In this episode of On the Record, brought to you by Associated Equipment Distributors, we take a look at CNH Industrial’s U.S.-based manufacturing and the potential impact of steel tariffs. In the Technology Corner, Noah Newman explores what autonomy in ag could look like 5 years down the road. Also in this episode, a closer look at how trade disputes are impacting the ag equipment business in Canada and an update from Sandhills Global on the used planer market in the U.S.

On the Record is brought to you by Associated Equipment Distributors — the leading association in North America for the equipment distribution industry.

Explore the 2025 AED Annual Education Seminars lineup which includes seminars on Parts Management, Service Management, and Branch/Store Management.

Additionally, don't miss the upcoming conferences, such as the Finance/HR Symposium, Leadership Conference, Women in Equipment Conference, and Policy Conference.

Contact us for more information about how you can register for these events.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- 66% of CNH Equipment Sold in U.S. Made Domestically

- Tracking Crop Prices

- How Autonomy in Ag Could Develop Faster Than Expected

- Trade Disruptions Will Put Pressure on 2026 Pre-Orders in Canada

- Used Planter Inventories Continue Downward Trend

- Machinery Value Per Acre by Farm Size 2013 vs. 2023

66% of CNH Equipment Sold in U.S. Made Domestically

While YouTubers would have you believe CNH was packing up and leaving the U.S., the OEM’s quarterly presentation suggests its U.S.-based manufacturing is alive and well, although softer due to current market conditions.

During a call with investors, CNH CEO Gerrit Marx noted the company kept production during the first quarter very low to reduce inventories while, quote, “defending our growing market shares.”

In line with expectations, CNH’s financial results came in at a low point, he said, adding that CNH is focused on what it can control while the industry demand remains soft and it “does its homework on multiple commercial and operations fronts.

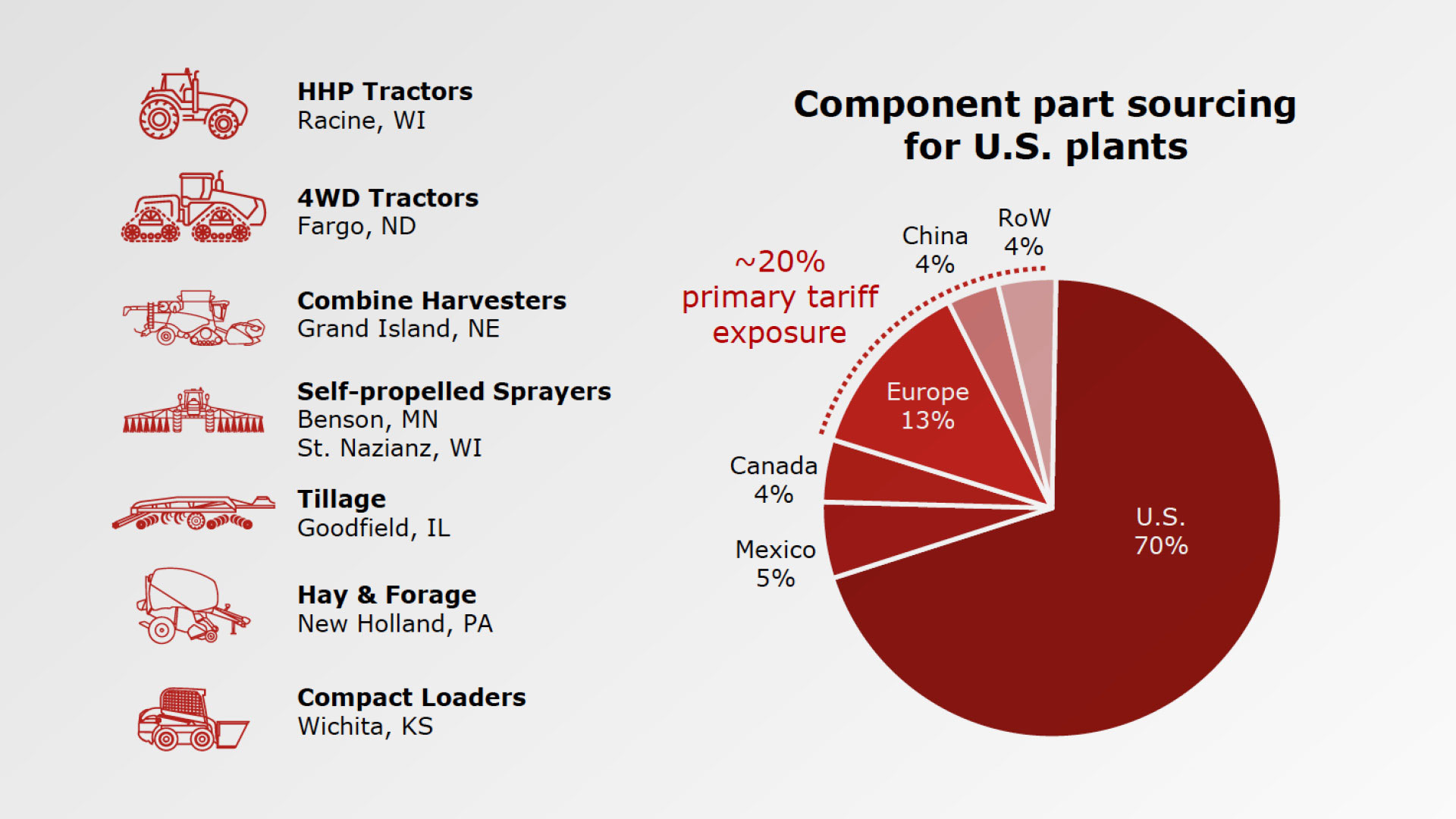

During the call, CNH executives addressed the potential impact of tariffs. Oddone Incisa noted that in 2024, about two-thirds of the machines sold in the U.S. were manufactured in CNH’s U.S. plants. And, the U.S. plants sourced 70% of its components from U.S. suppliers with an additional 10% coming from Mexico and Canada. The remaining 20% of components are sourced mainly from Europe and China.

Marx added,

“We import planters from our factory in Saskatoon, Canada, and they are fully USMCA compliant. We’re also working on getting all the paperwork in place for the very small number of tractors that come from our joint venture in Mexico. Also, 95% of steel directly purchased by our U.S. plants come from American mills. We are currently producing at very low levels in the U.S. given the industry demand, so the immediate tariff impact isn’t the same as if we were at the peak of the industry.”

Existing presold retail orders will not be affected by pricing adjustments, he said.

Tracking Crop Prices

As of May 7, corn prices were $4.49 down 23 cents from our last episode two weeks ago. Soybeans closed at $10.39, down 1 cent. And Wheat closed at $5.34, up 6 cents.

How Autonomy in Ag Could Develop Faster Than Expected

Our team recently caught up with Chris Hunsaker at the FEMA Supply Summit and Showcase. He’s the co-founder of Acuitus Ag, a company providing software-related tools to OEMs and farmers. We asked him for his “crystal ball take” on what autonomy might look like 5 years from now in the ag industry.

“The use of cameras to be able to see what’s going on — this is another design paradigm — where the idea in the tech world is if you can see it with your eyes, then you can train a computer to see it with a camera. When you think about automating the machines, how is the machine operated now? You have a person in a seat looking at what’s going on, making adjustments to the machine. A few hundred dollars’ worth of cameras and a GPU and some AI models can be trained in a relatively straightforward way to do the same thing. If you need an example of this, go schedule a test drive of a Tesla. Have that car drive itself for you and see what you come away thinking about the whole process because that car is only using cameras and a processor to do that. There’s no radar, there’s no ultrasonic sensors, there’s no hyper-accurate GPS that’s going into that. If that is able to be translated over into ag then I think you get to a spot in autonomy where it comes faster than what you would’ve expected otherwise.”

Hunsaker grew up on a farm and worked in the machinery space for several years before diving into the software world. He shared more perspective and predictions during a technology panel discussion at the conference, which you can read all about on PrecisionFarmingDealer.com.

Trade Disruptions Will Put Pressure on 2026 Pre-Orders in Canada

Global trade disruptions have caused significant challenges for Canadian agriculture, says Leigh Anderson, senior economist with Farm Credit Canada.

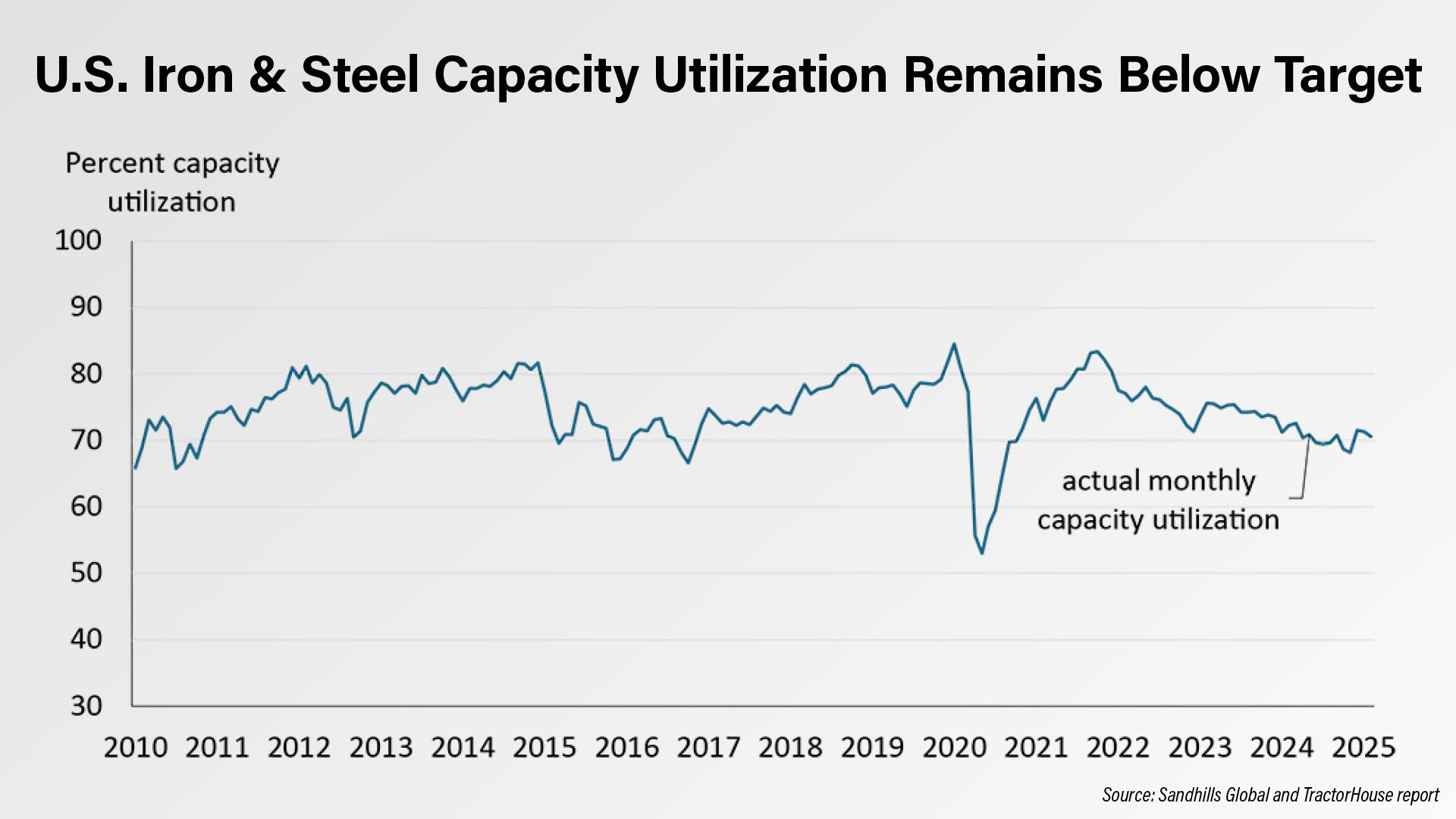

Anderson notes that the primary reason for implementing the U.S. steel and aluminum tariffs was to boost domestic U.S. steel production, aiming to increase capacity utilization to over 80%.

These tariffs have significant consequences for the farm equipment industry, Anderson says. When tariffs raise costs on raw materials like steel and aluminum, the price of new equipment also rises. This impacts demand for farm equipment and has broader implications for farmers and manufacturers, he notes.

For Canadian manufacturers, navigating CUSMA compliance amid a global component market can be complicated. Manufacturers must provide a certification of origin to claim preferential tariff treatment, which involves detailed documentation proving the equipment meets CUSMA's rules of origin. For the majority of parts, Anderson says, it’s not possible to be CUSMA compliant.

Newly manufactured farm equipment often includes components such as semiconductors or other electrical components imported from other countries including China, notes Anderson.

He says, quote, “The U.S.– China trade war has significantly increased the cost of these components. Many parts, like hydraulic systems, belts, and bearings, are sourced internationally.

“Tariffs, whether related to steel, non-CUSMA compliance, or the U.S. – China trade war, will raise the costs for manufacturers even for equipment being finalized for delivery and used this year. The Canadian farm equipment industry was already facing declining demand due to high equipment prices and reduced farm profitability. The current environment of tariffs and trade disruptions will further impede the farm equipment market and pressure pre-orders for 2026.”

Used Planter Inventories Continue Downward Trend

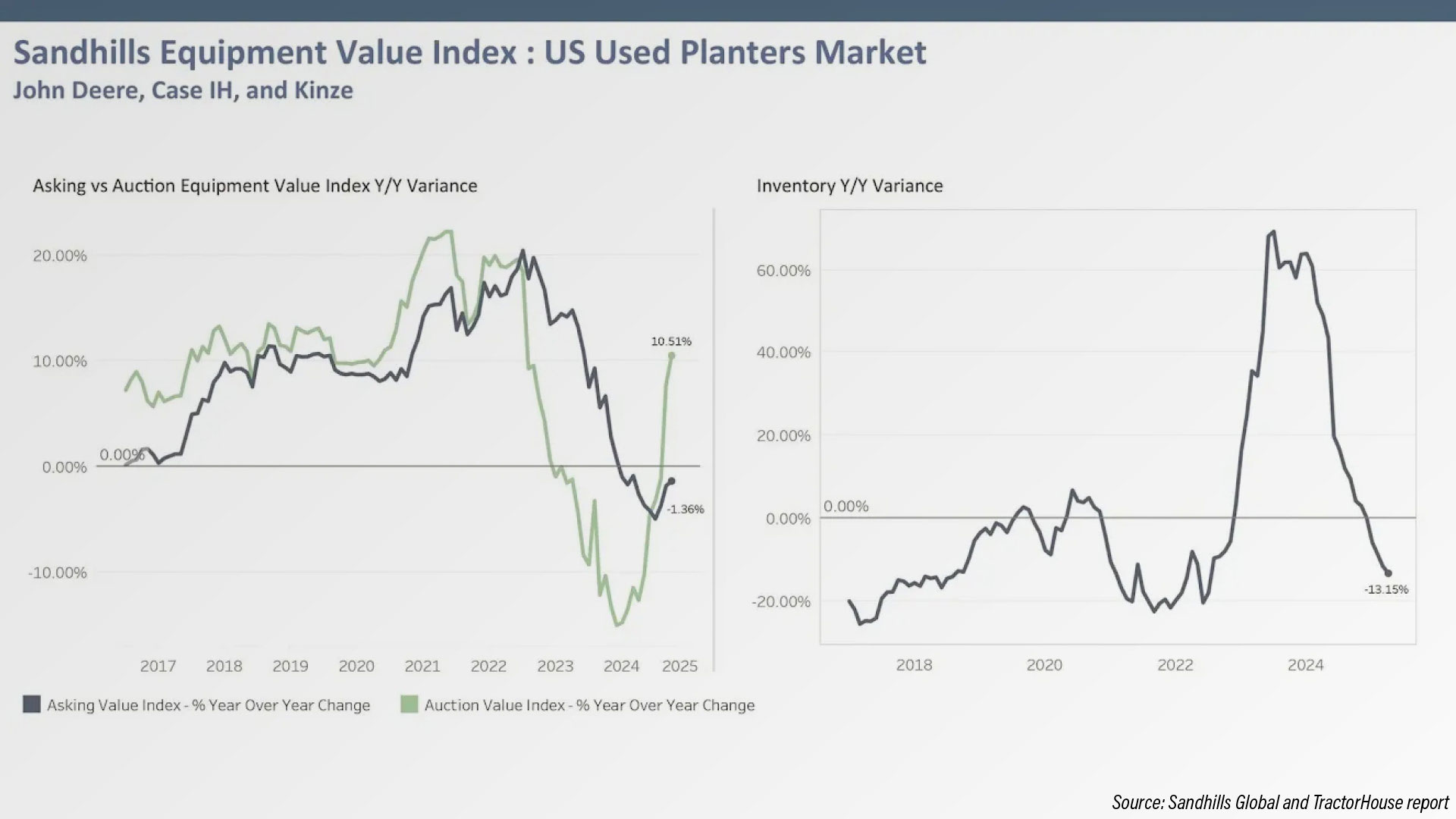

As farmers begin heading to the fields for planting, Sandhills Global and TractorHouse report U.S. inventories of used planters continued on a downward trend in April. Used planter inventories were down 4.22% month-over-month and down 13.15% year-over-year in April.

Asking values in this market remained relatively stable, with slight decreases of 0.28% month-over-month and 1.36% year-over-year in April.

Auction values, on the other hand, rose by 1.2% month-over-month and 10.51% year-over-year in April while maintaining a sideways trend.

The Equipment Value Index spread for used planters dropped two points to 51% in April, still lower than the peak values observed in 2015.

Machinery Value Per Acre by Farm Size 2013 vs. 2023

This week’s DataPoint is brought to you by the Dealership Minds Summit. To learn more and to register, visit DealershipMindsSummit.com.

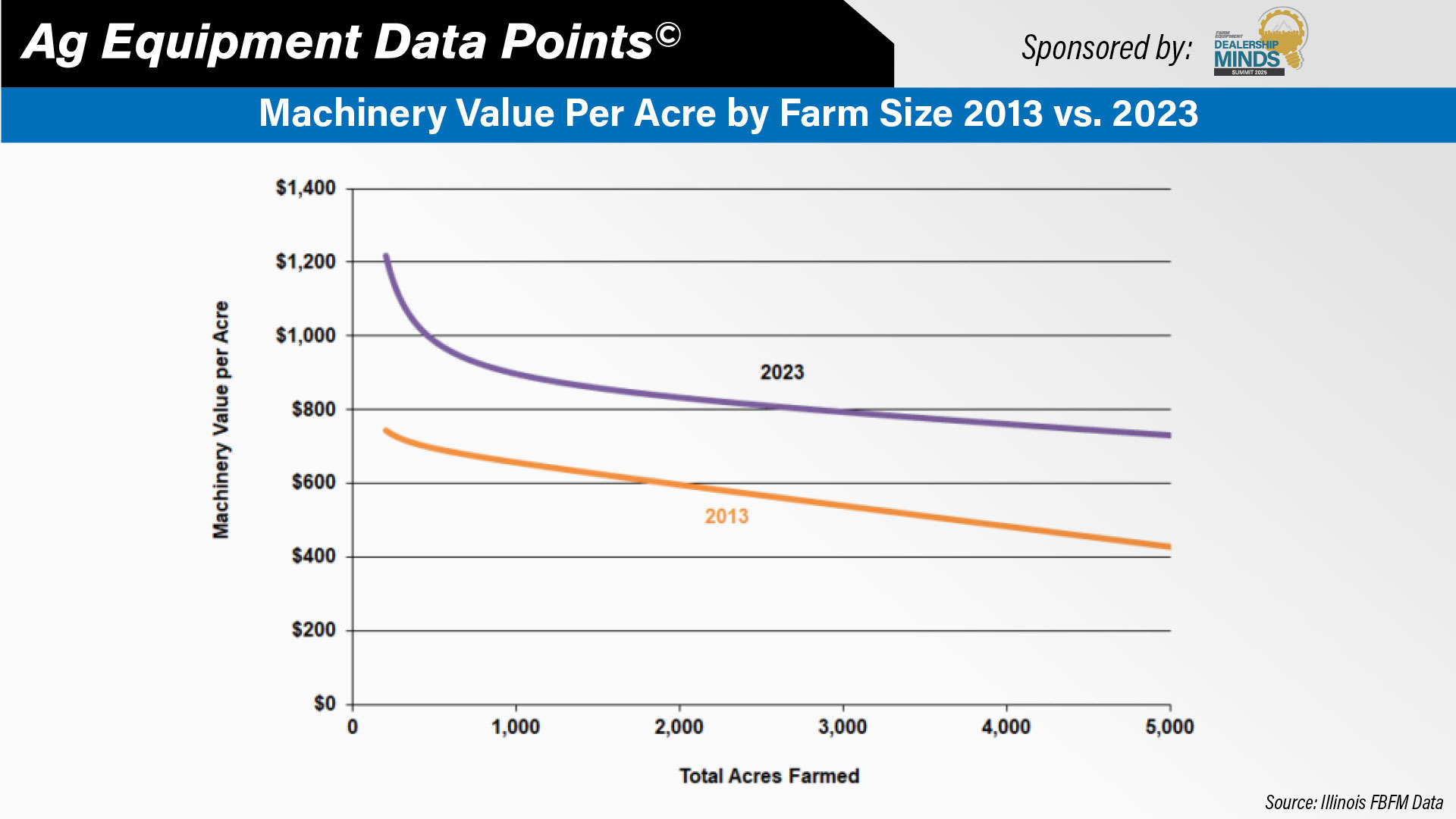

In both 2013 and 2023, per- acre machinery value declines as farm acreage increases. However, the rate of decline is less steep in 2023 than in 2013, indicating a more efficient allocation of machinery investment on larger farms, according to a report by Bradley Zwilling with Illinois FBMF Association and the Department of Agriculture and Consumer Economics at the University of Illinois.

For example, Zwilling says, in 2013, a 1,000-acre farm had an average machinery value of about $660 per acre. This declined to approximately $420 per acre on a 5,000-acre farm – a difference of $240 per acre. In contrast, in 2023, the per-acre machinery value decreased from about $900 on a 1,000-acre farm to $730 on a 5,000-acre farm – a decline of only $170 per acre. These trends suggest that larger farms in 2023 were able to spread higher-value machinery investments over more acres.

That’s it for this week’s On the Record. You can send any comments or suggestions to kschmidt@lessitermedia.com. Until next time, I’m Kim Schmidt, thanks for joining us.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.