In an interview at this year’s Farm Progress Show, New Holland Brand President Carlo Lambro says the company is looking to remove several other manufacturer brands from its dealer network in the future to “clean” the network as much as possible. This will be part of a larger plan to revitalize the North American New Holland network. He says that, as a first step, it is looking at removing OEMs with equipment that competes with New Holland’s own products.

The goal is “to try to clean as much as possible in our network,” says Lambro. “We know that we have several other OEMs that are sold through our network. We will not eliminate all because some OEMs will resist. But we believe there are some OEMs that, today, provide products that are existing alongside the New Holland line that are competitive products, in terms of pricing, delivering and product features. This is going to be our first step.”

The second step in this plan will be moving the New Holland network into territories in which Lambro says the brand isn’t well covered, including Florida and Texas. He adds that the company should “rationalize” its network somewhat and look for new investors in areas where the brand doesn’t have a strong presence or any presence at all. New Holland is not looking to explore the realm of manufacturer-owned stores according to Lambro, who says the company had toyed with the concept outside North America before, and it was “not a successful story.”

Lambro also says that over the next 5 years, the company’s North American dealers should refocus on the New Holland brand. He says New Holland dealers need to decide if they trust the brand or not and make an effort to gain back ground in a customer base he says they’ve lost.

“And for me it’s just a question to — maybe I’m going to be too direct — but to decide if they want to be really on board to be true blue dealers, trusting the brand or not,” he says. “If they trust the brand, I think that the brand can provide all the support, product, service, machinery, financing, whatever they need.

“So it’s not the brand that has to be built from scratch. It’s not the product we need to build from scratch. We really need to revamp and re-energize and probably we need dealers that are proud to represent our brand to be successful.”

Among CNH Industrial’s brands, Lambro says New Holland has a notable opportunity to grow in the future, citing previous struggles the company had.

“It’s not a secret that in the past we were a little bit down,” Lambro says. “We lost market share, we lost dealers and so on … We have all the tools and the methods to be successful. And for me, there is no reason why. And if I see the relative market share of New Holland in North America vs. Europe or Brazil, it’s by far lower here. And there is no reason why because the legacy’s here, the history is here, the product is here.”

Shifting Global Network

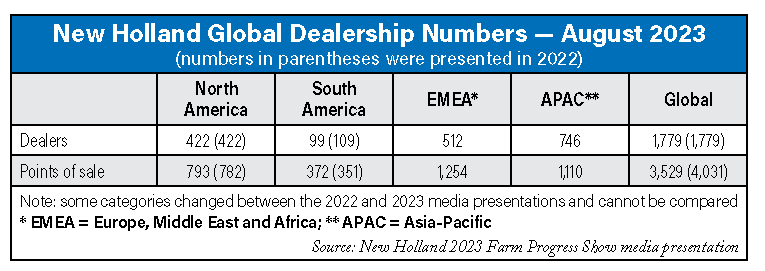

New Holland presented its global dealer network stats during a private media event at this year’s Farm Progress Show, during which it reported having 422 dealers in North America (unchanged from the numbers presented at the 2022 Farm Progress media event) with 793 points of sale, up from 782 reported last year. The number of dealers (99) in South America was down year-over-year, while New Holland’s points of sale rose to 372 vs. 351 last year. Overall, New Holland maintained the 1,779 dealers it reported at last year’s show, though the total points of sale dropped 12.5% to 3,529 from over 4,000.