In this episode of On the Record, brought to you by Associated Equipment Distributors, we talk to an analyst and dealers on how interest rate cuts could impact the ag equipment industry. In the Technology Corner, Noah Newman shows us how cover crop planting could be done autonomously. Also in this episode, the Baltimore bridge collapse, planter sales forecasts, leasing volumes and Titan Machinery's latest earnings report.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- What Interest Rate Cuts Mean for the Ag Equipment Industry

- Port of Baltimore Closure’s Impact on Ag Equipment Industry

- Dealers Just Scratching the Surface of Autonomy Retrofit Kits

- Dealers’ Planter Sales Forecasts Hit 5-Year Low for 2024

- Volume of Leases vs. Last Year

- Titan Machinery Reports $2 Billion in FY24 Ag Revenue

- DataPoint: AGCO Adds North American Dealers

What Interest Rate Cuts Mean for the Ag Equipment Industry

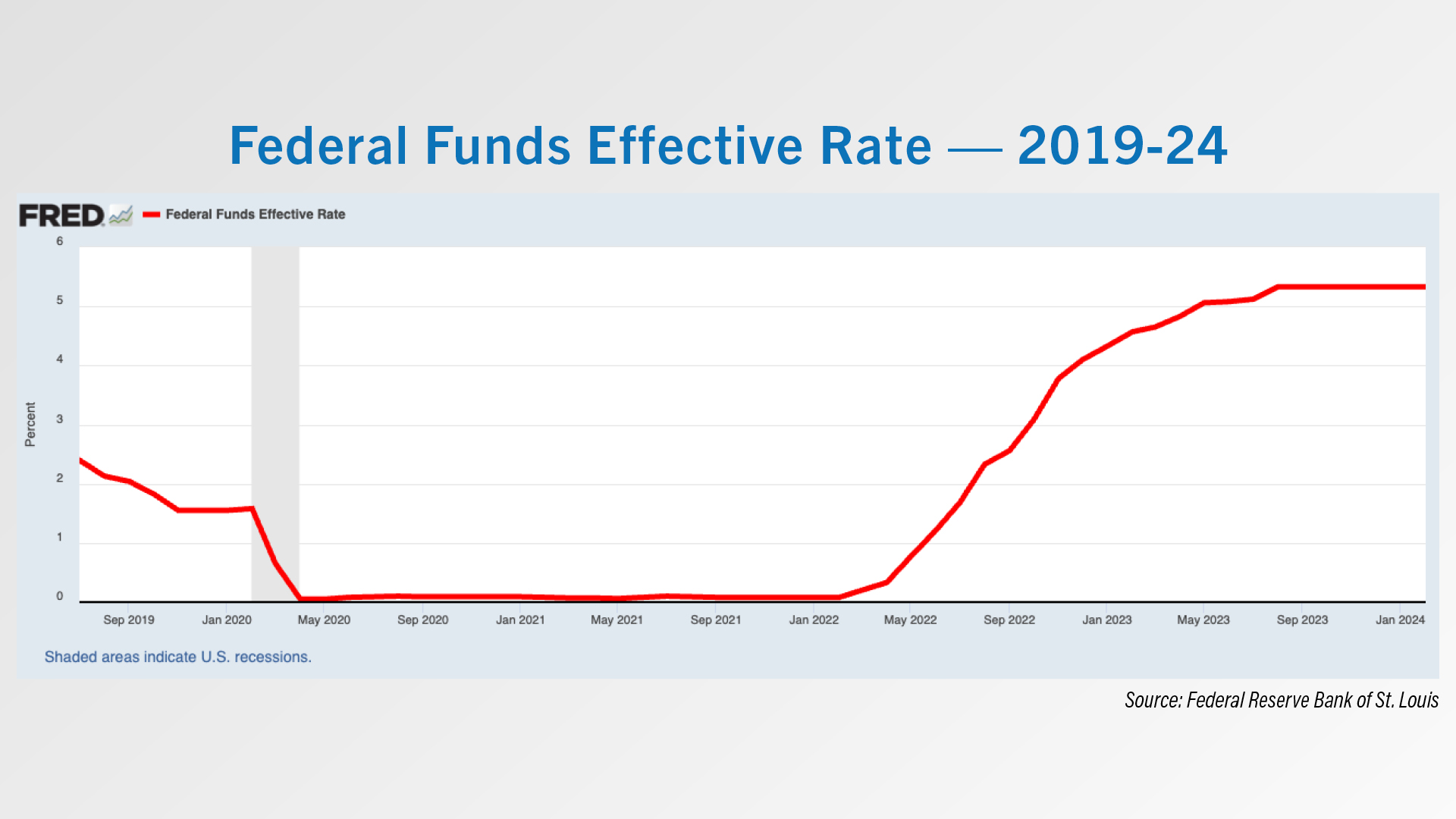

The Federal Reserve has hinted at possible interest rate cuts in 2024, according to recent reports. Reuters reported March 20 that Federal Reserve Chair Jerome Powell said the central bank was staying on track for 3 interest rate cuts this year, though the Federal Reserve left rates unchanged.

However, a March 26 report from CNN said Federal Reserve officials are now considering fewer rate cuts, with 4 of the 19 officers on the rate-setting committee seeing rates staying above 5% this year, indicating one or no rate cut. A March 20 report from Bankrate stated that in the last year and a half, the Federal Reserve has raised interest rates 11 times, bringing the federal funds rate to a 23-year high of 5.25-5.5%.

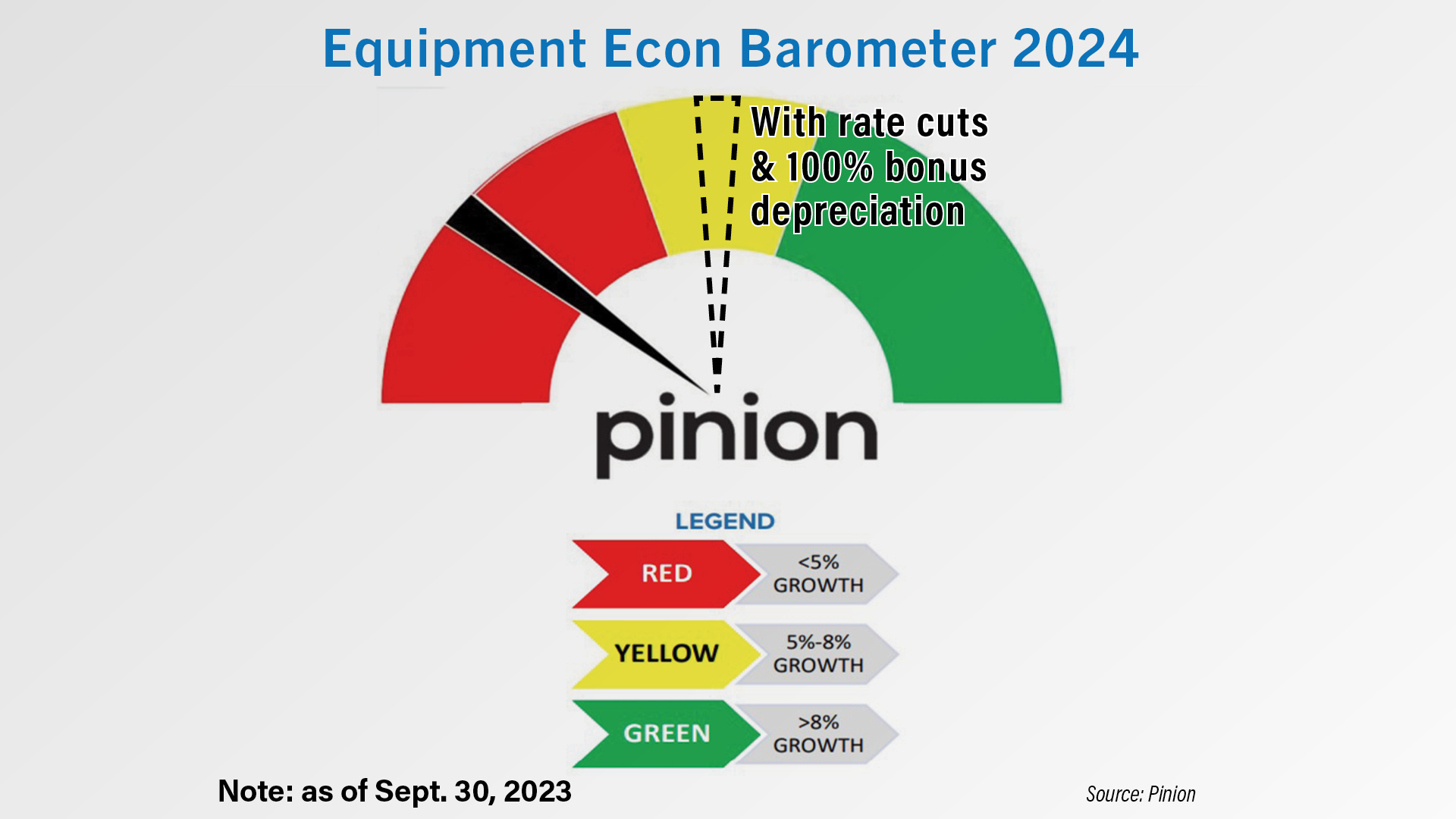

Marc Johnson, principal at ag consulting and accounting firm Pinion, said if the Federal Reserve delivered 1 or 2 rate cuts, combined with legislative action to get bonus depreciation tax incentives back to 100%, the large ag equipment market could grow up to 9% this year. Johnson had originally forecast market growth of 4-5% during the 2024 Ag Equipment Intelligence Executive Briefing in December.

“The last time that we had a big run on the equipment, when you look at demand, outpacing supply was in ’20 and ’21. So we've got older equipment out there, so there's definitely replaceable equipment out in the field. And so if the farmer could afford it with lower interest rates, then yeah, I think that we'd probably get that 4-5% up to — it's not going to exceed 10-12% again for a year or better — but I think we'd see 7%, 8%, 9% growth.”

One important aspect that ties into this, said Johnson, is getting bonus depreciation back to 100% vs. its current 60%. Bonus depreciation is a tax incentive that allows companies to accelerate the depreciation of qualifying assets, such as equipment.

“If we had 1 or 2 cuts combined with Congress getting some action going on the bonus depreciation getting back towards full expensing vs. 60% expensing, and from what we've seen, both sides of the aisle are in favor of that.”

Jon Eis, COO at Wisconsin John Deere dealer Eis Implement, said lower interest rates would make a difference with customers’ sentiments toward equipment purchases, specifically helping the store get back to the 0% financing that he said customers really want.

Eis also said the dealership has held off on certain renovations and upgrades due to high interest rates.

“Just dealer capital investment for dealers to put on shop additions or purchase new vehicles for their fleets. It's getting costly when you have an 8% interest rate. It's made it much more difficult for us to pull the trigger on some of the things we want to do around here just because of that.”

Todd Bachman, CEO of Florida Kubota dealer Florida Coast Equipment, doesn’t believe 1 or 2 interest rate cuts would make a dramatic difference for the dealership’s business. For Bachman, a potential cut in interest rates would benefit shortline manufacturers, specifically tractor manufacturers.

“The biggest impact is going to be on the manufacturers, I would think with interest cuts because the financing that they're having to put — especially the ‘B brands’ — these interest rates are really hard on them because they're ultimately usually carrying a good chunk of the floor plan cost for the dealer.”

Port of Baltimore Closure’s Impact on Ag Equipment Industry

A container ship collided with the Francis Scott Key Bridge in Baltimore, Maryland, on March 26, causing it to collapses and suspending all vessel traffic in and out of the port until further notice, according to a statement from the Maryland Transportation Authority.

The port’s inability to handle imports and exports following the collapse likely could mean shifting traffic to other ports, according to a March 26 report from USA Today. That reshuffling could cause product delivery delays.

Among East Coast ports, Baltimore is the closest to the Midwest and in 2023, according to the Maryland State Archives, ranked first in the nation in handling automobiles, light trucks, farm and construction machinery, handling a record 1.3 million tons of roll on/roll off farm and construction machinery that year.

A Feb. 13 report from DAT Freight & Analytics said Baltimore has become the leading U.S. port for combines, tractors, hay balers and importing excavators and backhoes.

A November 2021 report from The Port of Baltimore said John Deere, Caterpillar and CNH Industrial were among the port’s major roll on/roll off customers, with CNH Industrial shipping 3,500-4,000 units annually from Baltimore to its overseas customers.

Dealers Just Scratching the Surface of Autonomy Retrofit Kits

We’ve covered autonomy extensively here in the Technology Corner. We’ve seen retrofit kits used for mowing and tillage, but what about planting cover crops? Jake Warford, precision specialist with Linco-Precision in Nokomis, Ill., tell us they’re just scratching the surface when it comes to implementing autonomy in their customers’ operations.

“Currently their big focus is on the sod market. It’s very labor intensive. There’s a lot of mowing that has to be done multiple times a week over large acreage. But I think there are a lot of more row crop type applications that are going to be beneficial. I think there are going to be big opportunities in fertilizer and lime spreading. I think cover crop planting is going to be big. I used ours last year to sow some cover crops and wheat. The opportunities are kind of endless. Anywhere you can make it work, I think there’s an application for it.”

Warford and Linco-Precision offer the Sabanto autonomy kit. Warford says Sabanto’s philosophy has been, “crawl, walk, run.” He says right now they’re probably walking.

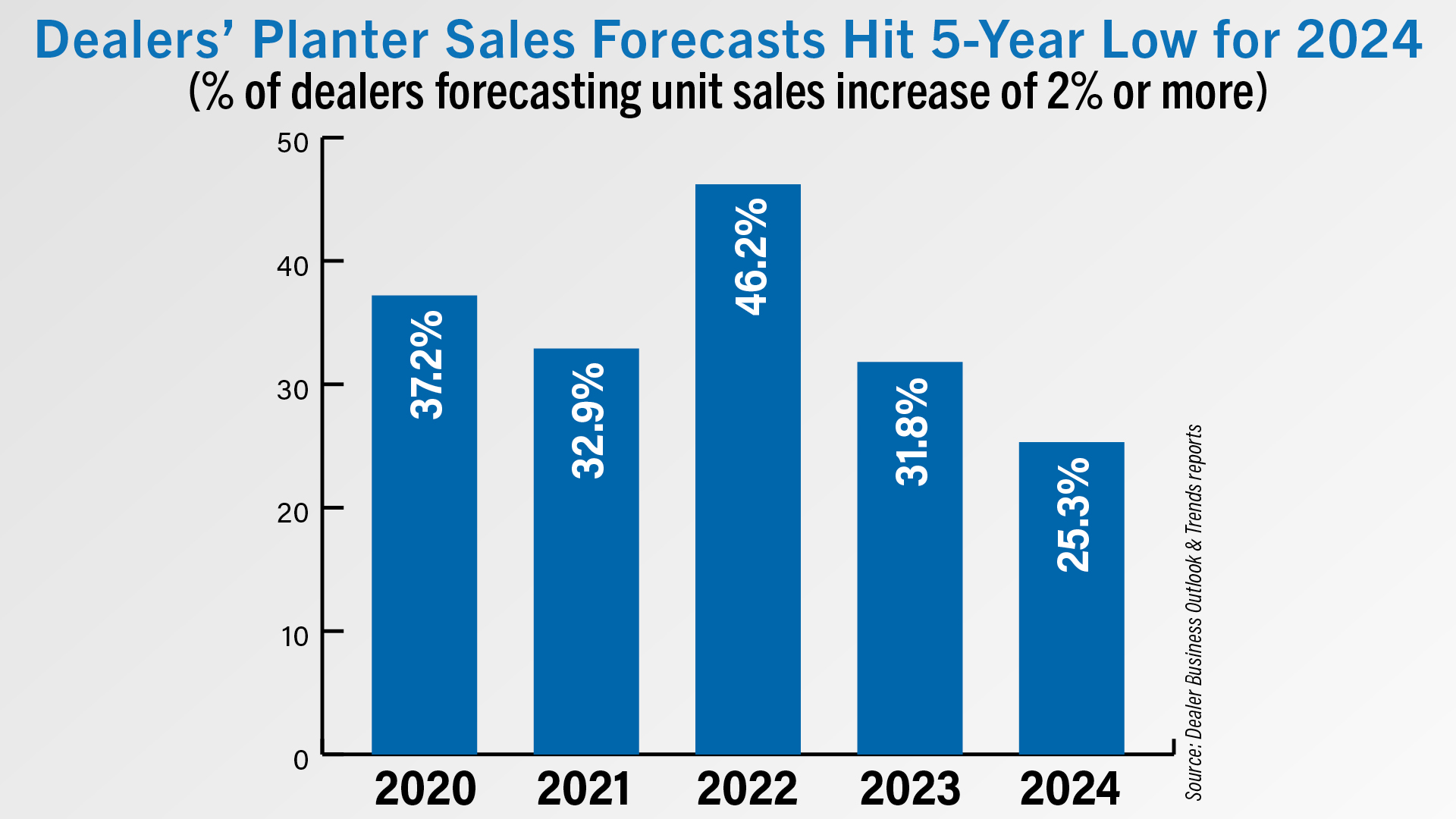

Dealers’ Planter Sales Forecasts Hit 5-Year Low for 2024

The percentage of dealers forecasting sales growth of 2% or more in planter sales for the year hit a 5-year low for 2024, according to the 2024 Farm Equipment Dealer Business Outlook & Trends report.

Just over 25% of dealers forecast planter unit sales growth in 2024, the second year in a row this percentage has declined. In the last 5 years, dealers were most optimistic about planter sales growth in 2022, when 46.2% of dealers forecast growth of 2% or more.

According to the February 2024 Ag Equipment Intelligence Dealer Sentiments & Business Conditions update, dealers reported planter sales were down roughly 8% in January compared to December 2023. In the fourth quarter of 2023, dealers reported planter sales were down roughly 2% vs. the third quarter of 2023.

Volume of Leases vs. Last Year

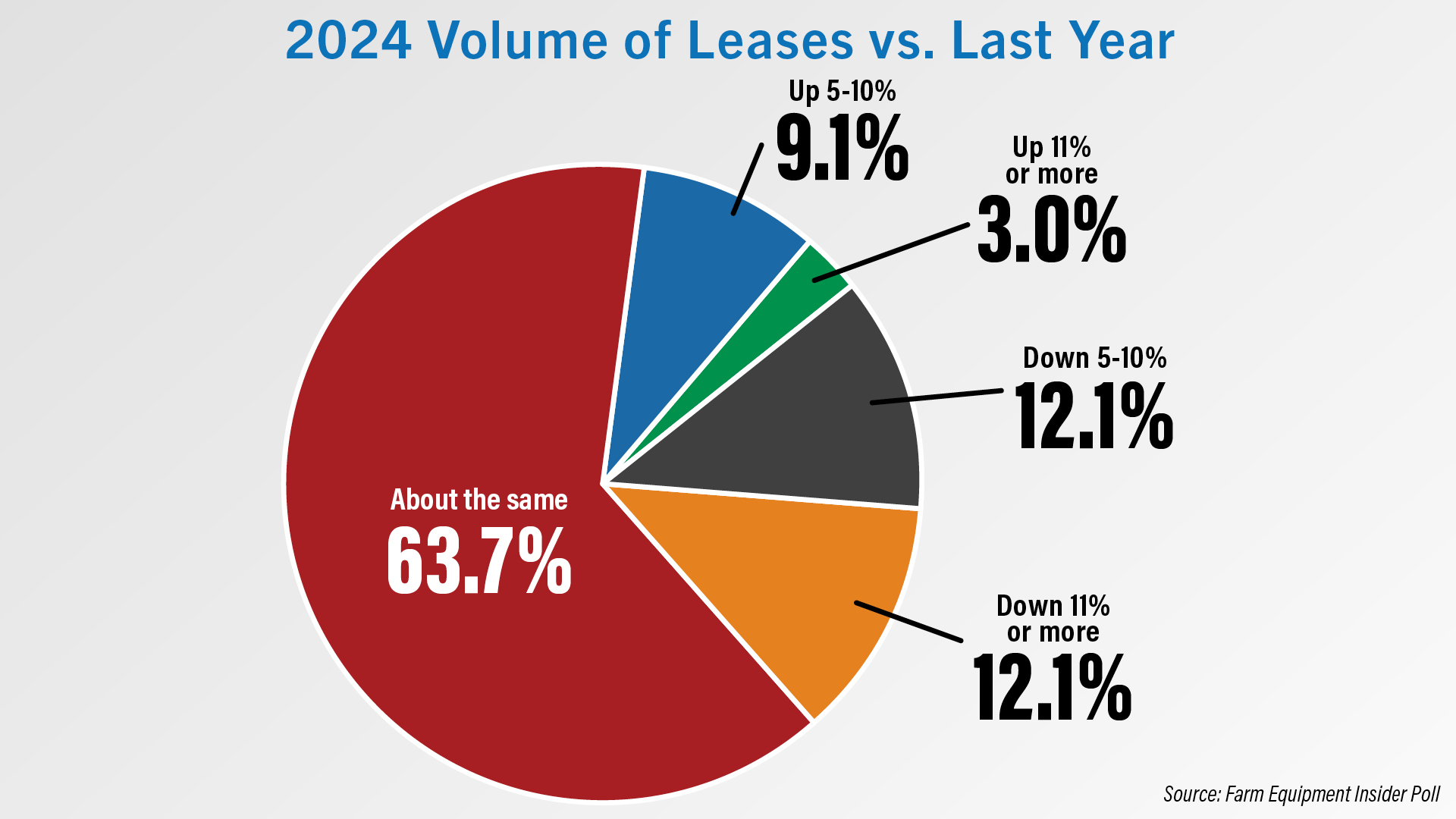

According to a recent Farm Equipment Insider text poll, the majority of dealers indicated their leased equipment hasn’t changed much year-over-year.

Nearly two-thirds of dealers say their current volume of leased equipment is about the same as last year, while 24% report leases are down by at least 5%. But just over 9% report an increase in leases of 5-10%. Only 3% of dealers said their leased equipment volume was up 11% or more.

To become a Farm Equipment Insider, you can text FARM to 833-413-2175 to sign up.

Titan Machinery Reports $2 Billion in FY24 Ag Revenue

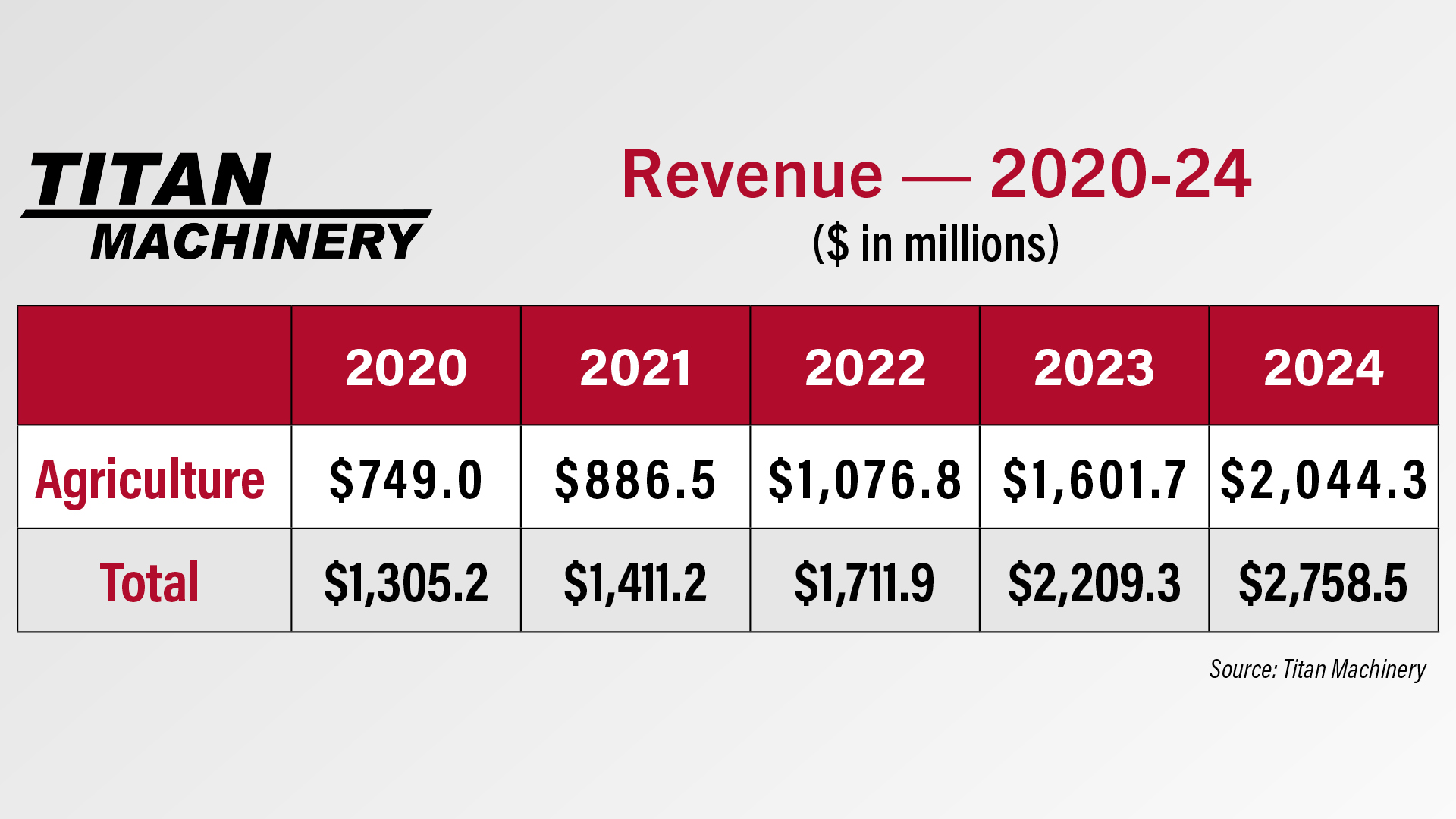

In its fiscal year 2024 earnings report on March 21, Titan Machinery reported $2 billion in ag equipment revenue for the year, a 28% year-over-year increase. Total revenue for the fiscal year was $2.8 billion, up 25% year-over-year.

This is a record high for the last 5 years and the second-highest year-over-year increase in full year ag revenue that Titan Machinery has seen in the last 5 years. Ag revenue for the fourth quarter came in at $620.6 million, up 41% compared to the fourth quarter of Titan’s 2023 fiscal year.

The company said this fourth quarter ag revenue growth was led by strong same-store sales growth of 35.5%, which was aided by strong demand and improved equipment availability. Segment revenue growth was also supported by contributions from Titan’s acquisitions of 2 dealers: Idaho dealer Pioneer Farm Equipment in February 2023 and South Dakota dealer Scott Supply in January 2024. Scott Supply was Farm Equipment’s 2007 Dealership of the Year.

Titan Machinery reported $894 million in floorplan payable as of Jan. 31, a 246% year-over-year increase from $258 million as of Jan 31. last year. Floorplan interest expense for the 12 months ended Jan. 31 was $13.8 million, up from $1.9 million in the previous year.

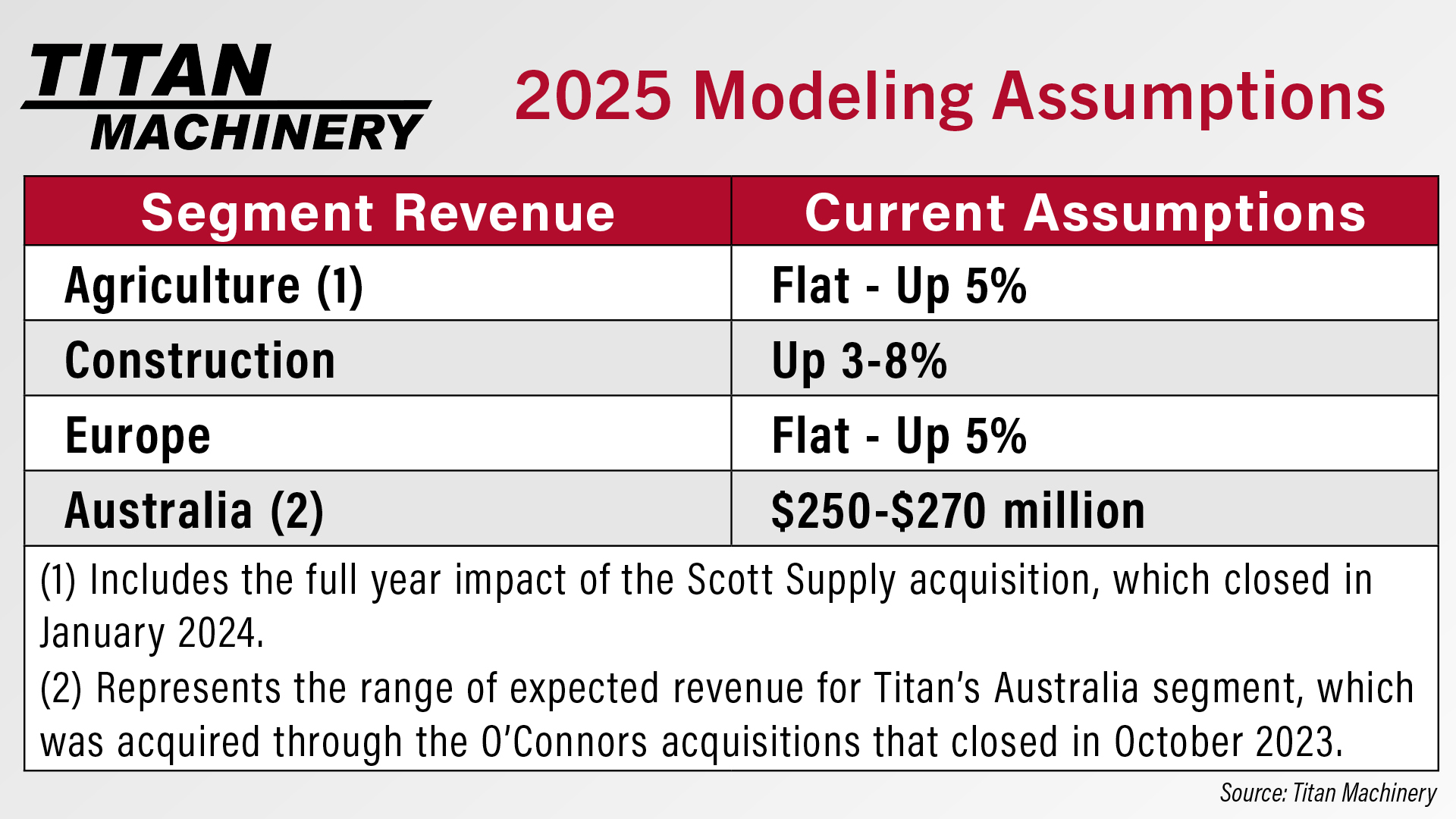

Looking ahead at its 2025 fiscal year, Titan Machinery expects its ag revenue to be flat to up 5%, including the impact of its acquisition of Scott Supply in January. During the March 21 earnings call, CFO Bo Larsen gave more color on the ag revenue projections.

“It [ag revenue projections] also assumes mid to high single-digit growth on our parts and service business. As for equipment revenues, it assumes industry equipment volumes to be down 10-15% and pricing on new equipment to be up low single-digits. The underlying growth for equipment revenue is expected to be driven by market share gains aided by improved availability of high-horsepower equipment as well as proactive posture on selling through the used equipment that will be generated through trade-ins.”

DataPoint: AGCO Adds North American Dealers

This week’s DataPoint is brought to you by the 2024 Dealership Minds Summit.

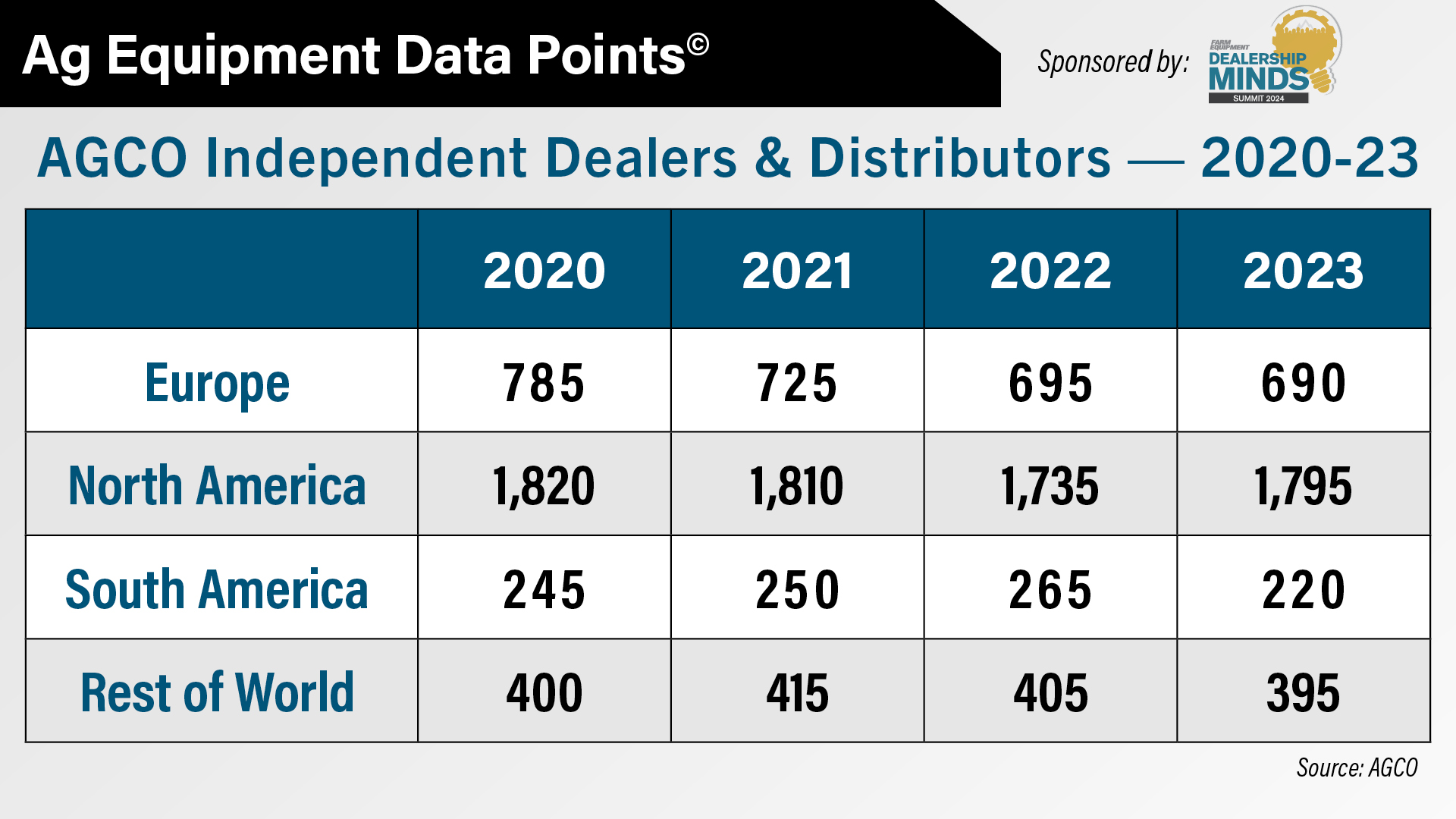

According to AGCO’s 2023 annual report, the manufacturer has 1,795 independent dealers and distributors in North America, a 3.5% year-over-year increase. AGCO’s total number of dealers and distributors dropped in 2023 for its Europe, South America and “Rest of World” regions. The number of independent dealers and distributors in the South America region was down 17% from 265 in 2022 to 220 in 2023.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.