In this episode of On the Record, brought to you by Weasler Engineering, we take a look at some responses to Kubota's new limiting acquisitions policy for dealers. In the Technology Corner, Noah Newman examines how autonomy may provide a health benefit to the ag equipment industry. Also in this episode, John Deere's latest earnings and the end of AGCO and Ohio Ag Equipment's distribution agreement.

For more than 70 years, Weasler has proudly led the industry in unsurpassed quality, reliability and service. We are a global leader in manufacturing and distribution of drive train systems and components for agricultural original equipment manufacturers around the world. Since 1951, our promise to our customers has remained the same: We will continually focus on our values, including expertise, quality, innovation and customer experience, to ensure that you have the best driveline products to meet the demands of your business and the market. Work with us and you’ll find we live our values. That's the Weasler Promise. Visit Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Kubota Dealers React to New Acquisition Limitations Policy

- Dealers on the Move

- One Autonomy Benefit That Doesn’t Get Talked About Enough

- Ohio Machinery to Exit Ag Equipment Market by End of 2024

- Deere 2Q Ag Sales Drop 16%

- DataPoint: Canadian Combine Sales

Kubota Dealers React to New Acquisition Limitations Policy

Kubota implemented a new policy effective May 17 capping the number of Kubota locations any dealer can own per state. In a memo to dealers, Kubota said it is setting these limitations "to maintain the integrity of its dealer network, support the Local Dealer of Choice philosophy, and promote transparency through the growth process."

Some reasons given in the memo for the new policy included:

- To "promote healthy intra-brand balance and maintain a strong market presence on a state and national level"

- "Maintain the integrity of the dealer network and continue to have a favorable mix of high performing single and multiple location entities."

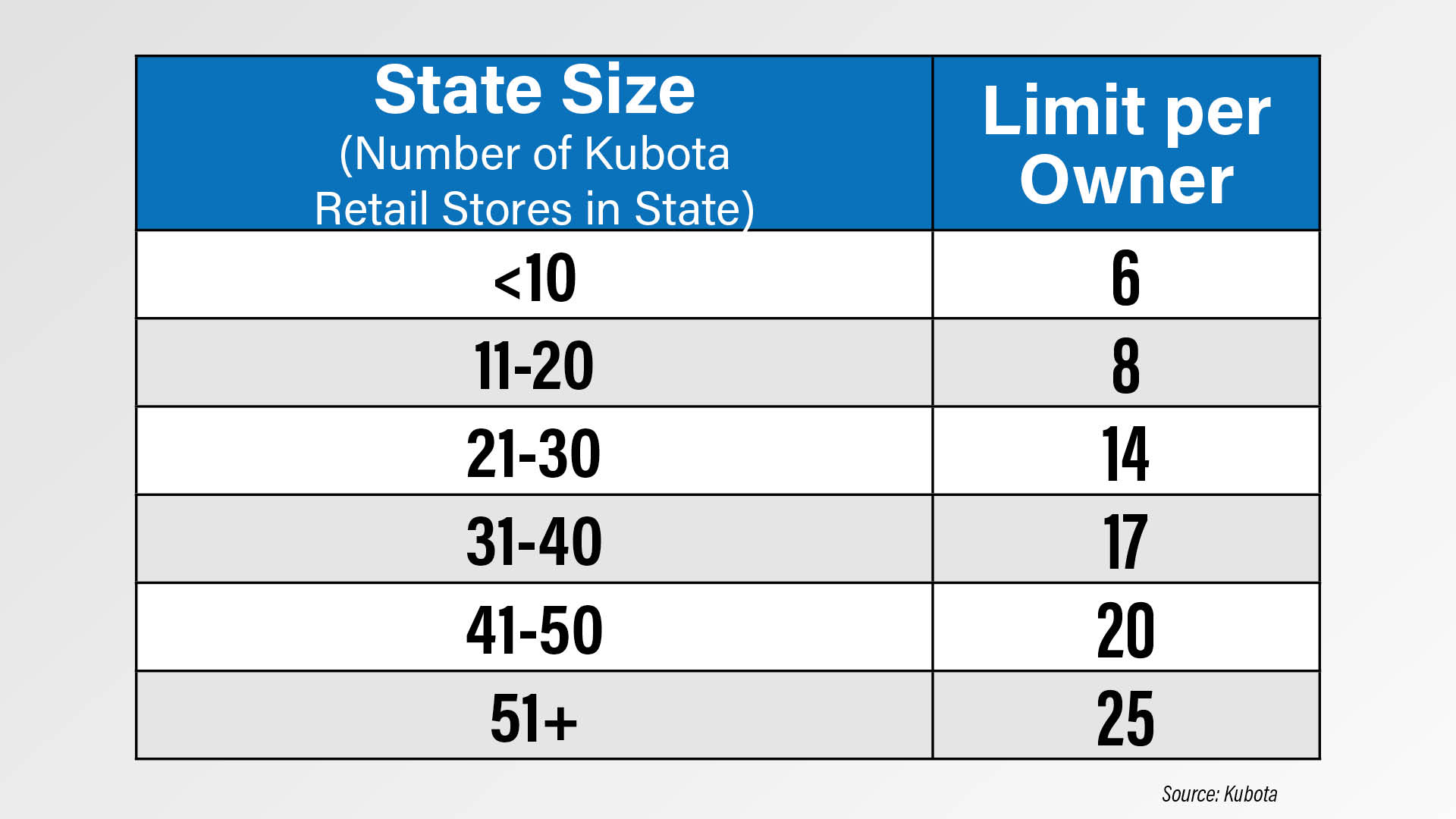

The memo included this table showing how Kubota store ownership is limited by state. The cap per state begins at 6 in states with 10 or fewer Kubota locations and ends at 25 stores per ownership group in states with 51 or more Kubota stores. The policy additionally limits the number of total Kubota locations one ownership group can own to 50 nationwide.

According to one Kubota dealer:

“It’s helpful for Kubota to share their philosophy and approach to dealer expansion. A dealer can go up to 6 stores, which would allow them to potentially own all the stores in one state. The philosophy is consumers need at least one other option to purchase the Kubota brand. For small states, they can typically cross state lines reasonably, so it’s not total control of a market to own all the stores in a small state. A large state like Texas would be quite different.”

Another Kubota had the following to say:

“There is a lot to consider. I think it is reactionary on Kubota’s part and creates as many problems as it corrects. That said, I know that Kubota is instituting this policy in what they consider to be the best interest of the dealer network.”

One Canadian Kubota dealer said this policy had not been posted to the Canadian Kubota dealer website and did not seem to be in effect in Canada. Kubota Canada didn’t respond to a request for commentary in time for this newscast.

George Russell, founding member of the Machinery Advisors Consortium, says this policy may indicate Kubota wants its dealers to sell a wider range of Kubota equipment in their current area vs. pushing to expand their territory with only their current Kubota offerings.

“And my observation about Kubota is that they've made a conscious decision that ‘We want our dealers to get deeper into the area that they have,’ and a limitation on size kind of signals that — their focus and as they add product lines. So that looks like a natural reflection — that is, selling a more broad product line that Kubota has in the geography you have, rather than getting broader.”

In a statement to Ag Equipment Intelligence, Kubota said:

“To foster healthy competition in the industry, Kubota is in favor of a balanced approach which allows for managed growth by dealer owners, while also requiring reasonable limits on the concentration of ownership at a state level. Our dealers will be the first to learn of any further developments on this matter.”

For more dealer commentary on this new policy, you can head to the Farm Equipment website.

Dealers on the Move

This week’s Dealers on the Move include Skyview Equipment and RDO. 2-store Missouri and Kansas New Holland dealer Skyview Equipment recently consolidated its stores — including its distribution business — under the Skyview Equipment name. John Deere dealer RDO Equipment finalized its acquisition of Rocky Mountain Transit & Laser this week, expanding its construction tech solutions offerings in 8 locations across Idaho, Wyoming and Utah.

One Autonomy Benefit That Doesn’t Get Talked About Enough

I recently had the chance to talk with Bluewhite CEO and founder Ben Alfi from Israel. The Robots-as-a-Service company, currently with John Deere and New Holland dealers on the West Coast, makes autonomy retrofit kits that are being used on over 300,000 acres in California and Washington.

Alfi says autonomy is not a dream anymore. It’s a reality and it’s not only saving people money and time, but it’s also doing something that he says doesn’t get talked about enough — it’s keeping people healthier.

“There is no reason for people to be near tractors running and spreading chemicals and the only reason there is no regulation about it is because there wasn't any other option. Now, we have options, so it will happen, and it should happen. Both of us have been in airplanes where people smoked inside and today, we think, "Oh, how the hell did that happen?" This is the only thing that I think that will happen much faster and we, at the ecosystem, should push everybody to transform as fast as possible because we need to have a healthier life, all of us.”

Alfi shared a lot of interesting perspective on the future of autonomy and precision technology. Catch the full conversation at PrecisionFarmingDealer.com.

Ohio Machinery to Exit Ag Equipment Market by End of 2024

8-store AGCO and Claas dealer Ohio Ag Equipment informed customers on May 17 it is ending its distribution arrangement with AGCO. The letter to customers said the dealer and OEM mutually decided to part ways and the dealership is working "diligently with AGCO and Class of America to find alternative distribution and dealership options to continue to support" its customers. Ohio Ag Equipment is also a dealer for Geringhoff and Woods Equipment and is the exclusive dealer of Claas combines in Ohio.

Ken Taylor, president of parent company Caterpillar dealer Ohio Machinery, said in a memo to Ohio Ag Equipment employees:

“As the world of agriculture changes, so does the landscape of its suppliers. More than ever, market forces are requiring us to look within and focus on our core competencies, optimizing our organization to more efficiently serve the industries that are closest to our roots in order to remain a viable, relevant partner with our customers. As such, and after a great deal of difficult discussion, Ohio Machinery Co. and AGCO have mutually decided to end the distribution relationship, and we will be dissolving our ag division by the end of the year.”

According to the newly released 2024 Big Dealer Report, Ohio Ag Equipment sells Claas combines at 7 of its 8 stores and is currently tied with 3 other dealers for being the 4th largest Claas dealer in North America.

AGCO and Ohio Ag Equipment will announce the replacement and successor plans for the dealership on or before July 1, 2024.

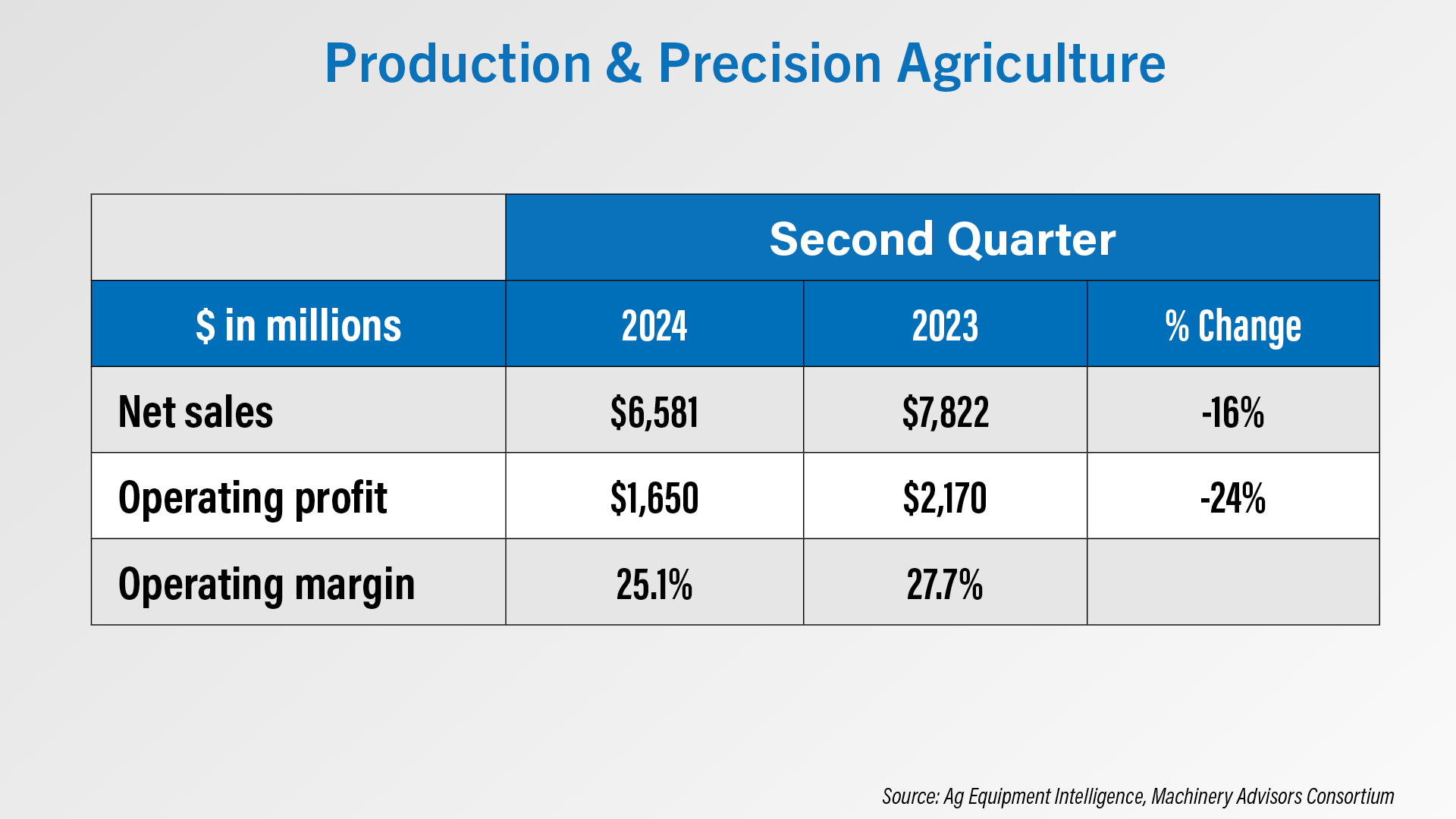

Deere 2Q Ag Sales Drop 16%

Deere & Co.‘s Production and Precision Ag net sales were down 16% year-over-year for the second quarter.. Josh Rohleder, Deere’s manager of investor communications, says the decline is primarily due to lower shipment volumes. That was partially offset by price realization.

Noting that the industry is coming down from a period of high demand, Cory Reed, president of Deere’s Worldwide Agriculture & Turf Division, says historically the industry would be sold to react to that change.

He says:

“Often, we would drive higher levels of field inventory to the detriment of the following years. Within Deere, we're managing this year differently, which is a testament to the fact that both we and our dealers have learned from the past cycles. This is probably best exemplified by our decision to underproduce large tractor retail demand in North America in the back half of the year. We ended 2023 with really low levels of large tractor inventory, but we think it's prudent to drive those levels even lower as we close out our 2024. The key here is that by staying ahead of demand changes, we're giving ourselves the optionality to react most efficiently to whichever way the market moves in the next year.”

For FY 2024, Deere forecasts large ag sales to be down in all regions.

Rohleder says:

“Across all our major markets, we see continued softening in grower sentiment as the combined impacts of rising global stocks, lower commodity prices, high interest rates, and weather volatility weigh on customer purchase decisions. Amidst this backdrop to rising uncertainty, we're seeing customers exercise greater discretion in their equipment purchases, which is reflected in the changes in our industry guide this quarter.”

“In the U.S. and Canada, Deere now expects large ag equipment sales to be down 15% for the FY 2024. Rohleder says the declines reflect “further demand reduction in the back half of the year, primarily in large tractors.”

He also says increases in used inventory levels, particularly for late model year machines, are impacting purchasing decisions. But, these headwinds are partially offset by fleet fundamental tailwinds, including elevated fleet age, stable farmland values, and strong farmer balance sheets.

Deere expects European large ag sales to be down 15% as well and in South America for sales to be down 15-20%.

DataPoint: Canadian Combine Sales

This week’s DataPoint is brought to you by the 2024 Dealership Minds Summit.

Sales of new combines in Canada are projected to decline 20% in 2024, below the 5-year average. This is due in part to declining grain and oilseed revenue and strong sales from 2023, according to an April 24 report from Farm Credit Canada.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.