Category: Over $50 Million in Annual Revenue

Pictured with Ron Offutt (2nd from r) are Northern Ag's Steven Connelly (l), Kieth Kreps (2nd from l) and Tom Iverson (r).

2009 Northern Agriculture Sales: $406.9 million: Midwest Ag Division (MWAG): $310.9 million; Northwest Ag Division (NWAG): $95.9 million. Breakdown: Wholegoods: 82%; Parts: 12%; Services: 6%.

Locations: 17

2009 ROA: MWAG: 11.90%; NWAG: 11.20%

2009 Market Share: MWAG: 55.16%; NWAG: 79.53%

2009 Parts/Service Absorption Rate: MWAG: 72.05%; NWAG: 68.66%

Other Key Lines: Vermeer, Summers Manufacturing, Wil-Rich, Trioliet, Brent/Unverferth and Brandt.

Key Staff: Keith Kreps, vice president; Mark Kreps, GM-core accounts; Steven Connelly, GM (Moorhead/Casselton, Kindred, Hawley); Bruce Daughters, GM (Aberdeen, Redfield, Hazen, Washburn); Tom Iverson, GM-sales; Jeffery Lemna, GM (Breckenridge, Lisbon, Fergus Falls); Davin Peterson, GM; and Todd Thompson, sales manager.

Spend time at Fargo, N.D.-based RDO Equipment, and you’ll hear the familiar story of a passerby who asks three hardworking laborers what they’re doing. The first mumbles that he is laying bricks. The second replies he is building a wall. The third man, however, proudly exclaims that he is “constructing a grand cathedral.”

For RDO Equipment, the second-largest farm equipment dealer organization in the U.S., employing a top-to-bottom staff that thinks of their work like the third laborer may be the secret to their success. This giant dealership group, and specifically its Northern Ag Division, has earned Farm Equipment’s 2010 Dealership of the Year title.

RDO Equipment, a $804-million John Deere ag and construction dealership group, runs 56 locations in 9 states. These numbers (and the ratios in the box at left) are impressive enough on their own accord. But also take into account the following:

- The 9 states are not in a contiguous geography, in fact there is a 9-state “hole” in the company’s territory map (see p. 20).

- The owners (the Offutt family) are located in a Fargo, considered a “faraway land” for many of the stores.

- This formerly publicly-traded company (1997-2003) once lived by a bigger-is-better mentality.

- Stores are not manned by dealer-principals, but employee managers (nearly all of whom share a parts- or service-manager title)

RDO Equipment is a big believer in training and development at all levels. Pictured is a recent session for personnel from various stores held at the Field Support Offices in Fargo, N.D.

These four bullet points above are the very same reasons cited for the failure of company-owned stores farm equipment stores in America. The difference for RDO and its protection of entrepreneurialism appears to be a single-team culture where employees identify themselves with the RDO entity (not just one store), an empowered and motivated workforce, an approachable and engaged ownership group that lives by its mission, and the constant tutelage and coaching on all aspects of the business.

“It starts with an authentic leadership team that works well together to connect with, provide a vision for and fully develop employees across the organization,” says Christi Offutt, CEO.

What the Judges Say About RDO Equipment …

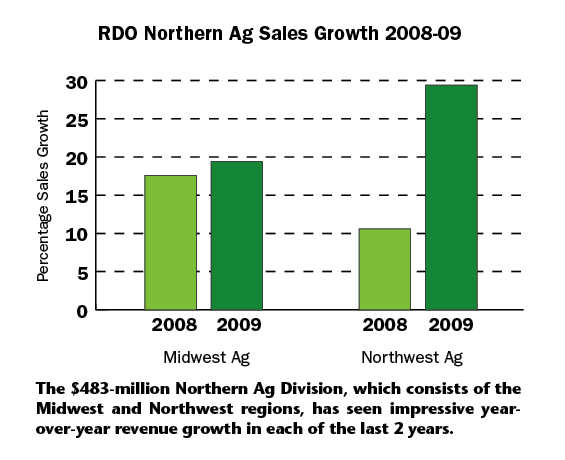

“Three ag divisions doing nearly one-half a billion dollars in revenue” … “Worked to increase their market share to nearly 60% overall” … “A decent ROA considering its size” … “Three-year growth numbers have averaged more than 15% per year” … “Strong dollars generated per employee at $804,243” …. “A very strong community involvement” … “Strongest suit is company’s employee training program, with its own RDO University and a 7-month Leadership Institute.”

A One-Team Culture

RDO’s non-contiguous locations are a result of acquisition by opportunity, says Ron Offutt, chairman. One of the serendipitous results of RDO’s high-acquisition days is the firm’s diversification within ag machinery markets. “We have 5 different ag markets now, from vegetables and alfalfa in the south to wheat in the West to the sugar beets and cash crops in the Midwest. It’s given us greater stability.”

One of the things that’s unique about RDO among large, multi-store organizations is the scope of its centralized operations, a byproduct of the firm’s publicly-held years when fast growth and reporting requirements made it a necessity. Like many other large dealer groups, RDO believes that giving asset management responsibilities to a headquarters staff and removing administrative activities from each store equates to more customer involvement. RDO, however, appears to take the concept deeper than many other multi-store dealerships.

The degree to which a firm centralizes tasks is a tight-rope walk. Other organizations that operate stores as individual entities forfeit some economies of scales. Yet take away too much autonomy from the store and you’ll get in the way of the personal attention that farmers demand, regardless of how big the group has become.

“You’ve got to capitalize on the few economies that exist from multi-store organizations and use them to better push customer satisfaction,” says Keith Kreps, vice president, Northern Agriculture, which consists of 17 stores in the Midwest and Northwest regions. “Yes, we’re centralized on the activities that aren’t felt by the customer, but we insist on an entrepreneurial spirit at the store level.”

Ron Offutt, chairman and founder, elaborates. “We centralize the back room of the organization, but we’re noncentralized in those areas that are important for meeting customer needs. We expect everyone to have face time with their customers in the store and on their farms. By centralizing tasks, it takes the pressure off of them for those activities that the customer doesn’t value.”

In explaining how you can centralize operations yet maintain an entrepreneurial feel, Kreps cites an example. “While our Field Support Offices (or FSO) headquarters handles accounts receivables, each store can extend credit up to their limit without jumping through hoops. We are efficient and professional, but make sure that our actions don’t leave the customer feeling that it’s a large, cold corporation.”

Asset management is one of the key things handled by FSO, which coordinates the inventories from Texas to Washington to North Dakota. “We manage the risks and downcycles,” says Kreps. “There are too many emotions involved at the store level with regard to inventory and booking equipment. We empower the stores’ sales managers to take a deal on a trade — if within a margin of error specified in our account manager playbook — but we don’t allow them to manipulate the cost of the used equipment. Impartial managers handle the booking values to give us a consistent used turn.”

Dual-Role Store Managers

While the Fargo-based FSO is impressive, the organization is flat for a company of its size — particularly at the levels closest to the customer. It’s the firm’s store manager model that is most unique — in most cases the store manager is assumed by an individual who retains the parts or service manager title.

“Without a traditional store manager, per se, we’ve taken out a layer. While we have a flat organization, you still need a go-to person at the store. We’ve given that responsibility to either the parts or service manager.”

For RDO, the magic happens because store or departmental agendas are cast aside for the good of the singular team, a mindset that Christi Offutt stressed in 1998. “Our specialists and technicians are involved in store profit-sharing, rather than individual departments,” says Kreps. “That’s why you don’t see parts people yelling at technicians and vice versa.”

He adds that in the past, you wouldn’t see the teamwork from store to store that now exists. “When one shop is getting slammed, there’s far more willingness to send a tech to help out now — the locations aren’t competing with one another but trying to grow the overall business.”

There are little things that the system has brought out as well. “You don’t generally see someone driving over a power cord out in the shop. They tend to keep an eye on the little things so they don’t waste their own money.”

“The culture is clearly entrepreneurial,” says Tom Iverson, GM of sales for Northern Agriculture. “We play to win, and a big part of it is the core values that this company lives by — the owners, the vice presidents, everyone.”

Account Manager Structure

RDO also set the pace in the industry with its account manager model, which Kreps says further maximizes the firm’s biggest competitive advantage — parts and service.

Around 1998, John Deere was encouraging its dealers to add customer service reps to more actively sell parts and service. Kreps recalls discussions with Christi where they looked at each other and asked, “Why do we need to add personnel to promote parts and service? Why can’t the salesmen do both?”

To do what the pair had in mind would take some big structural changes, and the idea percolated for years. “The stars aligned in 2006 when we were looking at a down year,” says Kreps. “We thought that if ever there was a time to make a big change in the structure of the sales role, this was it. Within 6 months, we developed a playbook that gave GMs more stores to oversee, appointed a GM of sales, gave store managers dual responsibilities, created the new account manager role and introduced a sales support function to assist the account manager in administrative tasks.”

In February 2007, RDO moved forward on this sweeping structural change, with the success hinging on the account manager model. The objective was to focus on individual customers and broaden the approach beyond wholegoods to actively pursue the parts/service business, says Kreps. “Our goal was to take the role of those traditionally selling iron and shift to a position of partnerships and expanded relationships.”

Not only are account managers responsible for selling the large equipment, but also the parts and service — everything from oil filters to winter inspections. And account managers are rewarded for the parts/service business that they grow, focusing them on their customer’s entire operation.

What Others Have to Say About RDO Equipment …

Farm Equipment interviewed two other industry observers about what they most admired about RDO. Here’s what Matthew Larsgaard, president/CEO, North Dakota Implement Dealers Assn. and Jeremy Unruh, territory manager, John Deere — both based in Fargo — had to say:

Professionalism & Business Structure. “It’s a large company that is very entrepreneurial in nature,” says Larsgaard. “They have a decentralized structure that empowers people to make decisions necessary to support their customers but balances that with effective processes and back-end support that assures excellence and consistency throughout all locations. It’s a customer-oriented business that persistently strives for continuous improvement in all that they do, from customer service to internal operations.”

Account Managers. “RDO is on the leading edge with the account management structure,” says Unruh. “Other dealers are now doing it, too, but they jumped in with both feet and have fully embraced it for some time now. The manner in which they handle account management and their processes is very much the structure we see developing. In fact, they’ve taken it much farther than most by also encompassing parts and service, not just sales.”

Training Commitment. “Their training feeds the account management structure and they have strict training processes, including requiring all account managers to be AMS-certified,” says Unruh. “They work closely with John Deere on RDO-specific training, and regularly free their people up for several days to do the intensive training that they believe in.”

Larsgaard adds that RDO also has several expert trainers that contribute as instructors in his association’s “Parts & Service Management Essentials” course, helping advance the profession of all dealers in the state, including competitors.

Communications & Openness. “From the early morning huddles in each store to the monthly open-book meetings where everyone from the janitor to store manager is present, they share everything,” says Unruh. “The financial picture, progress on key initiatives, facility plans and spending, etc. — everyone knows what’s happening in the business.”

Individual Farm Responsibility

The account managers are assigned a customer list that range from 35-110 farmers based on the region, experience and relationships. The account lists are under constant review, says Iverson, and account activity is also readily available via the computer system. “We discuss each assigned farmer with the account manager, what’s happening and if there’s an obstacle or personality issue. We have an upfront process that we follow and if there’s reason to move the account, we reassign it. To provide world-class customer service, you’ve got to have that one-on-one face time.”

Iverson said that it was a big change from the old days when you could hang out the RDO sign and a salesman wouldn’t have to leave the dealership. “Some salespeople had 200 customers, and 95% of the store manager’s work day was spent desking deals. Parts and service discussions simply weren’t getting the time it deserved. Now, we’re going on the offensive to work with the customer on their farm rather than reacting to the door swinging open in the store.”

Attaining Expertise

The change required a great deal of training, and recognizing the high esteem farmers had for precision ag specialists helped set the course. “We saw that most, if not all, of the Ag Management Solutions (AMS) specialists are the go-to-people,” says Iverson. “So we learned that accounts managers, parts and techs all needed info on AMS. To be viewed as the expert, all points of contact must be viewed as experts.”

This realization resulted in the pre-requisite for account manager status. Account managers must attend four RDO-sponsored training sessions per year and must meet John Deere certification for AMS products. John Deere has become an advocate for the system as well, and is even providing account-manager specific training. Currently, the Northern Ag stores have 78 account managers.

Along with the change in role was a change in compensation programs, which differed from the traditional salesperson’s gross margin commission. Instead, account managers have a three-pronged compensation structure that includes a base salary, commission based on top-line revenue, and a bonus based on aftermarket sales growth to the assigned customer.

While the market share gains in recent years speak for themselves (see p.24-26), Kreps points to the aftermarket sales to the assigned customers when asked about the results. “We’ve increased parts and service more than 10% year over year,” he says. “Before, we never had an annual increase over 3%. If you want an indicator of how you’re performing, review aftermarket growth by each customer. If it isn’t growing, something needs to change.”

Steven Connelly, GM, adds that the structure plays to the one-team culture. “When techs are on the farm servicing equipment, they’ll often hear of planned purchases that the sales team wouldn’t hear about until much later. Because they know who the assigned account manager is, they’ll return to the store and make sure that information is passed along so the account manager can start a conversation.”

Jon Zuther, an account manager at the Casselton, N.D., store describes the role this way. “The account manager is the one person that customers can come to for questions on anything in the store. They know that the account manager is the person that can get an answer for them — whether it’s sales, parts or service.”

From structural changes like account managers and store managers who share

parts or service management duties to 10-minute daily huddles, RDO is proud of

its efforts to foster teamwork and cooperation for better bottom-line results.

An Evolving Structure

While the account manager structure has been a winner, RDO continues to refine it as well. Just as it realized that store managers could get distracted, management also saw that the account managers could, too. Thus came the transactional sales professional role that deals with the smaller customers or those who are 200 miles away and call on the phone.

Account managers can sell only to their assigned accounts. All other business is redirected to the transactional sales professional and/or it’s used as a training ground. RDO plans to expand and roll out this model across other locations.

Another recent change was RDO’s new parts support center that’s located offsite in a retail strip mall in Moorhead, Minn. A team of experienced parts personnel man the phones at the call center, increasing customer satisfaction for call-in customers while freeing up dealership staff to work with the customers who are right in front of them.

“It’s bothersome if the phone is ringing at the parts counter when you’re with a customer, and the rushing can sour the customer’s experience,” says Glen Haekenkamp, parts support center manager, explaining the motive for the new call center. “With our dedicated parts support staff here at the call center, we can satisfy a high number of these callers. Both here and in the dealership, more time spent with the customer on parts equals more parts sales.”

Calls are forwarded to the parts support center after 4 rings at the dealership. “The majority of the calls are parts-related,” says Haekenkamp, “and our CISCO computer system allows us to add tickets or start new tickets, as though we were at the dealership’s parts counter ourselves.”

He says that in the last month alone, 513 overflow calls were directed to his call center team, meaning those customers weren’t put on hold or caught in voicemail.

Since the call center approach debuted in March, RDO has seen more parts sales, better customer satisfaction and more upselling opportunities. The firm hopes to roll out the call center approach to all the stores by year’s end.

SATISFYD Dealer Direct Systems:

A Scorecard for Measuring Growth Prospects

RDO Equipment leaves nothing to chance that can be measured. One example is the Strategic Feedback SATISFYD Dealer Direct System that has been in place since mid-2008, to follow up on customers’ experiences with the company, now including parts, service and sales.

Each week, records of all closed work orders and invoices over predetermined dollar values are pulled. From that pool, 8 customers per department for each store are randomly selected to receive a brief survey. Sent and collected by a third-party (either by mail or online), RDO typically receives an impressive 20-25% response rate.

By sending surveys only after a transaction, RDO feels it gets relevant information in a timely fashion. Surveys that are indicating dissatisfaction are flagged for immediate follow-up.

“If a customer takes time to fill out a survey to let us know where we can improve, we owe it to them to follow up immediately,” says Christi Offutt, CEO. RDO expects all returned surveys deposited into the “issues tracking system” will be resolved within 10 days.

Data, both positive and negative, is shared in team meetings, open book meetings and the daily store huddles so all are aware of the customers’ experiences. “We’re getting feedback from customers we just wouldn’t get in person,” says Bruce Daughters, GM of RDO South Dakota. “As a management team, we can then address the issues face-to-face with customers and resolve the issue or at least explain the situation. The survey has been a good tool for us.”

Net Promoter Index: Necessary for Growth. Besides the ability to clear up individual issues, the survey also shows how poised the firm is for growth through the Net Promoter Index (NPI), which measures customer loyalty. The NPI score is based on the question of “Would you recommend this company? (The highest possible score is “definitely recommend,” which equals 5 points.)

The NPI takes the number of dealers’ customers who strongly recommend the company (the “5” scores) and subtracts the detractors (1-2s) and those who are indifferent (3-4s).

Fred Reichheld, the developer of the NPI concept, notes that the most loyal customers bring in new customers without any cost to the company, especially in mature markets where incremental customer gains are expensive and tough to come by. Loyal customers not only affect top-line growth, but also reduce the service costs associated with detractors.

Because the strong correlation between recommending a store and revenue growth, Reichheld maintains a company can’t realize revenue growth without increasing its ratio of promoters to detractors.

RDO’s NPI goal equates to an average NPI score of 92%, well above the 75-80% range seen among the most loyal customers in 28 industries.

“The surveys bring out all kinds of statistics,” says Greg Erickson, marketing and database analyst at FSO. “It shows where there’s a performance gap from customers’ expectations, which alerts us to respond. A recent complaint about parts availability gave us the chance to bring the customer in, tour our in-store inventory and explain how we order what we do. He was satisfied after understanding that we were following a process.”

Erickson also says that the surveys allow management to drill into problem areas and isolate data to see what’s going on. “It helps us find best practices. If one group needs help, we can find out what some of the locations getting the best scores are doing.” While not an inexpensive endeavor, Erickson says that the stores believe it is paying off. “If they didn’t see an ROI, we wouldn’t be doing it,” he says.

A Bigger Piece of the Pie

Across its ag stores, RDO’s market share is up by nearly 10% over the last year, to a companywide 58.9%. And even with the economic struggles in the Southwest Ag Division, that group increased market share by 15%. Kreps explains how it has achieved these benchmark levels.

RDO Equipment’s Moorhead, Minn., store opened in 2006, bringing ag, construction

and lawn/garden equipment together under one roof.

“We’ve always been strong in partnering with the large, mega customers. With our size and scale, we’ve been very good with the very large customer for a long time now. Where we haven’t always done so well in the past is with the smaller and medium-size farmer. We weren’t pulling into those yards often enough. If the customer only buys equipment once every 3 years, we can’t afford to see him only every other year,” Kreps says.

“The account manager structure we have now assigns those customer accounts to an individual, who makes sure we get onto those yards. Now, that account manager is in front of that farmer 3-4 times per year.”

RDO also has an uptime guarantee program that extends beyond John Deere’s own warranty program. Called the RDO Promise, the program is available on the self-propelled equipment and provides a number of benefits, including guaranteed response times and a free loaner if the unit can’t be fixed within 48 hours.

“It’s become a true competitive advantage and a means to show our value even if our quoted price is higher,” says Iverson. “Farmers have come back to us because other dealers couldn’t put the uptime guarantee in writing like we do.”

Adds Ron Offutt: “The rise in market share that we’re seeing is the culmination of all the training dollars and attention on the culture starting to pay back, along with the improved face-to-face time with the customer.”

RDO invests heavily in the most modern and well-equipped facilities, and specifically

the service shop area, to back up its service capability and its RDO Promise

uptime guarantee.

RDO’s Post-Acquisition Steps

After executing more than 60 acquisitions in 42 years, RDO follows a carefully thought-out integration plan for new stores, which Keith Kreps, vice president, Northern Agriculture, says is “close to a science.” “We don’t believe you can acquire a dozen stores a year and effectively manage them all. We are content with 2-3 acquisitions per year.”

Here’s a list of what the acquired dealership can expect from its new parent.

- Immediate Visit from the Leadership Team — A leadership team (and whenever possible, Ron and Christi Offutt) go in immediately upon the consummation of a deal so people can get to know them and have their fears calmed. There’s always uncertainty, and the pair answer all questions, including how compensation is affected and that RDO honors the workers’ years of service. Some issues are trivial, but they get them out of the away early on.

-

Peer Team Deployed — Even before a public acquisition announcement is made, RDO places a team of employees into the store so employees can watch them in action. “This exposes the store to our culture and they see how well our team works with each other,” says Tom Iverson, GM of sales, Northern Agriculture. “It calms them down.”

Adds Steven Connelly, GM: “After the acquisition, it’s not a management team hitting the store to work on integration issues, it’s a team of peers. The peer-arrangement can typically win them over quickly. They understand they have a very vested interest in a successful transition.” - Staff Retention — “There’s a huge psychological issue for some when you start doing business under a different banner,” says Kreps. He adds that the ag divisions have retained 95% of the staff in the last 5-6 acquisitions, with each store doing significantly more volume than before.

- Immediate Investment — RDO generally sends a statement about its commitment to employees and customers by making an immediate investment in the facility or service trucks. “We send the message to the community that it’s an important location, and that we acquired it for a reason — to build the business,” says Kreps. Following the recent Ada, Minn., acquisition, RDO doubled the value of the building (raising it to today’s standards), increased parts inventory within 60 days and upgraded service trucks.

- Listening, Patience — Iverson says it’s important to listen and not force-feed change. “The long-term employees bring a lot of benefit and value. We’ve learned of some best practices that have served a particular market very well. We’ll allow a subtle transfer of the culture. It’ll happen, particularly if you live by your core values and do what you say.”

- Increased Business — Kreps adds that the store almost always sees an immediate spike in used equipment sales after an acquisition, simply because of the access to used inventory. That is generally followed by an increase in new wholegoods because of the ability to take on more trades and distribute them throughout the company, he says.

Training as a Core Strength

Of no small significance to the judges was RDO’s emphasis on developing its people. RDO spends more than twice the national average on training, and that commitment is no accident.

“We see training as a partnership between the employees and the company,” says Jean Zimmerman, vice president-organizational development. “Each team member comes to work with a set of talents and skills, and we commit to providing a continuous learning plan to enhance and grow their talents and careers.”

Zimmerman answers the ROI question this way. “Actionable learning adds value to the teammates, the organization, customers, manufacturing, parts and the community at large.”

One of the most telling symbols of the firm’s commitment to training is the fact that Iverson, Northern Agriculture’s GM of sales, had zero iron-peddling experience when he joined the firm in February 2006. Instead, he was a university administrator with organizational development background. “My role boils down to coaching, specifically with regional service managers and account managers,” says Iverson.

When Kreps was asked about the most significant changes in the business coming in the next 3 years, topping the list was the increased skills required employees. “The new generation of customers won’t have the patience for dealerships in which only a handful of people in the store are highly trained on technology and the role it plays in their farming operations.

Customers expect and will demand skilled solution providers not only as account managers but also technicians and parts specialists.”

Ron Offutt says there’s a clear, direct correlation between investment in people development and company growth. “We need an organization we can manage as we acquire stores. You need the right people to do that. When we were public and growing rapidly, we ran out of good people to make it work. Now, we have processes in place to manage the stores effectively. Our focus is on building a team and being able to transfer our processes from one store to another.”

As a result, RDO offers multiple training opportunities to all team members. Northern Agriculture managers, and those showing management potential, have participated in:

- A 7-month Leadership Institute training program

- An Emerging Leadership training program

- RDO University, an online portal that serves as an online resource tool and will soon be expanded to include online classroom training.

Several members of Northern Agriculture are also participating in a 30-month long Management Institute, a program designed to provide a strong management pipeline.

Kreps adds: “As an industry, we’ll all need to figure out how to attract new talent and at the same time develop and retain current employees. We’ll all need to balance the customer expectations of 24/7 on-call parts and service with the new workforce that wants to work 40 hours a week with nights and weekends off. The employees and dealerships that have resisted and not reinvested in education and continuous improvement will not be around 3 years from today.”

More on RDO Equipment Co.

- Founded in 1968 as a single-store John Deere, Melroe and Versatile location in Cassleton, N.D. Ron Offutt purchased the store by taking out a farm loan, selling a potato warehouse and 160 acres of farmland and paying the last $10,000 of the price with the help of his grandmother.

- 56 locations total (including John Deere Agriculture, Construction and Vermeer). Midwest Agriculture: 12 ag locations (plus 2 CE/Ag); Northwest Agriculture: 5 locations (3 ag plus 4 CE/Ag), Southwest Agriculture: 5 locations.

- 1,392 total employees

- $804 million in revenue in 2009.

- Owners are Ron Offutt, Jr., chairman and founder, Christi Offutt, CEO. The R.D. Offutt Co., which shares headquarters with RDO Equipment, is among the world’s largest potato farming organizations, including a french-fry processing and distribution business.

A Model for the Future

Christi Offutt maintains that the future will be bright as long as the company continues its focus on the customer, and understanding that employees differentiate the business. “It’s important that we look at and measure both customer loyalty and employee satisfaction,” she says. “These are the most important measurements to ensure you’re building a long-term sustainable business.”

When it comes to discussions about the future, Kreps says “We see the next 3 years continuing to bring even more significant change in the farm equipment industry than what we’ve seen in the past decade. These changes will continue to include rapid dealer and customer consolidation, new technology and increased capital demands.”

With these changes, Ron Offutt also expects that there’ll be more companies operating in a model similar to RDO in the coming years. With the changing structure and volume-based programs, he says the business is moving to larger operations where the target of $150 million per owner and/or whatever expectation comes next, can be maintained.

While John Deere’s market share limitations within a given AOR have made it difficult for RDO to expand near current markets, this directive may change as the business evolves. “The more others grow, the less risk there’ll be for us,” says Kreps. “The majors are changing their business model to support the bigger operations.

“In recent years, there was free-flowing capital, good times for the industry and that fueled the partnerships. When the industry hits a downcycle, there will likely be a number of dealer-principals looking to exit. We’ll be ready to move when this happens.”

To watch Farm Equipment's Dealership of the Year video interviews filmed onsite with RDO management, click here .