In this episode of On the Record, New Holland Agriculture President Carlo Lambro talks about the future of the company's North America network. In the Technology Corner, Noah Newman takes a look at the recently award-winning One Smart Spray system. Also in this episode, Titan Machinery's latest earnings report, dealers forecast fourth quarter wholegoods sales and ag equipment manufacturers' reasons to be optimistic in 2024.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- New Holland to ‘Clean’ Dealer Network of Shortlines

- Dealers on the Move

- One Smart Spray “Leaves No Weeds Behind”

- Titan Machinery Ag Revenue Growth Slows

- Dealers Forecast Mixed Results for 4Q23 Wholegood Sales

- Farm Progress Exhibitors Weigh in on 2024 Trends

- DataPoint: Ag Economist Outlook

New Holland to ‘Clean’ Dealer Network of Shortlines

In an interview at this year’s Farm Progress show, New Holland Brand President Carlo Lambro said the company was looking at removing several other manufacturer brands from its dealer network in the future to “clean” the network as much as possible. This will be part of a larger plan to revitalize the North American New Holland network. He said that, as a first step, they are looking at removing OEMs with equipment that competes with New Holland’s own products.

“To try to clean as much as possible our network. We know that we have several other OEMs that are sold through our network. For sure, we will not eliminate all because some OEMs will resist, but we do believe that there are some OEMs where, today provide products that are existing [alongside] the New Holland line that are competitive [products], in terms of pricing, delivering and product features. This is going to be our first step.”

The second step in this plan will be moving the New Holland network into territories in which Lambro said the brand isn’t well covered, including Florida and Texas. Lambro also said that over the next 5 years, the company’s North American dealers should refocus on the New Holland brand. He said New Holland dealers need to decide if they trust the brand or not and make an effort to gain back ground in a customer base he said they’ve lost.

“And for me it’s just a question to — maybe I’m going to be too direct — but to decide if they want to be really on board to be true blue dealers, trusting the brand or not. If they trust the brand, I think that the brand can provide all the support, product, service, machinery, financing, whatever they need.

“So it’s not the brand that has to [be] built from scratch. It’s not the product we need to build from scratch. We really need to revamp and reenergize and probably we need really dealer[s] that are proud to represent our brand to be successful.”

Dealers on the Move

This week’s Dealers on the Move include Titan Machinery, Agri-Service, Plevna Implement and AgRevolution.

Case IH dealer Titan Machinery announced Aug. 30 its acquisition of 16-store Australian Case IH dealer J.J. O’Connor & Sons for $63 million. O’Connors was the largest Case IH dealer in Australia.

13-store AGCO dealer Agri-Service announced Sept. 5 it acquired n 2-store Idaho dealer Blue Mountain Agri-Support.

AGCO dealer Plevna Implement announced earlier this month the opening of its third location in Garrett, Ind.

On Sept. 12, AGCO dealer AgRevolution announced its intent to expand into Harrisburg, Ill., through its acquisition of M&S Implement.

One Smart Spray “Leaves No Weeds Behind”

Fresh off its CropLife Iron ShowStopper Award at the Midwest Ag Industries Exhibition Show in Bloomington, Ill., the One Smart Spray system made its way 30 miles south to the Farm Progress Show in Decatur.

As you can see in this video, the system was hooked up to the new Fendt Rogator self-propelled sprayer. I tracked down One Smart Spray’s Aaron Hunsinger to find out what truly makes this product a “Show Stopper.”

“It’s very unique because those are industrial cameras, infrared cameras and lights, that allows us to go 24/7 in the field, no calibration or anything, and allows us to do many things in the future. We’re looking to improve the profitability and efficiency of growers and retailers here coming about. We will only be offered on OEM equipment. So, it will be offered at the OEM when you go to buy a new sprayer, you’ll tell them you want the new One Smart Spray system on it and it will come from the factory like that. At this present time, we’re not doing any kind of retrofitting of the system.”

The One Smart Spray system will be offered in North America and Europe starting next year, with more widespread availability taking place in 2025.

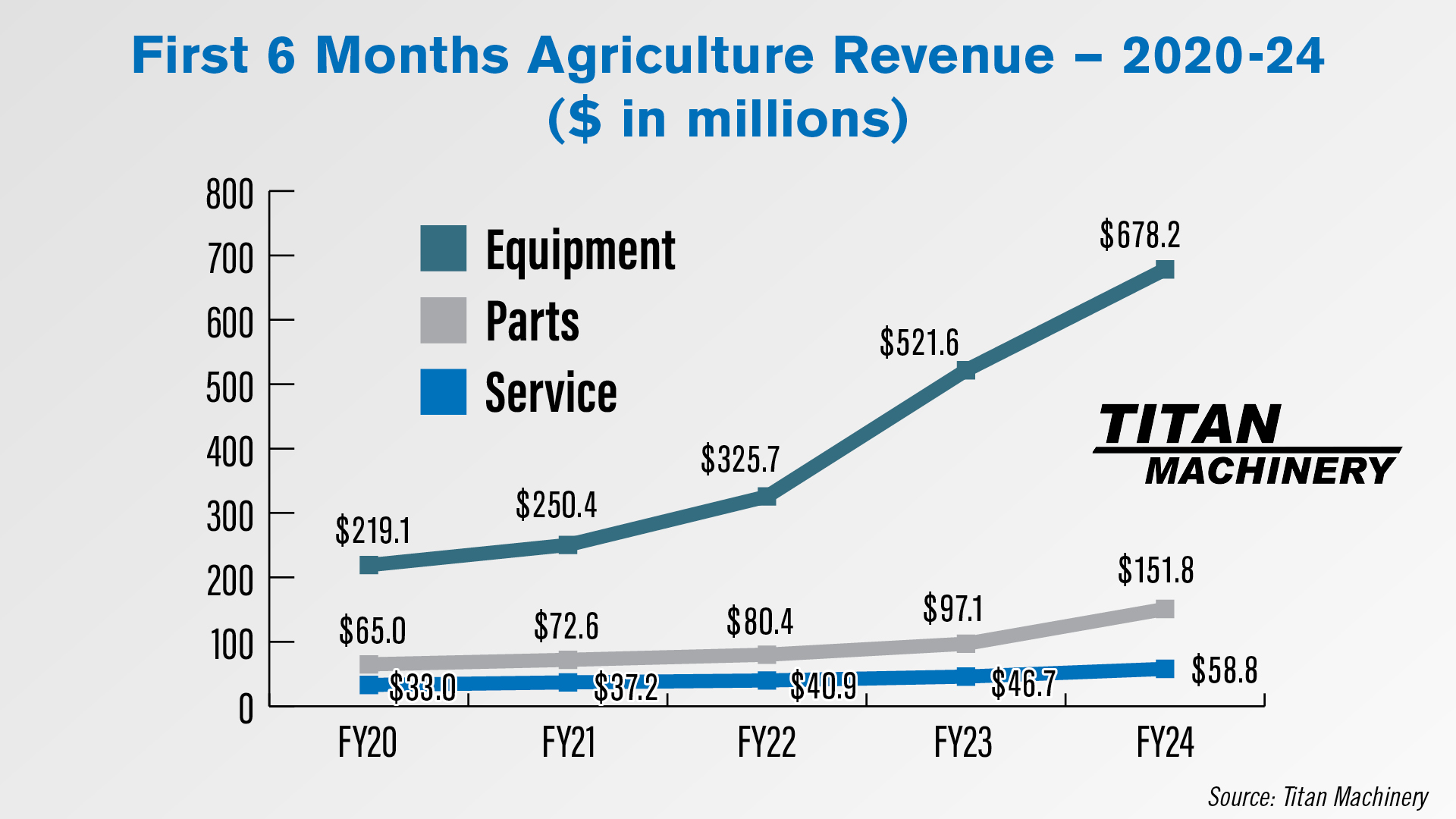

Titan Machinery Ag Revenue Growth Slows

Titan Machinery reported $678 million in ag equipment sales for the first half of its fiscal year 2024. While this was the 4th year in a row of growth during this time period, it showed a notable decline in percentage increase vs. previous years.

Titan Machinery’s ag wholegoods revenue for the first 6 months of its 2024 fiscal year rose 30% year-over-year, half the 60% year-over-year growth seen for the first half of its last iscal year. Year-over-year growth between the first 6 months of Titan’s 2021 and 2022 fiscal years was also 30%.

However, Titan reported almost $152 million in parts revenue for the first half of the year, a 5-year high and the largest year-over-year increase seen since 2019 at 95.5%. Service revenue also saw its largest year-over-year increase in the last 5 years, increasing 25.9% to $58.8 million for the first 6 months.

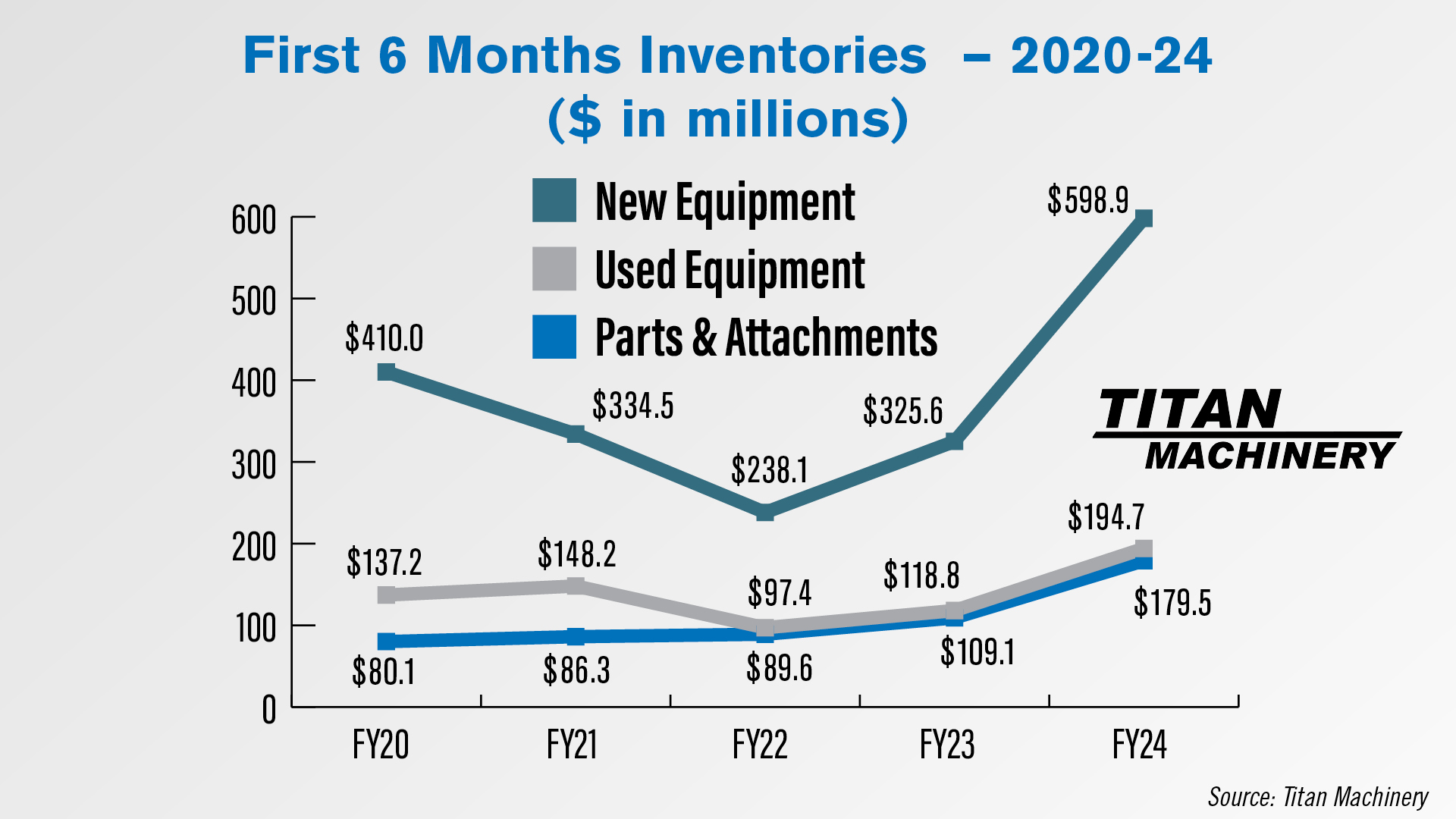

Titan’s floorplan payables have notably reversed declines seen leading up to its 2022 fiscal year. After reaching a 5-year low of $186 million in the first half of Titan’s 2022 fiscal year, the dealership’s floorplan payables reached almost $600 million in its 2024 fiscal year. This represents a 5-year high and a 117% year-over-year increase.

Titan also reported inventories were up across the board. New equipment, used equipment and parts & attachments inventories were all at 5-year highs in the first 6 months of Titan’s 2024 fiscal year. New equipment inventories were valued at almost $600 million and saw the greatest year-over-year increase among inventory categories at 83.9%. Used equipment inventories were up 63.8% year-over-year to $195 million and parts & attachments inventories were up 64.5% to $180 million.

Titan Machinery also gave details in its earnings report about its recent dealer acquisitions. The company stated it paid $4 million in cash for Midwest Truck Parts in Dawson, Minn., on June 1 and paid $19.5 million in cash for Pioneer Farm Equipment’s 5 Idaho stores on Feb. 1.

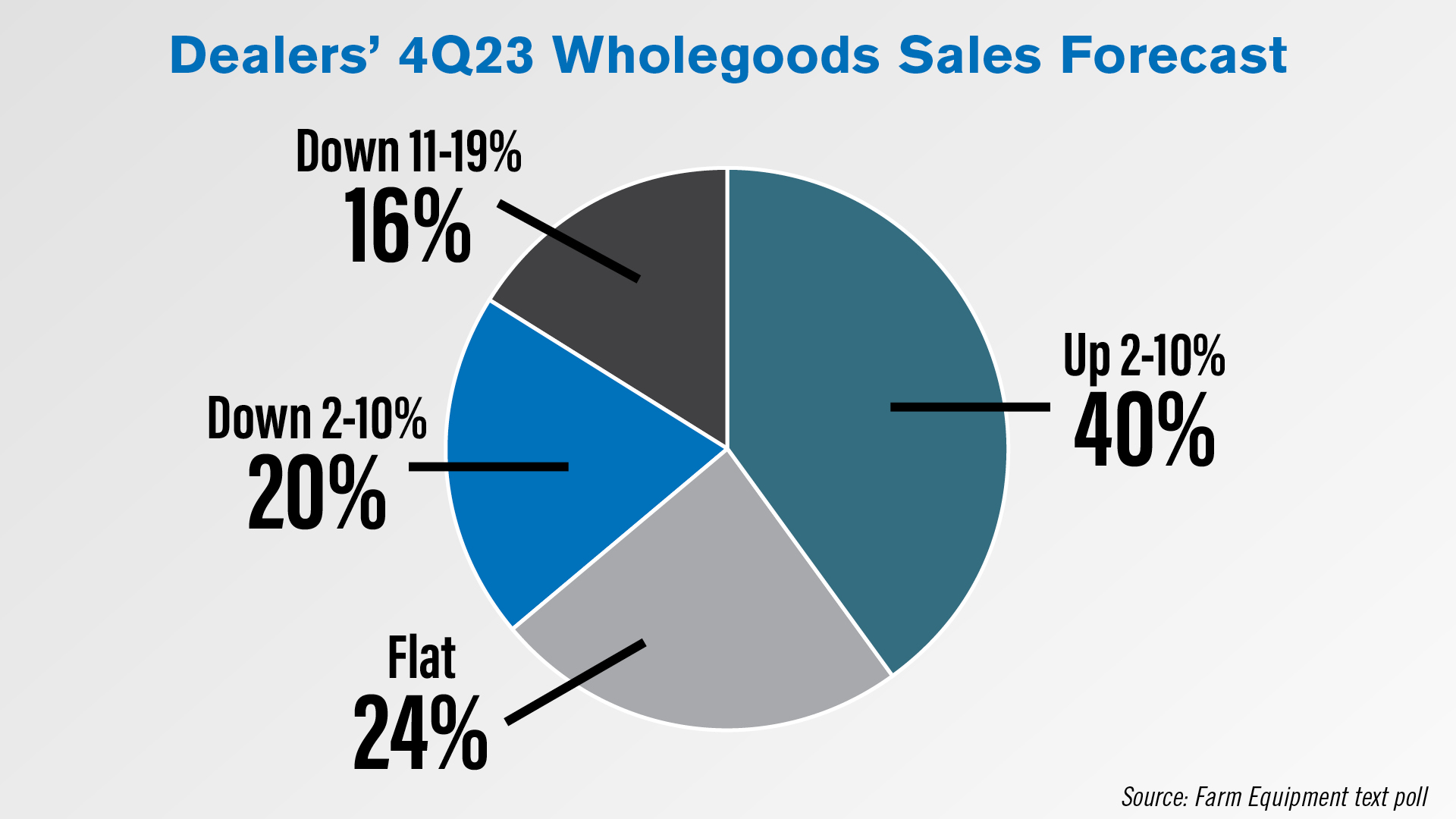

Dealers Forecast Mixed Results for 4Q23 Wholegood Sales

According to the latest Farm Equipment text poll, U.S. dealers are forecasting mixed results for wholegoods sales in the fourth quarter compared to last year. 40% of responding dealers expect equipment sales to be up 2-10% year-over-year in the upcoming quarter, and another 24% of dealers are expecting flat sales.

A total of 36% of dealers expect fourth quarter wholegood sales to decline vs. the same period last year. Among those dealers, 20% are expecting sales to be down 2-10%, while 16% are forecasting sales to be down in the 11-19% range.

No dealers are expecting sales to be down 20% or more. Likewise, no dealers forecast sales to be up more than 10% compared to 2022’s fourth quarter.

Farm Progress Exhibitors Weigh in on 2024 Trends

At the recent Farm Progress show, Ag Equipment Intelligence editors asked several exhibitors about trends they were seeing on the horizon for 2024. One question concerned what they were most optimistic about in 2024 and why. There didn’t seem to be any one thing that sparked excitement, but what we heard indicated there was much to look forward to.

For Carlo Lambro, brand president of New Holland Agriculture, optimism for 2024 included technology.

“But in our trajectory, really, 2024 should be the year where really the technology stack is going to be completely bundled with what we call the great iron and we'll be able to provide the full competitive product from A to Z, including connectivity, which today we already are doing but as we did comment today, we are only covering some product ranges, not all.”

Among shortline manufacturers, Andy Unverferth, marketing manager at Unverferth Manufacturing, said he’s excited about finally knowing how to navigate supplier lead times that were made unpredictable due to COVID.

“That's been a challenge the last 2-3 years. We feel we have finally had that process nailed in. So the lead times are a little bit longer from some suppliers, but we're forecasting out further, so we're realizing the gains from that. We will be realizing that in 2024. So, we're looking forward to getting our production schedules back on track in '24 because it's been a challenge in the last 2-3 years to get stuff built on time just because of supplier shortages, labor challenges, and we feel we're in a good spot to meet our schedules in '24.”

Ryan Loethen, president for North and Central America at CEAT Specialty Tires, expressed optimism about the ag economy in general.

“I think it's resilient. I think it's strong. Like I said, I think we're going to sell — I do believe — everything we can make, especially when the war in Europe ends. So I'm hoping when that war ends — my prediction is 6 months, I just don't think it can go much longer than midsummer next year — and then I really think we're going to sell everything we make, and so is every manufacturer. I just want to make sure that the dealer's prepared when that happens. He has to realize that it's going to end, and I've got to stock, and I've got to have a stock now, otherwise I'm going to be on the outside looking in.”

For a complete deep-dive into this and other 2024 trends from Farm Progress exhibitors, look for my full show coverage in the upcoming October/November issue of Farm Equipment magazine.

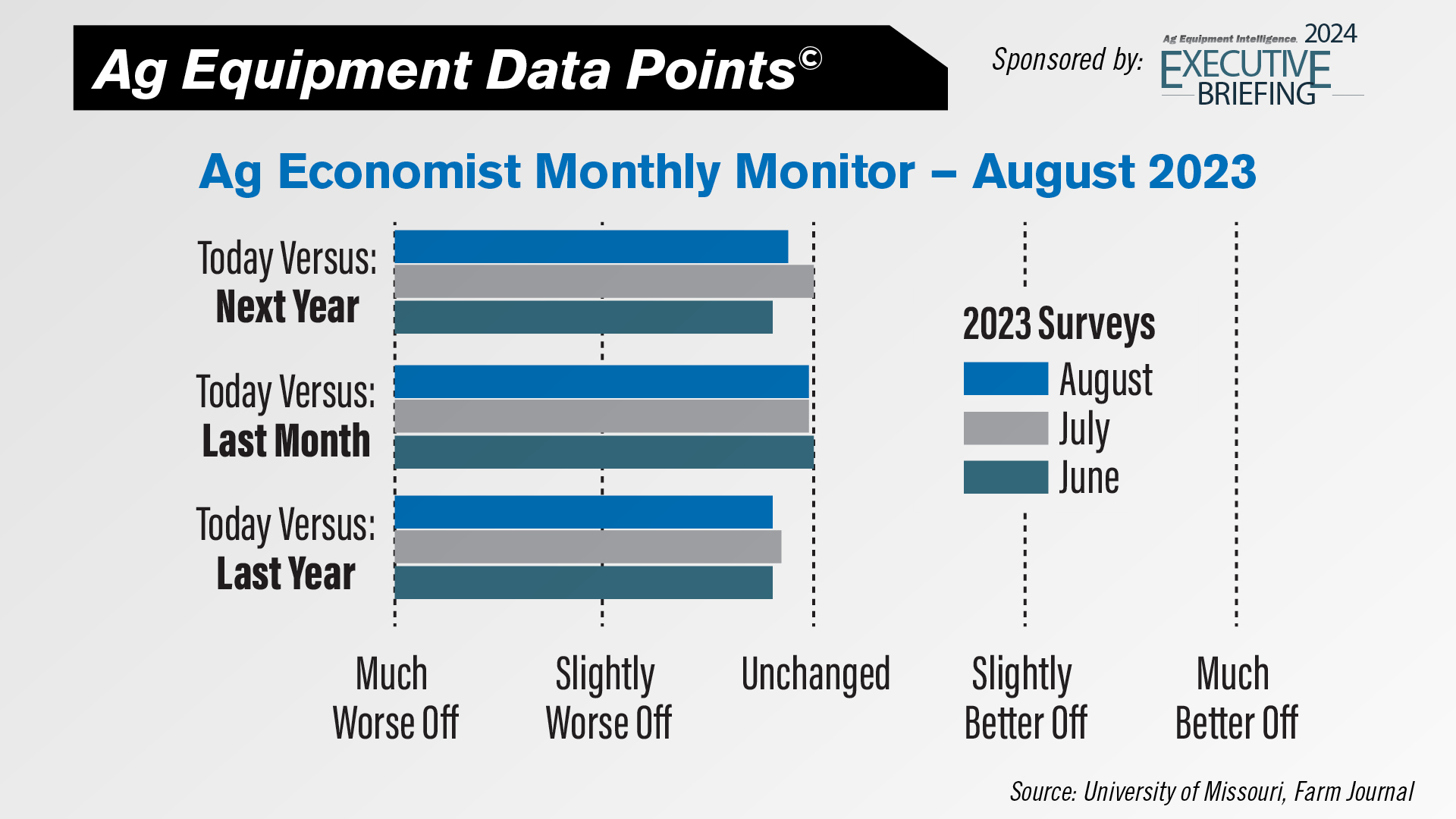

DataPoint: Ag Economist Outlook

This week’s DataPoint is brought to you by the Ag Equipment Intelligence 2024 Executive Briefing.

Declining consumer demand for protein and other commodities continues to be a red flag for agricultural economists, according to the August Ag Economists’ Monthly Monitor. The August data shows economists are 5% less optimistic about the health of the ag economy a year from now relative to today and 10% less optimistic when looking at the ag economy today vs. 12 months ago.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.