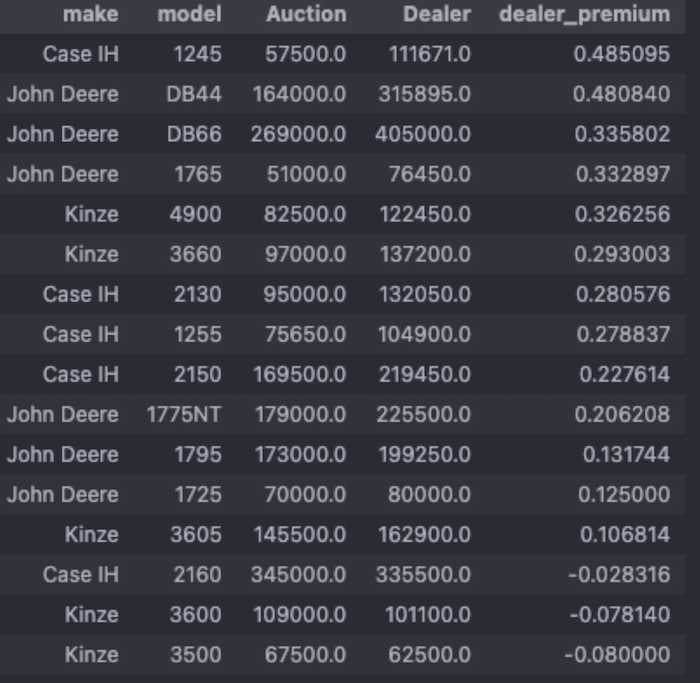

Looking at sales data on the 10 top planter models from TractorZoom, Mandsager says the average dealer premium hovers around 20%. He says the data should be taken with a grain of salt, as there’s noticeably fewer auction listings of planters in a given month than dealer listings.

Among the top 10 planter models, only one reported higher prices at auction vs. dealer sales.

Source: TractorZoom

Though auction data isn’t available on all models, the results show almost all planters sell for more at dealerships, save for the Kinze 3600, which goes for slightly more at auction on average. John Deere D860 planters are valued the highest at dealerships on average at over $300,000.

While most planter models command dealer premiums, there are some exceptions of which to be mindful.

Source: TractorZoom.

The planter with the highest dealer premium on average was the Case IH 1245 at 49%, while the lowest premium was on the Kinze 3605 at 11%.

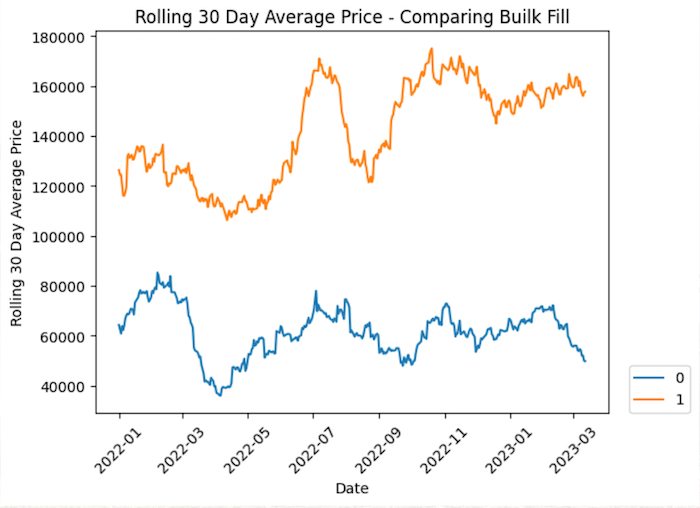

2. Bulk fill planters command high premiums, particularly on smaller planters.

The data also shows planters with bulk fill delivery systems (orange line) commanding a premium of 30-40% over those without the tech (blue line). Mandsager says that both small and large planters are seeing premiums in that 30-40% range, though they can be more significant for smaller planters.

Planters with bulk fill technology have, on average, seen rising prices since the start of the year, while those without bulk fill have seen declines.

Source: TractorZoom

“We’re looking at 12-31 row planters, which is where we have a lot of data,” says Mandsager. “In general, there’s a large premium put on bulk fill. One thing that we want to keep in mind is bulk fill might be a relatively new feature for planters. Even if you focus on planter model years of 2015 or newer, we’re still seeing a 30-40% premium on bulk fill.

“Looking at 12-row planters, we’re seeing a mean average price of about $23,000. And then with bulk fill $85,000. It is a significant premium on those smaller planters. And as you get up toward the 24-row planters, it’s still a large premium. Without bulk fill, we’re looking at an average price of about $105,000, but with bulk fill closer to $160,000.”

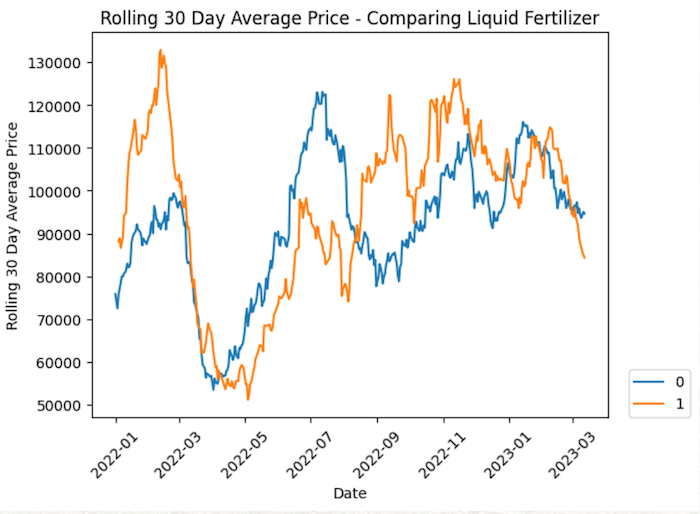

3. Tougher premiums on liquid fertilizer.

Planters with liquid fertilizer application technology are commanding a notably low premium, and in some cases, no premium at all. Mandsager says premiums have been particularly lower in the first and second quarters of this year

Auction vs. dealer prices on planters with liquid fertilizer are generally a mixed bag. The most recent data shows dealer prices surpassing auction prices in the first half of March.

Source: TractorZoom.

While he says it can depend on the region and the farmer, Campbell theorizes the mixed bag on liquid fertilizer premiums could have to do with the extra weight and labor involved.

“I was assuming the opportunity to apply while you’re planting, meaning possibly one less pass on the field, and the benefit that it provides is great,” says Campbell. “But once I saw it was a bit of a mixed bag, I started asking a couple farmers we work with, and they mentioned the weight it requires and the extra labor that goes into it if you have a larger planter.”

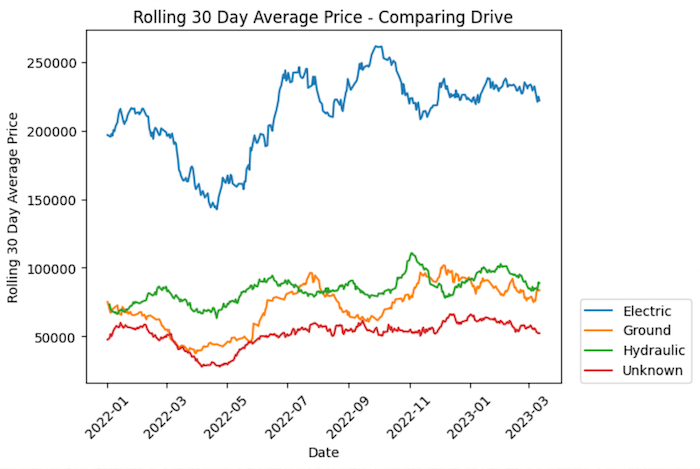

4. Electric drives price higher than ground and hydraulic drives.

Another feature reporting higher dealer premiums is electric drives. Mandsager notes that the “Unknown” line on the graph comes from the listings that don’t list a drive type.

So far in 2023, planters with electric drives have commanded the highest price, followed by hydraulic drives.

Source: TractorZoom

Like with bulk fill technology premiums, Mandsager says it’s important to remember electric drives, as a new tech, will likely be newer planters, which are inherently worth more.

“Just because this [blue] line is at $200,000 vs. the green line at $100,000, that doesn’t mean it’s worth twice as much,” he says. “You want to also look at how new the planter is, the size of the planter and then other components as well. This is looking at drive on its own, but you’ve got to keep in mind that the hydraulics are going to be a slightly older planter most likely.”

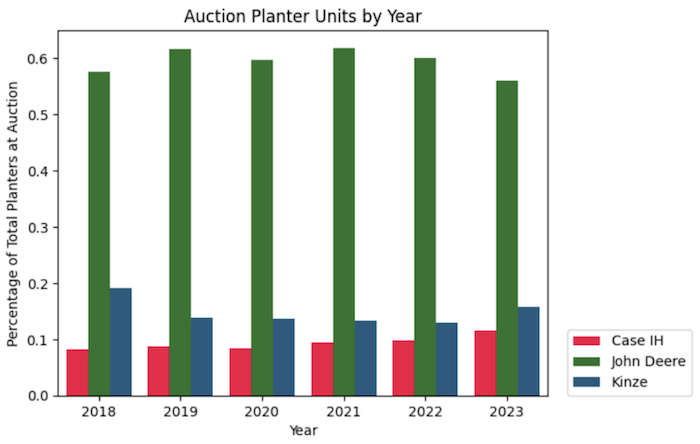

5. Case IH & Kinze are closing their auction market share gap.

Looking at OEM market share over the last 6 years, Mandsager notes that Kinze and Case IH have closed the gap in their auction market share. John Deere has also seen a decline in its overall market share since 2021.

The last 2 years have seen Deere's planter auction market share drop, while Kinze and Case IH have reported gains.

Source: TractorZoom

“On the John Deere side, we saw it oscillate from 2018 to 2022, but roughly it held in that 60% range,” says Mandsager. “The one interesting point I want to pay attention to is that we’re seeing that Case IH and Kinze gap shrink over the last couple years. You can see Kinze dropping and Case IH coming up. We’ll be looking to see if that trend continues into 2023.”