In this episode we take a look at how used tractor prices continue to increase while inventories remain low. In the Technology Corner Michaela Paukner breaks down the technology plans for strip-tillers based on Strip-Till Farmer's 2022 Strip-Till Operational Practices Benchmark Study. Also in this episode: NAEDA completes its merger, the forecast for China tractor sales over the next 5 years, Purdue's Farm Capital Investment Index remains at a record low, and we introduce the pilot episode of our new docuseries Stories from Independent Ag Equipment Innovators.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

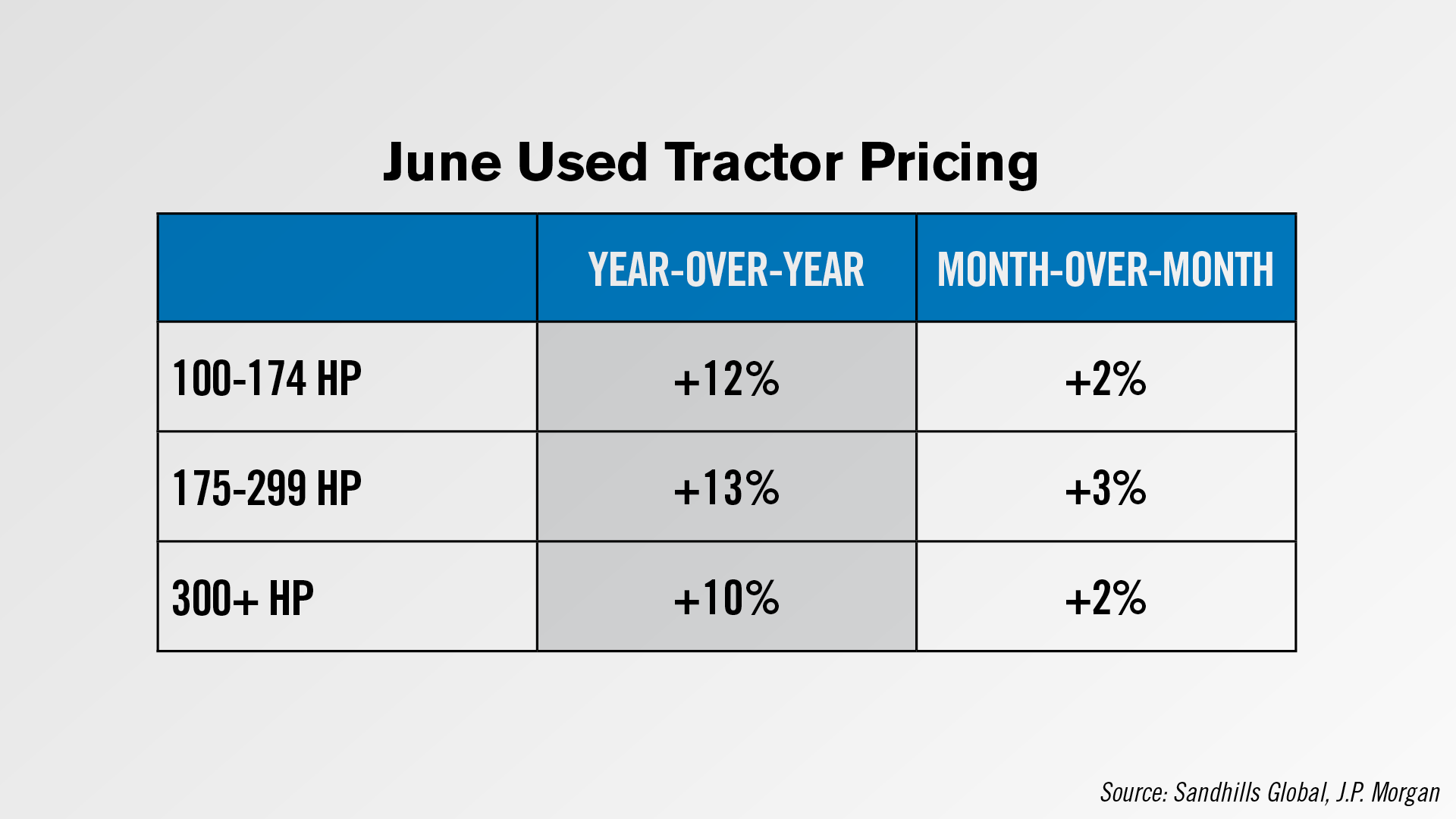

Used High Horsepower Tractor Prices Up 11%

According to data from Sandhills Global and a research note from J.P. Morgan, used high horsepower tractor inventories remain subdued while low horsepower tractor inventories continue to climb.

The average list price of used tractors was up 11% year-over-year in June and up 2% month-over-month.

Pricing for used 100-174 horsepower tractors was up 12% year-over-year and 2% month-over-month. For 175-299 horsepower tractors, used prices were up 13% year-over-year and up 3% vs. May. Pricing was up 10% year-over-year for tractors over 300 horsepower.

Inventory was down 9% year-over-year and up 3% month-over-month, driven primarily by tractors with less than 100 horsepower.

Dealers on the Move

This week’s Dealers on the Move include Ziegler Ag, Bottom Line Solutions and Linco-Precision.

AGCO dealer Ziegler Ag is expanding in Minnesota with a new store in Ada that will serve both the agriculture and construction markets. The dealership acquired an existing building that was formerly Norman County Implement and opened for business June 13.

Precision farming dealers Bottom Line Solutions and Linco-Precision announced the two businesses are merging. Bottom Line Solutions will operate under the name Bottom Line Solutions - Ag Technology Solutions Group. Linco-Precision will be known as Linco-Precision LLV Ag Technologies Solutions Group.

Strip-Tillers Plan Variable-Rate Technology Purchases in 2022

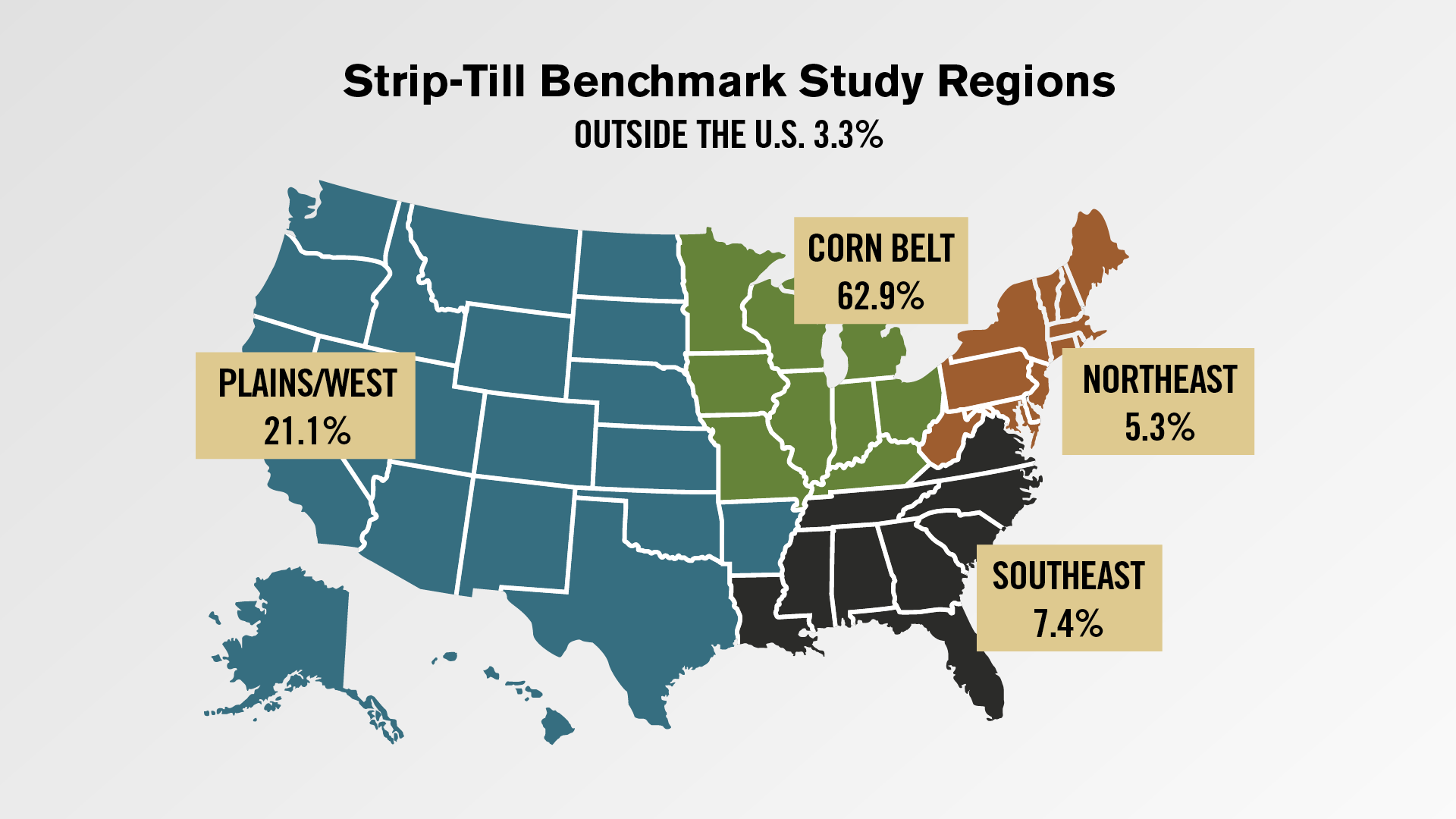

The growing practice of strip-till farming presents an opportunity for dealerships and their precision departments to establish authority and increase revenue. As the results of the 2022 Strip-Till Operational Practices Benchmark Study reveal, most strip-tillers are using and investing in precision.

Most of the respondents to the 2022 Strip-Till Benchmark Study farm in the U.S. About 63% farm in the Corn Belt, followed by about 21% in the Plains/West. About 44% of strip-tillers who took the 2022 survey are farming 1,000 acres or less.

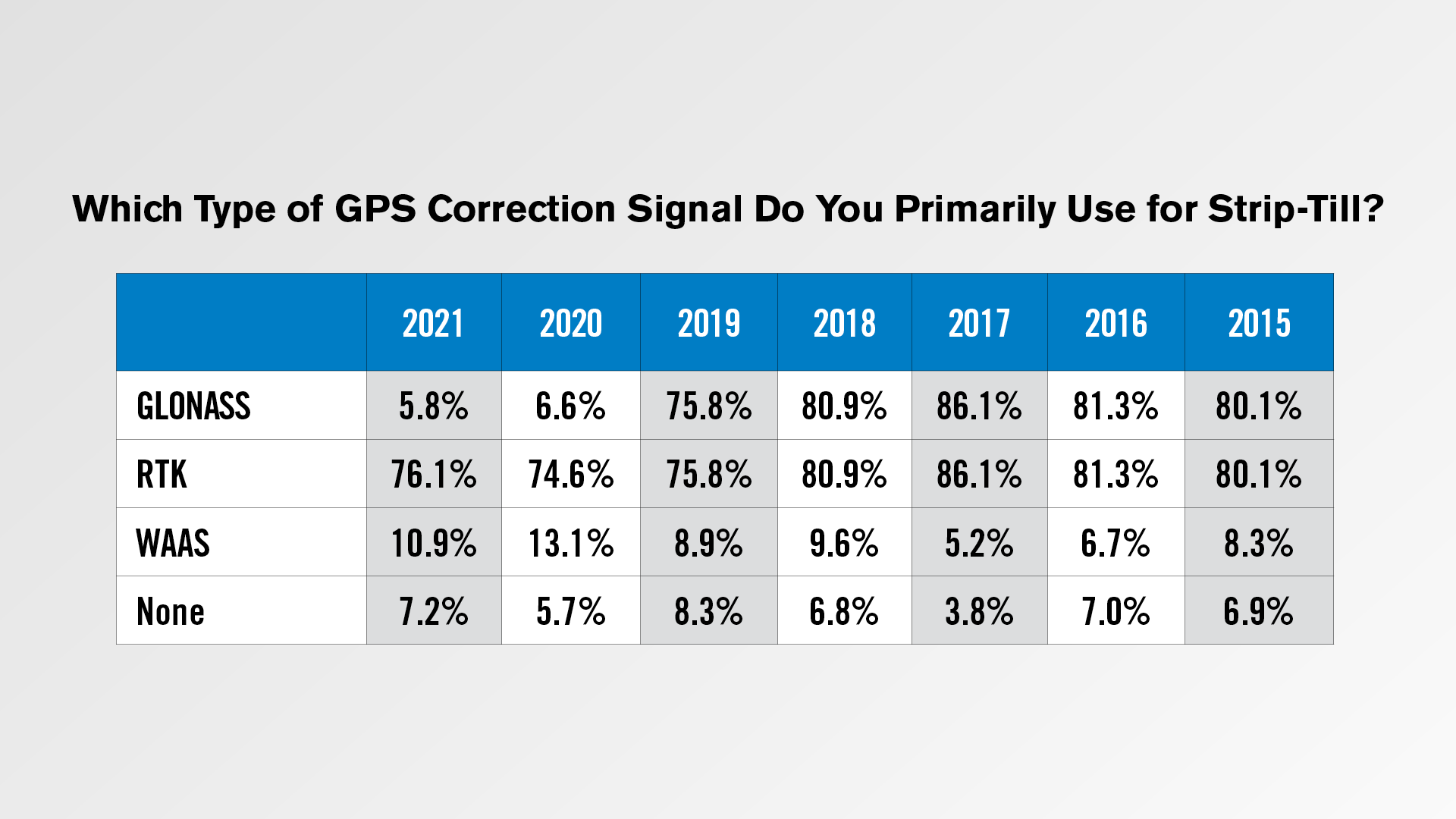

Most surveyed strip-tillers are using RTK guidance for strip-till. About 76% of respondents indicated RTK is their primary type of GPS correction signal, a slight increase from the 74.6% reporting using RTK in 2021.

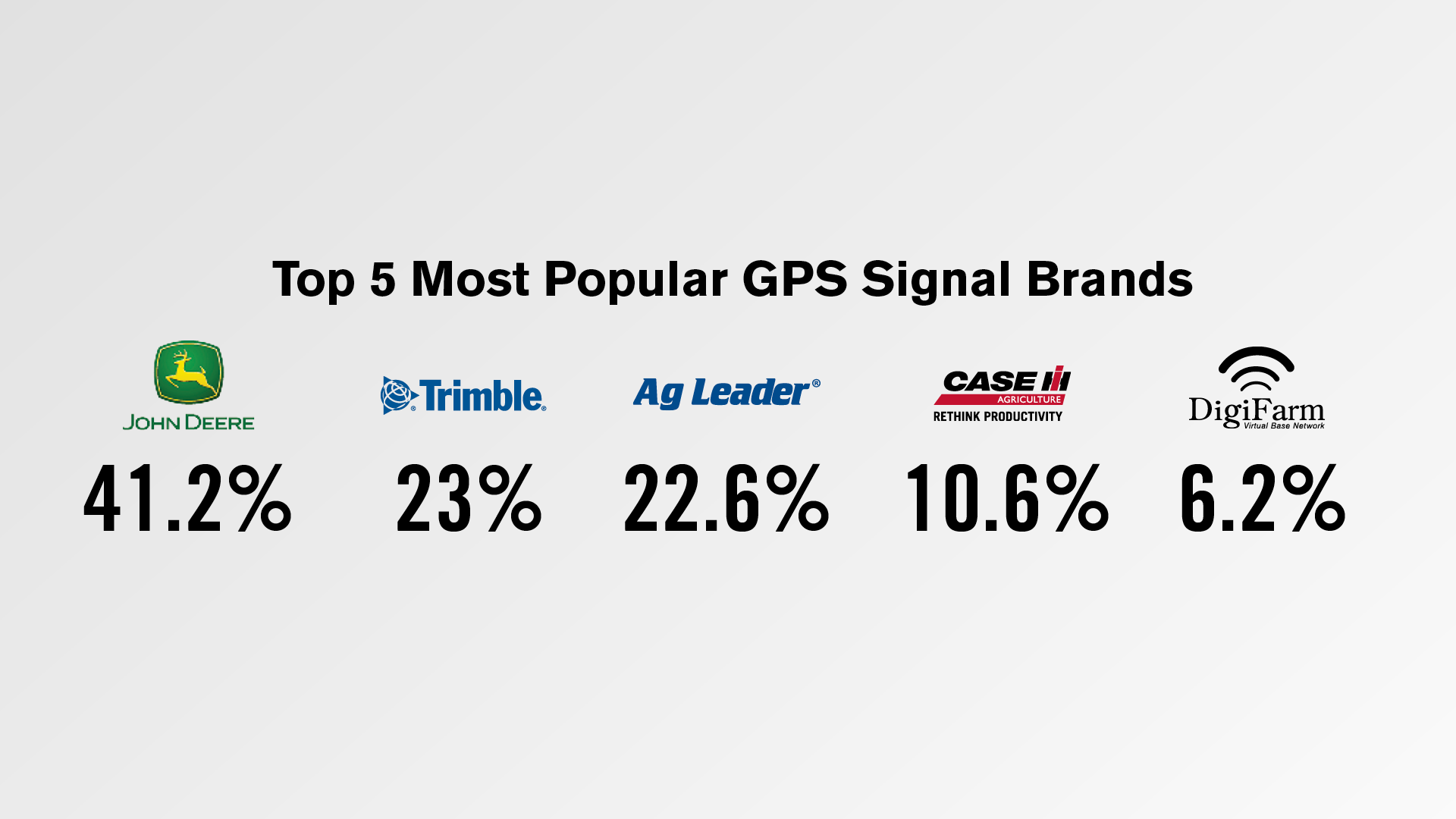

The most popular guidance brand among respondents is John Deere at 41.2%, followed by Trimble, Ag Leader and Case IH. More than 97% of this year’s survey respondents use at least one of these brands. DigiFarm rounds out the top 5 most popular guidance brands in 2022.

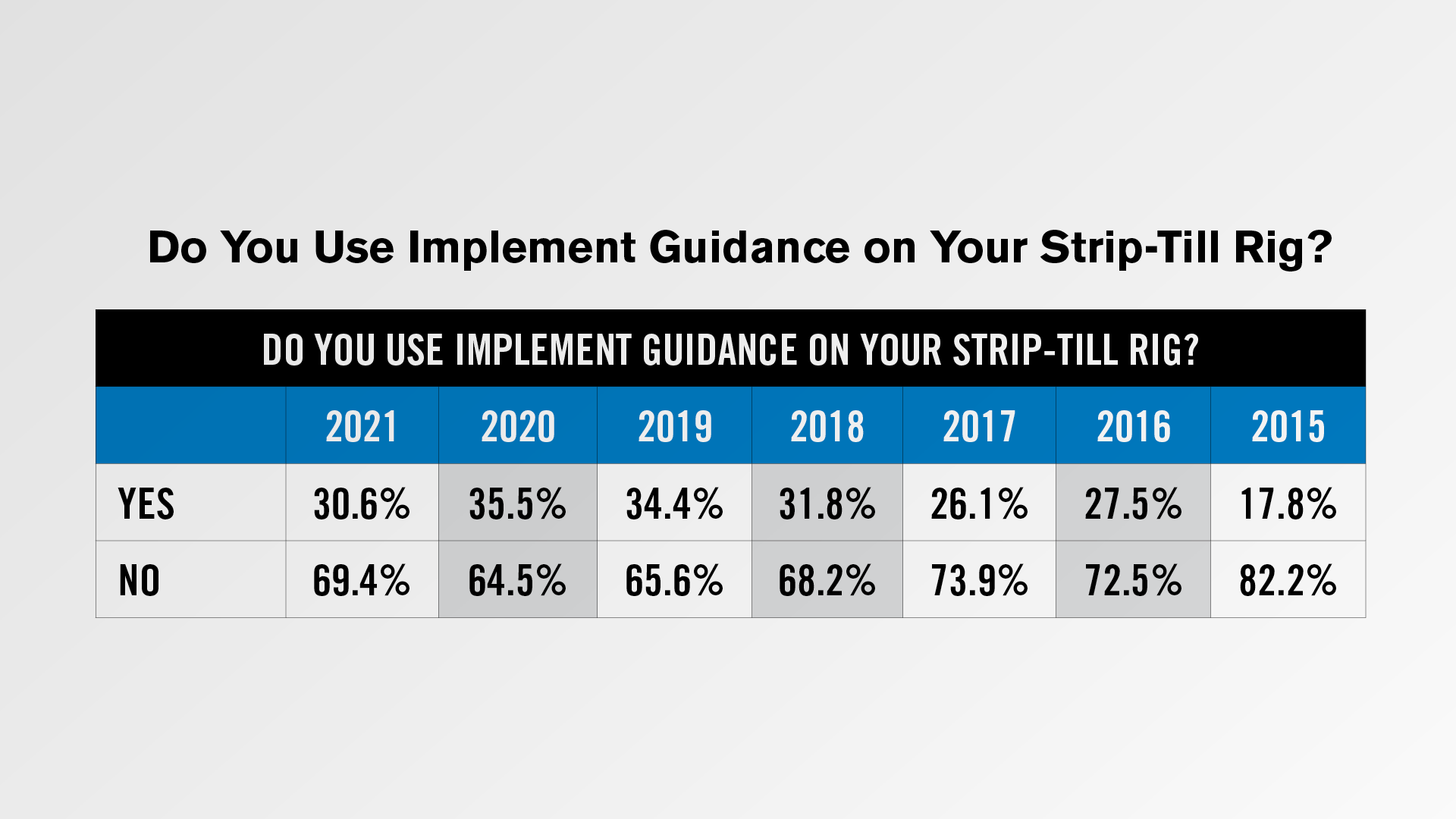

About 69% of strip-tillers do not use implement guidance, continuing an 8-year decline in usage. However, nearly 40% of this year’s survey respondents say they plan to buy implement guidance technology in the next year, a 4.5% increase compared to 2021 projections.

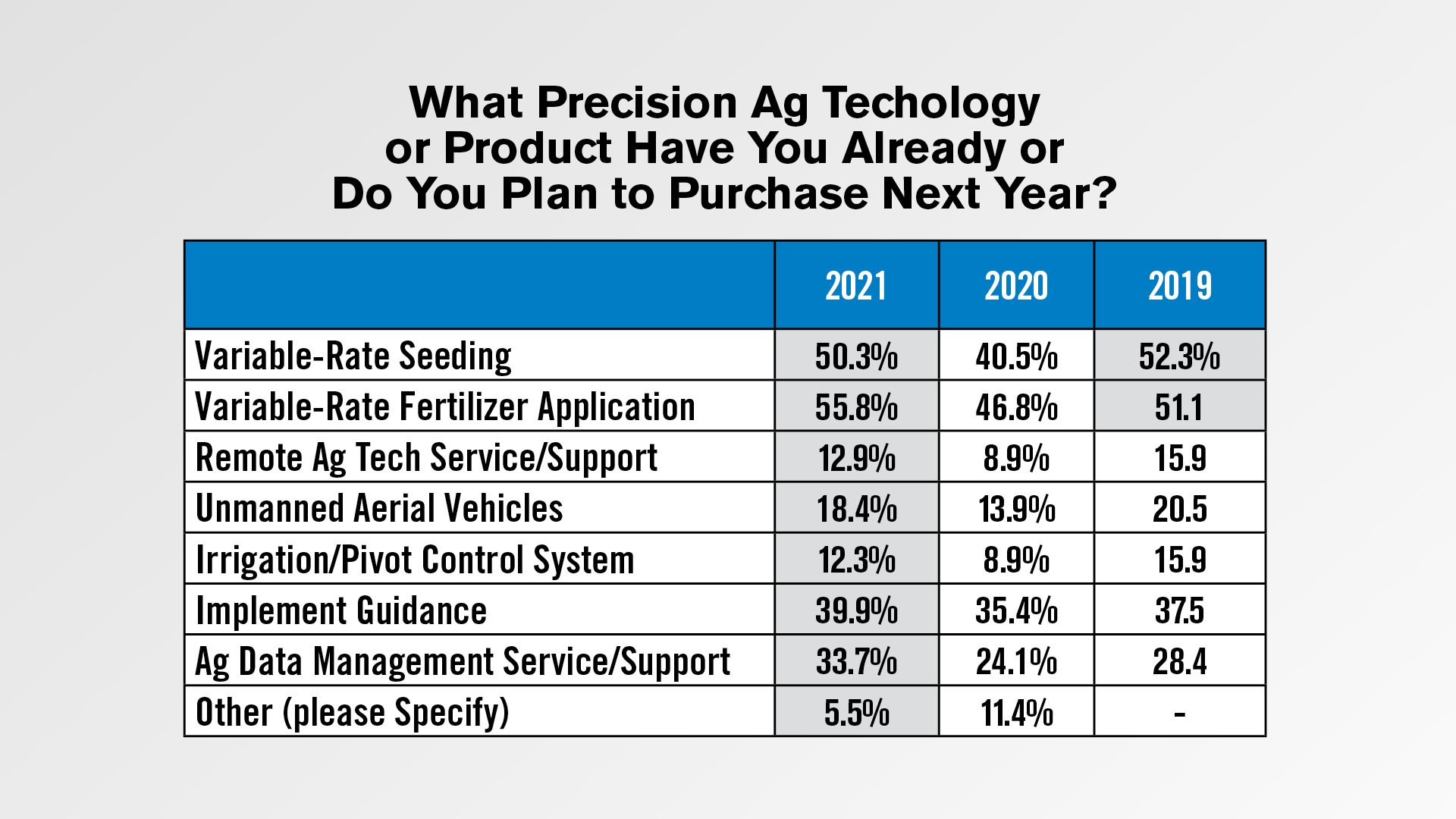

Variable-rate seeding (VRS) and variable-rate fertilizer application (VRA) technologies are higher on strip-tillers’ purchase wish lists. About 56% bought or planned to buy VRA products in 2022, and 50% bought or planned to buy VRS technology this year.

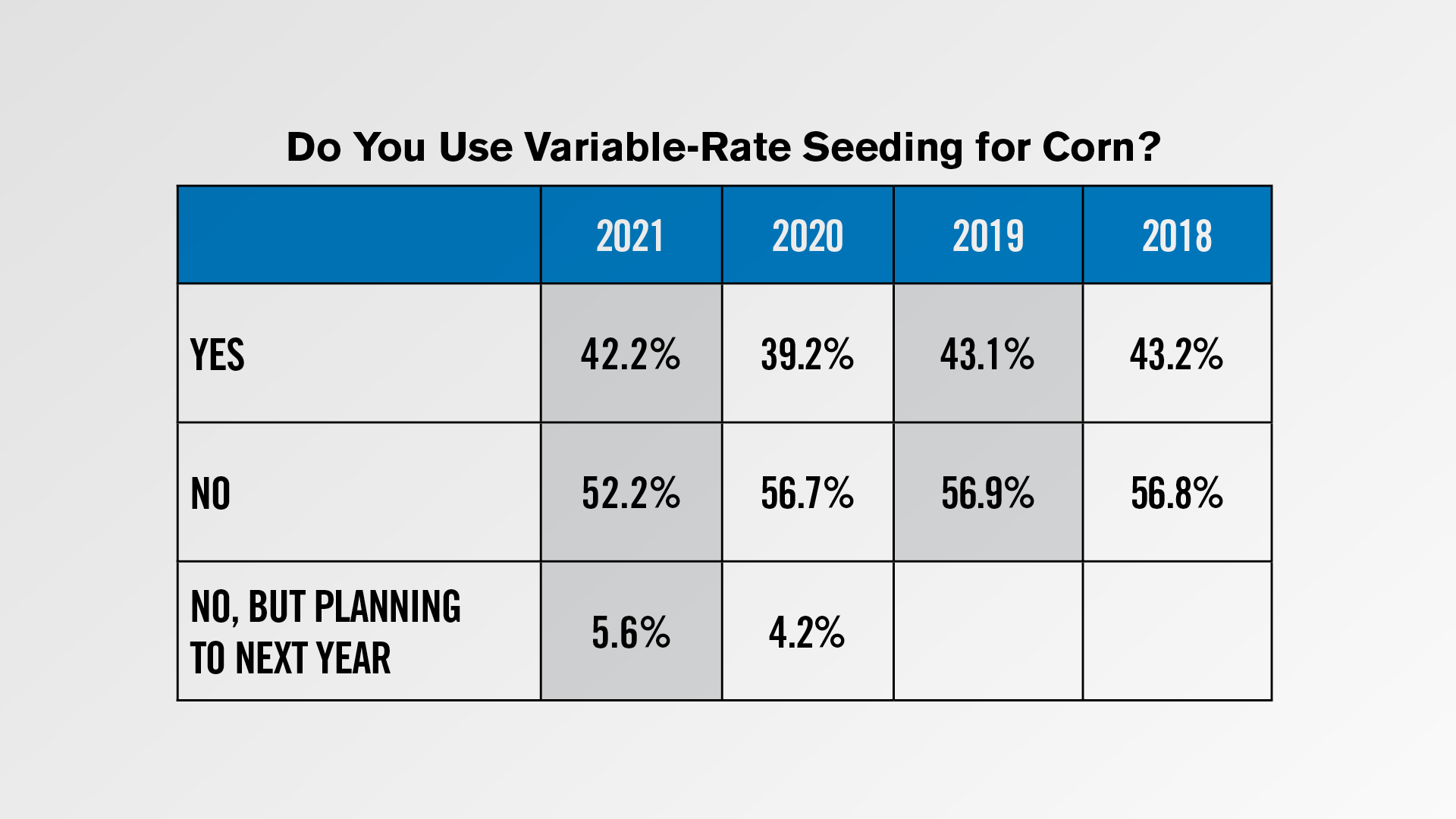

In 2021, 42.2% of strip-tillers used VRS for corn, while 52.2% did not. The remaining 5.6% didn’t use VRS for corn in 2021 but planned to in 2022. Approximately 34% of respondents said they used a variable rate when applying fertilizer with their strip-till rig in 2021, compared to about 28% in 2020. An additional 5% of strip-tillers plan to start using variable-rate application for fertilizer next year.

Other popular precision ag products planned for purchase in 2022 include ag data management service and support, drones, remote precision service and support, and irrigation/pivot control systems.

If you’d like deeper insights into the results of the Strip-Till Operational Benchmark Study, join the editors of Ag Equipment Intelligence and Strip-Till Farmer July 28-29 in Iowa City at the 9th annual National Strip-Tillage Conference.

The National Strip-Tillage Conference offers a collaborative environment for farmers, ag equipment dealers and anybody else interested in learning about the growing strip-tillage market to come together to network, share successful strategies and solve common challenges. On the Record viewers can receive an exclusive $50 discount on their registration by entering code OTR at StripTillConference.com.

Additional insights are also available on the Strip-Till Farmer website.

NAEDA Completes Association Merger

The North American Equipment Dealers Assn. has completed its transition period, and the new organization has successfully unified three regional equipment dealer associations with the Equipment Dealers Assn.

NAEDA has identified the following priorities:

- Manufacturer Relations

- Government Affairs

- Training

- Data & Information

- Business Services

- Events

NAEDA COO John Schmeiser said while having programs and services available across North America as well as a diverse revenue stream were priorities, so was not losing sight of why the association exists in the first place — manufacturer and government affairs.

CEO Kim Romminger said the merger will help further foster the relationship between the dealers and manufacturers.

“From the manufacturer's point of view, obviously, there’s a renewed image, an idea of one strong national association. As opposed to a national and a lot of other smaller groups. I think that presents to them a real key point of contact and of influence. And so that's critical because I think that was starting to wane a little bit with some of the different things that were going on. Right to repairs’ built a commonality to a degree of us working with the manufacturers on key areas and key projects that benefit dealers and the manufacturers together. So there's that willingness there. There's not as much opposition or conflict between the dealer body and the manufacturers. Dealers want to have a good relationship with their manufacturers … One of the influences we're bringing is, these two parties to get along. If they're both working in unison, everybody profits. It's when we're in conflict is where the real problems come up. And so while we're not going be opposed to when we see something detrimental to the dealer body at large opposing that, our goal will be to try to work to prevent that from happening and raise the relationship, so to speak for both parties and keep the industry strong.”

As the association gets bigger, Schmeiser reiterated that it is more important than ever for them to have their ear to the ground for dealers to be relevant to the grassroots of the organization.

China’s HHP Tractor Sales Forecast at 79,000 by 2026

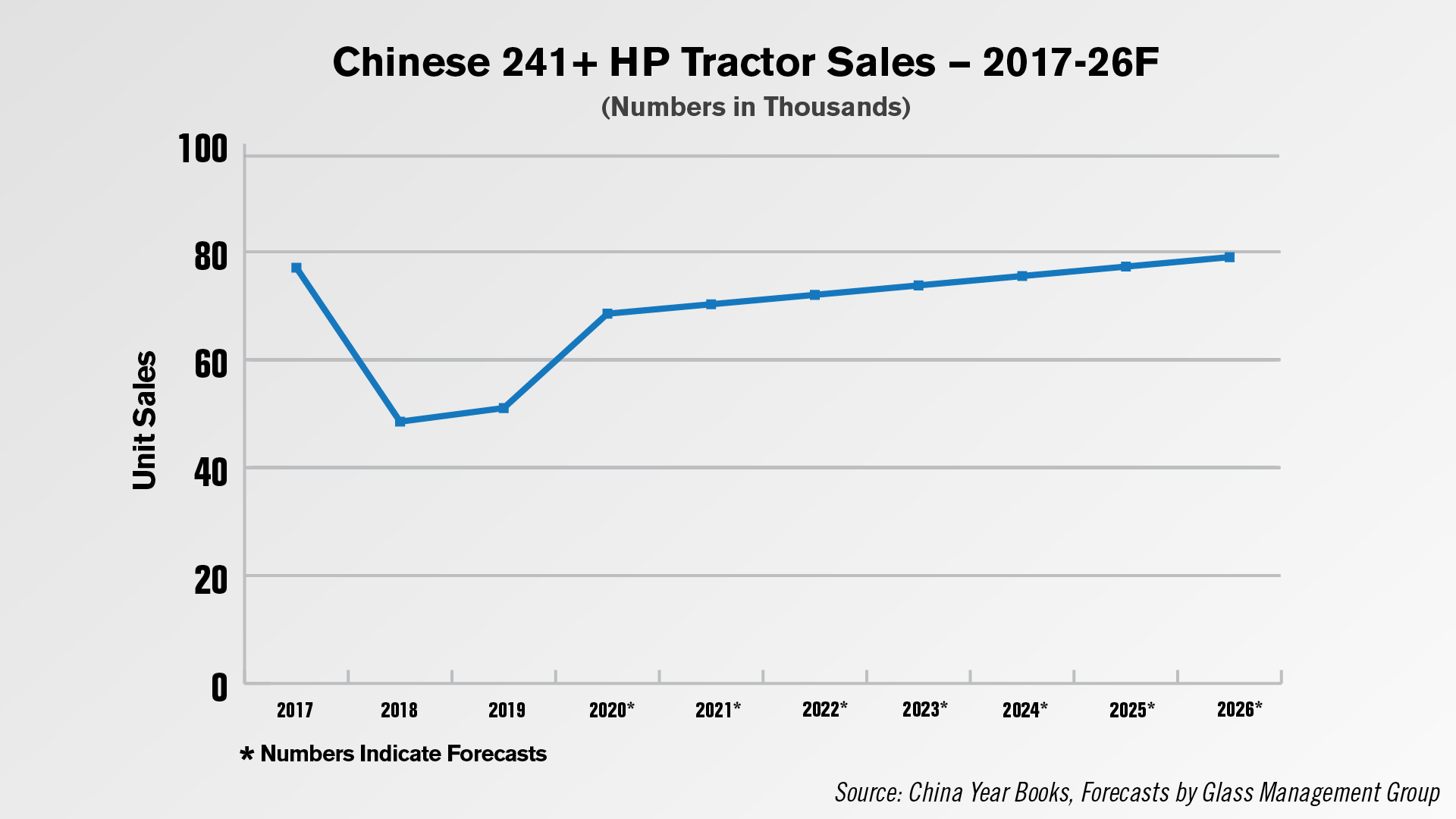

According to Ag Equipment Intelligence’s latest research report “Chinese Tractor Market: Analysis & Forecast,” sales of tractors over 240 horsepower are forecast to reach 79,000 annually by 2026.

Analysis from Glass Management Group forecasts sales in this horsepower category to increase 54.8% between 2019 — the last year data is available — and 2026. Between 2008 and 2017, tractor sales in this horsepower category rose 124% from 34,500 units in 2008.

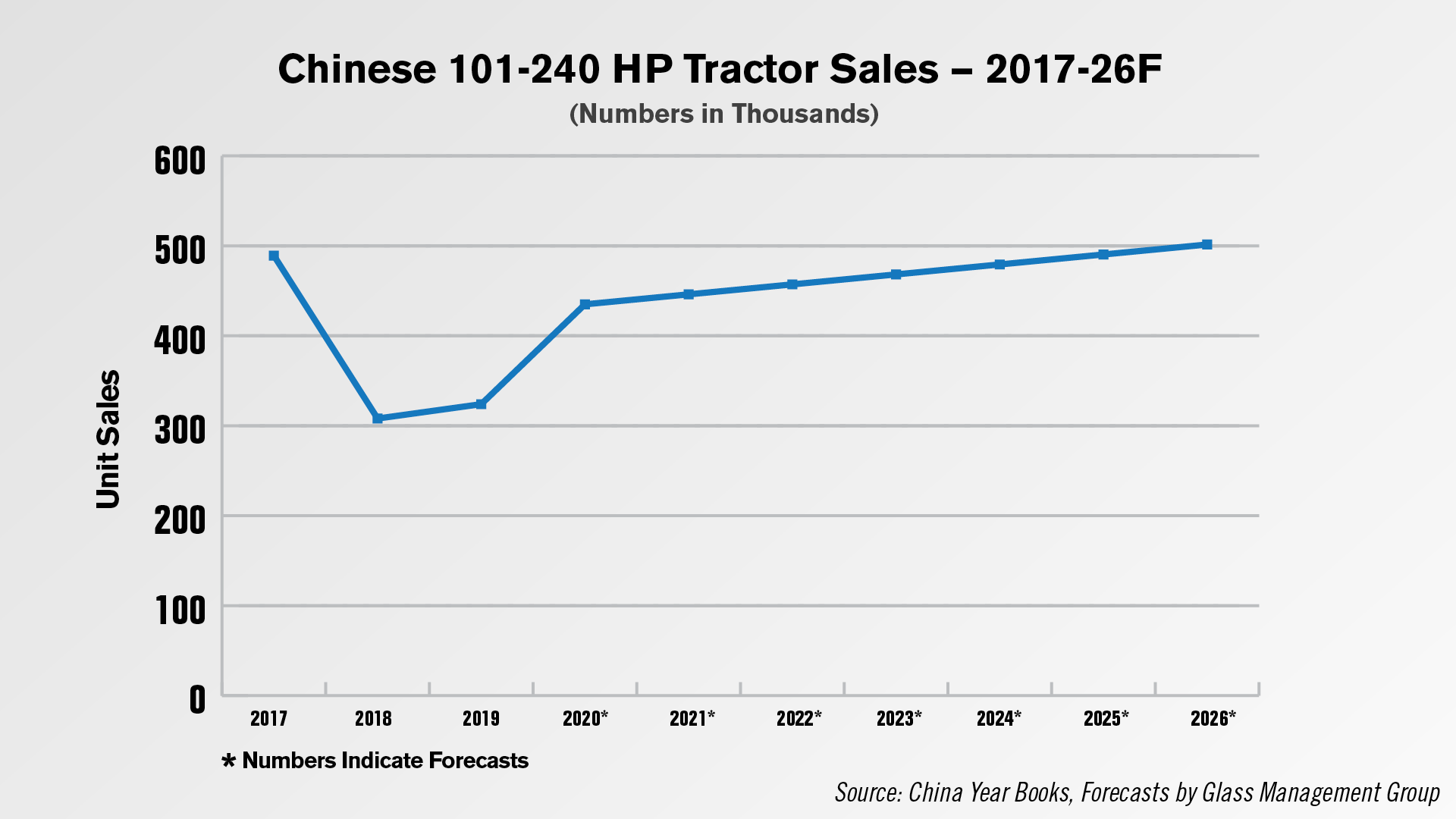

A similar increase is forecast for the 101-240 horsepower range in China. Annual sales came in at 324,000 units in 2019 and are forecast to rise 54.8% to 501,000 in 2026. Between 2008 and 2017, tractor sales in this horsepower category rose 124% from 219,000 units in 2008.

Giving context to these numbers, Charlie Glass, senior partner at Glass Management Group and collaborator on the report, points to China’s private enterprise farming operations and their growing need for higher horsepower tractors.

“Private enterprise farms in China range in size from 125 acres up to 23 million acres. Those farms require the use of tractors that range from 70 horsepower up to the largest 300-plus horsepower tractors. As these private farms increase in size, there is a smaller pool of decision makers who manage more acres, purchase large numbers of tractors and are looking for larger horsepower tractors to complete the work more quickly. This would indicate that as the horsepower requirements increase, the number of tractors required will decrease.”

You can learn more about the Chinese tractor market by purchasing the full report at AgEquipmentIntelligence.com.

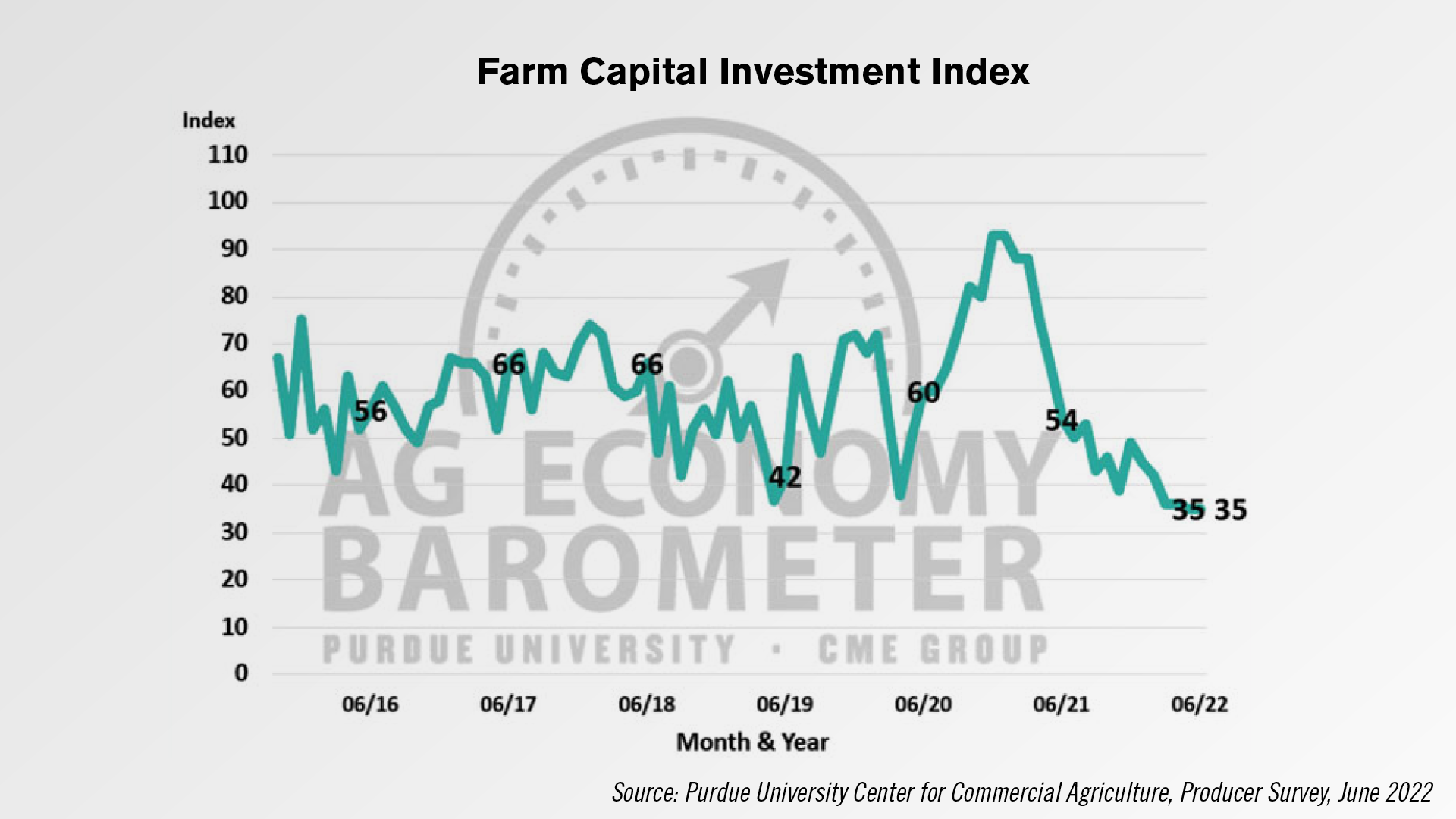

Farm Capital Investment Index Remains at Record Low

According to the latest Ag Economy Barometer update from Purdue University, the Farm Capital Investment Index remained at a record-low reading in June.

The index reported a reading of 35, in line with the record low seen last month. For the second month in a row, 50% of surveyed farmers said tight machinery inventories impacted their farm machinery purchase plans.

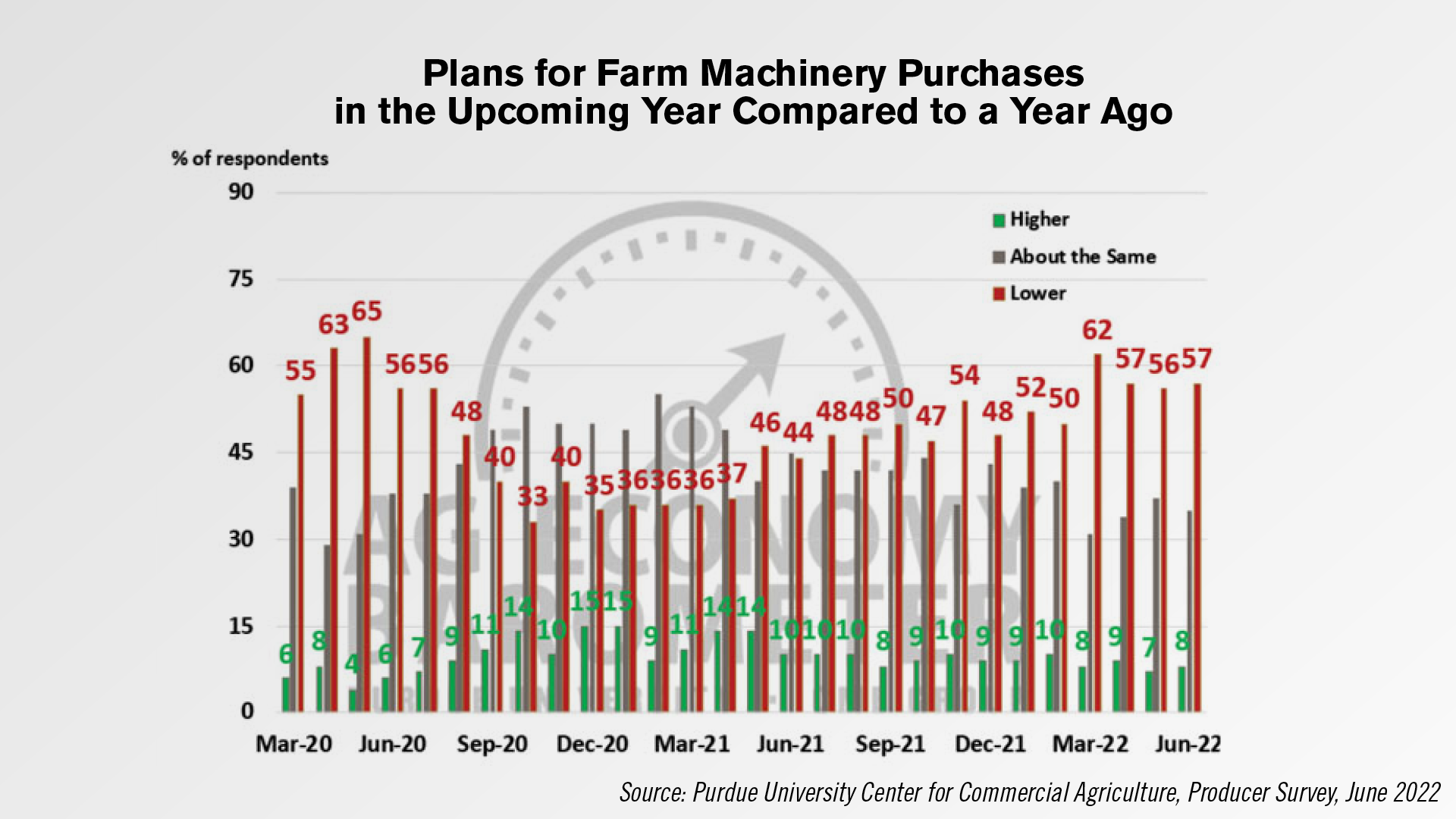

Just 8% of surveyed farmers said their plans for farm machinery purchases in the upcoming year were higher year-over-year, while 57% said their purchase plans were lower.

The survey found over half of respondents expect their farms to be worse off financially a year from now, which was the most negative response received to this question since data collection began in 2015. The report concluded that rising input costs and uncertainty about the future continue to weigh on farmer sentiment.

Pilot Episode: Stories from Independent Ag Equipment Innovators

The Video Team at Farm Equipment & Ag Equipment Intelligence just released a pilot episode for its new docuseries, with the launch featuring interviews with father-son duo Ward and Marc McConnell of Art’s Way Manufacturing. The quick clip that follows is 1 of 25 in-person interviews on the legacies of family-run ag equipment manufacturers and was released to mark the recent 1-year anniversary of Ward’s passing. To see the full 13-minute pilot episode, visit www.farm-equipment.com/innovators

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.