In this episode of On the Record, brought to you by Associated Equipment Distributors, we take a look at CNH Industrial''s goals for in-house precision tech production. In the Technology Corner, Noah Newman shows us Mississippi State University's brand-new Agricultural Autonomy Institute. Also in this episode, grain prices and farmer purchases, dealers' capital spending plans and Kubota's third quarter earnings.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- CNHI Aims for Almost All In-House Precision Tech by 2025

- Dealers on the Move

- Technology Corner: Inside the First-Ever Agricultural Autonomy Institute

- How Grain Prices & Farm Income Will Impact Purchase Plans

- Dealers Report Slowdown in Early Orders, Capital Spending Plans for 2024

- Kubota First 9 Months Ag Revenue Up 14%

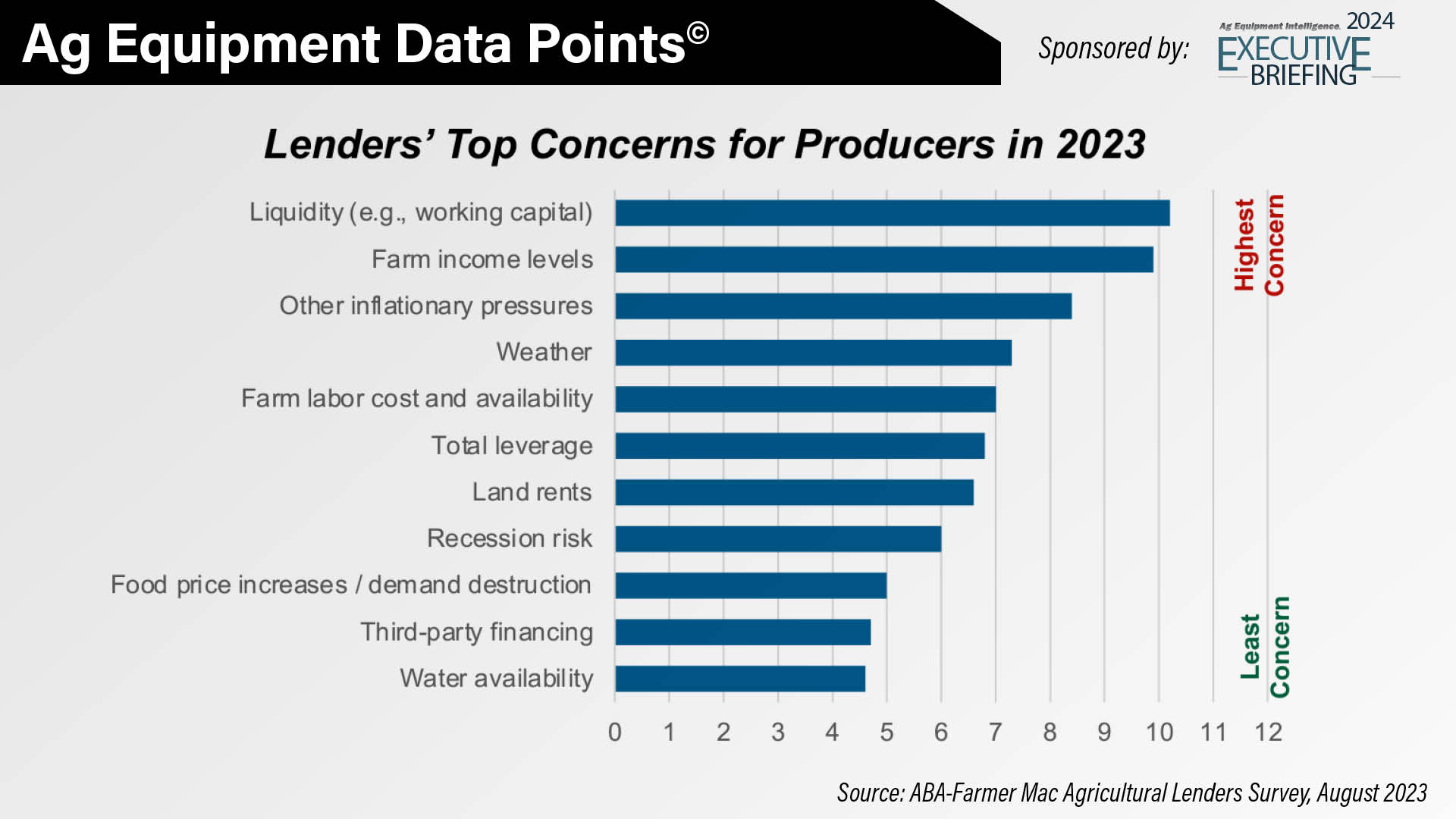

- DataPoint: Ag Lenders’ Top Concerns

CNHI Aims for Almost All In-House Precision Tech by 2025

During CNH Industrial’s earnings call for its third quarter, CEO Scott Wine addressed the company’s goal of transitioning to in-house tech solutions.

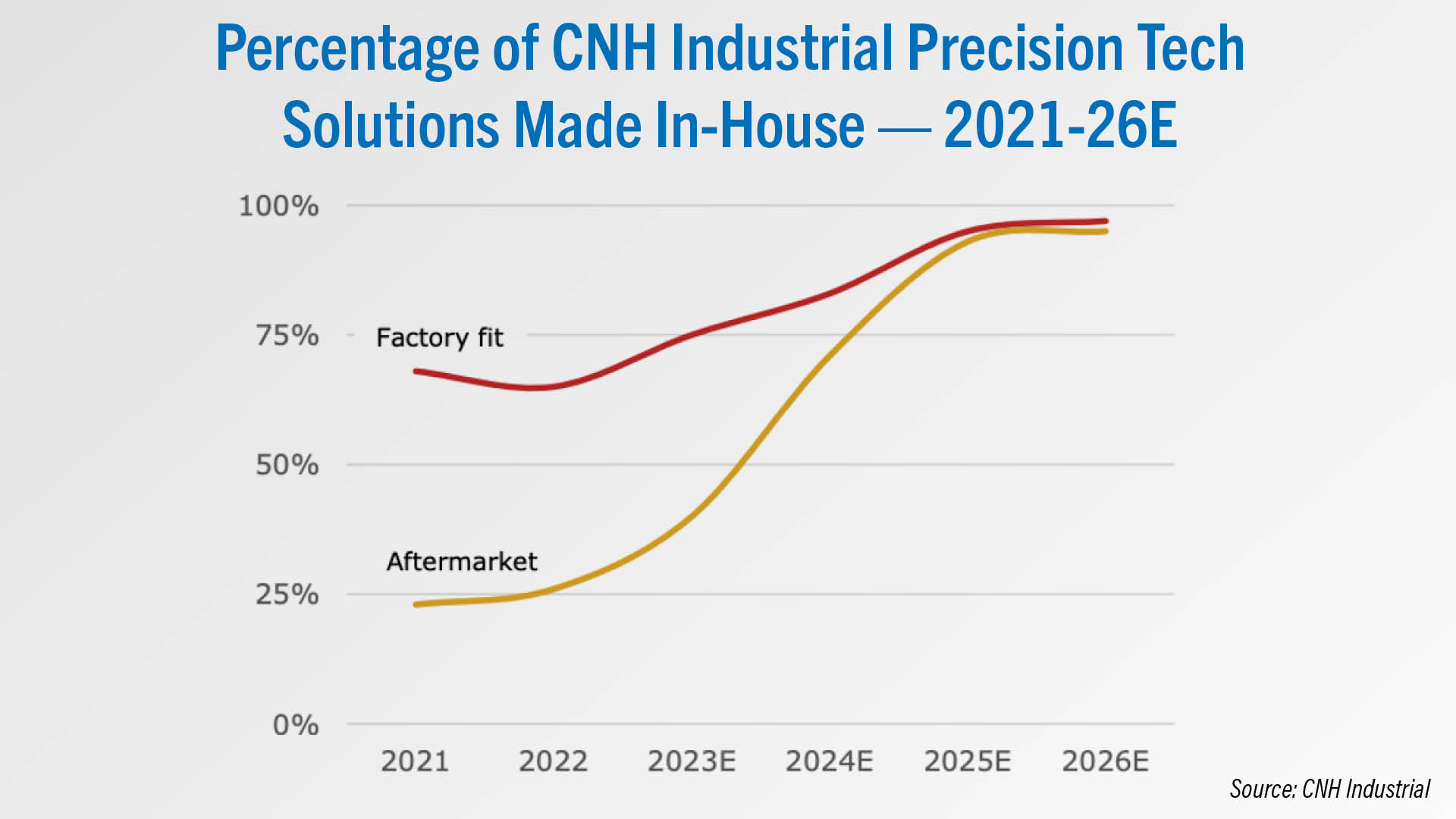

With around 75% of its factory fit solutions and 40% of its aftermarket solutions already produced in-house, CNH Industrial is aiming for almost all those solutions to be brought in house by 2025.

Wine said the company has been aggressively pursuing this strategy since 2019 and was accelerated by its acquisition of Raven Industries. Wine said:

“Our tech stack hit an inflection point in 2023 with the integration of Raven and the contribution of some of our recent acquisitions. This activity allowed us to bypass years of organic development in key areas such as autonomy, vision and guidance, which we further expedite by rapidly scaling our own tech talent. This steep increase in this ownership curve is no accident. And it is the manifestation of our strategy to take control of our tech offerings.”

When asked during the Q&A about how AGCO and Trimble’s recently announced joint venture might impact the company, Wine said it won’t and that the two companies’ business relationships likely won’t change.

“We still serve our customers well with a lot of products from Precision Planting, and we'll continue to do that. Raven continues to be a supplier to AGCO and that will likely continue. We compete in the market, but we also sell to each other, and we don't see that necessarily changing.”

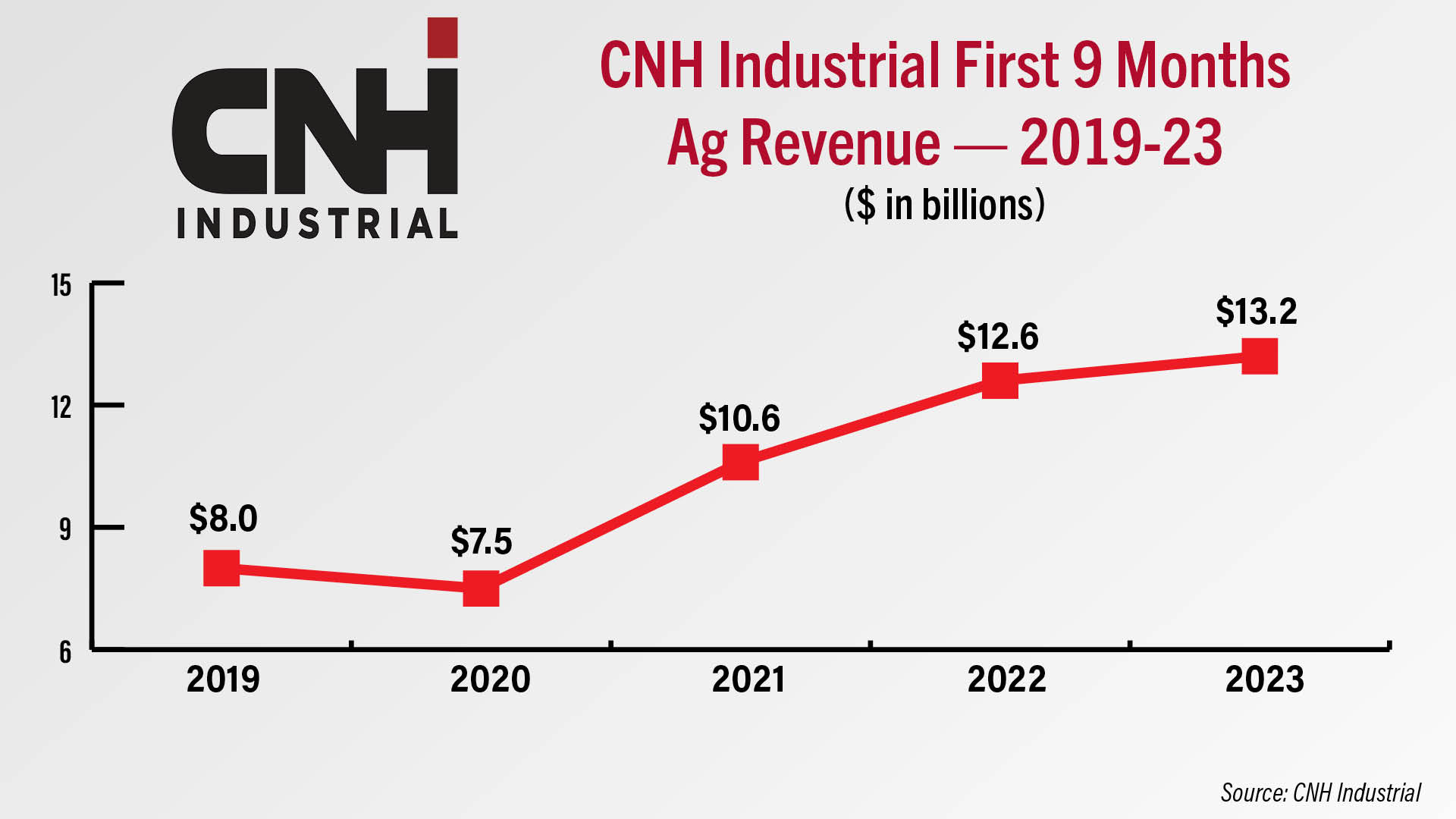

Looking at the financials, CNH Industrial reported $13 billion in ag revenue for the first 9 months of the year, up 5% year-over-year, and $4.4 billion in ag revenue for the third quarter. Total revenue for the first 9 months of the year was almost $18 billion and almost $6 billion in the third quarter.

CNH Industrial reported an increase in its net inventories as of Sept. 30 to $6.5 billion vs. $5.4 billion at the same point last year. President and CFO Oddone Incisa (oh-doe-nay ?) said during the earnings call that the company produced around 20% fewer low-horsepower tractors in Q3 2023 globally compared to a year ago. High-horsepower tractor production was up 13%, and combine production was up 8%.

Dealers on the Move

This week’s Dealers on the Move include Redlund Equipment, Claas FarmPoint and Plevna Implement.

AGCO dealer Plevna Implement announced it is purchasing MacAllister Machinery’s store in Rensselaer, Ind. The dealership also announced plans to open a 5th store in northern Indiana.

Claas FarmPoint announced it has signed a 10-year lease for a permanent brick-and-mortar dealership in Hanson, Ky., just a few miles down the road from its temporary location in Madisonville.

AGCO dealer Redlund Equipment recently completed the purchase of Sorum Tractor Co., a single-store New Holland and Massey Ferguson dealer in Alamosa, Colo. Redlund now has 5 stores in Colorado.

Inside the First-Ever Agricultural Autonomy Institute

We’ve seen several colleges offer more precision-focused training courses and learning opportunities for ag students recently. But one school in the south is taking it to a whole new level.

Mississippi State University opened a brand-new Agricultural Autonomy Institute in Starkville. It will serve as an on-campus hub for research in robotics, AI, remote sensing and more. The research infrastructure includes a 4,800 square-foot laboratory space and an “Autonomous Acres” proving ground that stretches 5 acres. It’s a big step for the future of precision ag in the classroom and beyond.

“We want to attract agricultural equipment companies to Mississippi. We want to conduct research that leads to technology-based startup companies. We want to develop a new workforce that will have the ability to work in this new world of robotics, mechatronics and computer coding, whether that be on farm, manufacturing, distribution or service. I really hope to see Mississippi become the Silicon Valley of agricultural autonomy.”

This has been in the works for quite some time at Mississippi State. A team of approximately 40 researchers across campus established an ag autonomy working group several months ago. They’ve already used robots to autonomously harvest cotton. Learn more about it at PrecisionFamringDealer.com.

How Grain Prices & Farm Income Will Impact Purchase Plans

During the Farm Equipment Manufacturer Assn.’s Fall Marketing & Distribution Convention in Kansas City, Richard Brock of Brock Associates provided an outlook for how grain prices and farm income might impact farmers purchasing plans.

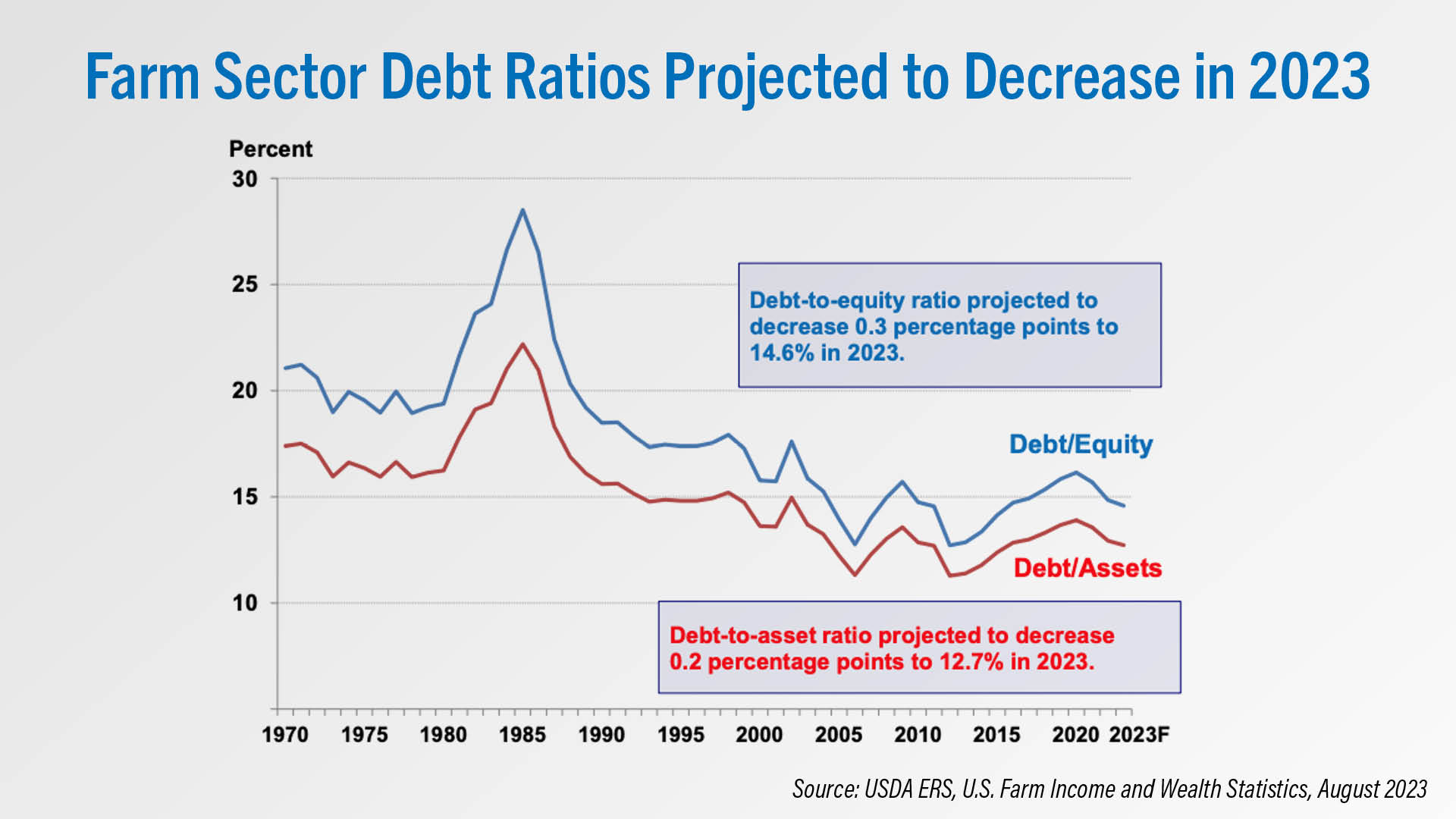

Brock, whose firm manages grain sales for about 800,000 acres, noted that farm wealth is at an all time high. In addition, debt continues to be extremely low on farms, he says. “Asset values have gone up faster than debt has gone up on farm lines, so you have a lot of equity to work with,” he says.

When farmers have excess cash, their top 2 priorities to spend it on are dirt and steel, Brock says. While some are projecting sales to be soft, Brock doesn’t think that will be the case.

“I think as we move into 2024, obviously with the price of grain, net income is going to be softer this year than it was last year. The farmers are also going to receive some pretty hefty crop insurance payments this year, so it’s not going to be down as much as some people might be anticipating it’s going to be down. But more importantly, we’re going into this timeframe where farmers are very solid financially, good balance sheets and a lot of carryover income from previous years. So we don’t see much of a change coming in farm equipment purchases for at least the next 6 months. And then a lot will depend on what happens to prices this spring as we go into next fall. But for right now, if you just look at the price of corn, soybeans, some people are expecting sales to be really soft. We don’t think that’s going to be the case because we also are going to be impacted by the fact of a lot of farm consolidation taking place right now with the size of farms increasing. And so a lot of the purchases we think will be technology driven because the farmers want to have the most current technology possible.”

In terms of how interest rates could impact farmers’ equipment purchasing decisions, Brock doesn't anticipate they will have much impact.

“Some people will talk about that, but still historically these are not high price interest rates. They’re just low compared to where we were 3 years ago. So interest rates are not going to have a lot to do with it. And we think land prices are just going to stay flat from where they are right now. We’ve seen some big increases in the last 2.5-3 years, but that's helped build up the net worth of producers, which gives them more buying power. So those are primary factors and as we've said many times, if farmers have excess cash, they like to buy dirt and they like to buy steel and so it favors land prices and equipment prices. And so as farmers expand though in acreage, they need equipment and they all want newer stuff and not old stuff. So I think it bodes well for the industry for the next six months.”

Dealers Report Slowdown in Early Orders, Capital Spending Plans for 2024

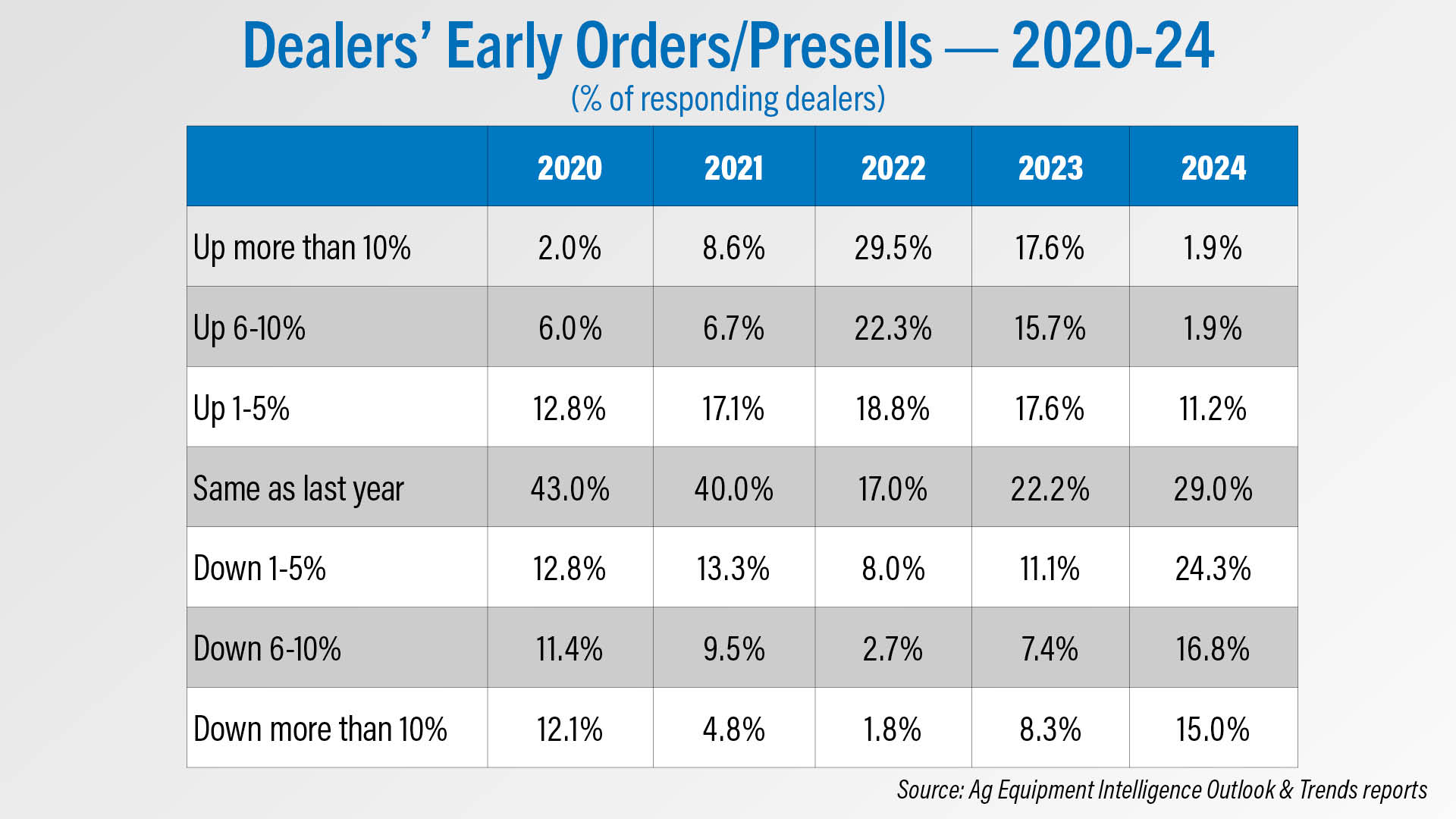

According to the final results of this year’s Farm Equipment Dealer Business Outlook & Trends report, dealers are pulling back on increasing their capital spending and reporting fewer early orders.

For 2024, just 15% of dealers are reporting an increase in early orders, down from 51% who had forecast the same for 2023 in last year’s report. At the same time, 56% of dealers are reporting declines in early orders for 2024, with 15% reporting a decline of more than 10%. This is the highest percentage of dealers reporting declines in early orders seen in the last 5 years.

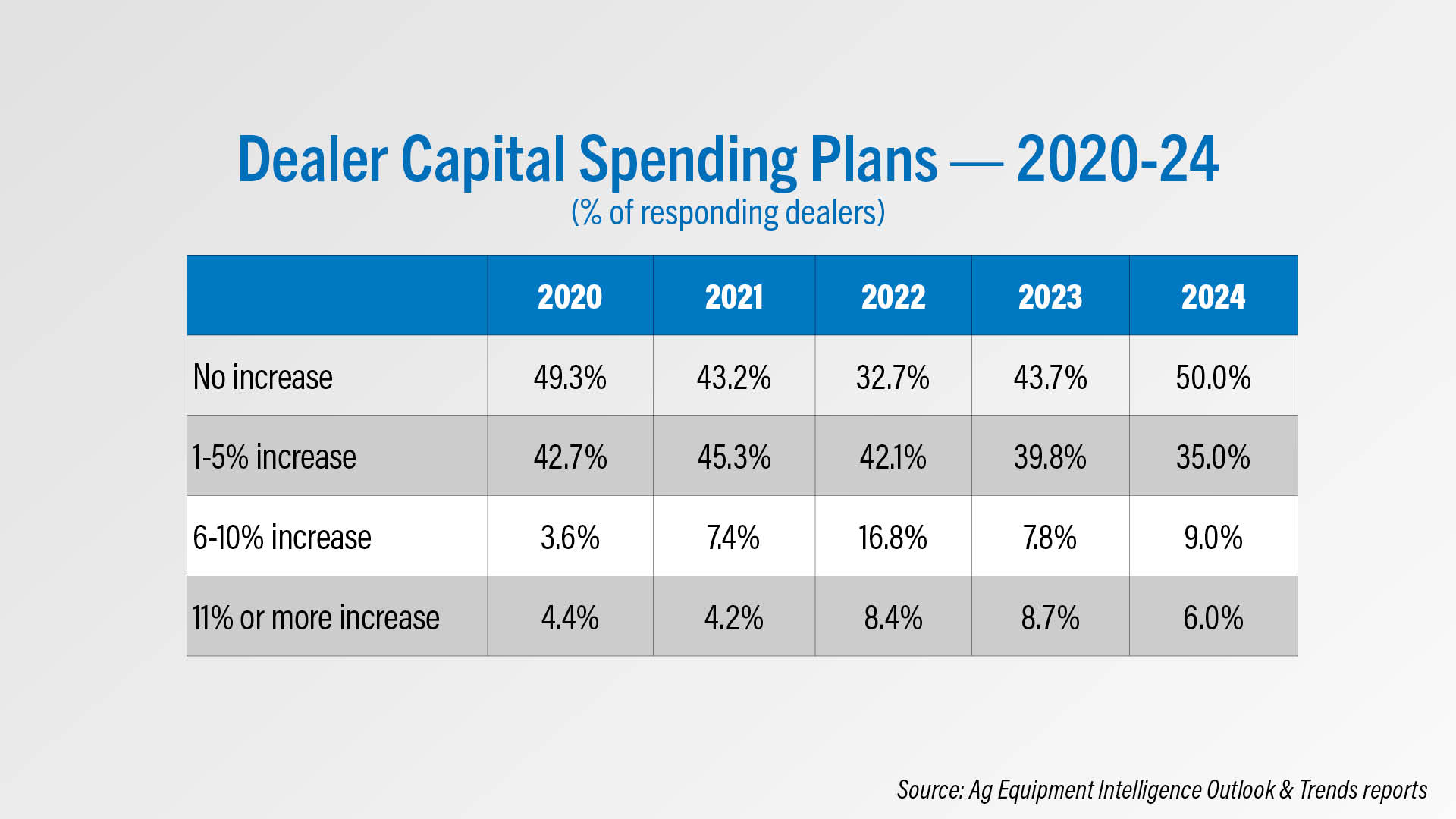

For 2024, 50% of dealers are forecasting no increase in their capital spending plans, the highest this percentage has been in 5 years. Another 35% are planning to increase their capital spending 1-5%, which is a 5-year low for this category. Just 9% are forecasting an increase of 6-10% and another 6% are planning to increase their capital spending 11% or more.

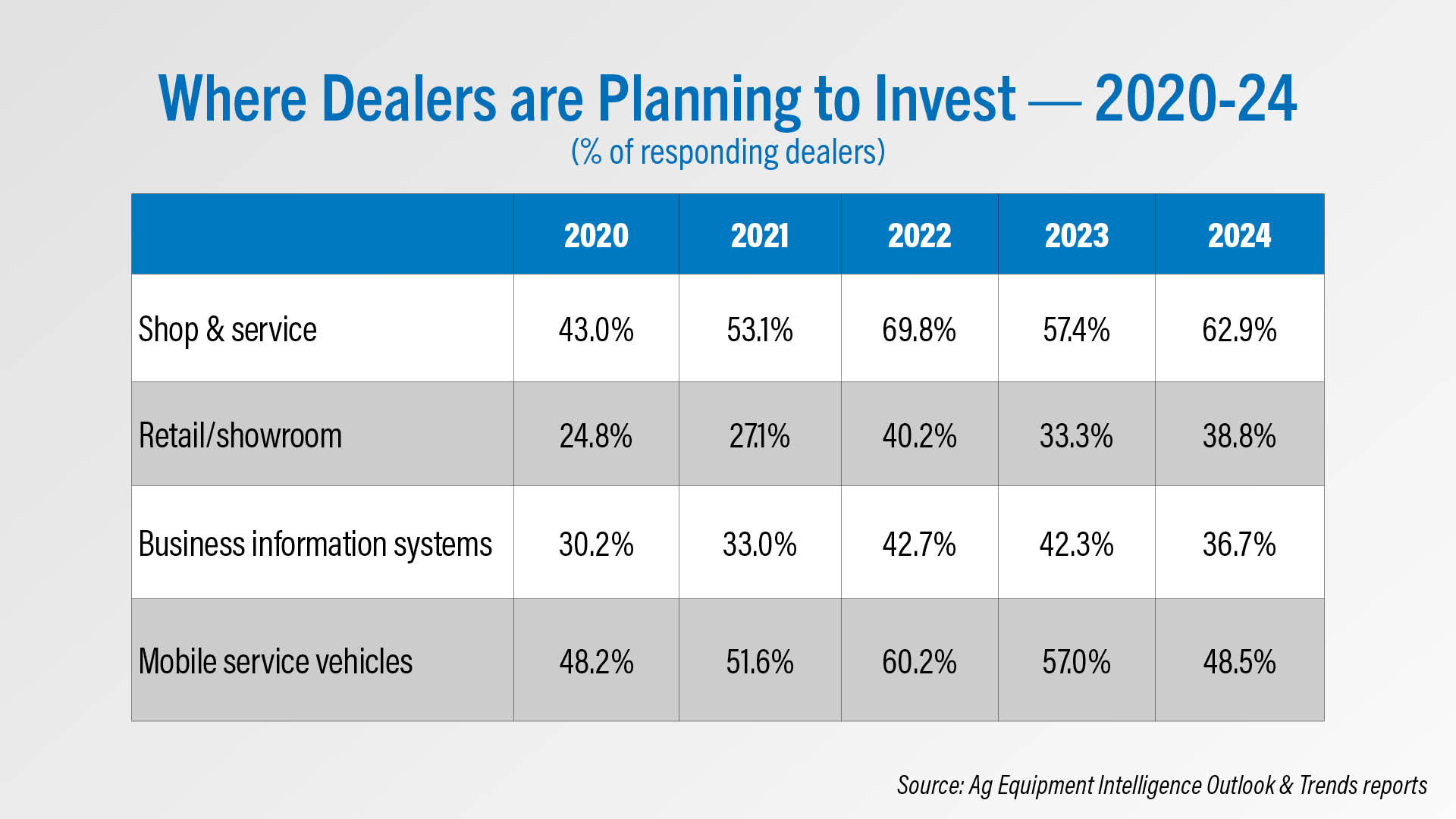

Among places they will invest, almost 63% indicated they’d be putting money into their shop and service departments, a 5-year high for this category and its fourth year in a row as the most popular option. The second-most popular option was investing in mobile service vehicles at 48.5%, though this is the second-lowest this percentage has been in 5 years.

Another 39% of dealers will invest in their showrooms and 37% said they’ll be investing in their business information systems.

Kubota First 9 Months Ag Revenue Up 14%

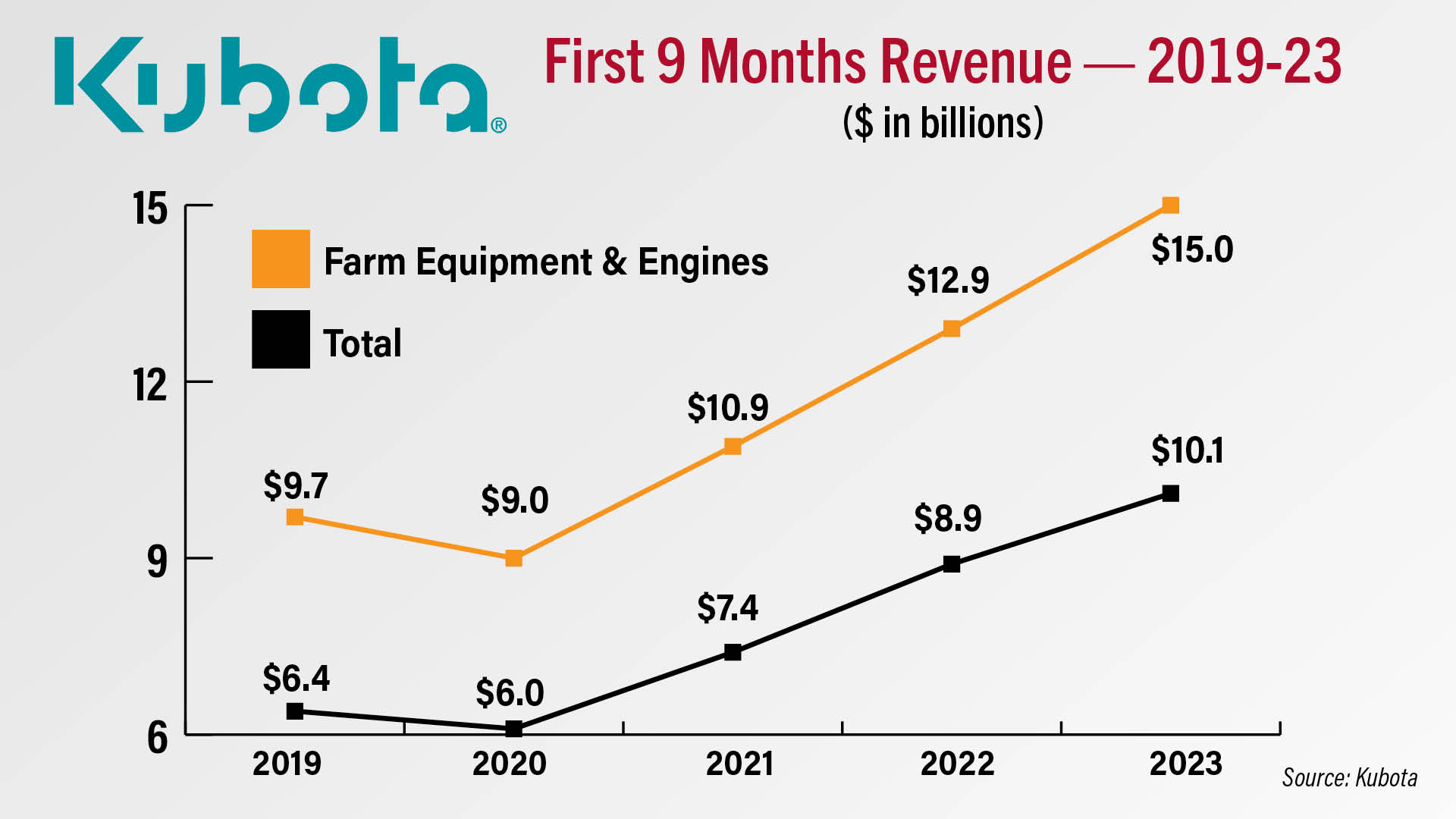

In its third quarter 2023 earnings reported on Nov. 8, Kubota reported $10.1 billion in revenue for its Farm Equipment & Engines segment for the first 9 months of the year.

This represented a 14% year-over-year increase from $8.9 billion in the same period last year. Total revenue for the first 9 months of the year came in at $15 billion, up 16% year-over-year.

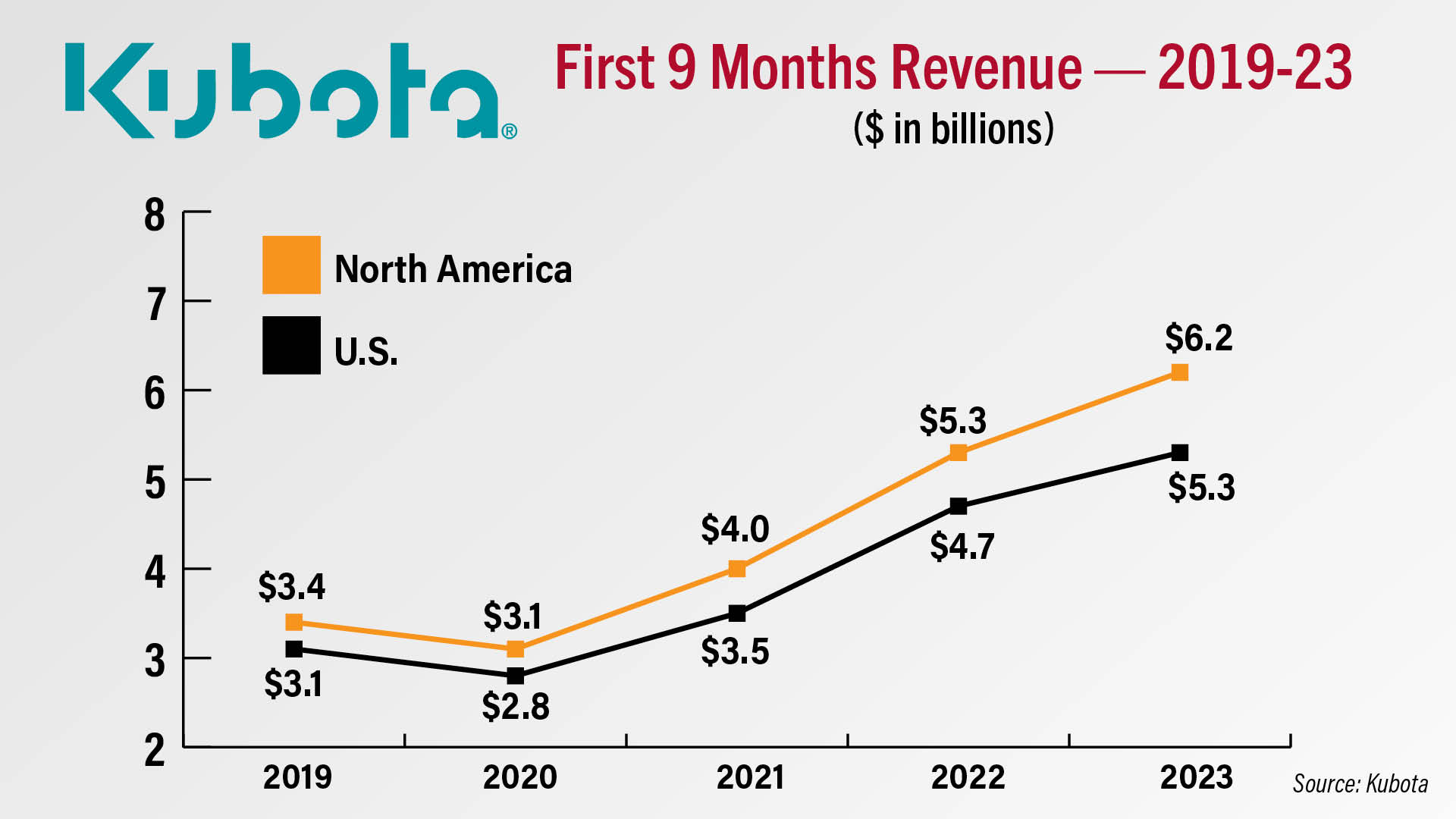

Total revenue from North America, including revenue outside of Kubota’s ag business, came in at $6.2 billion for the first 9 months of the year, an 18% year-over-year increase. In the U.S., revenue for the first 9 months was $6.2 billion, up 14% year-over-year. This brought the percentage of Kubota’s North American revenue coming from the U.S. to 85.4% vs. 88.4% in the same period last year.

Inventories as of Sept. 30 were valued at $4.7 billion, its third year in a row of increase.

DataPoint: Ag Lenders’ Top Concerns

This week’s DataPoint is brought to you by the Ag Equipment Intelligence 2024 Executive Briefing.

According to the Fall 2023 Agricultural Lender survey results from the American Bankers Assn. and the Federal Agricultural Mortgage Corporation’s, ag lenders’ top concern for producers in 2023 is liquidity. The report said that lender sentiment this year for producers largely reflects the recent pullback in farm profitability. Liquidity as a top concern is followed closely by farm income levels. These two were also listed as top concerns in 2021 and 2022, highlighting their importance even during periods of elevated profitability.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.