CNH Industrial has reported results for the first quarter and full year 2024 earnings. The company statement offered the following update:

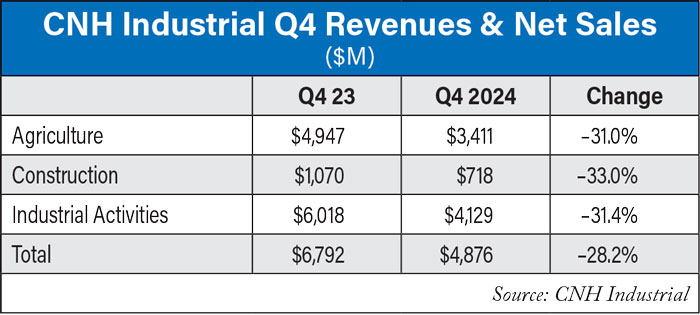

- Fourth quarter consolidated revenues declined 28%;

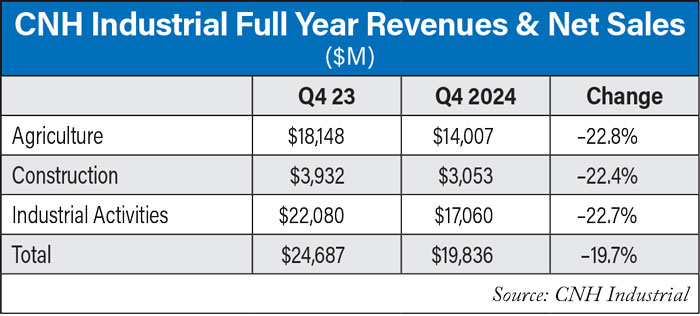

- Full year consolidated revenues declined 20% on lower industry demand for Agriculture and Construction equipment

- Fourth quarter net income of $176 million; full year net income of $1,259 million

- Full year diluted EPS at $0.99; adjusted diluted EPS at $1.05

- Results reflect channel destocking and continued execution of cost savings initiatives

In a detailed overview, CNH Industrial has reported results for the three months and 12 months ended December 31, 2024, with Q4 2024 net income of $176 million and diluted earnings per share of $0.14, compared with net income of $583 million and diluted earnings per share of $0.44 in Q4 2023(1). Consolidated revenues were $4.88 billion in the quarter (down 28% compared to Q4 2023) and Net sales of Industrial Activities were $4.13 billion (down 31% compared to Q4 2023). Net cash provided by operating activities was $1,692 million, and Industrial Free Cash Flow was $848 million in Q4 2024.

Additionally, the company says that the 2025 outlook for agriculture segment net sales is expected to be down between 13% and 18% year-over-year, including currency translation effects. Its forecast also noted its agriculture segment adjusted EBIT margin will land between 8.5% and 9.5%.

Following the earnings call, Michael Shlisky, an analyst with DA Davidson, noted, "In discussing the global tariff situation on our call-back, we got the sense that U.S. tariffs between Mexico, Canada and China will have little effect on CNH's earnings, were they to become permanent. CNH also agreed that retaliatory tariffs on U.S. corn and soybeans would be met with grain purchases in other countries, bolstering those farmers' outlooks and partially offsetting the U.S. downside.

"For now, however, CNH is not making wholesale changes in where it sources or produces product, as tariff policies on all sides will need to firm up before a 12-18 month project to adjust to them is implemented."

Tami Zakaria, analyst with JP Morgan, noted that tariff costs are expected to be passed through to customers. She noted that CNH is monitoring potential tariffs on components from Mexico, Canada and China, affecting about $400 million in imports. "The company plans to pass these costs to customers through immediate pricing adjustments," she wrote in a note to investors.

CNH imports small to midsize tractors into North America from Turkey, Italy, India and South Korea, while large tractors are made domestically, Zakaria noted. Additional, CNH imports planters from Canada and has a plant in Mexico, but that plant only serves the local market.

"CNH is considering reshoring or relocating assembly to the U.S. if tariffs justify it, but such decisions depend on stable policy conditions," Zakaria noted. "They are running scenarios to assess tariff impacts, considering exchange rates and competition. CNH also highlighted that anticipated tariffs might trigger pre-buy behavior from farmers, affecting inventory and sales."

Full year 2024 consolidated revenues were $19.84 billion, down 20% year-over-year, with Net sales of Industrial Activities at $17.06 billion, down 23%. Full year net income was $1,259 million compared to 2023 net income of $2,287 million. Full year diluted earnings per share was $0.99 compared to $1.69 in 2023. Adjusted net income was $1,339 million compared to $2,217 million in 2023, with adjusted diluted earnings per share of $1.05 compared to $1.63 in 2023. Full year net cash provided by operating activities was $1,968 million and Industrial Free Cash Flow absorption was $401 million.

In the agricultural sector, the company stated said, In North America, industry volume was down 34% year-over-year in Q4 2024 for tractors over 140 HP and was down 10% for tractors under 140 HP; combines were down 33%. In Europe, Middle East and Africa (EMEA), tractor and combine demand was down 6% and 31%, respectively, of which Europe tractor and combine demand was down 8% and 11%, respectively. South America tractor demand was down 5% and combine demand was down 21%. Asia Pacific tractor demand was up 10%, and combine demand was down 1%.

Agriculture net sales decreased for the quarter by 31% to $3.4 billion primarily due to lower shipment volumes on decreased industry demand across all regions and dealer destocking.

Adjusted EBIT decreased to $244 million ($635 million in Q4 2023), primarily due to lower shipment volumes, partially offset by a continued reduction in SG&A expenses. R&D investments accounted for 6.2% of net sales (5.0% in Q4 2023). Adjusted EBIT margin was 7.2% (12.8% in Q4 2023).

According to Gerrit Marx, chief executive officer. “As intended, agriculture dealer inventory went down in Q4 by over $700 million due to focused retail sales support and 34% fewer production hours. Our proactive and ongoing efforts to align our business structure with the current industry environment have allowed us to deliver our products with reasonable margin erosion. The challenging market conditions will continue at least through the first half of 2025, and we will keep production levels fairly low by design to drive channel inventory down further. I am confident that our continuing efforts to simplify, streamline, and raise the quality of our operations prepare us well for the regional cycle dynamics ahead.”

2025 Outlook

The Company forecasts that 2025 global industry retail sales will be lower in both the agriculture and construction equipment markets when compared to 2024. In addition, CNH is focused on driving down excess channel inventory primarily by producing fewer units than the retail demand level. Therefore, 2025 net sales will be lower than in 2024.

The lower production and sales levels will negatively impact our segment margin results. However, the Company’s past and ongoing efforts to reduce its operating costs will partially mitigate the margin erosion. CNH is continuing to focus on reducing product costs through

lean manufacturing principles and strategic sourcing. The Company will also carefully manage its SG&A and R&D expenses accordingly, according to the Feb. 4 news release.

Consequently, the Company is providing the following 2025 outlook:

- Agriculture segment net sales down between 13% and 18% year-over-year, including currency translation effects

- Agriculture segment adjusted EBIT margin between 8.5% and 9.5%

- Construction segment net sales down between 5% and 10% year-over-year, including currency translation effects

- Free Cash Flow of Industrial Activities between $200 million and $500 million

- Adjusted diluted EPS between $0.65 to $0.75