In this episode of On the Record, brought to you by Associated Equipment Distributors, Casey Seymour gives his thoughts on what the used equipment market might look like in 2025. In the Technology Corner, Noah Newman highlights ag equipment tech at this year's Consumer Electronics Show. Also in this episode, precision farming revenue was up for dealers in 2023 and AEM data shows large ag equipment sales in 2023 rose in both the U.S. and Canada.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Analyst Forecasts Used Equipment Market Contraction Over by Mid-2025

- Cutting-Edge Ag Technology on Display at CES 2024

- Dealers Report Strong Precision Revenue Growth in 2023

- 2023 Sees Bump in Large Ag Equipment Sales

- DataPoint: Farm Machinery Consumption of Iron & Steel Castings

Analyst Forecasts Used Equipment Market Contraction Over by Mid-2025

Casey Seymour of Moving Iron LLC recently stopped by the Lessiter Media offices and spoke to us about the future of the used equipment market. Seymour said that while the growth bubble of the last few years has “popped” and 2024 will have its challenges, the year won’t be as bad as people might think.

“As I look at the used equipment market space moving forward in '24, there are going to be some challenges. People keep talking about, ‘Oh, we're in a bad market, a bad market,’ and I think we are in a bad market to the extent that the market's contracting. We came off of a huge bubble and now the bubble popped and we're seeing that contraction happen. I still feel like producers are going to have a good year. I still feel like that's going to be OK.

“But when I look at where the market's going, there's a lot of things out there that I think are going to be tested this year. When you look at row-crop tractors, for example, there's a lot of row-crop tractors out there and you start looking at the overall price of used equipment and what that looks like and then how interest rates play into that. There's a little bit of headwind there that we haven't seen in some places before.”

Seymour said that among equipment segments, the over 300 horsepower tractor segment will be particularly troublesome in 2024, between a high population and notably high advertised prices. Looking toward 2025, Seymour forecast the used equipment market contraction to be over in about 18 months and return to some of what the industry saw between 2017 and 2019.

“I'm kind of seeing this contraction now as the first 18 months. So '24 through midway/third quarter of '25. I think you could start seeing what the ‘new norma’l looks like. I feel like we could kind of go back to a 2017, 2018, 2019 type of equipment movement in the marketplace. When you start looking at how machines moved and what it looked like, how many machines would come in used vs. new, balancing those things out. I really feel like as you look at where inventory levels are at now, they're really spiking up, and they're going to continue to spike up through 2024. And as you look at '25, those things are going to continue to level out and whatever that looks like.

“So I'm looking at inventory levels being similar to what '17 through '20 would look like, with '20 being kind of the peak going into COVID and they had the big sell off and everything. But as I'm looking at it, I kind of feel like '25 is going to level off and be normal and then for the next 2 or 3 years until some other catastrophic event happens, we will see something similar to what we saw there.”

For more from Seymour, check out his Ask The Expert column on the Farm Equipment website.

Cutting-Edge Ag Technology on Display at CES 2024

The 2024 Consumer Electronics Show took place last week in Las Vegas. Let’s bring you up to speed on some of the key takeaways.

John Deere confirmed its Furrow Vision retrofit solution for planters will be available in 2025 and will be monetized on a per acre or per unit basis.

Deere also discussed its See and Spray software-as-a-service (SaaS) pricing model — it will vary by customer, but the company said its currently charging $4 per acre in the test run with corn growers.

Deere also announced that testing of autonomous tillage solutions for 8 and 9 series tractors is underway, with a dozen customers already using the technology to till 50,000 acres.

Meanwhile, Kubota unveiled its fully electric, multi-purpose vehicle, called the New Agri Concept. Key technologies include automatic data collection, real-time monitoring, AI identifying potential issues and more. Its 6 independent drive motors and standard three-point hitch allow it to use many existing implements for common operations including mowing and tilling. And it can fast charge from 10% to 80% in less than 6 minutes.

And finally, Bobcat generated some buzz with the unveiling of the first autonomous and electric articulating tractor — the Bobcat AT450X enabled by Agtonomy. It’s designed to carry out critical farm tasks autonomously or remotely in compact applications, such as vineyards and orchards. Commercialization details will be announced at a later date.

For more information on all the happenings at CES, head to PrecisionFarmingDealer.com. In Tech Corner, NN, back to you Ben.

Dealers Report Strong Precision Revenue Growth in 2023

Dealers saw an increase in precision farming sales and service revenue in 2023, and most predict the positive trend will continue in 2024, according to the 11th annual Precision Farming Dealer benchmark study.

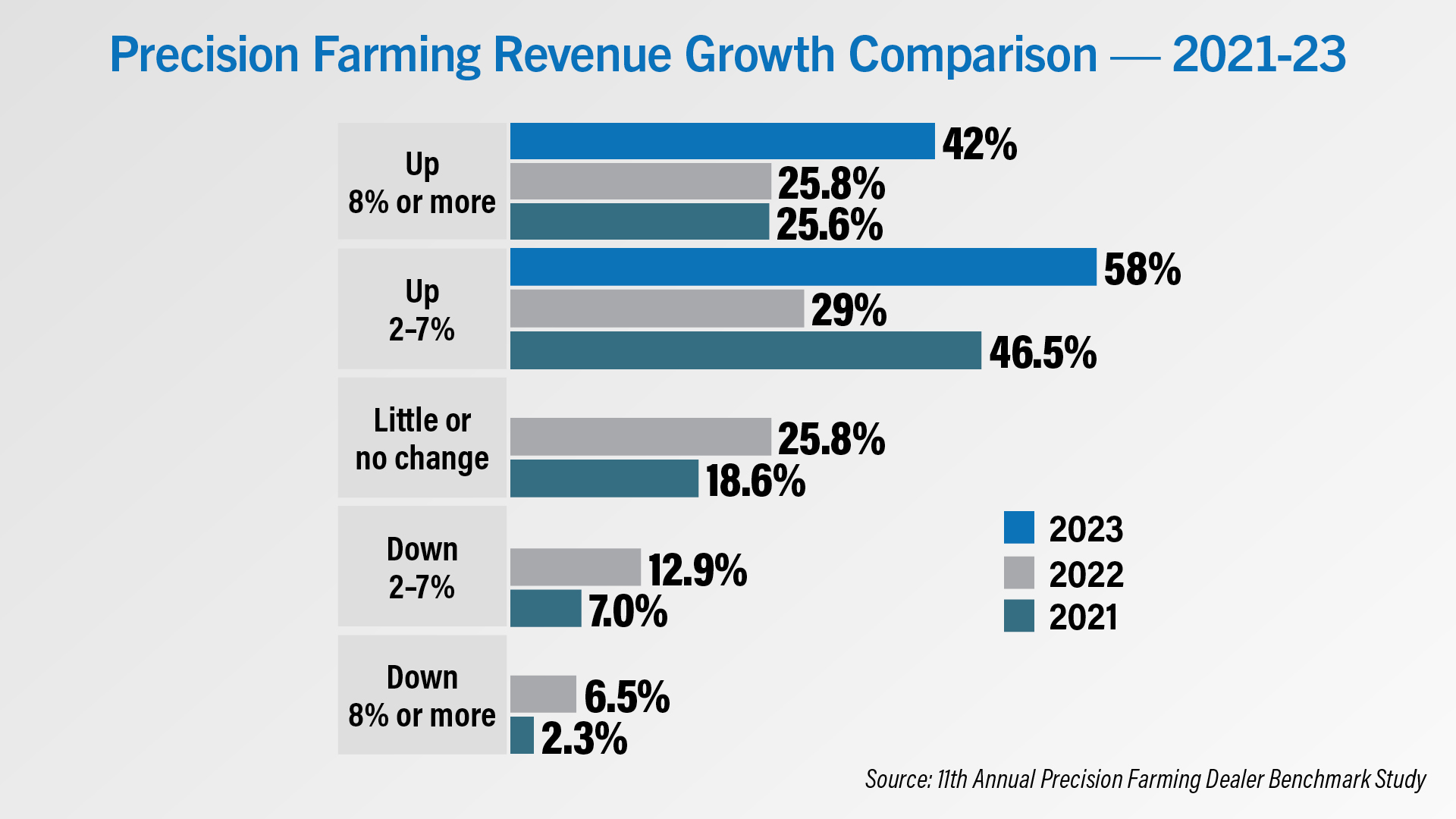

All dealers surveyed said their total precision revenue increased from 2022, with 58% reporting a growth of 2-7% and 42% reporting a growth of 8% or more. This is more positive than 2022 when nearly 26% reported little or no change in revenue growth, 13% reported a decline of 2-7% and 6.5% reported a decline of 8% or more.

Hardware sales once again represented most of the total precision revenue in 2023 at 52%, compared to 57% in 2022.. Service/support made up an average of 27% of dealers’ total precision revenue, up 7 percentage points from 2022. Software sales at 12% and signal subscriptions at 11% rounded out the top 4.

Additionally, factory installed precision systems made up 57% of total sales in 2023, up 5 percentage points from 2022.

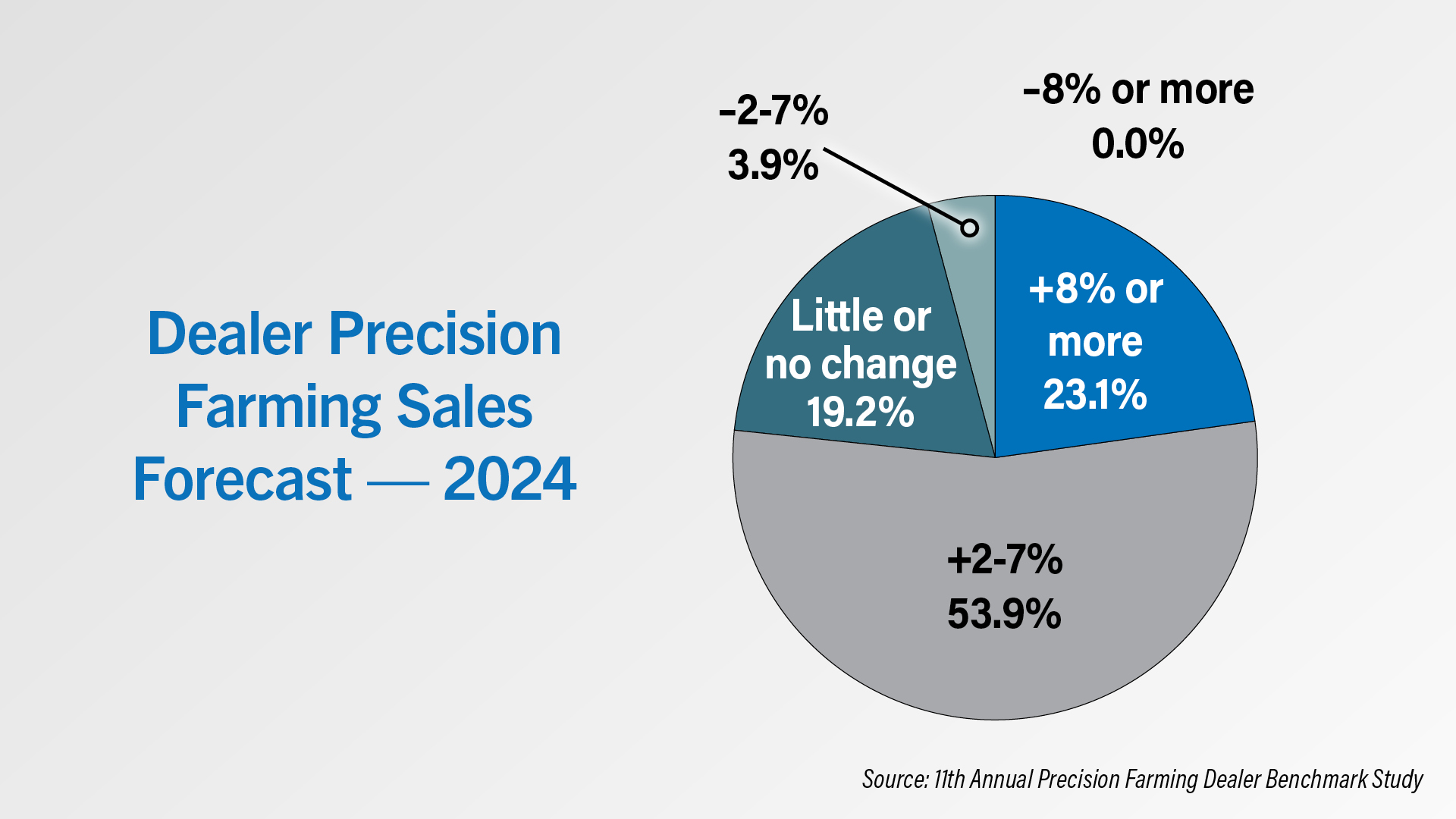

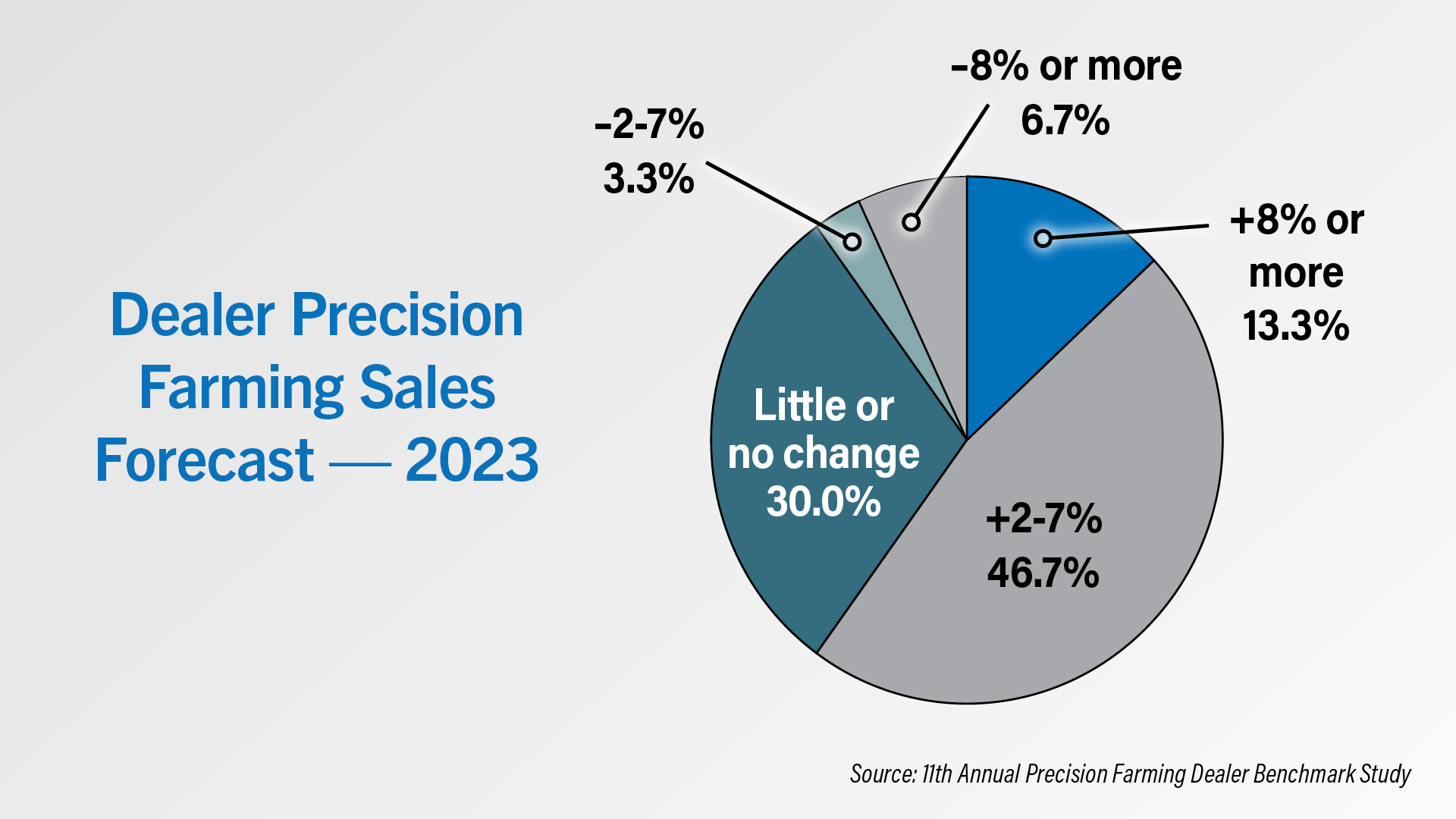

Looking ahead to 2024, 54% of dealers forecast precision farming sales revenue to be up 2-7%, while 23% forecast an even bigger increase of 8% or more. 19% forecast little or no change and 4% project a revenue decline of 2-7%. Those numbers are more positive across the board than in 2022 when 10% projected a revenue decline of 2% or more, 13% projected an increase of 8% or more and 47% projected an increase between 2-7%.

2023 Sees Bump in Large Ag Equipment Sales

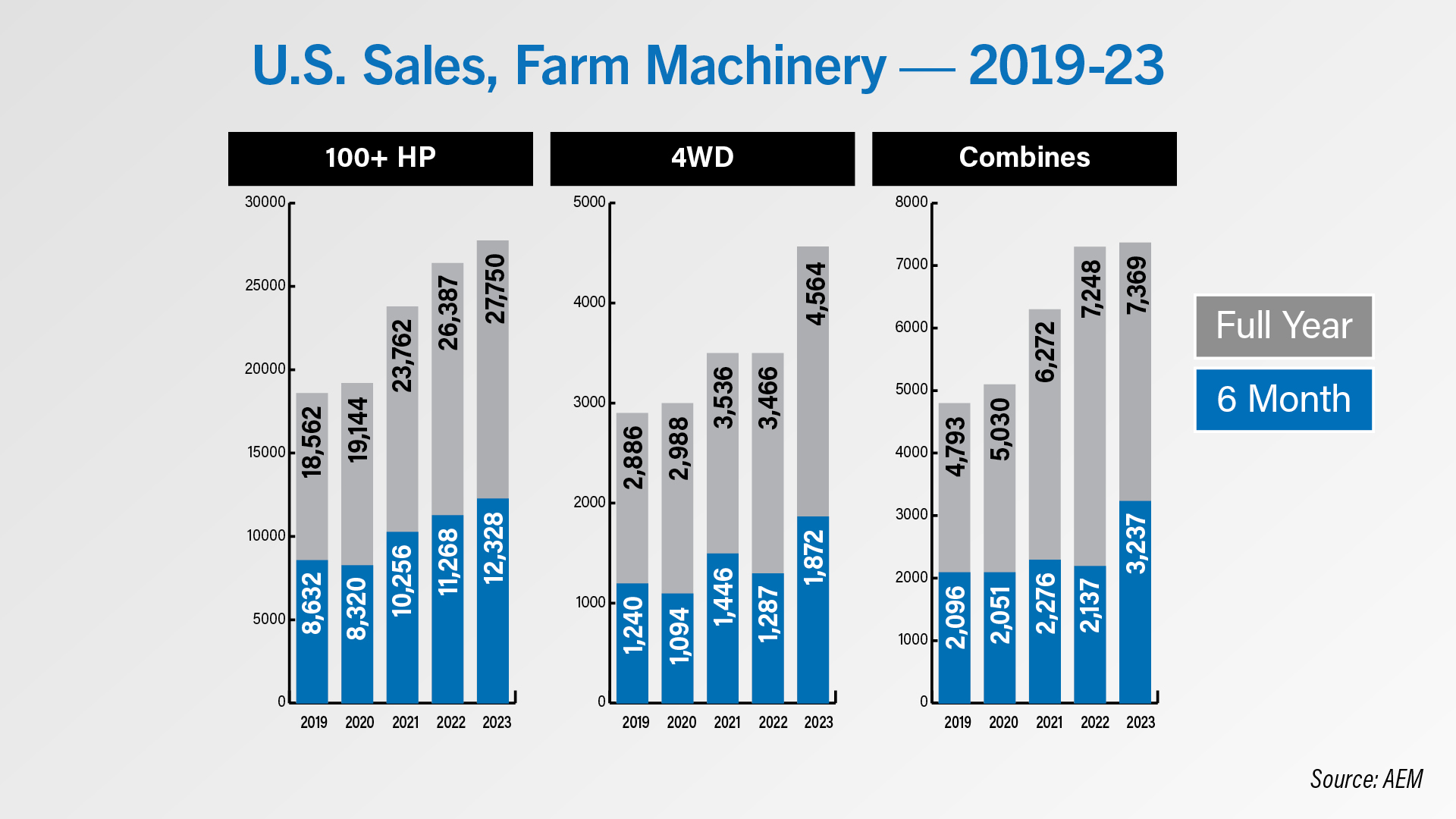

2023 saw sales of row-crop and 4WD tractors, as well as combine, increase compared to 2022 levels, according to the latest AEM data.

4WD tractors had the largest year-over-year increase — up 32% — to 4,564 units, a reversal from a slight decline in 2022. Under 40 horsepower tractors had the largest decline, down 11% to 156,000, taking full-year sales to a 5-year low.

Sales for over 100 horsepower tractors rose for the 4th year in a row to almost 28,000, reaching a 5-year high. Combine sales achieved a smaller year-over-year increase than in 2021 and 2022, up only 1.7% to roughly 7,369 units vs. up 15.8% in 2022.

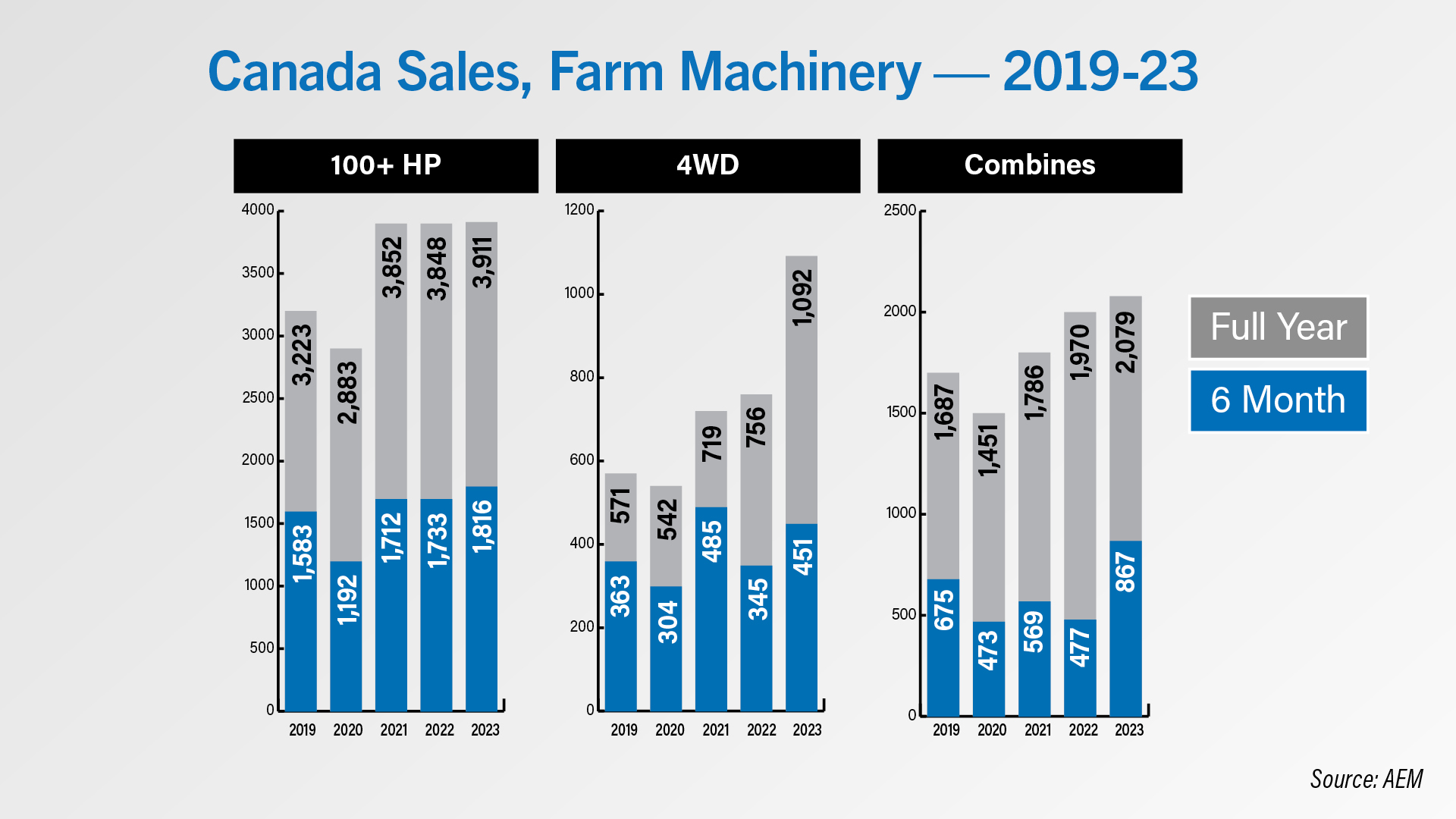

In Canada, 2023 row-crop tractor, 4WD tractor and combine sales all rose year-over-year. Canadian 4WD tractors also showed the greatest increase at, rising 44.4% compared to 2022 to 1,092 units. Compact tractors showed the largest decline at, dropping 16.5% year-over-year to 16,342 units.

Over 100 horsepower saw a slight year-over-year increase to 3,911 and hit a 5-year high. Canadian combine sales for 2023 were up 5.5% year-over-year to 2,079 units.

DataPoint: Farm Machinery Consumption of Iron & Steel Castings

This week’s DataPoint is brought to you by the Dealer Success Academy.

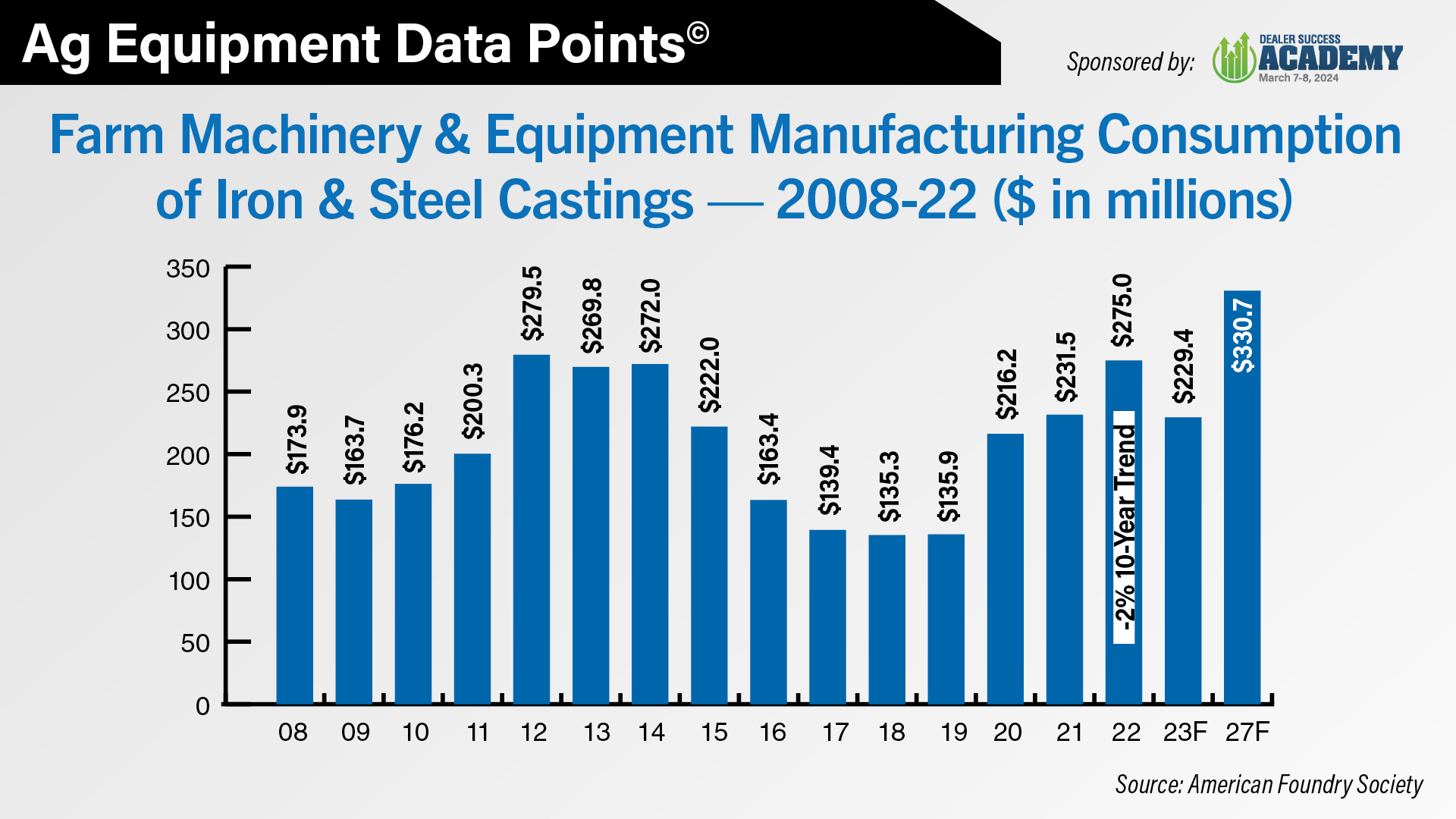

According to data from the American Foundry Society, the farm machinery and equipment manufacturing segment is estimated to have spent $275 million on iron and steel castings in 2022, based on U.S. Census survey results. This puts the 10-year trend at –2%. Industry spending in this category is forecast to drop 16.6% to $229.4 million in 2023. By 2027, the American Foundry Society forecasts the farm machinery and equipment manufacturing industry will spend $330.7 million on iron and steel castings.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.