In this episode of On the Record, brought to you by Weasler Engineering, we look at how the Port of Baltimore's closure will alter the flow of high horsepower tractors in and out of the country. In the Technology Corner, Noah Newman talks about some changes coming to drone operation regulations. Also in this episode, Kazakhstan's potential for the North American ag equipment industry and what 2024 holds for the sprayer market.

For more than 70 years, Weasler has proudly led the industry in unsurpassed quality, reliability and service. We are a global leader in manufacturing and distribution of drive train systems and components for agricultural original equipment manufacturers around the world. Since 1951, our promise to our customers has remained the same: We will continually focus on our values, including expertise, quality, innovation and customer experience, to ensure that you have the best driveline products to meet the demands of your business and the market. Work with us and you’ll find we live our values. That's the Weasler Promise. Visit Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Baltimore Port Closure to Impact High Horsepower Tractor Imports & Exports

- Dealers on the Move

- Future of Drone Use in U.S. Brighter After FAA Regulation Change

- Kazakhstan Offers Opportunities for North American Manufacturers

- Pull-Type Sprayers & Sprayer Precision Tech Sales Looking Good for 2024

- DataPoint: Precision Farming Systems Unit Sales

Baltimore Port Closure to Impact High Horsepower Tractor Imports & Exports

The Port of Baltimore is a key hub for ag equipment imports and exports in the U.S., and its closure could have a notable impact on importing high horsepower tractors specifically. A cargo ship collided with the Francis Scott Key Bridge on March 26, collapsing and rendering the port inoperable. The U.S. Army Corps of Engineers estimates the port will see limited opening by the end of April and fully operational by the end of May.

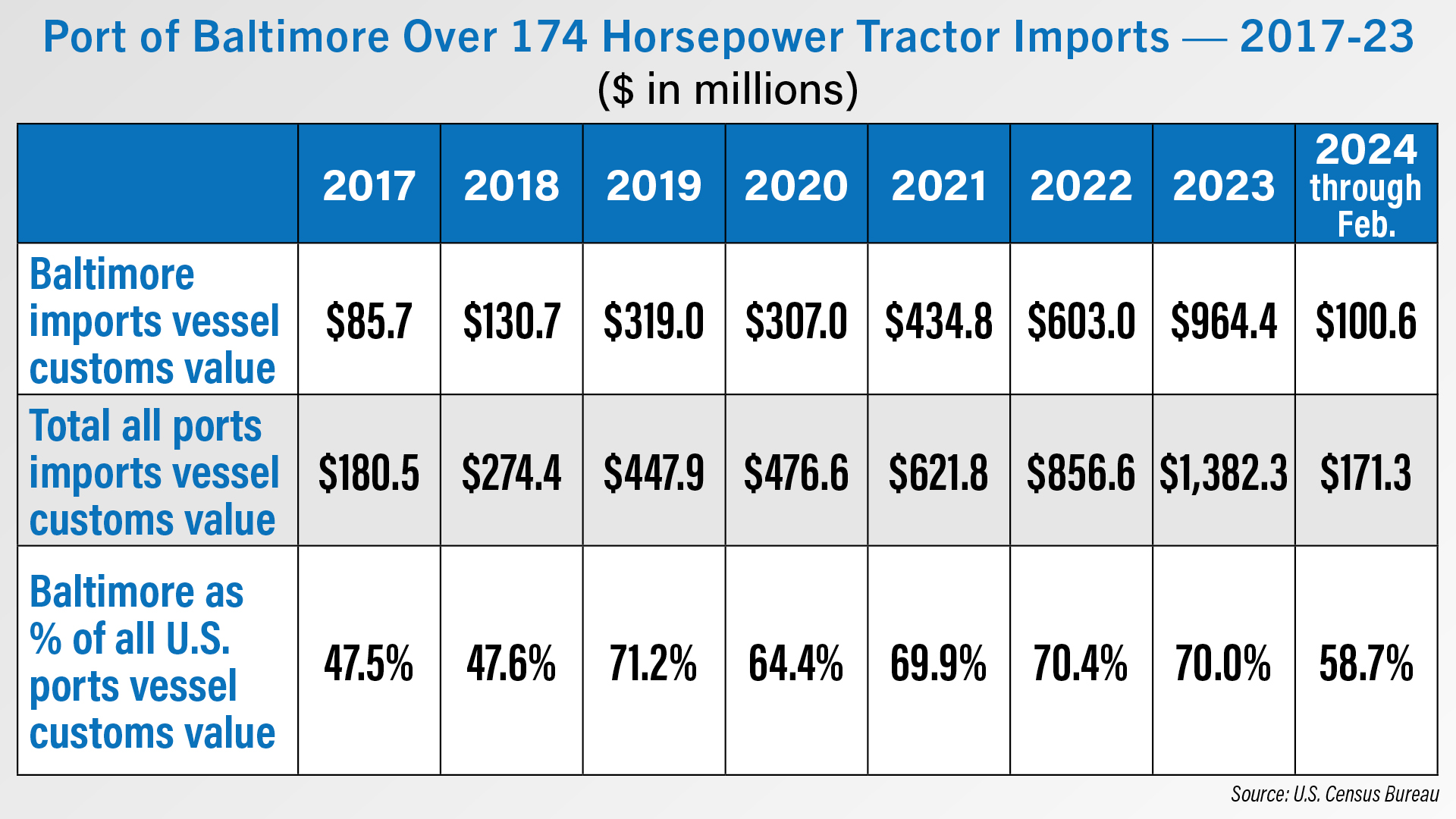

Data from the U.S. Census Bureau shows the Port of Baltimore received almost $1 billion in imported tractors over 174 horsepower last year, representing 70% of all tractor imports in that horsepower category. This was up 60% year-over-year from $603 million in imports in 2022.

The Port of Baltimore has played a growing role in importing high horsepower tractors since 2017, growing from handling 48% to now 70% of these imported tractors. For the first 2 months of 2024, the Port of Baltimore reported over $100 million in imported tractors over 174 horsepower, 59% of total imports.

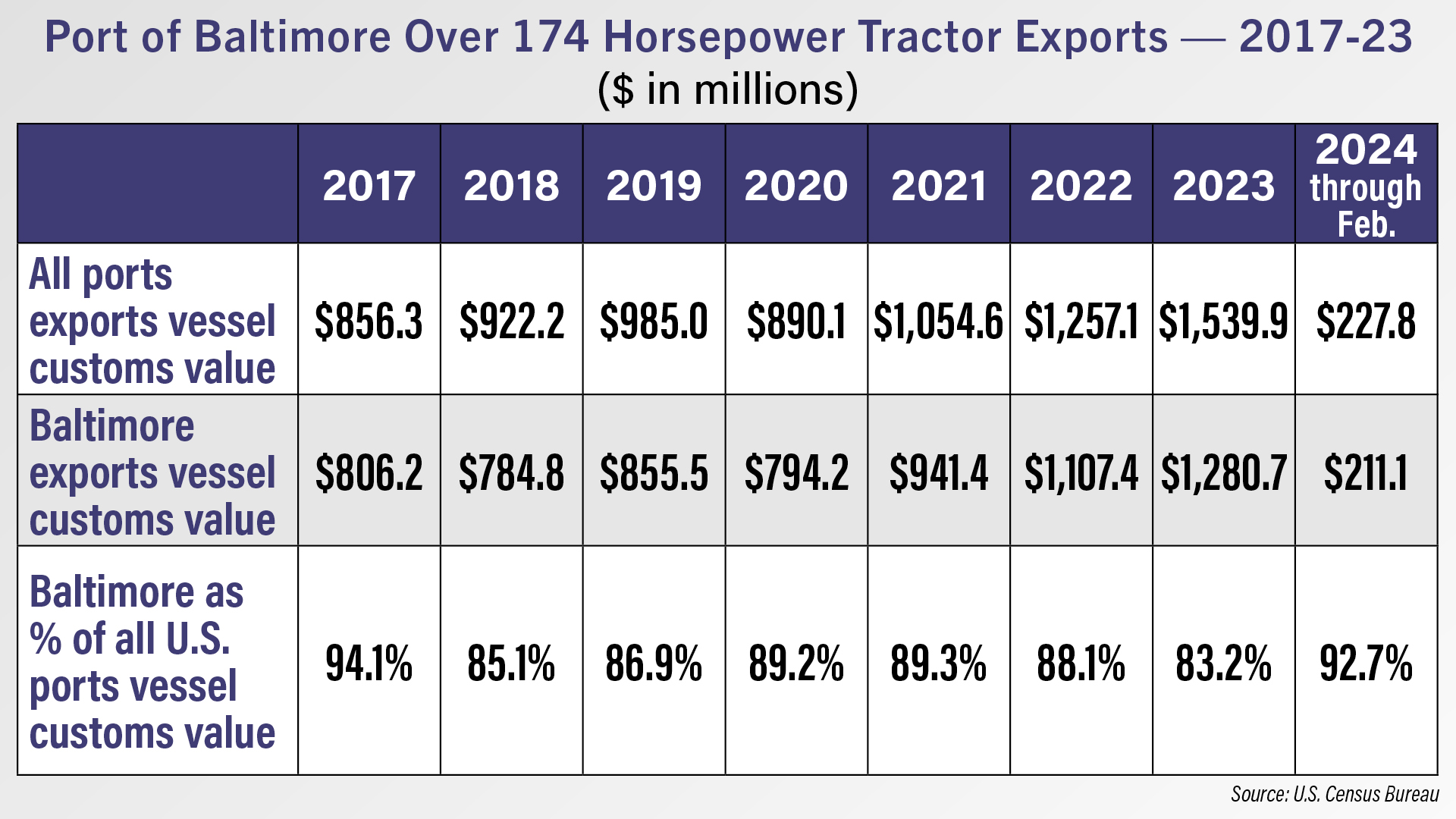

The Port of Baltimore plays an even more significant role in exporting this category of tractors, seeing over $1.5 billion in these exports last year, 83% of total exports. For the first 2 months of the year, Baltimore handled 93% of all exports for tractors over 174 horsepower

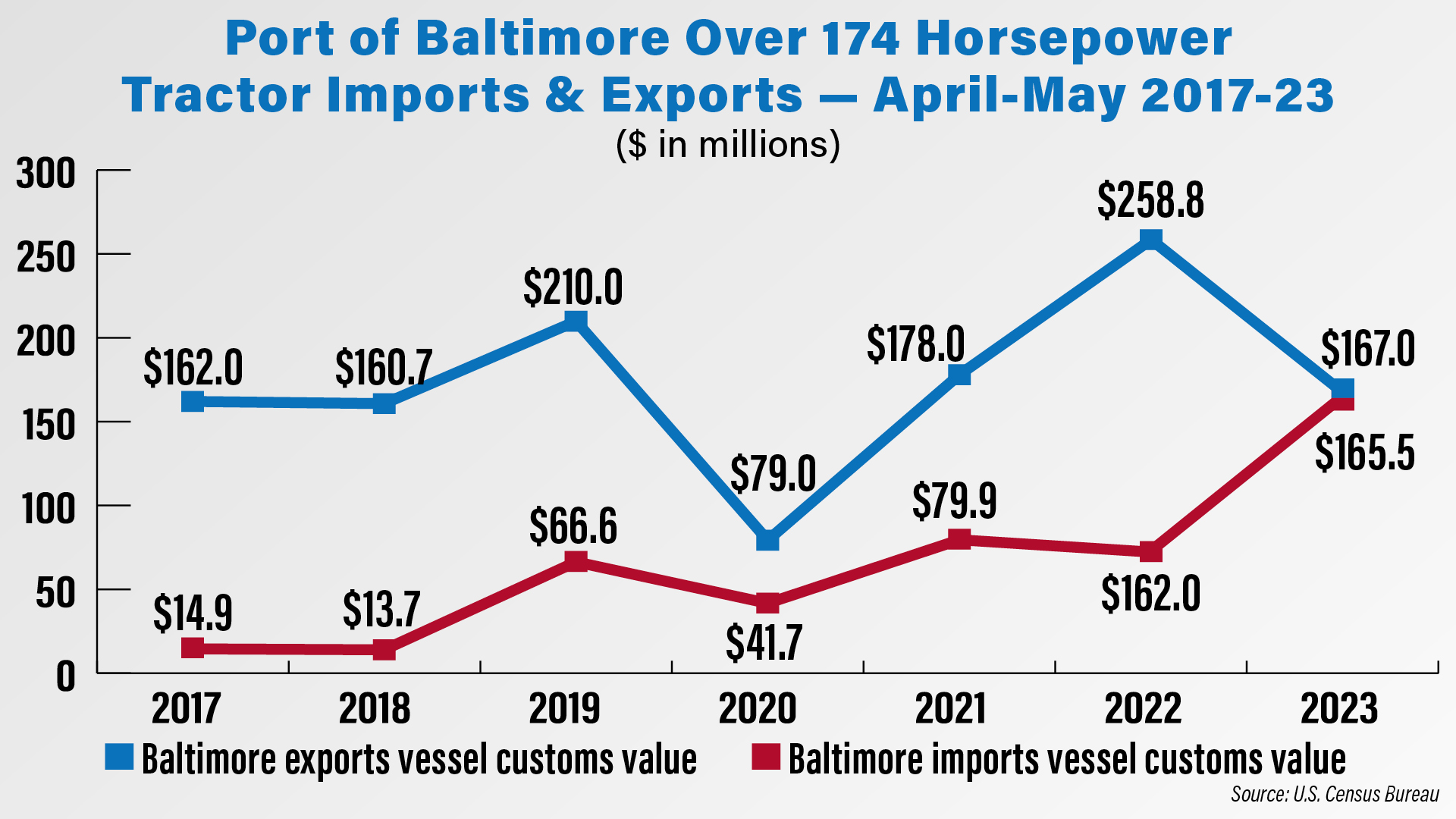

With the port forecast to see only limited operations throughout May, this could result in hundreds of millions of dollars of high horsepower tractors imports and exports being diverted to other ports. Since 2017, the average value of exports of tractors over 174 horsepower coming through Baltimore in April and May has been $173.7 million, with 2023 April and May exports valued at $167.4 million. Average imports in April and May since 2017 come in at $65 million, and 2023 imports in this horsepower category came in at $166 million.

Claas Senior Vice President of the Americas Eric Raby said the company is already redirecting imports from Baltimore. This included an initial delivery of forage harvesters and tractors, most of which were bound for dealers. Raby stated the company is currently seeing 5-7 day delays on equipment deliveries, though he added its improving”more rapidly than we first thought it would.”

“Those [shipments] that were there, getting offloaded to Baltimore, we have looked at a couple other ports and rerouted a few ships, like to Halifax to the north and looking what can we do in the south, whether it be like Charleston. The only thing is you have to be sure that they're a deep water port. Kind of narrows down what availability we have, but we've already diverted a few ships to, or at least one ship I know of to Halifax.”

Marc Heater, USA director of sales and marketing at Amazone, said the company doesn’t usually use the Port of Baltimore to import its equipment. As a result, he’s concerned about how diverted traffic from Baltimore might impact the operations of other ports they use. Depending on where the equipment is going, Amazone uses ports in Montreal, the Carolinas and Texas.

“That would affect the lead times. Because if you know instead of being able to tell someone, ‘Hey, your machine's going to be hitting the port,’ say, I don't know a timeline, ‘June,’ and now that we’re delayed, and they say, ‘Hey, it's got 2 months.’ If a machine's going to be delayed — farming is not just happening all the time. It's a cyclical thing. So we have spring planting, fall harvesting. So with us being tillage and fertilizer spreaders, that's a big thing for timely. If a guy's going to be planting and the planter shows up late, that hurts their planting season. But for us, if the tillage isn’t here in time for the end of the year, then you miss that. So it definitely could play a big role for those types of manufacturers.

You can find more ongoing coverage of the Baltimore Port closure at agequipmentintelligence.com.

Dealers on the Move

This week’s Dealers on the Move include Bob Howard Luxury Auto Group, Valley Plains Equipment and Sloan Implement.

Bob Howard Luxury Auto Group enters the Kubota dealer network with its purchase of Universal Tractor Co. in Lakewood, Colo. The dealership will be renamed Kubota of Denver.

North Dakota-based John Deere dealer Valley Plains Equipment is updating its Valley City, N.D., location. The Valley City store will be open in late November or early December. The addition will quadruple the store's 100 by 200 foot service area.

John Deere dealer Sloan Implement has acquired Alliance Tractor, which has 4 locations in Illinois and Indiana, bringing Sloan’s total locations to 26 across Illinois, Wisconsin and Indiana.

Future of Drone Use in U.S. Brighter After FAA Regulation Change

Big news in the drone world — the Federal Aviation Administration recently granted Texas-based drone builder Hylio a regulatory exemption that will allow it to swarm its heavy-lift drones with only one operator in control.

Hylio co-founder and CEO Arthur Erickson says the development was a case of regulations catching up with existing technology and promises a 3-fold increase in productivity for drone operators applying material to crops, plus a significant reduction in their labor requirements.

“If the drone was over 55 pounds, you would need not only just a pilot per drone, but also a second person, which was called the visual observer. It's kind of ludicrous. If you had three drones out in an operation, you would need six people, which is counter to the entire logic of drones. They're called drones for a reason, meaning they go fly autonomously. You would want to force multiply what a single operator could do and have them use multiple drones.

“So, law is finally caught up to the logic of the technology. It's one operator now able to command three drones. One person, three drones. Instead of one drone doing 50 acres per hour, now you have 50 acres per hour times three, 150 acres per hour per operator, is legally possible. It's a huge jump. The math is simple, it's a 3x boost in productivity.”

Currently the exemption applies only to Hylio and its products, but Erickson says the FAA will soon codify a general set of requirements to include other manufacturers of such drones.

Kazakhstan Offers Opportunities for North American Manufacturers

During the Farm Equipment Manufacturers Assn. spring Supply Summit & Showcase in Little Rock, Ark., last week, we caught up with Montag’s Roger Murdock who recently returned from Kazakhstan.

Murdock joined Great Plains as part of the USA Commerce pavilion at a trade show in the country, which he says has great opportunities for North American farm equipment manufacturers.

Kazakhstan is the 9th largest country in the world, but one of the least populated, Murdock said. He said as a company Montag thinks there’s “great opportunity” to educate farmers on how to increase their yield and how banding fertilizer can play a role in improving yields.

“I think that there's a lot of opportunity for North American companies in Kazakhstan. It appears that it has the ability to have the same farming practices as Ukraine, and so with that and with quite a bit more land opportunities, because there is so much land available for farming, I think there's tremendous growth. It's just educating the people to change their farming practices a little bit, and it appears that the US government is assisting with that because I talked to several growers who, English was very good, and they are going to be coming to the US to various agricultural schools this fall to get Masters in production or agronomy or something, so there is a path to educate the people on maybe figuring out how to make their land more productive.”

While the country seems to have a good infrastructure, Murdock said, the farmers are more focused on profit and cutting costs than on productivity. We’ll have extended coverage on the opportunities in the country in the April 15 Ag Equipment Intelligence newsletter.

Pull-Type Sprayers & Sprayer Precision Tech Sales Looking Good for 2024

We recently caught up with a manufacturer and dealer at the 2024 WPS Farm Show in Oshkosh, Wis., to talk about what 2024 has in store for the sprayer market.

Demco Sales Territory Manager Chris Currans said the company has seen a large increase in farmers adding a second or third pull-type sprayer to do a more efficient job after using a self-propelled sprayer.

“Especially in big grain markets where guys are maybe 2,000-12,000 acre farmers. Most of those guys will have a self-propelled sprayer. But they might be adding a smaller rear mount sprayer to clean up around edges of fields or waterways or stuff like that. This market will always be solid with a pull-type sprayer and a 600 gallon and down size.”

Currans added that, during a downturn in the ag cycle, he sees farmers lean more toward buying sprayers to do their own application vs. paying the local co-op to spray. He said pull-type sprayer inventories are at a manageable level vs. the glut from 10 years ago.

“When dollars per acre coming into the grower's hands are tighter, they look for ways to be more efficient. So maybe you're hiring your sprayer — spraying done by the co-op or a custom applicator and he's charging you $5-$10 an acre depending on what products you're putting on. And he says, ‘Well, maybe I can purchase my own sprayer and keep that cost in house.’

“Pull-type sprayer inventory I would say is at a manageable level. It was way more challenging about 10 years ago. There was a glut of used pull-type sprayer equipment. That is in a lot better place today. So the used values have hung in there nicely. Now new prices went up drastically in the last 2 years. So there's still a kind of figure out — an equilibrium point there. Sprayer product inventory is not a bad place to be right now, because the grower can still invest in it and pay himself back.”

Barry Bewley, technology marketing manager for Wisconsin independent ag tech dealer CROP IMS reported strong sales in precision tech for sprayers, saying growers are looking to upgrade their sprayers when they’re not willing to purchase a brand new machine.

“Guys are looking to upgrade, and we've got the equipment that'll upgrade what they already have in their sprayer. So just for instance, yesterday we had two guys come in here still using speed and pressure, and they were asking us about putting an Ag Leader controller on there and a flow meter and doing all that automatically. So there's still guys looking to do that where maybe they're not going to go purchase a real high dollar self-propelled sprayer.”

Bewley said what he’s concerned about right now is 2025, when he believes the ag economy is going to see a real downturn.

DataPoint: Precision Farming Systems Unit Sales

This week’s DataPoint is brought to you by the 2024 Dealership Minds Summit.

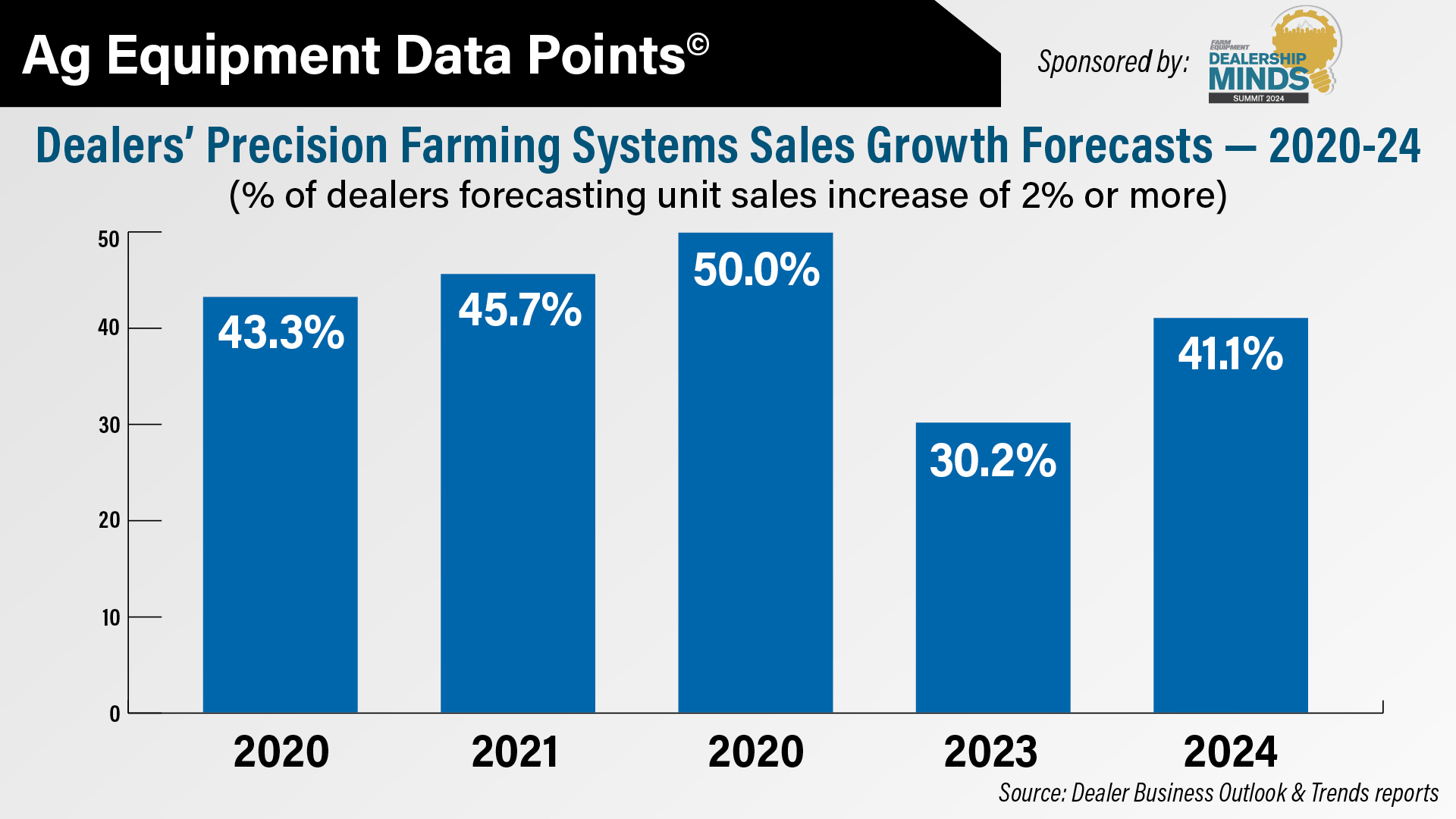

The percentage of dealers forecasting sales growth of 2% or more in precision farming systems sales for the year rose for 2024 to 41%, according to the 2024 Farm Equipment Dealer Business Outlook & Trends report. This percentage peaked in the last 5 years when 50% of dealers were forecasting unit sales growth for 2022.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.