Whether you’re looking to reel in a customer of another color or more intent on keeping your competitor off your customers’ farm, these dealers share their practical insights on the subject.

Mike Lessiter, Editor/Publisher

When asked about brand loyalties, John Schaff, Foley Implement Co., Foley, Ala., recalled the emotional depth — and lifecycle — of brand decisions. “Some of my older farm customers went from mules to red or green tractors. They had a lot of pride in their choice.”

Brand loyalty is still very strong today, but “color-blindness” in farm equipment buying decisions appears to erode a bit every year. Dealership closings and consolidations are affecting local decisions, and farming increasingly requires more business-based decisions and fewer emotional ones. And there’s more product information to be devoured from an endless list of sources. At the same time, the major manufacturers’ emphasis on market share metrics has brought unprecedented — and cut-throat — competition.

Brand loyalty is still very strong today, but “color-blindness” in farm equipment buying decisions appears to erode a bit every year. Dealership closings and consolidations are affecting local decisions, and farming increasingly requires more business-based decisions and fewer emotional ones. And there’s more product information to be devoured from an endless list of sources. At the same time, the major manufacturers’ emphasis on market share metrics has brought unprecedented — and cut-throat — competition.

The vast majority (90%) of dealers that Farm Equipment had dialog with say brand loyalty has declined over the last 5 years. Yes, the farm equipment retail industry of 2011 is certainly “not your father’s industry.”

Brand Loyalty — Good or Bad?

Though nearly all dealers recognize brand loyalty is declining, there’s no agreement on whether it’s a good or bad thing. In total, 54% view it as a positive trend, while 46% say it’s bad for their business. Clearly, one dealership’s customer gain is another’s loss, and those competing against the most established brands are more welcoming of the movement toward open-minded purchasing decisions.

Michael Laethem, Farm Depot, Caro, Mich., says that less brand loyalty is good for his dealership. “Instead, the loyalty is becoming more attached to the dealership, not the equipment.” Adds Carl Laux, Fisher Farm Lawn, Lafayette, Ore., “The best part is it makes us become better at selling the support side of our business.”

Among those who see the downside do diminishing brand loyalty say the manufacturers are making things worse by offering other-brand customers bigger discounts and deals to get their business. Some feel that this penalizes the most loyal customers. Dealers say the word gets out quickly when farmers are offered a better deal to switch brands.

Other dealers say it’s neither positive nor negative. “I consider brand loyalty changes more of a business characteristic of a mature industry, rather than a trend,” says Bill Garton, Garton Tractor, Turlock, Calif. “Most manufacturers offer good products, so if a satisfied customer tries another brand due to price or ‘I just want to try it’ mindset, it’s just part of the business.”

Mike Lynch, Vacin Inc., Humphrey, Neb., (who reports high levels of business even with a good dealer located immediately next door), says, “If you have good facilities, an up-to-date parts inventory, excellent and well trained technicians, and treat your customers with respect, they tend to stay with you.”

Even as things slowly change, it’s clear that the blinders are still on to a large degree. But as Schaff says, the younger farmers pore over a lot of information, and some just like to try something new. “The sellers of the bigger brands need to be aware, because nothing is for sure.”

Causes of Brand Switches

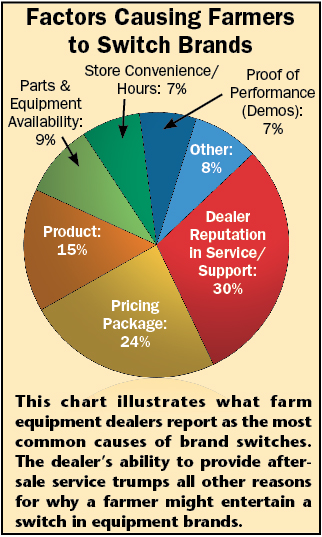

In looking at the list of factors that most often contribute to a brand switch (see chart on p. 50), it’s evident that the pricing package (including finance, warranty, etc.) and product are secondary to the dealership’s service and support record.

|

Dealer Takeaways

|

Herman Wilson, of Houston-headquartered Pioneer Equipment, says everything boils down to the dealership’s strength in support service, product reliability and economics. “The farmer switches when the manufacturer is not price-competitive, when the dealership failed to do what is fair even though not precisely covered by warranty, or the units have reliability problems. A lack of parts availability is a huge issue on new equipment.”

In most cases, the door to a brand switch is opened with the other dealer (or brand) shooting itself in the foot in some way. “Among the biggest reasons is dissatisfaction with their dealer, valid or not,” says Lynch. “You often hear, ‘They don’t value my business.’ The scary part is you also wonder how many times it been said about you.”

While Bob Mitrovich, Rainbow Ag, Windsor, Calif., sees brand-switching due to price, another contributor is the customer listening to his neighbor who has had a bad experience. Adds Lynch: “Perception is often more important than reality.”

Even after a farmer reaches a boiling point of discontent with the current dealer, there’s a psychological barrier to cross, says Todd Hopkins, Garden City Farm Equipment, Garden City, Kan. “They need to realize that another color can build a product as good or better and they also need to be mad enough that the harassment they will take for changing colors won’t matter to them.”

Relationships Key

The relationship is as key to winning a customer conversion as to thwarting another dealership’s efforts in stealing your customer. Craig Harthoorn, Brokaw Farm Supply, Fort Dodge, Iowa, says that a lack of customer follow-up, or waiting for the customer to pick up the phone, is asking for problems. “If the dealer stays in constant contact with the customer, it’ll reduce the opportunity for another dealer to slip in.”

On the other hand, an aggressive dealership can make a difference through diligent communication. “Dealer personnel must have the perseverance to stay on task of building the relationship with the prospective customer,” says Ron Straub, Straub International, Great Bend, Kan. “They must demonstrate the willingness to understand the farmer’s operation and needs before trying to make the sale. Then, show them the equipment and allow them to demonstrate the equipment long enough to see it for themselves.”

This, the communication quotient, is where a single-store can thrive. The change in business philosophies ushered in by the multi-store dealers don’t always sit well with local farmers. Says one dealer-principal, “We have more at stake than the managers at multi-stores, and we can take care of our customers on a more personnel level.” (See “Multi-Stores Can Open the Door to Brand Switches” sidebar).

As many dealers shared, any sign of instability — at both the major-line level and with the dealership — can cast doubt in farmers’ minds. Regular communications can neutralize the rumor mill and coffee-shop talk.

|

On-the-Farm Help: How the Major Manufacturer Assists in Color Conversions Farm Equipment asked dealers how they leverage the strengths of their major line to execute a color conversion. Among the most cited were promoting their major’s longevity/stability, resources in competitive intelligence, factory tours, parts availability (overnight delivery), service/warranty and resale strengths. But one of the biggest differentiators, according to both Birkey’s Farm Stores and Straub International, has been the path that Case IH has taken with getting company officials out on the farm, working with the dealer. “Case IH invested heavily in product specialists that we can call on to help show the customer the advantages of the equipment,” says Ron Straub, Straub International, Great Bend, Kan. “We also have a great territory representative who is valuable in the getting the deal. These guys want to be on the customers’ farms and they get there often. They back it up with good programs and finance options to help close the deal.” |

Knowledge: Making an Impression

Besides dissatisfaction with a product or dealer, knowledge can be a game-changer. Exhaustive knowledge of a product and competitor’s product as well as a deep understanding of a particular application.

Greg Simpson, Simpson Farm Enterprises, Ransom, Kan., says brand changes arise when a farmer seeks a specific expertise that his current dealer can’t offer, which he says is most often seen with farmers unmarried to a specific color. Harthoorn says that a dealership can build a unique selling proposition around this, noting that his firm leverages it technical strength, including its service fleets and precision ag expertise.

C.L. Williams, Medlin Equipment Co., Sikeston, Mo., says that conversion success often comes with a new salesman who possesses a strong desire to succeed and is familiar with the local area and customers. Another contributor, he says, is constant training of salesmen and mechanics on the newest technology. “We get the word out to farmers through seminars, meetings, open houses, appreciation dinners, etc. to show how the dealership is trying to stay up with or ahead of the learning curve. The farmer wants to go to someone who can help them or know someone who can.”

Once the base work is done and the farmer is open to defecting from his primary brand, the demo is where the rubber meets the road. Several dealers share that the demo can reinforce the dealership’s understanding of the customer’s unique needs, and that a staff willing to get its hands dirty in the field can deliver a “Wow” factor that can tip the deal.

“When working to sway a customer, you must be very certain that your product will out-perform the primary brand machine,” says Russ Hawryluk, North Tractor Ltd., Courtenay, B.C. “You have an uphill battle to change a customer, and you’re seldom allowed a step backwards in the process of changing brand loyalties. So if your color does not perform as promised, the original brand is back in even stronger than before.”

Taken to Task on Trades

While not making the top factors list, the subject of trade-ins generated strong responses from several dealers, including Lynch. “While appraisal of used equipment is better than it used to be due to on-line sources available to us, it’s still not an exact science. The trade-in could be the reason we got the sale as well as the reason we lost the sale.”

Williams agrees, saying that a dealers’ lack of concern for a customer is often manifested when the trade discussion arrives. “Some dealers just assume a farmer will be in to trade and when they do come in, they act like, ‘I knew you’d be in.’ Another problem is when the value of the trade changes from what the farmer was led to believe it would be with no explanation why.”

Dealer’s Role…

With market share getting so much attention in major-line programs, there’s a great deal of debate about whether it was the dealer or manufacturer who won, or lost, a competitive deal. It’s not an easy nor conclusive conversation. “I’ve seen some good dealers go down because the brand let them down,” says Schaff. “I’ve also seen dealers let the brand down.”

Dealers widely agree that the manufacturer’s product is responsible for the first sale, but how the customer is treated by the dealer determines whether there’ll be repeat business. Clayton Camp, Kern Machinery, Buttonwillow, Calif., puts it this way: “Our customers do business with our company first, and our major manufacturer second, so the dealership deserves the credit for the selling process, attitude, treatment of customers, parts on hand, after hours service. When the reason a customer buys another brand is something other than specs of the tractor, the dealer would be at fault.” Some dealers, like Laethem, take full responsibility, stating, “The dealer is always responsible for getting, or not getting, the deal.” Others say their degree of influence in a conversion is shared by the manufacturer. Steve Heath, Hobby Dye Read, Scottsville, Ky., says “The dealer deserves credit or fault about 40% of time.”

That said, here are some instances when dealers admit they should be held responsible when a customer converts to a rival brand.

- Siding with the Manufacturer. Dealers deserve the most blame when they tend to side with the manufacturer and not the customer. “If we don’t take care of our customers, someone else will,” says Jamie Waldrip, GreenSouth Equipment, Athens, Ga. “Customers pay our bills, not the manufacturer.” Don Van Houweling, Van Wall Equipment, Perry, Iowa, adds that there are times shortline products meet customers’ needs better than those of the major line — and sometimes it’s better for the producer to own them. “The key is to look out for what’s best for the customer and not our own gross margins.”

- Poor Uptime Record. “If we’ve failed to deliver best-in-class service, the dealer can be blamed,” says Wilson. “If that service fails because the manufacturer cannot deliver the required parts within 24 hours, that’s the manufacturer’s responsibility. The dealer cannot manufacture parts and in spite of our best efforts, we simply cannot come up with parts outside the manufacturer’s parts system.”

- Equipment Performance. Assuming that the product is sound, Gene Saville, Lamb & Webster, Springville, N.Y., says that the dealership must have the knowledge and ability to make the equipment perform its task. “Our people make that happen,” he says.

- Poor Customer Service. If the customer felt ignored and that caused a brand defection, then that would fall on the dealer, says Mark Foster of Rantoul-Ill.-based Birkey’s Farm Stores.

|

Multi-Stores Can Open the Door to Brand Switches According to Mike Betts, Gateway Farm Equipment, Neosho, Mo., the opportunity for rival-brand conversions usually starts with the farmer feeling lost by the large corporation dealers. “The large farmers are treated like royalty but most of my customers feel left out or unwanted in the bigger dealerships. Many complain of being told what they need rather than the sales department listening to them about what they want and feel they can afford. Many feel the bigger dealers have lost the personal touch. “Most multiple-location dealerships have great leverage to purchase and supply parts faster. Yet, our pricing is usually better due to a leaner operation, and the customer can always find the owner should he feel he needs to discuss an issue.” “We gained a new customer based on the fact that he no longer wished to deal with a particular dealer and would’ve needed to drive over 100 miles to get to another. So instead, he changed brands. We find that for many customers, bigger is not always better.” |

Major Manufacturer’s Role...

Dealers shared their thoughts on when losing customers to a rival brand is outside of their control, and where the manufacturer bears responsibility.

- Warranty Coverage. Poor, or superior, warranty coverage opens the door to color conversions. “When the customer sees a big variance in warranty programs, he’ll be willing to try another brand to see if overall cost of operation is less,” says Camp.

- Product Quality. “When product quality issues caused the defection, most of that blame would fall on the major line manufacturer,” says Foster. Williams adds that when brands become lax on research and development, it’s very hard to play catch up when another brand unveils a new innovation.”

- Financing Programs. When a competing manufacturer “buys” the business, it’s hard to fault the dealer. Allen Berry, ACM Tractor Sales, San Marcos, Tex., says that on the color-conversions he’s landed, the incumbent brand refused to negotiate on price. “They take the attitude that they’re the only game in town, and rely on the customer being from a generation that bleeds green. In some cases it works, but not in this economy.” Conversely, if the farmer switches because of huge discounts or financing, then the manufacturer should get the credit.

- Availability. “Manufacturers deserve the most blame when availability forces a customer to purchase elsewhere,” says Waldrip. “Dealers don’t have the ability to stock everything and customers will not accept extended lead times.”

Finally, one dealer-principal told Farm Equipment that his major-line is going overboard trying to get others brands’ customers. “They offer a big, one-time discount. Other customers know about it and try to do the same thing only in reverse. I find that when you get a competitor’s customer on price alone, they switch back to their old brand with the next purchase.

“Converting someone is usually a long-term process. You must show them you deserve their business. The majors are just training customers to switch back and forth between brands.”

Post a comment

Report Abusive Comment