Global trade disruptions have caused significant challenges for Canadian agriculture, says Leigh Anderson, senior economist with Farm Credit Canada.

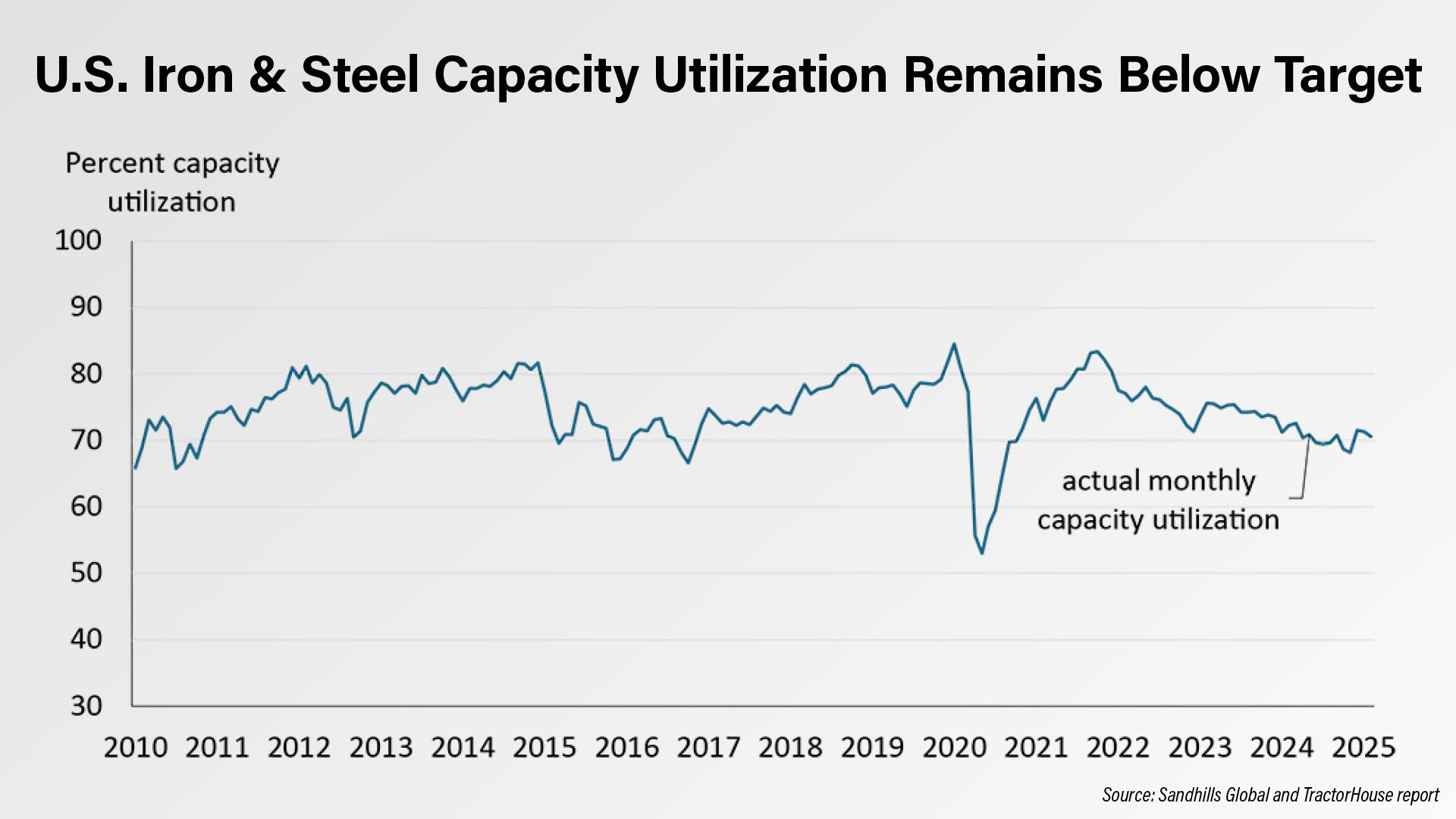

Anderson notes that the primary reason for implementing the U.S. steel and aluminum tariffs was to boost domestic U.S. steel production, aiming to increase capacity utilization to over 80%.

These tariffs have significant consequences for the farm equipment industry, Anderson says. When tariffs raise costs on raw materials like steel and aluminum, the price of new equipment also rises. This impacts demand for farm equipment and has broader implications for farmers and manufacturers, he notes.

For Canadian manufacturers, navigating CUSMA compliance amid a global component market can be complicated. Manufacturers must provide a certification of origin to claim preferential tariff treatment, which involves detailed documentation proving the equipment meets CUSMA's rules of origin. For the majority of parts, Anderson says, it’s not possible to be CUSMA compliant.

Newly manufactured farm equipment often includes components such as semiconductors or other electrical components imported from other countries including China, notes Anderson.

He says, quote, “The U.S.– China trade war has significantly increased the cost of these components. Many parts, like hydraulic systems, belts, and bearings, are sourced internationally.

“Tariffs, whether related to steel, non-CUSMA compliance, or the U.S. – China trade war, will raise the costs for manufacturers even for equipment being finalized for delivery and used this year. The Canadian farm equipment industry was already facing declining demand due to high equipment prices and reduced farm profitability. The current environment of tariffs and trade disruptions will further impede the farm equipment market and pressure pre-orders for 2026.”

Watch the full version of this episode of On The Record