Most farm equipment dealers will tell you that at least part of the surge in new equipment sales during the past few years was fueled by generous depreciation rules. Despite this, the February 2013 issue of USDA’s Amber Waves suggests that it will be the larger farm operations that will be most affected by the upcoming changes to the rules.

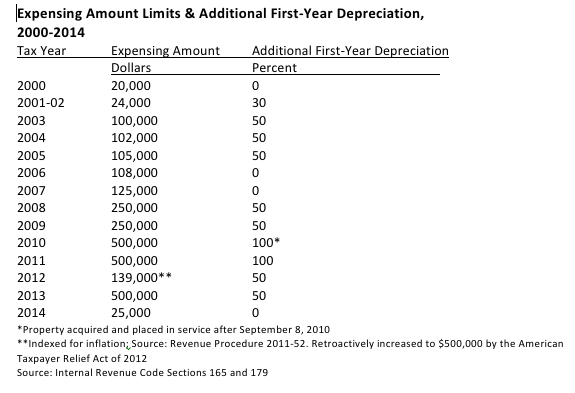

The ability of business owners, including farmers, to deduct the cost of depreciable capital in the year of purchase reduces their tax liability and encourages additional investment. Although the cap is scheduled to drop in 2014, the American Taxpayer Relief Act of 2012 extended provisions allowing depreciable property to be expensed currently, while retroactively raising the 2012 expensing limit. Based on the 2010 Agricultural Resource Management Survey (ARMS), about 18% of all farms reported investing more than the prior 2012 expensing limit of $139,000, while just over 1% invested more than the revised limit of $500,000.

If the expensing limit drops to $25,000 in 2014, as current law provides, large farms would be affected most. Less than 20% of smaller farms — those with less than $250,000 in annual sales — invested more than $25,000 in 2010, while nearly 55% of large farms reported capital purchases exceeding that amount.

—Ag Equipment Intelligence, March 2013

To subscribe to Ag Equipment Intelligence click here.