In this episode of On the Record, we take a look at the most recent push for right to repair, this time at the federal level. In the Technology Corner, Mackane Vogel shows us some new tech he recently encountered from Solinftec. Also in this episode, the latest Farm Equipment text poll, responses to our recent coverage of New Holland's brand purity attempts and one tire manufacturer's bet on strong year-end ag equipment tax purchases.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- New Federal R2R Bill ‘Drastic Departure’ from State Legislation

- Dealers on the Move

- Solix Hunter Autonomous Robot by Solinftec

- Lambro’s Plans for ‘Cleaning’ Dealer Network Spur Discussion

- Dealers Estimate Revenue Impact of Tech Vacancies

- CEAT Exec: Grower Pessimism Won’t Stop Year-End Tax Purchases

- DataPoint: Inflation in Farm Production Expenses

New Federal R2R Bill ‘Drastic Departure’ from State Legislation

The U.S. House of Representatives introduced HR5604, or the Agriculture Right to Repair Act, on September 20.

According to the bill sponsors, the Act defines what types of information OEMs are required to provide to make repair accessible. If the OEM does not have the digital or physical tools available, they are required to provide sufficient information to create the tools. Additionally, the bill gives the Federal Trade Commission the ability to enforce these requirements and make rules to assist in the implementation of these requirements.

Eric Wareham, senior vice president of government relations for the North American Equipment Dealers Association, says the bill is very different from the state legislation we’ve seen and even previous federal legislation that’s been introduced.

He says this new bill introduces some new concepts and specifically focuses on copyright and intellectual property.

“And when you look at the bill as a whole, my take on it, and this is pretty blunt, but it's a blatant appropriation of intellectual property masquerading as a right to repair bill.”

He adds that there are several reasons this bill is different from a lot of the legislation we’ve seen on the state level. Unlike the state bills, HR5604 doesn’t address selling parts at dealer net cost. Instead, it focuses on making tools available to farmers.

“What it does address is it does have a fair and reasonable —actually they say fair and reasonable, but in the bill it's defined as no cost to farmers, so that's an interesting way to describe fair and reasonable — for tools. And the interesting way they define tools is basically software and firmware and also diagnostic tools. So that's a separate issue, somewhat similar to the state legislation. Where it also has common ground is that when it does talk about making available software, they use the same vernacular as disable or enable an electronic security lock or other security-related function of farm equipment.

So that's a mandate they place on the OEM to make that available. So that is consistent language that we've seen in all state legislation. There's big problems with that because we've always talked about, what does that mean? It's very nebulous language, not a discernible standard and sounds pretty broad. And in this legislation at the federal level, because of probably the legislative council and the bill drafters’ requirements that they dial in to be kind of more specific at the federal level, they spell that out. And instead of placing sideboards on that access to security locks and security-related functions, in Section 3C of the bill, what they do is completely remove all copyright protections to allow for circumvention of technology protection measures with the express purpose of reprogramming and modification of farm equipment. So they're really spelling out their intentions here. That's the interesting part about the legislation.”

Wareham says currently under federal law, the Librarian of Congress has already said that specifically for farm equipment, you can circumvent TPMs for the purpose of repair, maintenance and diagnosis. While proponents of right to repair have tried to push for expanding that access to allow for modification, Wareham says the Librarian of Congress has responded by specifically saying that modification does not fall within the fair use rule.

He adds that this bill, in his words, “specifically attempts to make the hacking of farm equipment legal. And that is a drastic change from the current state of law today.”

Dealers on the Move

This week’s Dealer on the Move is King Ranch Ag & Turf. The Texas John Deere dealer has acquired Brookside Equipment, a John Deere dealership group with 9 stores throughout the Houston, Texas, area.

Solix Hunter Autonomous Robot by Solinftec

Mackane Vogel here, in for Noah Newman. I had the chance to attend the FIRA USA Conference in Salinas, Calif. last week, and I got to see lots of new ag technology on display. Here is Guilherme Guiné, chief sustainability officer at Solinftec, explaining some of the key features of the company’s “Solix Hunter.”

“We are showing here the Solix, this is the version we are presenting here at FIRA. This robot is a target spraying robot plus a bug zapper. We call it a hunter. This is the functionality we are using at night. During the day we are doing the spot spray for weeds, and during the night we are finding the bugs and trying to kill them. This robot is fully autonomous, working by solar panels and batteries. We can run all day and all night with the batteries. You don’t need to recharge it or to change the battery. It’s fully autonomous, worked by RHK antennas on top of it and some cameras to identify when we miss the signal. This robot was actually running outside during the summer, and we brought it here to show a real robot, not just a prototype or something different than that. We are showing the real one.”

“We have on top here 4 solar panels, and those solar panels are providing the energy we need. And at the bottom there we have a battery, and this battery provides the energy for the night. We have 2 tanks on the robot. With that we can cover close to 60 acres. Those things have 40 gallons of capacity.”

“We did this season the proof of concept, and we are sold out right now for the next season. We will have close to 100 running, some here in the U.S. and some in Brazil and Canada. We are splitting those units for next year.”

According to the company, in just its first commercial year, American producers who invested in the Solix Hunter recorded a 95% reduction in the volume of herbicides applied.

Lambro’s Plans for ‘Cleaning’ Dealer Network Spur Discussion

In our last episode of On the Record, we reported on comments New Holland Brand President Carlo Lambro made in a recent Farm Progress Show interview about plans to remove shortline brands from its dealer network. Those comments spurred much discussion on the Farm Equipment website.

“It’s clear you continue to fumble when it comes to how to treat your dealer network. You will never be successful in the USA with your current attitude.”

The day we published On the Record, one commenter said,

“It’s clear you continue to fumble when it comes to how to treat your dealer network. You will never be successful in the USA with your current attitude.”

“Maybe the other OEMs are more reliable, cheaper to purchase/run. The pertinent question is do the CUSTOMERS trust the brand?”

Seeming to address the need for shortlines, another commenter said a few days later, “Maybe the other OEMs are more reliable, cheaper to purchase or run. The pertinent question is do the customers trust the brand?”

“In my opinion, New Holland is not the leader in anything. If a dealer wants to have industry leading products, they need to look at other brands like Kubota. I agree that the question is do dealers and customers trust New Holland? All you can do is look at the past for answers, and today the answer is no.”

One viewer sought to answer that question by saying,

“In my opinion, New Holland is not the leader in anything. If a dealer wants to have industry leading products, they need to look at other brands like Kubota. I agree that the question is do dealers and customers trust New Holland? All you can do is look at the past for answers, and today the answer is no.”

“Pretty sure New Holland was a shortline for its first 100 years until its third buyout.”

Another viewer tried to remind New Holland of its roots by saying,

“Pretty sure New Holland was a shortline for its first 100 years until its third buyout.”

Finally, one person summed up their thoughts in just 4 words:

“Good luck with that.”

Do you have an opinion about New Holland’s plans specifically or brand purity in general? Let us know in the comments or email me at bthorpe@lessitermedia.com. We’d love to hear from you.

Dealers Estimate Revenue Impact of Tech Vacancies

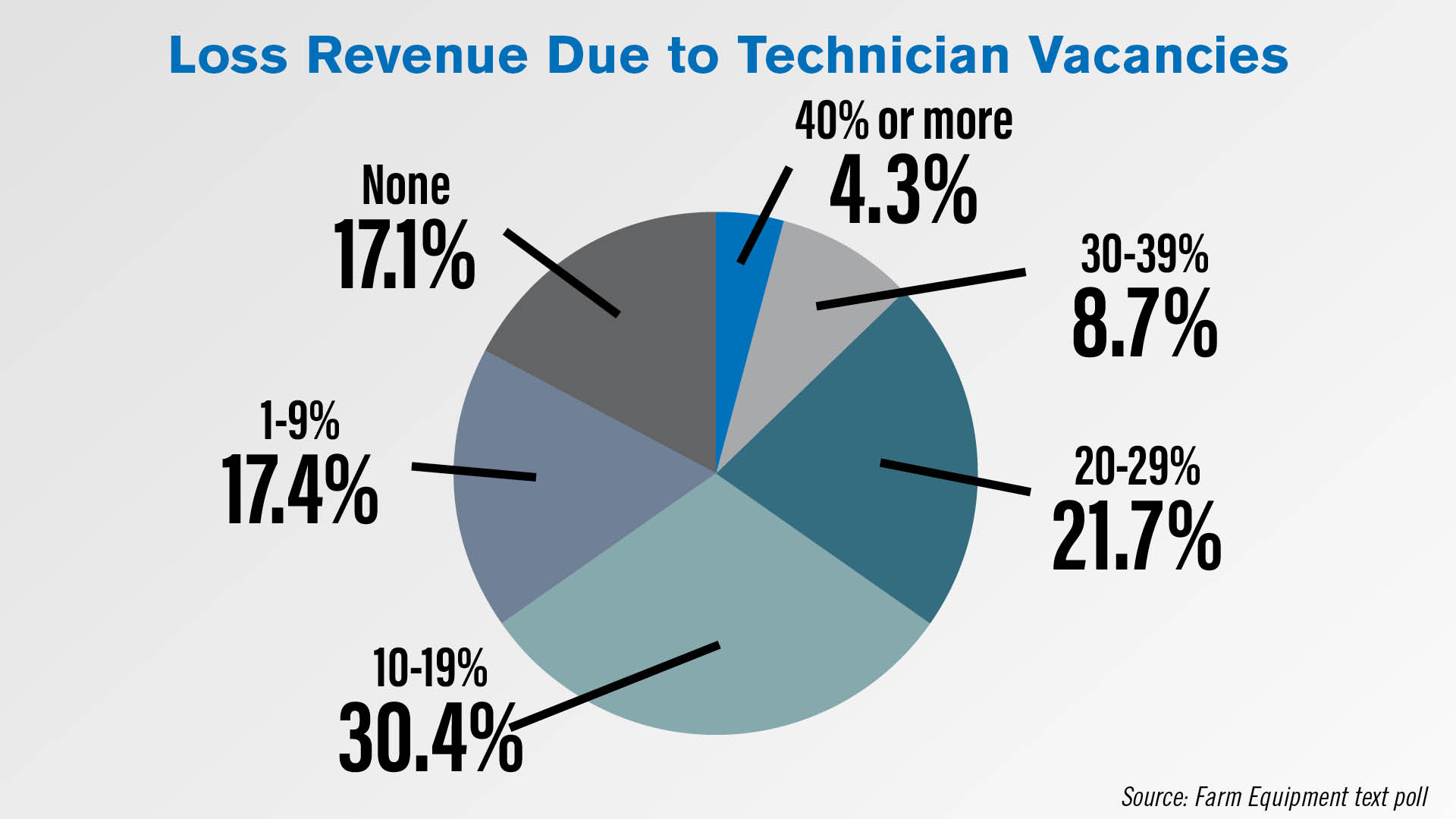

The on-going technician shortage could have an impact on dealers’ parts and service revenue in 2023. The latest Farm Equipment text poll asked dealers what percentage of their annual parts and service revenue they estimate will be lost this year by the inability to fill open tech positions at their store.

Just over 30% of respondents estimate a 10-19% of their annual aftermarket revenue could be lost this year because of the issue. About 22% of dealers said 20-29% of revenue could be lost. Just 4.3% of dealers said they expected a loss of 40% or more.

To be a part of future polls, you can text “farm” to 833-413-2175 to sign up.

CEAT Exec: Grower Pessimism Won’t Stop Year-End Tax Purchases

CEAT North and Central America President Ryan Loethen has a lot on his mind heading into 2024, including rising interest rates and fuel costs. And one of his forecasts is for more tax-related ag equipment purchases from growers in the last 2 months of the year, in spite of a lack of farmer optimism.

In an interview at this year’s Farm Progress Show, Loethen said that come December, growers with a lot of cash in their pockets due to good crop prices will be faced with 2 options: pay Uncle Sam or spend some money.

“So that's the other big unknown. Is there going to be a tax buy? I really think yes, because I think that they're going to have farmers who have a lot of cash and low input costs, and therefore, they don't want to get taxed. Also, you look at — the general pessimism is because you ask any farmer here, farmers are spending a lot of cash right now. They are. But that's generally because they’re concerned about the economy, concerned about the future, concerned about everything. But I really think, in my mind, them not wanting to pay excess taxes is going to override any pessimism. So I'm kind of hoping, and I tell my guys, ‘Yeah, you might have a slow harvest, but I really think your November, December sales are going to be high because people are going to look at harvest and go, 'I made a lot of money, I need to get rid of it.'"

Loethen also said that he’s optimistic the war in Ukraine will end in about 6 months, which he believes will lead to billions in aid arriving in Ukraine and trigger a wave of tractor purchases. For more on that, see my Farm Progress show coverage in the Oct./Nov. Issue of Farm Equipment.

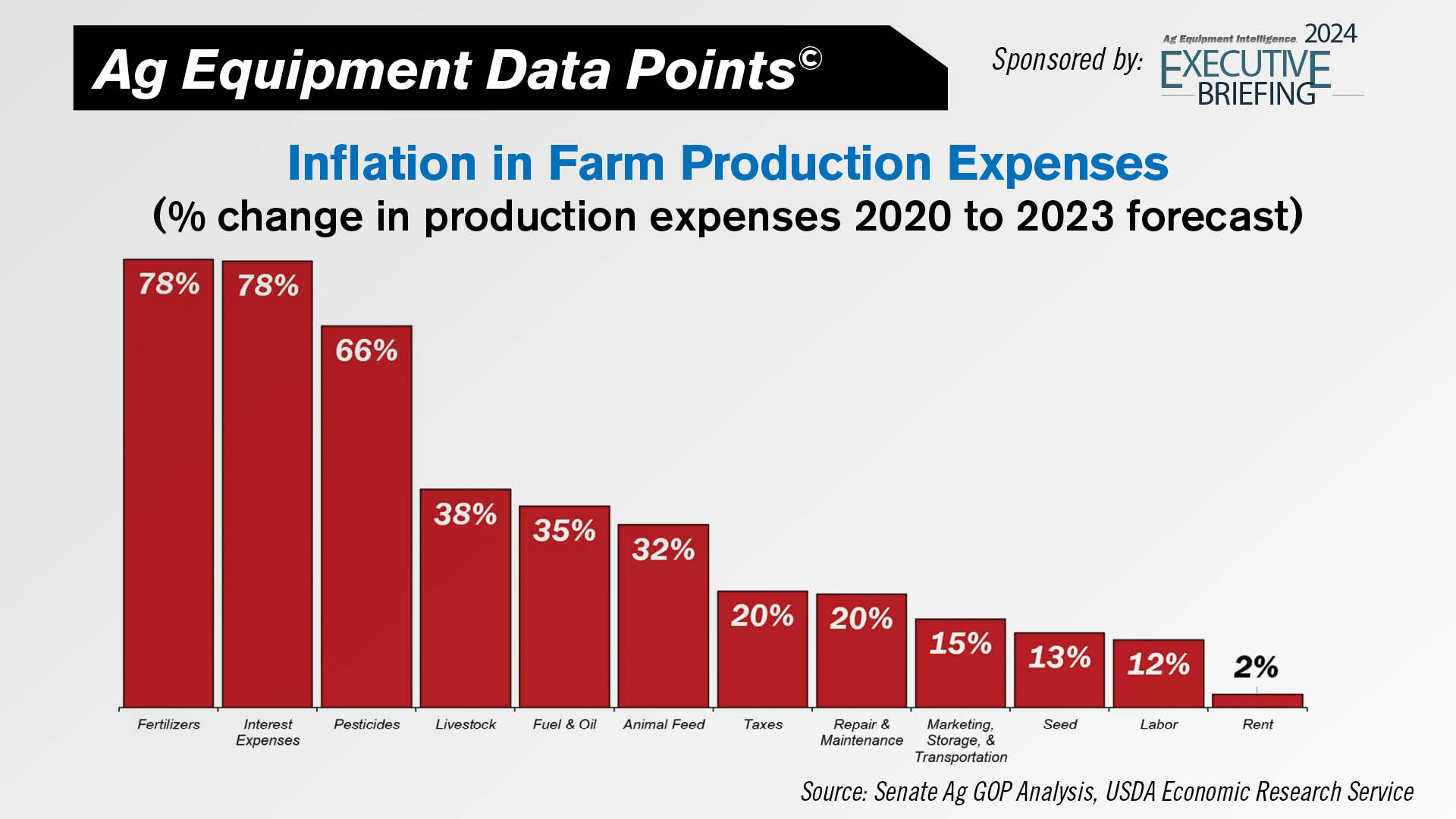

DataPoint: Inflation in Farm Production Expenses

This DataPoint is brought to you by the Ag Equipment Intelligence 2024 Executive Briefing.

While some input costs like fertilizer and chemicals are expected to decline from 2023 to 2024, other expenses like seed, labor, machinery and equipment, taxes and insurance are expected to rise, according to a July 26 report from Northern Ag Network. Since 2020, the total costs paid by farmers to raise crops and care for livestock have increased by more than $100 billion, or 28%, to an all-time high of $460 billion this year. Based on USDA’s current input cost projections, trend yields and commodity price trends, several major field crops may experience marketing year average prices below breakeven levels this year and possibly into 2024.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.